Amkor Technology: Tough Road For The Company In FY23

Summary

- Amkor posted its Q4 FY22 results with increased revenue.

- The management suggests decline in revenue growth in FY23.

- Demand for low-end smartphones market declined but the rest of the segments sees significant revenue growth.

- I assign a hold rating on AMKR stock.

narawon/E+ via Getty Images

Investment Thesis

Amkor Technology (NASDAQ:AMKR) recently announced its FY22 and Q4FY22 results. In this report, I will analyze their financial results and discuss their growth potential. I believe they are undervalued compared to industry norms, but they have limited revenue growth potential. Hence, I give a hold rating on AMKR.

About AMKR

AMKR is one of the world’s largest providers of outsourced semiconductor packaging and test services in Japan, Europe, Africa, the United States, and the Middle East. They provide turnkey packaging and test services like wafer probe, package design, wafer back grind, and drop shipment services. They also offer flip-chip-scale package products for use in tablets, smartphones, and other mobile electronic devices; flip-chip ball grid array packages for storage, consumer applications, and computing. They primarily serve fabless semiconductor companies, integrated device manufacturers, and contract foundries. AMKR was founded in 1968 and is based in Tempe, Arizona.

Financial Analysis

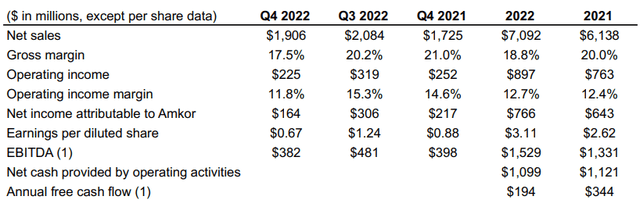

AMKR recently posted its FY22 and Q4 FY22 results. They beat the market revenue estimate by 3% but missed the market EPS estimate by 4.3%. The reported net revenue for FY22 was $7 billion, an increase of 15.5% compared to FY21. The net income for FY22 was $766 million, a rise of 19.1% compared to FY21. According to my analysis, the key factor contributing to the increase in revenue and net income in FY22 was the expansion in sales of advanced packaging, communications, automotive, and industrial market segments. Advanced packaging sales increased by 22% for the year and made up 76% of the company's overall revenue. The company's communications business expanded by 23% during the year as a result of a surge in high-end 5G phones and continued innovation. In FY22, the revenues of the automotive and industrial market increased by 14%. The business outperformed in every area, which allowed them to record a strong annual result.

The Q4 FY22 sales were $1.9 billion, up by 10.5% compared to the Q4 FY21. I believe the key factor in the revenue gain in Q4 FY22 was the record automotive sales due to geographic growth in Europe and industrial markets. The net income for Q4 FY22 was $164 million, a decrease of 24.4% compared to Q4 FY21. In my opinion, the drop in net income was primarily caused by the deterioration of the low-end smartphone market and a decline in the consumer and computing industries. Although AMKR's financial performance in FY22 was good overall, the company's fall in net income in Q4 of that year should raise some red flags.

Technical Analysis

AMKR is trading at the level of $27. Since October 2021, the stock has been in a downtrend, and it was continuously forming lower highs and lower lows formation, but it broke the structure in November 2022. After breaking the structure, it tested an important resistance zone at $29 but failed to break it. The stock made two attempts to break through the $29 level before succeeding a third time on a daily time frame, but it was a fakeout. The stock is currently at a critical point where it may either continue to trend downward from where it is or break through the $29 mark. If it does, the stock may see new momentum. Hence, in my opinion, one should wait till we have a clear image before buying stock.

Should One Invest In AMKR?

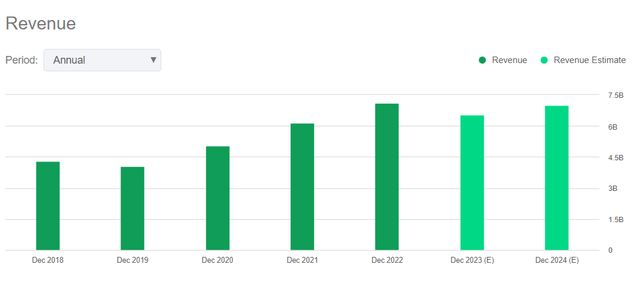

The revenues have grown significantly since 2019. Every year the revenue and net income have grown, which is quite impressive. The company has provided revenue guidance for FY23. The management anticipates FY23 revenue to be around $6.53 billion, which is around 7.9% less than the FY22 revenue. I believe FY23 will be challenging for the company as they expect a decline in the low end smartphones market demand. I think we can see a reduction in revenues and income, which can be concerning, as the consumer wearable and computing sectors are also under pressure.

AMKR has an A valuation grade by the Quant, and I agree with it. They have a P/E ratio FWD of 13.47x compared to the sector ratio of 21x, showing that they are undervalued. Another reliable ratio is the PEG ratio, as it takes future earnings and growth into consideration. So for growth companies like AMKR PEG ratio is a reliable metric. They have a PEG ratio TTM of 0.46x compared to the sector ratio of 0.66x. The third valuation metric is the Price / Sales ratio. They have a Price / Sales ratio FWD of 1x compared to the sector ratio of 2.96x. After looking at all the metrics, I believe AMKR is an undervalued company.

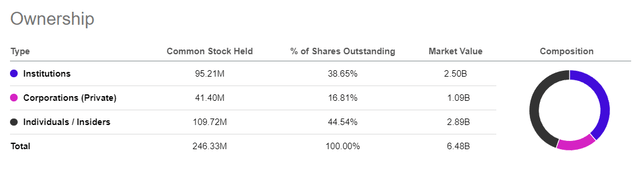

Since institutions hold only 38.6% of AMKR's shares, the shareholding structure doesn't appear healthy. While share price swings are less volatile, and a company is viewed as safe for investing when institutions own the majority of the stake, I believe the institution holding in a company should be at least 60%.

Risk

Cyclical In Nature

The semiconductor sector is cyclical by nature, and this, as well as more general economic factors like consumer spending and global GDP, affect their operations. Many times the semiconductor industry has experienced sudden downturns in the past. If the market they compete in experiences slow or negative growth, their business might be impacted. In addition, they depend on semiconductor companies for outsourced packaging and test services; hence any downturn in the industry that uses a significant number of semiconductor devices could adversely affect their business and operating results.

Bottom Line

It is my opinion that AMKR is an undervalued, promising company with growth potential. However, my sole worry is the company's future revenue growth. The management anticipates a decline in revenue in FY23, and a decline in net income in Q4 FY22 is concerning. Hence as per my analysis there is no fresh buying opportunity in AMKR stock.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.