Agree Realty: Not Worth Buying At The Current Price

Summary

- Agree Realty is one of my favorite Net Lease REITs, but I don't see a margin of safety at the current valuation.

- The company recently reported Q4 earnings, showing solid portfolio growth in 2022.

- Shares currently trade at a price/FFO of 19.3x which is a couple turns over the average multiple, and a bit more expensive than the rest of the sector.

- Shares currently yield 3.9%, but Agree did hike the monthly payout twice in 2022.

- I really like Agree, and I plan to continue to hold my shares, but I don't think now is a good time to be buying new shares.

Wolterk

My portfolio has had a great start to 2023, mostly due to strong performance in some of my largest holdings, like Enterprise Products Partners (EPD), Altria (MO), Alibaba (BABA), and NewLake Capital Partners (OTCQX:NLCP). Throw in leverage and a couple of speculations that I think are just getting started, like Transocean (RIG) and Peabody Energy (BTU), and I think 2023 could be a fun year. I’m more conservative in my Roth IRA, which primarily consists of REITs, but that account is up a fair amount as well. One of my largest positions in that account is Agree Realty (NYSE:ADC), which I view as a strong set it and forget it pick in the REIT space. The company recently filed its 10-K and I figured it was time for an update on one of my favorite net lease REITs.

Investment Thesis

While I occasionally speculate in higher risk opportunities, Agree Realty is a great net lease REIT for conservative investors. They have consistently grown their real estate portfolio over the last decade along with the monthly dividend. They have a good balance sheet with no significant debt maturities until 2028, and most of their borrowings are fixed rate. However, I wouldn’t be adding shares at the current price. I don’t see much in the way of a margin of safety with a price/FFO of 19.3x and a yield below 4%. I don’t think investors should expect multiple expansion, and growth is projected to be slow over the next couple years. While I have no intention of selling shares, I think investors interested in Agree should keep it on their watchlist and wait for a better potential entry point.

The Annual Report

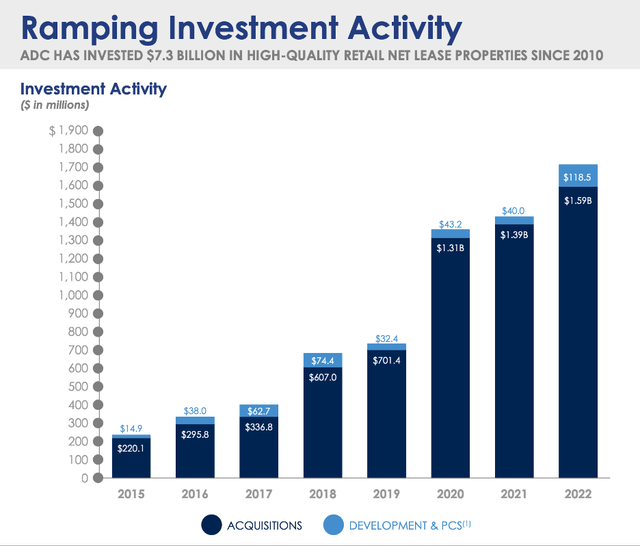

I skimmed the most recent 10-K, and I’m glad to report that I didn’t see any red flags that would materially impact the long-term thesis for investors. The company still has a solid balance sheet, and the company has continued to increase its investment activity. They were busy in 2022, with $1.7B in acquisitions and development.

Investment Activity (agreerealty.com)

They focus primarily on investment grade tenants, like Walmart (WMT), Dollar General (DG), and Tractor Supply (TSCO). They also have an impressive debt profile, with no significant maturities until 2028. While I view Agree Realty as a set it and forget it holding, I don’t think it is an opportune time to be buying shares, simply due to valuation.

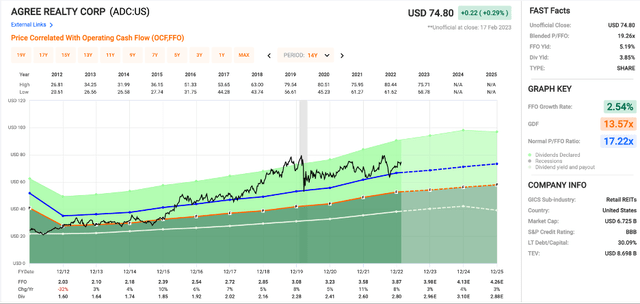

Valuation

I think shares of Agree Realty are sitting right near fair value today in the mid-$70s range. They currently trade at a price/FFO of 19.3x, which is a little rich compared to the sector as well as Agree’s average multiple. Shares have spent the last decade at an average multiple of 17.2x, but it is worth noting that shares have spent most of the last five years above that valuation. I wouldn’t count on any multiple expansion from here, so most of the returns are going to be driven FFO/share.

Price/FFO (fastgraphs.com)

Growth isn’t projected to be that impressive from here, but I think management has shown the ability to make new investments in attractive investment grade opportunities. They have been especially busy in the last three years, and I’m curious to see how rising interest rates impact their growth. Most of their debt is fixed rate so that won’t be an issue until the debt starts to roll over, but the rapid interest rate rise in recent months is going to have an impact throughout the economy. I think Agree is well positioned to weather whatever may come, but that doesn’t mean I would be adding shares right now. I just don’t see a margin of safety at the current price, and I have a tough time recommending investors buy new shares with the yield below 4%.

Consistent Dividend Growth

One of the things that draws income investors to a REIT like Agree is their consistent dividend growth. Agree hiked its monthly dividend a couple times in 2022, a pattern I expect to continue. They also changed their payout from quarterly to monthly a couple years ago, which doesn’t have a huge impact, but all else being equal, I prefer it for the dividend reinvestment. The yield currently sits at 3.9%, so there are REITs in the same sector with larger pay-outs, but I think investors will continue to see dividend hikes at a mid-single digit rate. For investors looking to buy shares, I would be patient to see if we get a more attractive entry point in coming months.

Conclusion

I like the net lease sector for several reasons, but I think investors should be picky with the companies they own. I own several net lease REITs, including Realty Income (O) and Netstreit (NTST), but I haven’t been buying any shares in the sector outside of dividend reinvestment because I think there are better opportunities in other stocks (or REITs). If I were buying REITs today, I would take a look at cell tower REITs like American Tower (AMT) or Crown Castle (CCI). Outside of the REIT sector, there are several opportunities that I find more attractive today.

That doesn’t mean I think investors should sell Agree (or others) and look elsewhere. I plan to hold my shares for a long time, but I’m not a buyer at the current price. With a yield below 4% and a price/FFO of 19.3x, I just don’t see a margin of safety. For me to consider selling, we would have to see significantly higher prices where the downside risk outweighs the potential for further gains. I think Agree is a solid defensive holding, and the recent 10-K didn’t have any red flags from what I saw. They continue to grow their real estate portfolio and their dividend, but I think shares are a hold for now.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ADC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I'm also long each stock mentioned except for ADC's tenants.