Why I Sold Simon Property Group - Again

Summary

- After buying into the stock in October, I am now selling.

- The company exceeded 2022 guidance and is projecting some growth in 2023.

- The company maintains a solid balance sheet with occupancy rates near pre-pandemic levels.

- I discuss where I view a more buyable target for the stock.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

martin-dm

With the pandemic in the rear view mirror, Simon Property Group (NYSE:SPG) is still trading well below pre-pandemic levels. The problem is that even as the company moves beyond pandemic headwinds, the same fears regarding e-commerce remain ever-present and are now being met with fears of a recession. The company maintains a strong balance sheet and trades cheaply on the basis of funds from operations, but I expect the company to have to continue funding redevelopment projects for the indefinite future just to counteract e-commerce headwinds. With the stock now trading at a 5.8% dividend yield, the risk-reward no longer favors a bullish position.

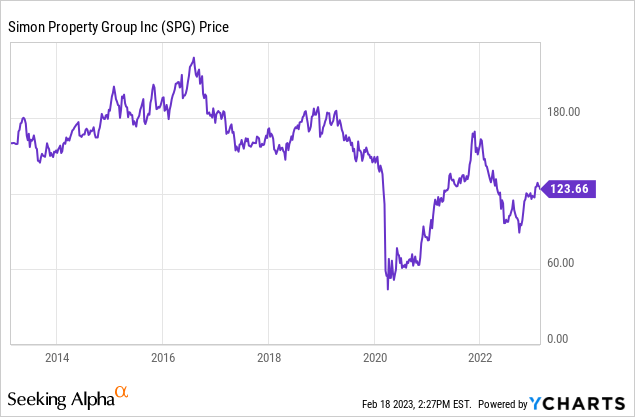

SPG Stock Price

For a while in late 2021, SPG had returned to pre-pandemic levels but has since given back some of those gains.

I last covered SPG in October where I explained why I was finally turning bullish again due to valuation. With the stock returning 23% since then, the valuation proposition is no longer as attractive.

SPG Stock Key Metrics

SPG closed out 2022 with $3.15 in comparable FFO per share in the fourth quarter, up marginally from $3.11 per share in 2021. For the full year, comparable FFO stood at $11.87 per share, up 3.8% YOY. As typical, that full-year result came ahead of original management guidance, which was for up to $11.70 in comparable FFO per share.

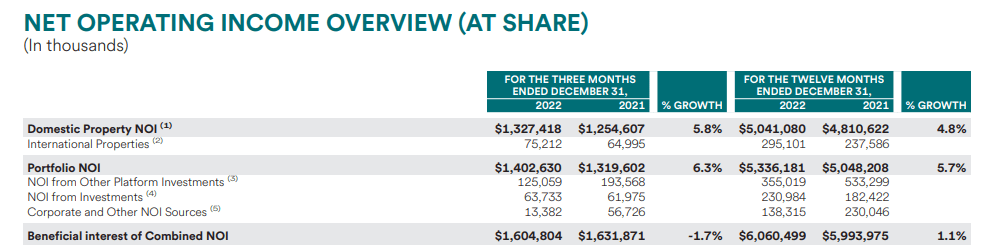

SPG saw solid comparable NOI growth at its properties, but material weakness from “other platform investments” which is primarily made up of its investment in retailers such as JCPenney.

2022 Q4 Supplemental

On the conference call, management noted that OPI made up around 5% of overall FFO.

On a bright note, SPG delivered 2% YOY growth in average base rent - its second consecutive quarter with sequential and YOY growth. As I discussed in a prior article, SPG has changed and reduced financial disclosure over the past few years, including ceasing to disclose leasing spreads and changing their definition for average base rents. It is good to see average base rents finally trend in the right direction, even if these results are still implying some volatility either in leasing spreads or perhaps select rent reductions.

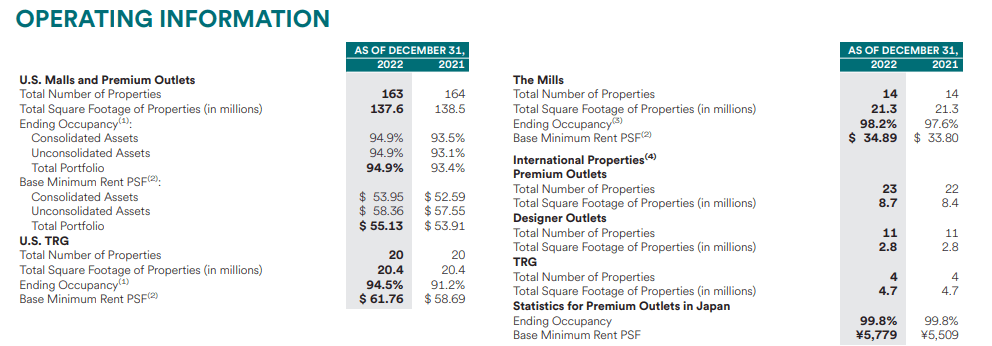

2022 Q4 Supplemental

On the call, management stated that leasing spreads have been positive, but without explicit disclosure and the fact that average base rent is growing somewhat below the typical 2% to 3% annual lease escalators that one would expect from class A mall assets, it may be too early to say that the company is out of the woods. Investors can be hopeful that now that occupancy rates are back very close to 95% that maybe the company may be able to finally show some pricing power.

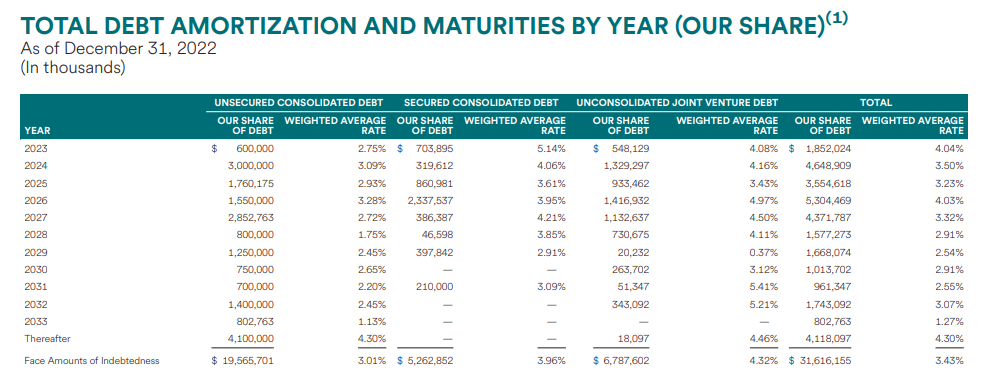

Looking ahead, SPG expects 2023 comparable FFO to come in at up to $11.95 per share, reflecting less than 1% YOY growth. That guidance incorporates expectations for 2% SS NOI growth with a material impact from the rising interest rate environment. We can see below that SPG has many debt tranches coming up for maturity over the coming years that will likely need to be refinanced at higher interest rates.

2022 Q4 Supplemental

Rising debt costs are expected to impact FFO by approximately $0.30 to $0.35 per share.

That 2% SS NOI growth guidance is below the aforementioned annual lease escalators, so investors are right for wondering about the puts and takes there. On the call, management stated that it is primarily due to increasing operating expenses, such as security and housekeeping costs. The tone on the conference call seemed to imply that guidance seemed conservative. That indeed may be true considering that management is projecting flat sales growth. The weak economy may put downward pressure on sales, but the reopening Chinese economy may help bring back tourists which had previously been crucial for foot traffic.

Is SPG Stock A Buy, Sell, or Hold?

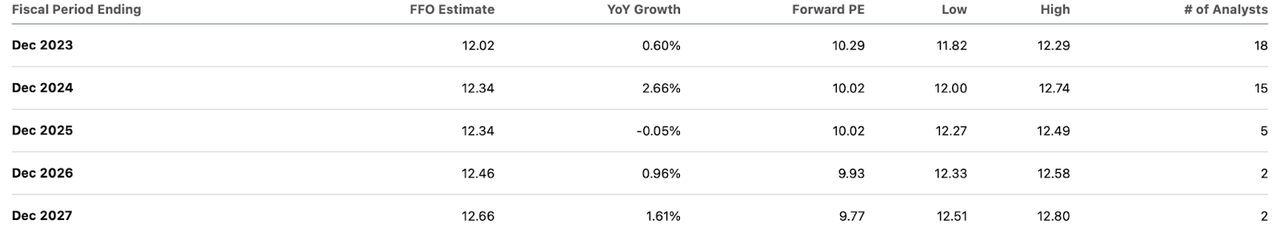

At recent prices, SPG was trading at only 10.3x forward FFO. That may seem cheap considering the A- rated balance sheet and portfolio primarily made up of class A real estate. But one mustn’t let feelings get in the way of numbers. We can see below that consensus estimates are mixed, projecting stagnant earnings over the next 5 years.

Seeking Alpha

Besides paying the dividend, the remaining free cash flow in general is spent towards redevelopment projects. While SPG has touted satisfactory yields on those investments, the company’s growth in recent years has not reflected such ROI. I expect SPG to continue investing heavily in redevelopment projects over the coming decade as it seeks to counteract the headwinds imposed by e-commerce. Some investors may be waiting for an end to the “CapEx cycle,” but I caution against such hopes because absent investment in redevelopment projects, what reason should investors have to hope for the company to not suffer from e-commerce over the long term? The argument is quite simple: e-commerce is more convenient than in-person shopping and oftentimes even cheaper due to the various shopping portals available. While there are certain items that may be more resilient to e-commerce headwinds (like luxury goods), the threat is instead in the smaller and higher risk tenants which are highly dependent on foot traffic.

That means that shareholders should focus more on the 5.8% dividend yield as opposed to the 9.7% FFO yield, as it is not clear if the retained cash flow will directly translate to cash flow growth. Perhaps SPG can grow their dividend at a 3% to 4% clip moving forward, that may lead to close to 10% annual returns assuming no multiple compression.

Yet I cannot help but continue to caution that there may be a tipping point in the future at which point it becomes clear that the mall REIT business model as it stands is not viable. That is not to say that malls will go away - but instead that there simply are too many stores in the mall. I expect the mall of 10 years later to be much different than the mall of today - with more restaurants and less small box stores. I expect e-commerce to be the main culprit. This would show up in the fundamentals through cash flow declines - it would obviously be very bearish if SPG is unable to grow annual cash flows in spite of annual lease escalators, leasing spreads, occupancy gains, and redevelopment projects. The lack of cash flow gains would imply weak leasing spreads, select rent reductions, or both. Given that the company for the bulk of 2022 has already been lapping pandemic comps with modest results, one could make the argument that we are already seeing such pressures today.

Based on that argument, it is difficult to see a case for multiple expansion, as growth is very unlikely to accelerate further than 4%, if it can even hit that level on a sustainable basis. These aren’t industrial real estate in which the long term story is promising, but instead mall real estate in which general sentiment remains pessimistic (again on account of e-commerce headwinds). Even if it takes many years before my anticipated tipping point takes place, I expect sentiment to remain negative as there is no clear reason why e-commerce will not simply continue chipping away at retail market share. I see SPG stock as being buyable mainly when it becomes more deeply undervalued. I previously purchased at a 7% dividend yield and find such a yield - if not higher - to be a more appropriate level to consider buying back into the name. I have sold my position and do not anticipate re-entering the stock until the valuation proposition improves - even if the company does end up outperforming 2023 estimates.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.