Aflac: Impressive Record, Mixed Results

Summary

- When looking into dividend growth investing, few companies have as strong a record as Aflac.

- Investors in Aflac have seen massive price appreciation and impressive dividend growth.

- The most recent quarterly report shows some soft numbers, and the latest dividend increase is somewhat disappointing.

Spencer Platt

Few concepts are more enjoyable to think about than the thought of passive income hitting one's bank account. This income usually takes work on the front end. Investing in stocks or real estate takes capital, and outside of a gift or an inheritance, it takes work to build up those initial dollars to invest.

However, once an individual or a household has some capital, it's possible to deploy it toward passive income that comes from investments. Bonds and bank accounts pay interest. Real estate, when done correctly, brings in rental payments. Stocks pay dividends. There are many tax benefits from real estate investments, but there can also be headaches. Renters can have the proverbial leaky toilet at 2 a.m., and owners who don't have a property manager might have to make a trip in the dead of night to fix it. I don't really find that hassle appealing.

That's why I like dividend investing. I can own real estate without having to manage it or even find a manager. All I need to do is buy some shares of a real estate investment trust. I can also own first-rate companies that have no connection to real estate when I own shares of their stock. I like to purchase companies or funds that pay out dividends every quarter or every month.

As long as the companies I own continue to do well, they can continue paying out dividends for the foreseeable future. If they have the ability to increase their revenues and, more importantly, their income, they can increase these dividends over time. Some companies have increased their dividends for decades. One of those companies is Aflac (NYSE:AFL). This supplemental insurance giant has grown its payout to shareholders for 40 years straight. This goes back to the first term of the Reagan presidency, and the years since have seen a global financial crisis and a global pandemic, not to mention terror attacks, governments run entirely by both political parties, along with divided government.

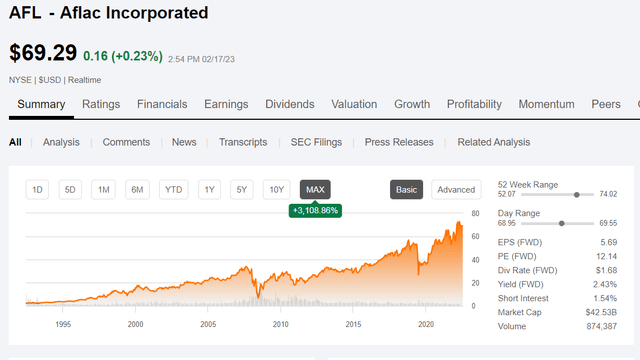

Year after year, under all sorts of economic conditions, Aflac has delivered results for its shareholders. The following chart tracks the price movement of AFL over the past 30 years, and it shows that investors who have held it for the entirety of this period saw the value of their shares increase to more than 30 times what it was. Accounting for splits, the price of Aflac has increased from $2.16 per share in February 1993 to its current price of $69.32 (as of 3 p.m. on February 17, 2023).

30 years of Aflac Price Appreciation (Seeking Alpha)

In addition to the price appreciation, the dividend paid out by AFL has grown impressively. When looking at the company's investor relations page, one can see Aflac's dividend growth history from 1992, when the split-adjusted dividend was $0.01 per share per quarter. Today, after a recent increase, the dividend sits at $0.42 per share per quarter. Indeed, the dividend payout has grown even faster than the price.

Again, the performance of Aflac has been strong. However, recent results might give investors a bit of pause before entering a position at the current price level.

Recent Quarterly Results

The most recent quarterly results did not show revenue or income growth. Some of the declines were due to investment losses that were tied to foreign exchange rates. Aflac is active primarily in the American and Japanese markets, and the latter was hurt extensively by a much weaker yen when compared to the dollar. In the fourth quarter of 2022, the exchange rate was 141.87 yen to one dollar; in the same period a year before, the exchange rate was 113.70:1. Net earned premiums in Japan were down more than 19% from the previous year (the fourth quarter also ended the fiscal year for Aflac), despite an 11.4% increase in new annualized premium sales in the Japanese market.

Sales in the US increased by 16.1% over the past year, but the net earned premiums might give investors a bit of pause. These actually declined by 0.2% over the past year, and the company indicated that "lower persistency" was the cause. In other words, enough policyholders allowed their policies to lapse to cut this number. Was this due to inflation? If people are having more trouble paying for necessities, supplemental insurance policies might be one of the areas that people decide to cut back on. If inflation continues and disposable income is stretched, this could weigh on Aflac's performance for a while. One quarter or one annual report does not a trend make, but it is important to watch this number over the long term to see if it does indicate a trend.

Overall, total revenue for the past 12 months came in at $19.502 billion, which was a decrease of 11.8% over the previous 12 months. Additionally, net earnings dropped 2.9% to $4.201 billion. Again, one year does not a trend make, but the revenue number for 2022 was the lowest Aflac has reported over the past 10 years.

Regarding the dividend, AFL, as noted above, has increased its dividend for 40 successive years. It's frequently argued that the safest dividend is the one that's just been raised. Aflac just announced late last year a 5% raise of $0.02 per share per quarter. This brings the quarterly payout to $0.42/share. While this is in line with increases from a few years ago, the last two increases were nearer 15% to 20% (21.2% for 2022, to be exact). Perhaps this shows that AFL is a bit less optimistic about the ability to increase the dividend as rapidly. However, it should be noted that according to Seeking Alpha, the current dividend payout ratio is still quite low at 30.08%.

The most recent quarterly report noted another area in which the company has been good to shareholders over the past year. Indeed, over the past 10 years, AFL has been engaged in the practice of buying back shares aggressively. In that period of time, the number of shares dropped from 929 million to 634.8 million. In other words, there are about 1/3 fewer shares on the market today than there were in 2012. Aflac bought back 39.2 million shares in 2022 alone, and in the most recent report, there are still 116.6 million additional shares authorized under the current buyback program as of the end of last year. That would take roughly 1/5 of the current shares outstanding off the market, a move that will benefit earnings per share.

Conclusion

There is much to like about Aflac. I have owned shares in the past, and I would like to own them again. The lower revenue in the past year is at least partially due to a fluctuating exchange rate. The current PE ratio for the stock (10.56 as of February 17, 2023) is higher than it has been for most of the past five years. Shares were in the $50s for much of the past two or three years, and even spent most of 2020 at or below the $40 mark. The release of the most recent quarterly report saw a bit of a drop in the price initially, but nowhere near the prices available as recently as October. If shares drop around the $60 mark or lower, I would be interesting in buying shares. At the current price, I would hold if I owned the stock. (For full disclosure, I owned shares until August. I sold to free up cash because of a move and the purchase of a new home, not because of any major concern in holding shares of Aflac for the long run.)

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment professional. The preceding is intended for informational and educational purposes. Please make sure to perform due diligence before investing in equities, as losses up to all capital invested can occur.