SQM: Lithium Prices Are Still Relatively High

Summary

- The end of EV subsidies in China and increasing lithium production caused lithium prices to drop in the past few months.

- However, lithium prices are significantly higher than the 5-year average, and the long-term demand for electric cars is strong.

- SQM’s net debt and total equity are well enough to tailor a scope of capacity to reward its shareholders and assimilate upcoming risks.

- In the third quarter of 2023, SQM catered the highest amount of $1255.2 million in free cash flow compared with recent quarters.

- SQM stock is a buy.

jroballo

Year to date, Sociedad Quimica y Minera de Chile’s (NYSE:SQM) stock price is up 12%. For the sake of the increasing demand for electric cars supported by different subsidies, lithium prices jumped in the first ten months of 2022, then dropped in the past few months as the supply increased and the Chinese government ended its EV subsidies. SQM’s lithium and derivatives revenues in 4Q 2022 and 1Q 2023 will not be as strong as in 3Q 2022. However, lithium prices are still significantly higher than the 5-year average. Also, the long-term demand for electric cars is expected to be strong. Thus, the company can remain considerably profitable. Also, SQM has been able to improve its cash and capital structures. The stock is a buy.

The market outlook

Due to the strong supply and lower demand for lithium batteries, lithium carbonate prices slashed in the past few months. The global lithium mining market is projected to value $495 million by 2028 (with a CAGR of 5.5%). Also, it is worth noting that the global lithium mining market is expected to witness a 32% jump in 2023.

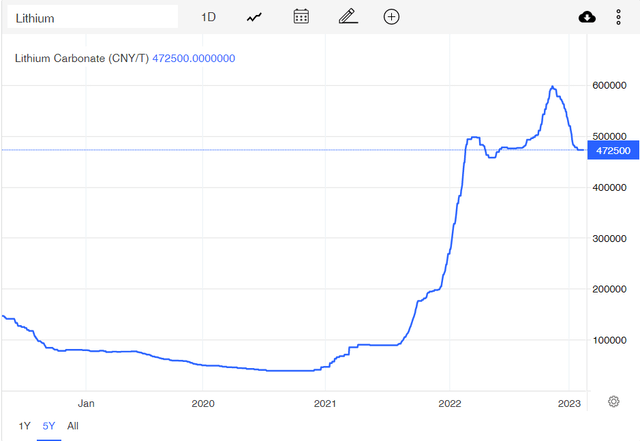

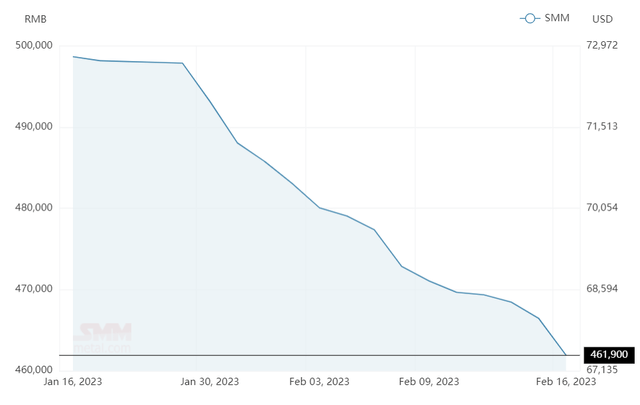

According to Figure 1, lithium carbonate prices are now more than 20% lower than their record high in November 2022. However, compared with February 2021, lithium carbonate prices in China are relatively high. Moreover, according to Figure 2, SMM Lithium Hydroxide Index dropped sharply in the past month.

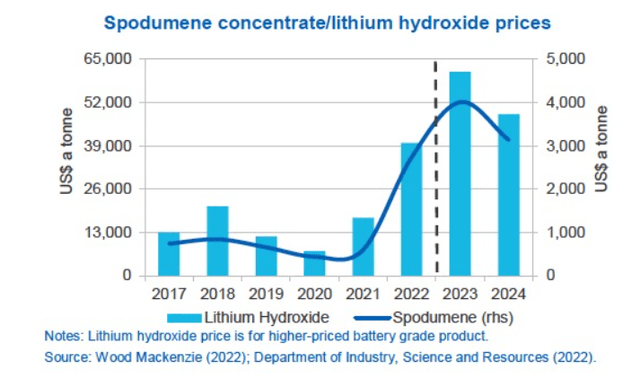

However, due to the robust long-term outlook for electric cars, I expect lithium carbonate prices to increase again. The Australian government forecasts lithium hydroxide prices to increase from about $40000 per tonne in 2022 to more than $61000 per tonne in 2023 and then moderate to an annual average of $48500 per tonne in 2024 (see Figure 3).

Figure 1 – Lithium carbonate prices in China

Figure 2 – SMM Lithium Hydroxide Index

Figure 3 – Lithium hydroxide prices

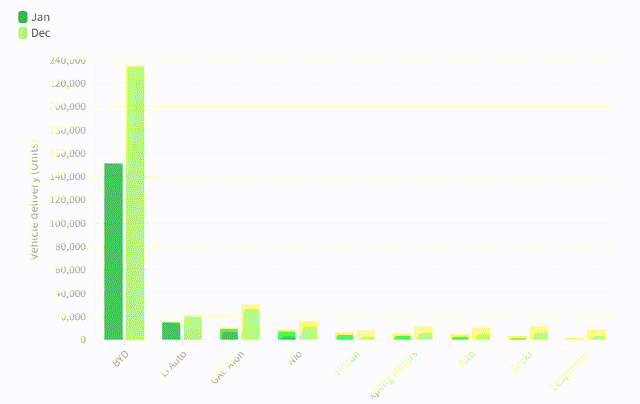

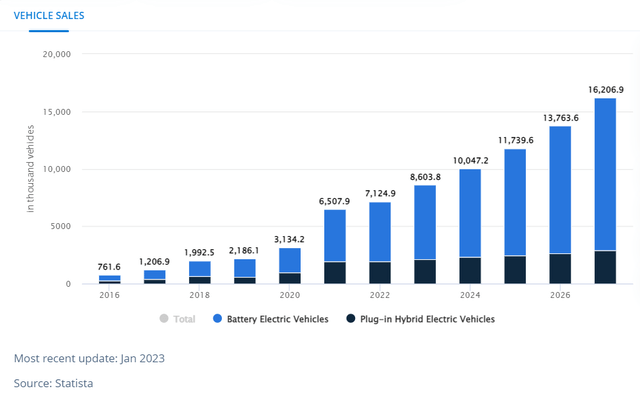

As the central government of China fully ended subsidies for purchasing EVs at the end of 2022, sales growth of electric vehicles has decreased. According to Figure 4, sales of major Chinese EV makers dropped in January. However, due to the increasing interest in electric cars and the zero-emission policies around the world, the global revenue in the EVs market is projected to rise at a CAGR of 17% between 2023 to 2023. Also, global EV unit sales are expected to increase from 7.1 million in 2022 to 8.6 million in 2023 and to 16.2 million in 2027 (see Figure 5).

Figure 4 – Sales of Chinese EV makers in December 2022 and January 2023

Figure 5 – EV unit sales

SQM performance outlook

Since the first quarter of 2022, the company’s cash and equivalents decreased by 21% to $2578 million in 2Q 2022 versus its amount of $3294 million at the end of 1Q 2022, while it increased back to $3763 in 3Q 2022. Also, the combination of amazing cash generation with an almost constant debt amount led to a deep drop in its net debt. In other words, SQM’s net debt sat at a negative level of $(1086) million for the second time in the preceding year, which is a clear witness of the company’s stability as it shows that it possesses more cash and cash equivalents than its obligations. Furthermore, SQM’s total equity improved considerably by 30% and sat at its highest amount of $4645 million in the third quarter of 2022. Also, the company’s total equity is about 40% higher year-over-year versus its level of $3324 million in 3Q 2021. Thankfully, SQM’s net debt and total equity are well enough to tailor a scope of capacity to bring benefits for its shareholders and assimilate upcoming risks. Thus, notwithstanding the discouraging market outlook for the first quarter of 2023, SQM’s capital structure may keep its healthy position (see Figure 6).

Figure 6 – SQM’s capital structure (in millions)

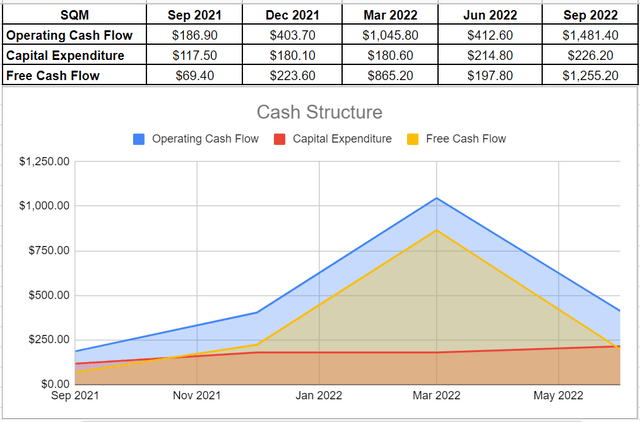

After the downturn of 2021 due to the COVID-19 pandemic, the company started the recovery process successfully. Albeit SQM’s cash operation plunged deeply to $412.6 million in 2Q 2022 compared with its amount of $1045.8 million at the end of 1Q 2022, its operating cash flow boosted back to $1481.4 million in 3Q 2022. It goes without saying that the cash operation in 3Q 2022 is far higher year-over-year compared with its level of only $186.9 million at the same time in 2021. This huge advance in operating cash balance, aligned with a slight increase in CapEx, led to a jump in free cash flow generation. In minutiae, in the third quarter of 2023, SQM catered the highest amount of $1255.2 million in free cash flow compared with recent quarters. When all was said and done, SQM showed its capability of providing reliable distributions in case of a stronger market outlook (see Figure 7).

Figure 7 – SQM’s cash structure (in millions)

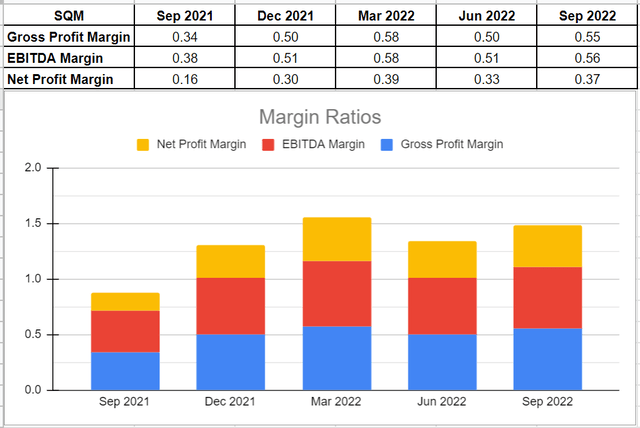

Furthermore, I looked at SQM’s profitability ratios in this section to assess how well the company can turn a profit and use its assets to make money for its investors. After observing the company’s well-performed cash and capital structure, it is not surprising to see their reflection on profitability metrics. Thus, I have examined the profitability condition across the margin ratios to provide useful insights into the financial health of the company. I calculated the ratios in comparison to earlier quarters to be more helpful.

In general, margin ratios evaluate the ability of the company to turn revenues into profits in a number of ways. For the sake of higher lithium prices in 2022, this energy company had stronger gross profit, EBITDA, and net profit margins in the third quarter compared with the end of 2021. In minutiae, the total revenue of SQM improved by 13% from $2598.8 million in 2Q 2022 to $2958.3 million in 3Q 2022. An increase in revenue combined with a higher level of profits and EBITDA led to lower margin ratios in the third quarter of 2022.

SQM’s gross profit margin was 0.55 in the third quarter of 2022, which is slightly higher than its amount of 0.50 at the end of 2Q 2022. Also, the company’s EBITDA margin was 0.56 in 3Q 2022, which is 9% higher than the previous quarter of 0.51 and 47% higher year-over-year compared with its amount of 0.38 in 3Q 2021. Moreover, SQM’s net profit margin, which is the final picture of how profitable the company is after all expenses, increased by 12% to 0.37 in 3Q 2022 versus its previous amount of 0.33 at the end of the second quarter of 2022. As a result, the higher prices of Lithium and the company’s well performance in the preceding year led to higher revenue and profitability ratios. However, due to the lower Lithium prices in 2023, I expect lower margin ratios for the first quarter of 2023 (see Figure 8).

Figure 8 – SQM’s margin ratios

Summary

As lithium prices decreased in the past few months, I don’t expect SQM’s 4Q 2022 and 1Q 2023 financial results to be as strong as in 3Q 2022. However, it doesn’t mean that SQM’s 4Q 2022 and 1Q 2023 quarterly results will be unappealing. The lithium market outlook is strong as SQM’s average selling prices are expected to remain significantly higher than two years ago. SQM stock is a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.