Alibaba: The Selling Has Intensified

Summary

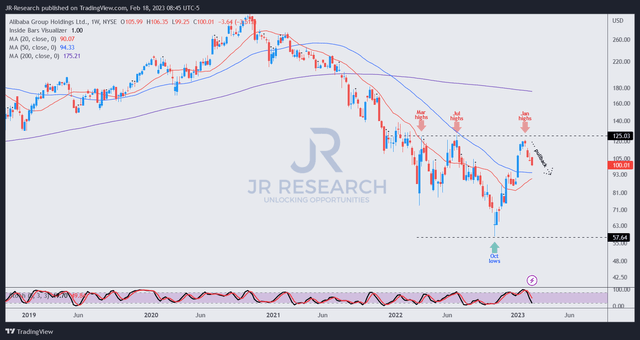

- BABA's breathtaking rally from its October 2022 lows, surging over 100%, hit a speed bump as it pulled back from its January highs.

- Alibaba is aggressively expanding its cloud computing footprint beyond China as growth slows.

- BABA's attractive NTM EBITDA multiple of just 8.8x demands attention, signaling a potential bargain not fully exploited yet.

- Investors who overlooked BABA's 2022 lows should seize the opportunity to buy the dip and ride the recovery.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

maybefalse

Alibaba Group Holding Limited (NYSE:BABA) is slated to report its highly anticipated FQ3'23 earnings release on February 23. Investors will likely look to management for optimistic commentary following China's full reopening from COVID and a nascent consumption recovery underway.

However, investors need to note that China's economic recovery remains highly uncertain in H1'23, with more clarity in H2. In addition, China's dependence on its domestic economy for recovery will be critical, given the likely weakness in export markets.

Therefore, it has moved ahead to restart its industrial engine as consumer spending could remain tepid in the near term, given relatively low confidence. China's property market has also not emerged from its doldrums, as property developers still face "liquidity struggles."

However, with BABA having recovered more than 100% from its October lows toward its January highs, much is at stake for CEO Daniel Zhang and his team to prove as BABA's valuation normalized.

We also highlighted in our previous article cautioning investors about chasing the momentum spike, which seemed to be plateauing. As such, we aren't surprised that BABA has pulled back significantly from its January highs, even as investors have piled into Chinese stocks, hoping not to miss out on its surge.

With that in mind, we believe BABA is at a critical juncture as investors assess whether management could resume its guidance after pausing it previously due to macro and regulatory uncertainty.

The regulatory landscape has since improved significantly, even though Nikkei Asia published an op-ed highlighting that "tech regulation will never recover to the pre-2020 status quo, even though tech companies will enjoy a temporary reprieve."

As such, investors will need to be cautious about expecting Chinese President Xi Jinping to completely release the shackles on its Internet companies, returning them to unfettered growth mode.

Hence, even as China reopens for business with the world, it expects its domestic companies to behave appropriately. Xi stressed in a recent address to top officials that "China needs to create a path to modernization that is more efficient than capitalism and better safeguards social justice."

Hence, we believe the hyper-growth phase in domestic consumption is likely over for Alibaba and its Internet peers, behooving a strategic revamp of its growth vectors.

Recent reports indicate that China's declining population highlights structural growth impediments, requiring Alibaba to look outside China to spur growth.

Therefore, investors should be on the lookout for Alibaba's opportunities in the cloud computing space in Southeast Asia. In addition, keen investors should recall that CEO Daniel Zhang has assumed control of "Alibaba's important cloud division and [becoming] acting president of Alibaba Cloud Intelligence."

The company has also shifted its Alibaba Cloud's ex-China HQ to Singapore as it looks to expand its footprint in Southeast Asia, challenging the hegemony of the US hyperscalers.

WSJ reported that Alibaba and its peers mainly engage in price competition to convince companies to adopt their services, "[offering] prices that are 20% to 40% lower than American firms on different products."

However, it's a tall order to expect Alibaba to dislodge the market share of AWS (AMZN), Microsoft Azure (MSFT), and Google Cloud (GOOGL) (GOOG), which hold a combined share of 70% in Southeast Asia.

Furthermore, western companies based in Southeast Asia could also be concerned with geopolitical risks between the US and China, frayed recently by the spy balloon incident.

Despite that, Berkshire Hathaway's (BRK.A) (BRK.B) Vice Chairman Charlie Munger argued that "China is still a prime opportunity for investors despite geopolitical risks." He stressed that "investors can buy stronger Chinese companies at cheaper valuations than those in the US."

That thesis was bolstered recently by Scion Asset Management's Michael Burry, whose firm released filings showing new positions of 50K BABA shares added in CQ4'22, demonstrating his prescience.

Therefore, is the recent pullback an opportunity for investors who missed its October lows another chance to load up?

BABA price chart (weekly) (TradingView)

At an NTM EBITDA multiple of just 8.8x, BABA is not expensive, having pulled back closer to the two standard deviation zone under its 10Y average of 8.2x.

Hence, the market has likely priced in a much weak growth recovery phase for China's leading e-commerce company.

As such, we will look at Zhang's commentary on its recent forays into Southeast Asia as Alibaba looks to expand its cloud presence and market share to rejuvenate growth out of China.

While the pullback could continue as the bearish bets intensified recently, we believe it represents an opportunity for investors to start adding if they missed its October lows previously.

Rating: Buy (Revised from Hold).

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you'll also gain access to exclusive resources including:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Unlock the secrets of successful investing with JR Research - led by founder and lead writer JR. Our dedicated team is laser-focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular marketplace service - specializing in a price-action-based approach to uncovering the hottest growth and technology stocks, backed by in-depth fundamental analysis. Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis. We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups. Join us and start seeing experiencing the quality of our service today.

My LinkedIn: www.linkedin.com/in/seekjo

Disclosure: I/we have a beneficial long position in the shares of BABA, AMZN, GOOGL, MSFT, BRK.A either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.