V.F. Corp.: Why I'm Taking The 'Buy' View

Summary

- I know many on our service have been positive on VFC for some time - I have not been one of them. There are reasons for this.

- I took my beatings when I overestimated the quality of A-rated international discretionary brands like Adidas. As a result, I no longer allow almost any business to trade at premium.

- V.F. Corp. is, to me, a good example of such a business, next to Adidas.

- The mistake however, is believing that there is not appeal at this business at any valuation. I believe there is appeal here.

- I bought my first shares in V.F. Corp. after the dividend cut. Here is my initiatory thesis.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Spencer Platt

Author's Note: This article was published on iREIT on Alpha in mid-February.

Dear subscribers,

V.F. Corp. (NYSE:VFC) has been a bit of a battleground stock for the past few years. The results have not been good. I've always been aware of VF Corp, but being European, I've preferred to invest in European discretionary companies. This includes not only Adidas (OTCQX:ADDYY), but quality businesses that actually have delivered alpha like LVMH (OTCPK:LVMUY), Kering (OTCPK:PPRUY), Campari (OTCPK:DVCMY), and others. I know them better than I know VFC.

However, I've always kept an eye on these companies, and they've been on my watchlist. And when the company crossed below 13x P/E, I became interested. I'm not going to claim to be able to forecast the dividend cut. That would be foolhardy - almost no one saw that one, realistically, coming. However, given the way the EPS forecasts looked, I fully believed the company could go far lower, and it has.

So, with that in mind, I'm going to take a very careful and methodic crack at V.F. Corp., and explain why I, unlike some of my respected colleagues, take a "BUY" view here - not a "SELL".

V.F. Corp. - From A to Z

First of all, I want to be clear that I never saw VFC as a company that deserved the sort of premium we saw starting in 2018-2021. I viewed these levels as absolutely insane. It might be that it's because I'm European and don't know the brands the same way - but I've never put VFC brands on par with Adidas, or any of the consumer discretionary brands I follow actively.

VFC is a quality business. It's BBB+ rated, it has nearly a billion dollars in market cap, and it owns some of the most qualitative brands in key segments. It has a 120+-year history. It's a component of the S&P500, and its organized into very attractive business segments of Outdoor, active and work.

Controlling over 50% of the US Backpack market is no small feat either.

However, while I'm sure that most Americans asked on the street would know what a pair of Adidas was, or a Louis Vuitton Bag, I doubt if I asked my colleagues right here at this minute if they knew what Altra was, or Eastpak, or Icebreaker - and I'm in a geography where active and outdoor-wear is quite popular due to weather. I say this not to beat down on the company's brands, I say that, unlike these aforementioned discretionary companies, most of VFC's appeal lies in NA.

This is not true for the other companies I cover - and this is key to the reason why I've been so lukewarm and uninterested in the company.

VFC is one of the largest companies in its field - and the company's largest brands are Vans, The North Face, Timberland, and Dickies. These are attractive brands to be sure. The company "plays" in the consumer discretionary field, and even in this field, however, they're a comparatively small player on a global field. Not just compared to Adidas, though that comparison can easily be made - but compared to other discretionary companies.

LVMH, VFC, Adidas, Revenues (TIKR.com/S&P Global)

I illustrate these revenue differences to explain to you why I'm 3.5% in Adidas, nearly 5% in LVMH, and 0% in VFC (until yesterday). To my mind, VFC has always been a comparatively small player in a field where I would rather own already-established, international companies. Barring the problems with Adidas, this strategy has worked out fairly well for me.

This does not mean that VFC is unattractive because of its smaller scale and almost "cute" revenues compared to LVMH. VFC follows your typical apparel/footwear/accessory structure. It works through wholesale, specialty stores, department, and national chains as well as DTC operations with a DTC mix to almost 50% of the current revenues.

And while some of you may say that VFC is indeed an international business with 29% EU and 14% APAC, compared to many of the other companies, having that low sales mix from the EU is still comparatively low, given that our population is far larger than the US - not to mention APAC.

VFC manages a complex supply chain to source its products across the world - 252 independent contractor manufacturing facilities in over 30 countries. In this, it does not differ all that much from Adidas, which also uses manufacturing that it itself does not own.

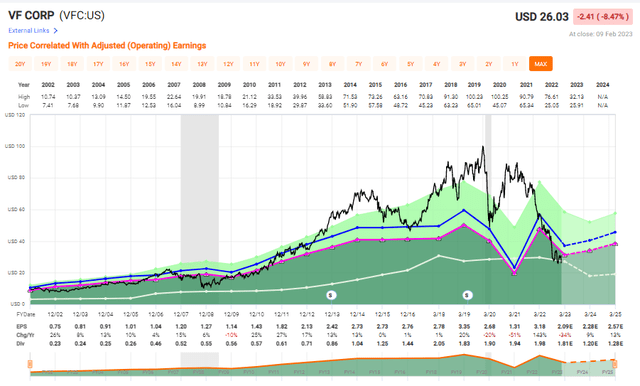

Like most companies in the apparel and footwear space, VFC has seen some extreme pressures in the past few years. However, in this company's case, it has been worse because unlike some of its peers, VFC's history of premiumization for the valuation is relatively short-lived. Until 2013, the company very rarely, if ever, traded above a 20x P/E ratio.

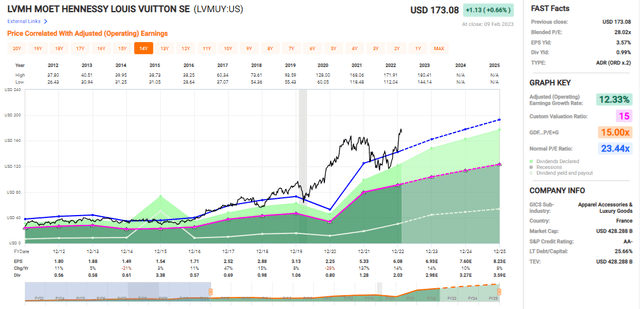

VF Valuation and earnings (F.A.S.T graphs)

You will note that despite very meager growth rates in the years of 2014-2018, the company saw premiumization, which only grew to excessive levels because the company delivered a significant beat a few times, with 2019 as an example.

In a way, it's very similar to what happened with Adidas. Premiumization in valuation is only valid, as I view it when there is potential for long-term and significant earnings potential and outperformance. That has never been the case for VFC, not in the long term, and isn't the case for Adidas either. LVMH pulls it off.

LVMH Valuation (F.A.S.T graphs)

This company has more than double the long-term growth rates that some of these other businesses, including VFC, has if you look at key time periods. The mistake I made in my initial Adidas staking was accepting too high a premium and not discounting enough in terms of the downside potential - or allowing a too high premium simply for the name - and Adidas is obviously a far stronger brand than is anything VFC has to offer.

That's why, in hindsight, my initial stakes in Adidas were allocated too early, and why the recent stakes much closer to conservative valuations have done far better. It's also why my investments in LVMH have been so successful. The way I see it, I valued the premium correctly in relation to the company's actual performance.

What's currently happening with VFC is perfectly natural. In today's environment, the company is only one example of many businesses facing extremely adverse operational results and trends. The fact that the company had a very high yield for a discretionary company did not help matters one bit. Whenever I see a company that struggles to grow above 5% on a 20-year basis annually yielding over 7%, I know something's out of whack, and I do become careful.

The right-sizing of the dividend is prudent and natural, even though the latest quarterly presentation was about as "cookie-cutter management speak" as you can get, with gems like this one in the slides.

I call on you to find a more insipid or bland description of a company's future targets and potential.

Simply put, VFC is a company that takes $100 revenue dollars, earns around $49-$53 gross margin from that, and around $7.69 in terms of operating margin. That is not a good operating margin.

Adidas is at over $10, or 10%. LVMH is over 26%. VFC typically averages over 10% as well, but this recent dip showcases how the company is struggling - the organization is not efficient at turning revenue dollars to the bottom line.

The challenges the company is facing are both typical and something we haven't seen in some time for this sort of business. High inventories coupled with supply chain issues, coupled with problematic macro, coupled with inflation. It's a deadly cocktail, and like other companies that have seen inventory issues in recent months and years, like Stanley Black & Decker (SWK), this has come to hound the company. Inventory issues of this nature mean that the company has misallocated capital and forecasted quite incorrectly.

This company is highly cyclical in nature, and this coupled with a current lack of growth explains the way the market has been punishing the business. Investors expected dividend safety from a newly-crowned king coupled with at least-decent growth from a host of qualitative brands.

That is not what they got.

Instead, they got served a dividend cut, and these aforementioned issues, which explains why many are rushing for the door.

If you're one of the investors that actually bought at over $60/share, then this is an understandable sentiment to have.

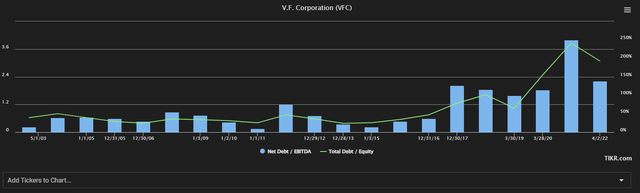

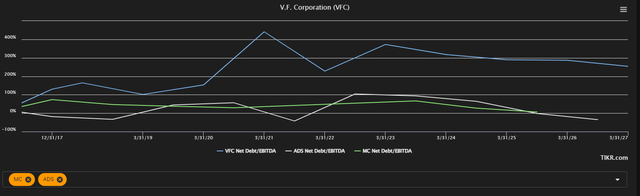

When I looked through VFC's filings and financials, it shocked me how badly prepared the company was for this. Another contributor did a good job in laying out the company's debt situation, but it's essentially a combination of over $3B in near-term 2023-2025E maturities, weakness in the refinancing perspective in a way that would put at least 50 basis points on the weighted average cost of debt for the company. While a 3.72x net debt/EBITDA might not sound as much for 2023E, this is to be taken in context where VFC was at 0.55x back in 2016.

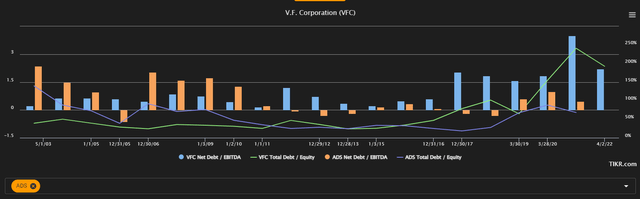

Compared to both the closer peer and the international luxury peer I look at and compare to, the cracks in VFC's façade are becoming clearer and clearer.

VFC/Adidas/LVMH Debt (TIKR.com)

With all this known, it's completely logical that the market is valuing VFC at no more than 10-12x P/E at this time. It's an overleveraged, over-inventoried cyclical apparel/accessories/footwear player with a negative outlook in the near term that recently cut its dividend, a 50-year tradition.

What about this does not scream "devalue me"?

VFC has fundamental issues. These go beyond what I mentioned here and also include what VFC has sold and bought over the past few years - how it manages what it has, and works with what it buys.

To only look at distances from highs or lows, recession forecasts, historical quality indicators, and peers without looking at the specifics here is to do yourself a disservice. If you looked at the last 5-8 years' worth of deals and how the company's debt, income, margins, and earnings have evolved, you could have noticed some, if not all of these cracks. I'm not claiming this was forecastable - but I'm saying I raised my eyebrow when VFC spun off Kontoor brands, only to then turn around and pay close to 4x sales, way above peer and more than 1.5-2x the company's own sales multiple and the sales multiple of far better companies, like Adidas, for Supreme®.

How a company uses its cash and its assets is more important to me than the earnings it makes - because a company can have the most wonderful earnings that are time-tested, but if this is then combined with a downturn, and management has started to mishandle company assets, then this can turn into a "tornado" of negative trends, which is what we've seen evolve here.

The operational problems in the company are nothing new - it's nothing I need to focus too long on, except perhaps if you over-focus on per-share metrics or near-term historicals, or the company's too-rosy forecasts.

Follow me on this exercise. Take a look at what's happened to company debt over the past 20 years. Both net debt/EBITDA and debt as a percentage of equity.

Debt isn't an issue if it's handled well - but given the increase we saw, and that it never really went down again could have been a red flag.

Want to see how Adidas did during the same?

The fact that many seemed to have been buying into VFC for some time despite this, and seem to have been unaware, leads me to believe that I need to be clearer on such points going forward. I don't even need to show you LVMH - it's far better even than Adidas.

This is the reason why I believe Adidas will outperform and revert faster than VFC will. VFC has a lot more troubles to handle.

What VFC needs to do is handle:

- Its relative overleverage/debt, which has led to the dividend cut

- It's operational issues, both on the SCM and company/corporate side.

- It's inventories.

This will take time, and there will be bumps in the road. Don't expect a quick turnaround.

However, let me say the following.

Why I believe VFC will turn around, and the valuation dictates "BUY" Here.

So, as the title says, I believe VFC will actually manage this turnaround.

The latest trends have been the roughest sort of wake-up to VFC, and the necessity for the dividend cut must have shocked many. Again, I would not say it was "forecastable" given the dividend king status, but it was inside the realm of possibility at least, given how much this has saved the company in terms of its leverage.

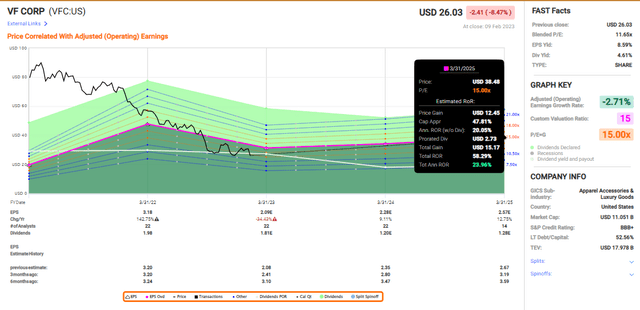

The reason I'm positive about VFC at this point is simple - it's now cheap enough.

Buying a cyclical, overleveraged, poorly-managed (with regards to divestments/M&A's) discretionary stock at what was 25-40x P/E is something that I could not be convinced to do with other people's money, let alone my own.

Buying the same company, after the fact of a sobering dividend cut, at a conservative 10-12x P/E even on the basis of a forecasted 35% adjusted EPS decline in 2023, followed by potential stabilization and/or reversal, while making around 4-5% dividend yield at a right-sized level, that's a different story.

For me, entering the business here is me knowing I'm entering a turnaround story.

And I love turnaround stories after the fact.

I went into Unum (UNM), Reinsurance Group of America (RGA), Prudential (PRU), KION (OTCPK:KIGRY), and many other, smaller local ones as well. I would say, without tooting my own horn, that I'm apt at spotting undervaluation in the market and investing in this, successfully. You can check my articles on those companies to see the relative performance there. Perfection doesn't exist of course - and everyone makes mistakes - but my ambition is to never repeat one.

I won't estimate or forecast VFC at 22-30x P/E here - I'll never do that, in fact.

VFC is worth 15x - if that - but it's a good proxy to begin with, given the double-digit reversal potential once 2023 sort of ebbs out.

Such a forecast calls for VFC to generate annual rates of return of 24% until 2025E, or nearly 60% RoR.

That's based on a 15x P/E ratio.

VFC Conservative Upside (F.A.S.T graphs)

But what if 15x P/E is too highly valued? Not a problem - VFC could face momentary declines of down to 9.1x P/E, without generating negative RoR from this level.

I'm not comfortable at 22-30x - but I'm very comfortable at 11x with those forecasts and potentials.

Furthermore, at today's valuation levels, the multiples make sense. They didn't before - not for what VFC offered.

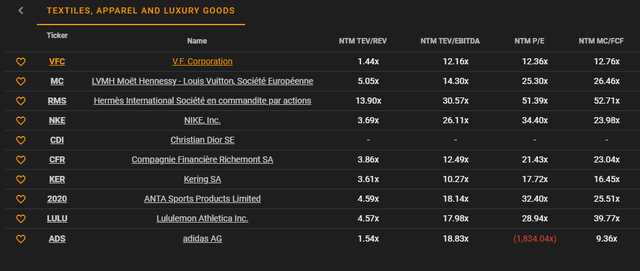

VFC is an overleveraged, over-inventoried, recently dividend-cut cyclical apparel retailer. That means that it should be cheaper than every single peer out there, and it currently is.

To those saying "VFC isn't comparable to the companies you've mentioned".

Yes, it most certainly is - they're in the same peer group of Textiles, apparel, and Luxury goods.

VFC Peers (TIKR.com/S&P Global)

Every single company on that list is more qualitative than VFC, in terms of debt, sales, inventories, brands, and management (as I see it). But VFC no longer commands a 20-30x P/E, as we would have seen in many of those peer companies. I would argue that it might still not be cheap enough compared to Adidas, which I view as better, but the valuation for VFC here is good enough, from a very clear-cut peer perspective.

Other analysts call VFC a "BUY" here, unsurprisingly. Of course, these are the same 21-25 analysts that gave the company 13 out of 20-25 "BUY" or similar targets at a PT of $80/share back in Christmas of 2021, which damages their believability somewhat. The average PT from 21 analysts here is $31, and I'm saying, once again, that this is wrong - at least to me.

VFC in a working state, with a 4-6% growth rate, which is where I believe the company is able to stay in the long-term, should be valued at a 15x P/E for a normalized level of earnings that's valid given the forecasts. I view this as being in a range of around $38-$42, given the current estimates. A year ago my PT was around $48/share, but I did not expect the debt/dividend situation to be as bad as it currently is.

DCF gives us a similar picture. Assuming that 4-6% and a higher discount rate due to the instability into the double digits, gives us a fair-value range for the stock of $34.5 at a low and $39.5 at a high end.

I would say that at anything below $30/share, this stock is a "STRONG BUY" given the quality inherent in some of the brands and sales - despite what's currently going on. At below $35 but above $30, it's still a fair "BUY", and at above $35/share, I would say that you can "BUY", but there would be better alternatives for you out there.

Given the current share price, this is a 35%+ upside.

But when I find quality coupled with undervaluation, I attack like a bloodhound.

None of the arguments the VFC bears make are invalid or wrong. The risks all exist. VFC is fundamentally challenged as a company, and it needs to really shape up and prove itself.

However, following the dividend cut and what we're seeing here, it's my stance that this has now begun, and the price is cheap enough for where an even further downside, a temporary one, might be priced in.

So, with all that said, here is my current thesis on VFC.

Thesis

- VFC is a market leader in certain apparel and accessory categories. It has a strong lineup and a good selection of products, as well as impressive market share fundamentals. The challenge lies in overcoming the fundamental issues facing the company at this time, and how we should discount these.

- I have been passive about VFC for years - other companies in the same sector have always seemed more attractive for the reasons and fundamentals mentioned in this article. But at this time, I finally believe the company is being undervalued and that most of the potential risk is priced in.

- I'm moving into coverage with VFC, and my stance is "BUY" here. My PT is $40/share.

- I recently staked out 0.3% in VFC, and I want to "BUY" more.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria, making it relatively clear why I view it as a "BUY" here. The recent cut in the dividend is a concern, but I look at current fundamentals - and those are, as I see it, safer.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of VFC, ADDYY, LVMUY, PPRUY, RGA, UNM, SWK, KIGRY, DVCMY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. The author's intent is never to give personalized financial advice, and publications are to be viewed as research and company interest pieces.

The author owns the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in the articles. The author owns the Canadian tickers of all Canadian stocks written about.