UVXY: Eyeing A Long Volatility Trade Through Mid-March

Summary

- Volatility has perked up just modestly lately as stocks have slid.

- Mid-February through mid-March is a bullish seasonal stretch for the VIX.

- I outline key VIX levels to watch that can help guide a long UVXY trade idea.

TERADAT SANTIVIVUT

Volatility has ticked up just a smidgen lately. Even with two straight down weeks on the S&P 500, the CBOE Volatility Index (VIX) is barely managing to rise above the 20 level. That’s a stark contrast to what was seen a year ago when the VIX neared 40 at times around Russia’s invasion of Ukraine. What is impressive about the current state of the market is that the latest jump in yields has been met with a ho-hum reaction by traders.

Recall during the middle of last year, into early Q4, when inflation jitters and a rising Fed Funds Terminal rate led to a swift selloff in stocks and a jump in volatility.

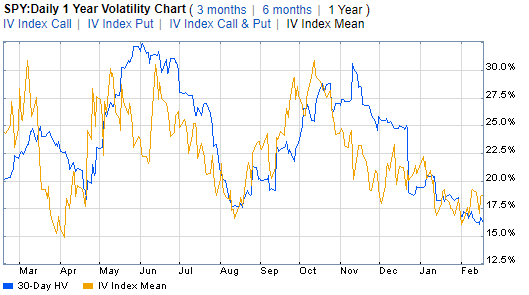

SPY TTM Historical Volatility & Implied Volatility Trends

Fidelity

We haven’t seen that yet in 2023. In the above chart from Fidelity, realized volatility (30-day HV) and the IV Index mean (a proxy for implied volatility) are both somewhat tame despite what feel like whippy day-to-day stock market changes.

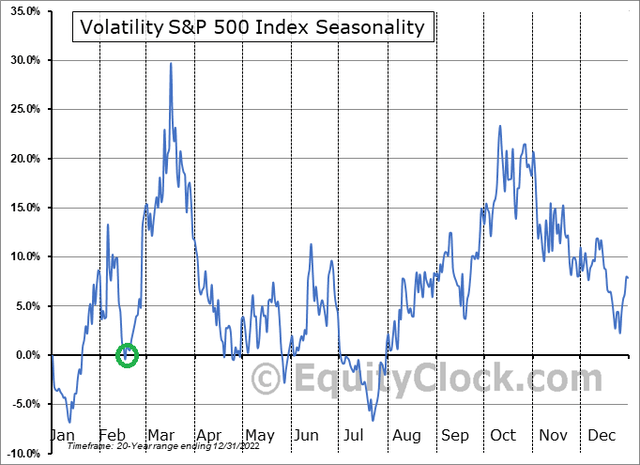

But the next month or so could see more choppy price action among U.S. large caps in my view. The back half of February is often fraught with a lousy tape while volatility spikes have historically come about during the first half of March, according to data compiled by Equity Clock.

Notice in the Equity Clock chart below that the VIX often spikes from mid-late February through mid-March. Of course, much of that was caused from events of 2003, 2008, 2009, and 2020. Still, a near-term long play on volatility could work. And that just as many suggest the VIX is a broken indicator. But it’s really just math – the VIX is calculated based on 30-day options pricing on the SPX.

VIX Seasonality: It's Now or Never

Equity Clock

But how can investors play volatility effectively? It is a dangerous world out there these days with leveraged ETFs, ODTE (zero days till expiration) options, and risky futures. One ETF is a popular trading vehicle for placing wagers on short-term vol moves.

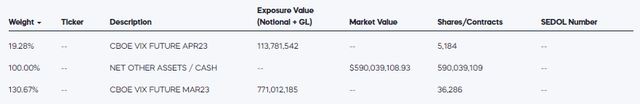

According to the issuer, the ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY) seeks daily investment results, before fees and expenses, that correspond to one and one-half times (1.5x) the daily performance of the S&P 500 VIX Short-Term Futures Index.

I like UVXY not for a long-term position due to its enhanced return construct and risk of negative compounding returns via leverage, but for day trades and swing trades. So, the time horizon of a few weeks is fine in my mind for investors looking to profit from a rise in VIX futures.

UVXY’s portfolio holds the front two months of the VIX futures curve, so it is ideal for such near-term VIX moves. It can also potentially hedge a long stock portfolio if you are concerned about downside stock price risk. ProShares is prudent to point out that only knowledgeable investors who actively manage the portfolio should trade UVXY, and the ETF can move differently from the VIX.

UVXY Portfolio: Front 2 Months of VIX Futures

ProShares

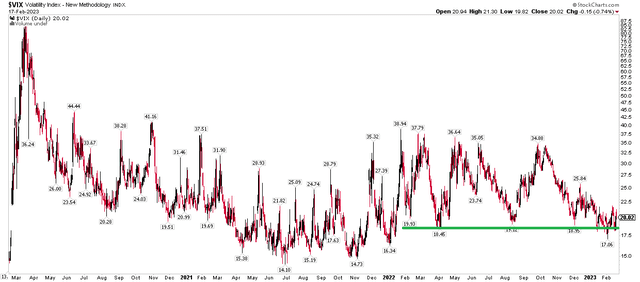

There is always debate about whether it’s appropriate to perform technical analysis on the VIX, but I see it as useful. Notice in the chart below that the VIX has climbed back above the key 18 to 19 level, though not with big spikes. I like this turn and could see vol spike to the late December high near 26 over the next few weeks. Perhaps an eventual move to the upper 30s could happen, but I am not making that case with just a 4-week time horizon.

VIX Technicals: Holding the 18-19 Line

Stockcharts.com

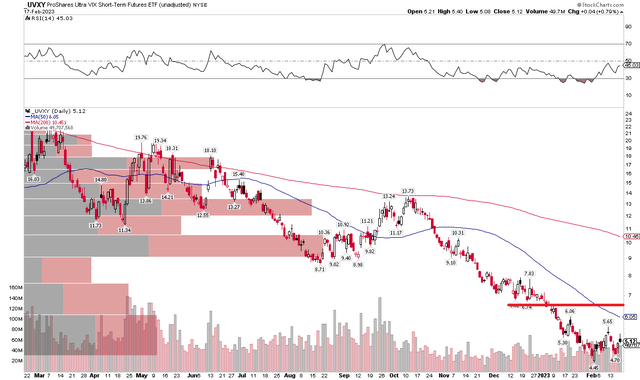

UVXY: Take Profits Near $6.50

Stockcharts.com

The Bottom Line

I think a long UVXY trade here makes sense given some recent downside momentum in stocks and volatility that appears cheap. Long UVXY here with a profit target corresponding to 25 on the VIX is an attractive swing trade idea.

Please be advised of various industry warnings about the unique risks due to negatively compounding returns of leveraged ETFs. Products such as UVXY are not designed to be held long-term but rather as short-term trading vehicles as described in the article.

1) The Lowdown on Leveraged and Inverse Exchange-Traded Products (FINRA)

2) Leveraged and Inverse ETFs: Specialized Products with Extra Risks for Buy-and-Hold Investors (SEC)

3) FINRA's Reminder on sales practices for Leveraged and Inverse ETFs (FINRA)

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.