Tilly's: Pressure On Revenue And Profitability Remains

Summary

- Consumer spending on clothing continues to be under pressure in the face of macro headwinds.

- The company continues to face a decline in revenue and traffic in its own stores.

- I do not see catalysts for the growth of stock prices despite the presence of a fundamental upside.

Elizaveta Shishlyannikova/iStock via Getty Images

Introduction

Shares of Tilly's (NYSE:TLYS) are down 1% YTD. Since my publication 14 October 2022, the company's shares are up 17.8%, while the S&P is up 14%. Despite the fact that the stock is currently outperforming the S&P index, I still adhere to the HOLD recommendation for the company's stock. Despite the fact that the stock continues to trade below its fair level, I don't see catalysts for the stock to rise in the coming quarters as consumer spending continues to be under pressure, which is having a negative impact on the business's revenue dynamics. At the same time, the decrease in economies of scale leads to an increase in the share of operating expenses and a decrease in profitability.

The survey of current trends

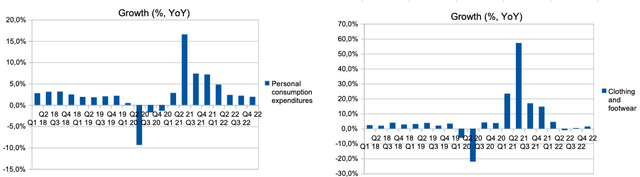

High inflation, declining real incomes and declining consumer confidence continue to have a negative impact on consumer spending. Thus, overall consumer spending was under pressure during 2022. At the same time, consumer spending growth in the Clothing and footwear category slowed down even more. In my personal opinion, macro and geopolitical uncertainty and high interest rates will continue to have a negative impact on the dynamics of consumer spending in the discretionary segment, in particular in the Clothing and footwear segment, which may have a negative impact on the company's revenue dynamics in the coming quarters. You can see the details of the dynamics of consumer spending in the charts below.

Personal expenditures (bea.gov)

Projections and valuation

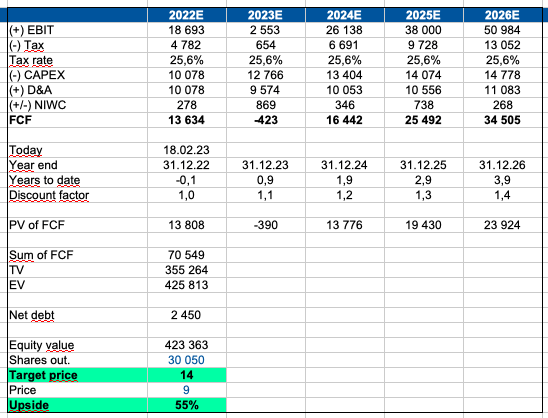

I decided to build a forecast of the future cash flows of the business in order to assess the value of the business and understand how the operating margin might change in 2023.

The main inputs in my model are:

Revenue growth: I forecast a 5% decrease in revenue for 2023 amid continued pressure on consumer spending, then I conservatively forecast 5% per year until 2026.

Gross margin: I believe we will see pressure on the gross margin in 2023 due to reduced economies of scale and the inability to effectively pass on high inflation to the end consumer due to shrinking real incomes. So, I predict a decrease in the gross margin to 29% in 2023, then I predict a recovery to 33% by 2026.

SGA: in view of decreasing economies of scale, I predict an increase in SGA spending (% of revenue) to 28.5% in 2023, then I predict a gradual decrease to 26% by 2023.

Yearly projections

Forecasts (Personal calculations)

To value a company, I prefer to use the DCF method and independently calculate current and target multiples. In my opinion, the use of DCF is the most preferable, because the company operates in a stable market, where we can make assumptions about future revenue growth and operating margin.

The main inputs in my model are:

WACC: 9,9%

Terminal growth rate: 3%

DCF model (Personal calculations)

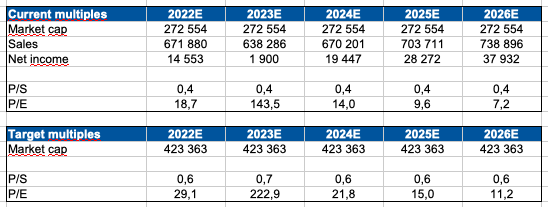

In addition, I have calculated current and target P/S and P/E multiples for the company, which are based on my Sales and Net Income forecasts. You can see the results of my calculations in the chart below.

Multiples (Personal calculations)

Risks

Macro: high interest rates, declining real incomes, declining consumer confidence may lead to lower consumer spending in the discretionary segment, which may have a negative impact on business revenue dynamics in the future.

Revenue growth: a decrease in the average check due to a decrease in real income and a decrease in traffic in the chain's stores may lead to a decrease in the growth rate of business revenue.

Margin: reduced economies of scale, an increase in the share of fixed costs (% of revenue) and an increase in operating expenses can lead to a decrease in the operating profitability of a business, which may be negatively perceived by investors.

Drivers

Macro: a recovery in real earnings and consumer confidence could support consumer spending, which could support the company's bottom line.

Revenue: growth in traffic and average check can help accelerate revenue growth and revalue the business. In addition, rising economies of scale could support operating margins.

Conclusion

Thus, in my personal opinion, now is not the best time to go long. I believe we will see continued pressure on consumer spending in the discretionary segment in the coming quarters, which will continue to weigh on the business's top line performance and could lead to lower operating margins due to reduced economies of scale. While there is fundamental upside potential for the stock, I don't currently see any catalysts for the stock price to rise. I'll be happy to re-evaluate my view of the stock later when I see consumer spending normalize and store traffic recover.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.