Yellow Pages: A Melting Ice Cube Staying Frozen

Summary

- Yellow Pages is a melting ice cube but is priced like it's going to die within the next 3 years.

- Yellow Pages offers an attractive risk/reward with a pristine balance sheet and some upside in a growing digital advertising space.

- As Yellow Pages continues its decline, it will continue buying back shares which will increase FCF per share, which will help them return capital to shareholders.

I Like That One

Business Overview

Yellow Pages Limited (TSX:Y:CA) offers small and medium-sized enterprises (SMEs) across Canada a full suite of digital and traditional marketing solutions. The company's media assets include desktop, mobile, and print. Their main four assets are:

1. YP.CA - This is essentially a combination of Angie's List and Yelp and integrates trip advisor reviews. It's a nice platform for SMEs to advertise their business, especially at a local level.

2. Canada411.ca - This is essentially an online phonebook. It's like the old yellow pages books that you remember looking through 25 years ago, but online.

3. YellowPages for Business - A tool that allows SMEs to manage and sync their marketing spend, marketing results, and analytics in a single platform. This asset is actually why I believe the company has a future. In my opinion this is the only asset they have that I believe has a real competitive edge.

4. Yellow Pages Print - The Corporation is the official directory publisher for Bell, Telus, Bell Aliant, MTS Allstream, and a number of other incumbent telephone companies. We all remember these from 30 years ago, but this is no longer the focal point of the business.

Environment

Yellow Page's print business operates in a very competitive environment with local newspapers, magazines, and digital advertisers. Additionally, in the digital advertising space, they are competing against the behemoths like Google and Facebook.

It seems like the company's north star is becoming the leader in Canada for small to medium size business digital advertising and advertising analytics.

To be clear, this is a very unsexy business that operates in a niche market.

Financials

Income Statement

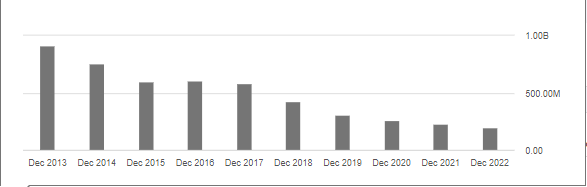

Yellow Pages Limited is a "legacy" business that operates in a very competitive industry, and is in structural decline. It is a melting ice cube that has seen revenues decline and probably will see revenues continue to approach zero.

Revenue (SA)

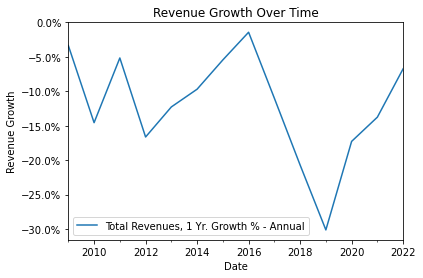

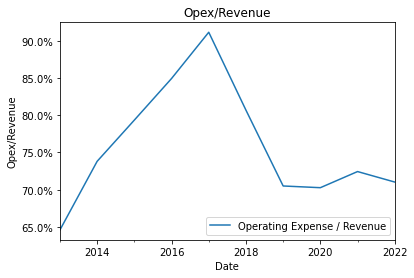

However, on a percentage basis, the revenue decline is slowing dramatically, and this is the key metric that management is focused on. In fact, management refers to it as "Bending the Curve". This phrase can be attributed to the new CEO David Alan Eckert who joined on September 15, 2017. It seems like he's done a great job since taking over, and has extensive experience dealing with turnarounds according to the press release of his CEO announcement. Since taking over, he has really helped to slow the rate of revenue decline and to decrease operating expenses as a percentage of revenue significantly.

1 yr Revenue Decline (s&p)

Opex/Revenue (s&p)

In fact, Y has reported 9 consecutive quarters, and 14 of 16 quarters on bending the curve (slowing revenue decline). They attribute these improvements to better spending per customer in digital, increased renewal rates as well as improvements in customer claims.

The Revenue can be broken down into two different businesses: Digital and Print. Print seems to be decreasing much faster than digital which is great because digital is a similar-margin business and the company is now describing itself as a digital business:

Our Business Yellow Pages, a leading digital media and marketing solutions provider in Canada, offers targeted tools to local businesses, national brands and consumers allowing them to interact and transact within today’s digital economy.

Unfortunately, the company just started breaking out the revenue streams last year, so there isn't enough data to look at a noticeable trend, but we can derive this from the latest earnings call, which says that the high-margin digital business makes up 55% of their digital revenue.

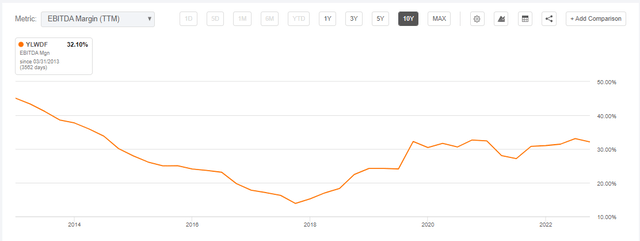

Additionally, from the CAPEX / OPEX side, they've done a great job of decreasing both of these and as a result, increased EBITDA margins over the past few years. Although the EBITDA margin slightly contracted, they were still able to increase Net income. Additionally, the company has forecasted that they will continue to experience some margin pressure due to revenue decline, but continued optimization in labor will partially offset this. Lastly, and most importantly, we already know this and it's sufficiently priced in. We know we aren't buying a sexy, high-margin business, we are buying something that will squeeze every last ounce of FCF out to be able to return capital to shareholders.

So to wrap up the income side of things, obviously, things are not looking great from the income side, but it seems they have some potential upside and given that customers are spending more, as per their latest 10-K which states:

These improvements were due to better spend per customer in digital, increased renewal rates as well as improvement in customer claims. The improved spend per customer is due in part to increased pricing.

It seems that these loyal customers who are staying with Yellow Pages will be enough to have them stay afloat for the foreseeable future.

Balance Sheet

So now onto the good news; the balance sheet is in very good shape. As of 1/31/2023 the company is sitting on $50.0M CAD in cash and completely extinguished its debt on 5/31/21 when it paid $107M CAD plus interest to redeem its outstanding notes.

Additionally, Y had a big pension deficit, but they contributed a voluntary additional 24 million and a total of 30 million in 2022 and are now on track to have it fully funded by 2030.

So with almost no debt, a small pension obligation, a small lease obligation, and ~20% of the market capitalization in cash they are in a great position to continue to give back cash to shareholders.

Cash Flow

Cash flow is also some other good news. Yellow Pages does around $55.5M CAD in free cash flow and sports an impressive ~21% free cash flow margin. This free cash flow opens a new massive lever for potential upside. As we gear up into a new regime of high interest rates, looking for companies who can generate positive free cash flow will become more important than ever.

Capital Allocation

As a result of their large cash balance, no debt, small pension obligation, and relatively little need for capital expenditures, the firm was able to initiate a massive buyback program and increase their dividend payments.

On 8/4/22, the Board approved a share repurchase by way of a plan of arrangement (approved by Y shareholders 9/23/22 and by the Supreme Court of British Columbia 9/27/22). On 10/4/22 and pursuant to the plan, Y repurchased from shareholders on a pro rata basis 7,949,125 shares at a price of $12.58. As a result, common shares outstanding were able to decrease from ~25.3M to ~17.9M. The company bought back 30% of its shares and it seems like this will be the main way management will continue to return capital to shareholders.

The dividend payments were also increased from $0.11 CAD to $0.15 CAD.

Management has also stated that they are not interested in doing acquisitions so given the flexibility that management has here, they can really start to turn on the spigot to reward shareholders.

Valuation

This business is priced at about 3x EV/EBITDA, so essentially if we make it past 3 years, which I believe we will, you have a free roll. I think we are going to make it past the 3-year mark, because of their extremely low debt (just lease obligations), they have a sustainable revenue stream, although decreasing, and the company is focused on lowering costs to maintain the proper liquidity and solvency needs. Cash is also about 20% of the total market capitalization, giving us an even bigger buffer.

Analysts expect Free cash flow to be $56.13 million in 2023 and then $50.76 in 2024. So in the next two years, they are going to have about 1/2 of the EV in free cash flow to mostly return to shareholders, and clearly, the company thinks the shares are undervalued since they are buying back shares with excess capital.

At this cheap valuation, there is a lot of flexibility and a margin of error for the company, but there are obvious risks.

Risks

The risks here are pretty obvious, but I will list what I think are the biggest risks:

1. The business declines faster than what is priced in.

2. Essentially, 3 firms own almost 100% of the company. So these shares are also very illiquid, so you must be in Yellow Pages for the long haul.

3. I would also say there is some key man risk as I think Eckert is very important to the success of this turnaround.

Thesis

Yellow Pages is an extremely cheap melting ice cube, which I believe will last for significantly longer than 3 years giving us a free ride with the company having a lot of optionality on how to return capital to shareholders.

Additionally, even if FCF decreases by 20% per year, and the company continues to buy back shares with all its FCF then FCF per share will grow!

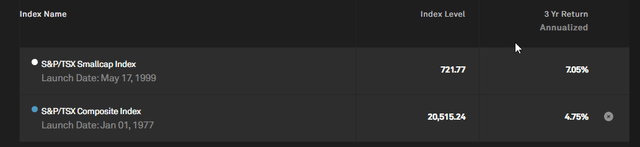

Lastly, Canadian small caps have been doing quite well (as shown below) which is a great tailwind for Yellow Pages. If they can leverage small cap success to slow their rate of revenue decline this is a home run.

Canadian Small Cap Index vs. TSX (TSX)

The risk-reward is extremely attractive in my opinion and offers shareholders the opportunity to buy a business, priced for death, with a lot of flexibility.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of YLWDF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.