NXP Semiconductors: Strong Q4 Supports Bullish Thesis

Summary

- NXP closed the FY 2022 with strong Q4 results, beating analyst consensus estimates with regards to both revenue and earnings.

- On a FY 2022 basis, NXP' automotive, industrial & IoT, mobile and commercial infrastructure & others unit were up 25%, 13, 14% and 15% respectively.

- On the backdrop of an expanding chip demand in the automotive industry, paired with other fast-growing technology verticals such as IoT, the metaverse and AI, NXP is poised to capture an attractive business tailwind through 2030, potentially growing top line at a 10 - 20% CAGR through 2030.

- NXPI is a 'Buy', and I calculate a fair implied share price equal to $277.36.

Michael Vi

Thesis

I have previously expressed a bullish argument on NXP Semiconductors (NASDAQ:NXPI). And following a strong Q4 reporting, I am confident to reiterate the thesis. On the backdrop of an expanding chip demand in the automotive industry, paired with other fast-growing technology verticals such as IoT, the metaverse and AI, NXP is poised to capture an attractive business tailwind through 2030, potentially growing top line at a 10 - 20% CAGR through 2030. With that frame of reference, NXPI is a 'Buy', and I calculate a fair implied share price equal to $277.36.

For reference, NXPI stock is up approximately 1.3% for the past twelve months, as compared to a loss of about 8% for the S&P 500 (SPY).

NXP Q4 and FY 2022 Results

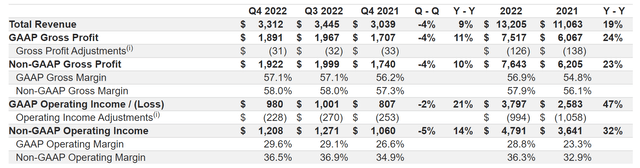

NXP closed the FY 2022 with strong Q4 results, beating analyst consensus estimates with regards to both revenue and earnings. During the period from September to end of December, the European semiconductor company recorded revenues of approximately $3,312 million, as compared to $3,039 million for the same period one year earlier (9% year over year growth), and compared to $3,300 as estimated by analyst consensus estimates ($12 million beat).

With regards to profitability, NXPI's GAAP gross margin expanded to 57.1% in Q4 2022, versus 56.2% in Q4 2021. Similarly, GAAP operating margin increased by about 3 percentage points, to 29.6%. That said, NXP accumulated $1.21 billion of operating income in Q4 (15% year over year growth) and $4.8 billion for the FY 2022.

With regards to NXP's segments, the automotive unit, which is also the company's largest in terms of revenue and profit, performed best: the segment generated about $1.81 billion of revenues, up 17% year over year as compared to Q4 2022, and up 25% over the full year 2022.

On a FY 2022 year over year basis, industrial & IoT, mobile and commercial infrastructure & others were up 13, 14% and 15% respectively.

The company also returned $696 million to shareholders in Q4, with a total capital return to shareholders of $2.24 billion on a trailing twelve-month basis. This brings NXP's equity return close to 5%--which is, in my opinion, exceptionally attractive for a growth company.

Confidently Stepping Into 2023

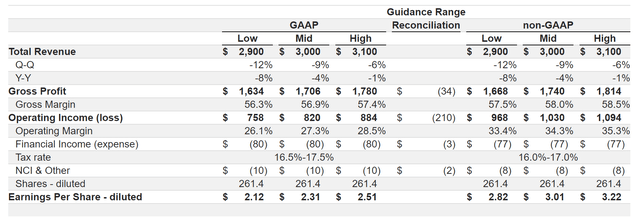

Reflecting on a downturn in the semiconductor industry it is arguably not surprising that NXP's Q1 2023 performance will somewhat slow down as compared to 2022 and 2021. For the March quarter, management expects revenues between $2.9 and $3.1 billion, which would reflect a year over year contraction of 8% and 1% respectively. The company's operating margin is expected in the range of 26.1% and 28.5%, which would translate into an operating income range of $760 and $880 million.

NXP did not give any update on the company's long term potential, which presumably indicates that previous expectations remain intact: It is projected that the semiconductor market will grow rapidly until 2030, potentially becoming a $1 trillion opportunity. The increasing digitalization of vehicles, including connected, autonomous, and electric cars, is expected to be a primary driver of this demand surge for semiconductors. NXP Semiconductor, a major European chip manufacturer with 50% of its revenue coming from the automotive industry, is well-positioned to benefit from these long-term trends in demand.

And NXP continues to capture opportunities in this estimated $1 trillion market. In Q4 2022, NXP introduced new analog front-end and microcontroller families optimized for factory automation and electric vehicle control, respectively, and expanded its IoT and industrial IoT solutions.

Valuation: Update Target Price

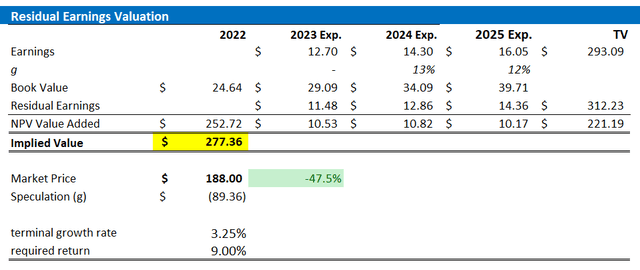

Reflecting on strong Q4 FY 2022 reporting, paired with a solid outlook going into 2023 and beyond, I now estimate that NXPI's EPS in 2023 will likely expand to somewhere between $12.5 and $12.9. Moreover, I also slightly raise my EPS expectations for 2024 and 2025, to $14.3 and $16.05, respectively.

I continue to anchor on a 3.25% terminal growth rate (one percentage point higher than estimated nominal global GDP growth), and a 9% cost of equity capital requirement, which I consider reasonable.

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $277.36.

Analyst Author's EPS estimates and calculation

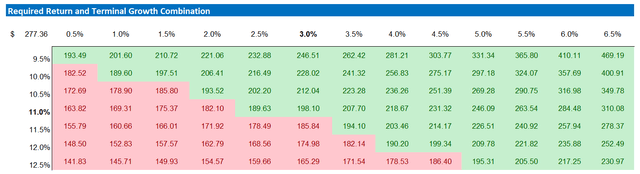

Below is also the updated sensitivity table.

Analyst Author's EPS estimates and calculation

Risks

As I see it, there has been no major risk-updated since I have last covered NXP stock. Thus, I would like to highlight what I have written before:

Investors could argue that NXP's business, with 50% exposure to the automotive industry is cyclical, and accordingly vulnerable to an earnings contraction that is driven by an economic slowdown. Moreover, investors should also note that the chip-maker industry is dynamic and competitive. Consequently, any loss/gain in market share could result in material downside/upwards revision for NXP's earnings potential. Investors should also consider that sentiment towards risk assets such as stocks remains strongly depressed. And given multiple macroeconomic headwinds, NXPI stock may suffer from share price volatility even though the company's fundamentals remain unchanged.

Conclusion

On the backdrop of a strong Q4 report, I am confident to reiterate my bullish thesis on NXP Semiconductors. In continue to believe that NXPI is well-positioned to benefit from the expanding demand for chips in the automotive industry and other growing technology verticals such as IoT, the metaverse, and AI. With that frame of reference, I forecast that NXPI could potentially achieve a 10-20% compound annual revenue growth through 2030.

Given updated EPS estimates, a 4.25% terminal YoY growth rate and a 10% cost of equity, I now calculate a fair implied share price for NXPI equal to $277.36. Buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise