Capgemini: Going 'LONG' On EU Quality For 2023

Summary

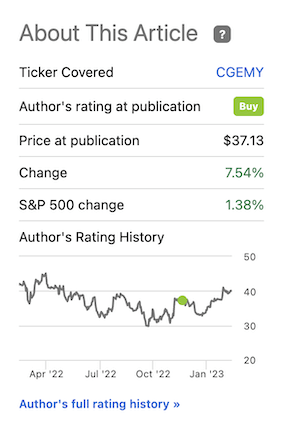

- Capgemini is a French company that I've covered a few times in various ways, with a deeper dive back in November of 2022.

- Since my first "BUY" rating, the company has outperformed the market by a few percent - above 5%, which makes it more than just a "fluke".

- I believe Capgemini is poised to continue to outperform here, and in this article, I'll explain why that is.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Mrinal Pal

Dear readers/subscribers,

In this article, we're going to be updating the 2023E thesis for Capgemini (OTCPK:CGEMY). I'll show you why despite a relatively decent outperformance based on my previous "BUY" thesis/rating...

Capgemini IR (Capgemini IR)

... the company could still be considered interesting to you - and me as well, of course. Being one of the largest IT businesses on the planet, it takes some time before anything truly impacts or derails Capgemini - and the latest set of results and forecasts for the coming year cements these expectations.

Let's look at what we have here, and why this company remains a decent pick for value investors.

Capgemini - Updating for 2023

First off, the company is set to report FY22 about a week from the time I'm writing this - so I'll update the article with relevant targets and specifics where needed in terms of changes to the thesis. Otherwise, I'll be working with estimates and expectations as to where we are headed for the coming year.

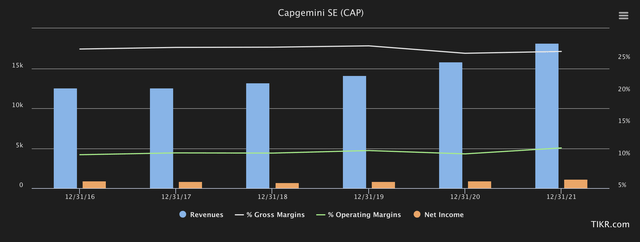

Capgemini, from a very high level, is as simple as IT businesses get. The company bills customers for managing its business through tech and has a 50-year history of doing that. It employs over 350,000 people that help them with this, and these people ensure that Capgemini is pushing the €20B revenue mark in 2022-2023, from which it manages to earn a 10-13% operating margin. It's neither bad, but it's also not class-leading in terms of IT companies.

Still, Capgemini has a solid tradition of increasing both the top and the bottom line, delivering both margin increases of 3.5%+ in less than 10 years, and annual revenue growth close to double digits. Given the company's scale even back in -14, this is quite impressive - but what I like most is how the company has transformed how it generates cash flow from those revenues. FCF on an organic basis has almost tripled, and the company has been expanding its customer base internationally. Together with other EU majors like SAP (SAP), this is one of the few IT companies playing in this league.

However, unlike SAP, Capgemini is still mostly a French/EU business, with the vast majority of its revenues coming from the EU. That's why when investing in the company, we need to look at the EU as the major source, even if the specifics of that revenue in terms of sector, are quite diversified, with the two largest services less than 48% of revenues (Financials and Manufacturing).

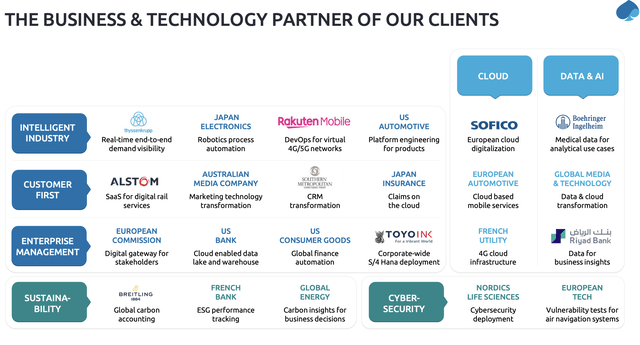

Capgemini doesn't have a geographical segmentation but instead splits R&D, development, and transformational consulting into their relevant segments. Use cases and examples are among the more interesting when looking at a company like this to grasp how important these services are and what the company does. I went through two in my initial article, found here.

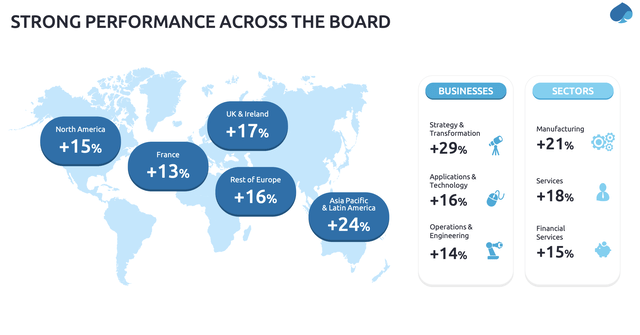

3Q22 numbers are the latest we do have, and these numbers more or less confirm the top-line and bottom-line upsides for the coming year. Despite a difficult macro, which includes Ukraine, Energy, and inflation, we saw double-digit revenue growth to a 3Q22 run rate of over €21B, which saw bookings go up by 13% (indicating pricing success), and a book-to-bill of close to 1x. Performance was good all over.

I like use cases and examples for a company like this. The difference between use cases and examples for a company like this, and a company that's only growth-oriented and a bit of a growth investor favorite, like Palantir (PLTR) is the following. Capgemini is profitable. Because I can see many investors in IT businesses making the argument that companies like PLTR have impressive use cases, and examples of where the company's services are absolutely crucial.

And I would 100% agree with that. But I would also say, very clearly, that there is no comparing the two businesses as businesses, no matter how many positive use cases you may have, such as these ones.

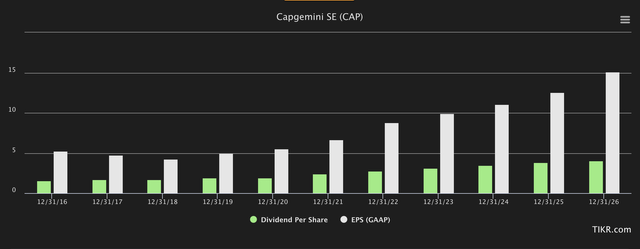

Capgemini fundamentals (TIKR.com)

Fundamentals matter. And if your business isn't making money, as in actual GAAP/equivalent net income attributable to shareholders, then it's either not a real business (or its hard to argue for it), or it has been in business such a short time that it's still finding its footing. Palantir has been around for over a decade - so it's not part of the latter category.

The breadth of Capgemini's portfolio and its customer appeal and expertise is what makes the company an interesting investment at the right price. The current revenue targets for 2022E already target a €20B+ total for the year, and operating margins are set to improve even more, breaching 13.1%, with over €1.6B of organic FCF. Those are results we can like, and those are results that actually justify a decent multiple. Quarterly trends in terms of the top-line have been absolutely superb during this year - and it would take a truly negative or disruptive set of 4Q22 to turn this around to the negative. Unlike other IT and tech businesses, Capgemini has not been cutting staff but adding them - by the tens of thousands. This is the sign of a healthy organization that not only prepared for this possibility but planned and executed it. The company's business-wide utilization rates have never dropped below 70% for the past few years company-wide, and in specific sectors, such as Applications/Tech, they're still above 80%.

Capgemini is an efficient, and profitable allocator of capital and generator of sales as well as net profit/GAAP Profit - and the forecasts call for this to continue. GAAP profit and dividends are set to increase, both of them, and the current set of forecasts open for the possibility of either far better DGR, share buybacks, or significant reinvestment into the company's business as profit levels start really pushing it. Take a look at these sets of forecasts.

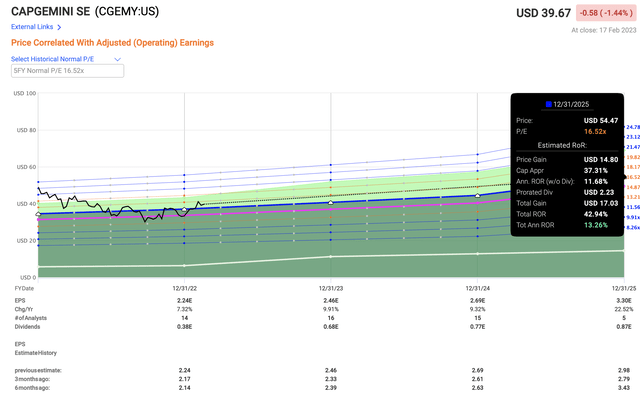

Capgemini Forecasts (TIKR.com)

What's the downside/risk here? In order for the company not to fulfill these targets, there would have to be some serious macro disruption, due to the way the company's contract and order structures work. They don't change overnight, and given inflation and cost increases, every contract that's signed today has clauses toward that. The company isn't immune to pressures or downturns, but at the same time, it's seeing really positive trends here. Customers are looking for cost efficiencies, and this always puts pressure on organizations like CG, but it's not as though this is unique for these sectors, and I don't like discussing such general things as a high-level risk for the company.

Capgemini is somewhat seasonal towards the 4QXX cycle because customers tend to use what budgets they have (and they don't want to go into tax) at this point, so there's some volatility potential there - but really, there isn't a massive sort of impact that I'm seeing that would turn Capgemini downward. Furthermore, analysts are pretty good at forecasting this business (more on that later).

So, I expect Capgemini to continue to perform well - and this forms the basis for my continued positive valuation of the company.

Despite Some growth, Capgemini remains attractively valued

So, despite growth, the upside for the company remains what would view as non-trivial. 16-20x P/E premium is a typical range that we've needed to accept unless we want to go into full discount mode and wait for the company to go below 15x P/E (which might, realistically, not happen). Obviously, 24x P/E which we saw some year/s back, is too much, and a sub-10x P/E is too low given the growth rates that this company offers - not to mention expected dividend growth in the next few years.

Comparing the company to Palantir and other growth stocks is moot, as I see it. The company's peers play in far higher divisions, and peers are businesses like Accenture (ACN), IBM (IBM), Infosys (INFY), CGI, and others - companies with typically low yields, but high quality and growth. Compared to some of the aforementioned here, Capgemini still trades at some impressive discounts here, because those peers command P/E's of 25x or thereabouts. It's also still at undervaluation from analyst forecasts, with analysts expecting around €216 out of the business, with a current share price of €186 for the native - still a 15.7% upside. You could impair the company's targets and fundamentals here, and still get a double-digit upside from the business.

That's likely also why 16 out of 18 analysts are either at a "BUY" or similar rating here. There's too much to like here. Even if you accept some of the lowest multiples and targets available here, there's still an upside to this company based on the high-conviction growth estimates.

Capgemini Upside (F.A.S.T graphs)

And those forecasts are based on accuracy with less than 9% 2-year forward misses with a 10-20% Margin of error, meaning I would consider them somewhat indicative here. Other multiples and ways of analyzing the business show equally interesting trends. Sales are below 1.5x at this price, and revenues are below 2x. As a comparison, ACN trades at well above 2.5x to revenues, 24x native P/E, and other positive multiples. Infosys is even higher, at 4x revenues and 25x P/E. Out of the relevant peers, Capgemini remains one of the least valued peers here, and I can't give it any other explanation than an "EU discount" - maybe market cap compared to ACN, which is far larger than CG.

DCF is tricky here because the company is expected to grow as much as it is. I can't apply a terminal rate of below 5% - it wouldn't be fair to the historians, and I won't go above 11.5% in discount, again, it wouldn't be fair to where the company is. DCF only makes sense if you stay realistic. And even if you give it the most conservative targets you can think of, I don't get a Fair value estimate of below €225 - which is above the current analyst average. In the positive DCF context, the target goes almost to €300/share.

The upside here is implied and clear no matter what you're looking at.

Current cash flow trends are positive - especially when considering the current trends in how costs and inflation are impacting things.

For the ADR, I would still put this at $40-$45, which means that my low-ball target of $40 is still above where the company is still trading. My native target was €210, which illustrates how much I'm impairing the company despite everything. And I'm sticking to that to stay conservative - but it also means that my continued thesis on Capgemini is very clear.

Thesis

My thesis for Capgemini is the following:

- Capgemini is one of the world-leading IT Consulting and Business management companies. It's inherently EU-focused, but with growing exposure to other areas in the world. The future for this company seems secure, with the ever-important role of IT in today's world.

- The company is a definite "BUY" at a good valuation - delivering double-digit upside while providing conservative safety owing to very solid processes, background, and customers with very long contracts.

- I give the company a PT of €210 for the native, making the company a "BUY" here with an upside. I'm not changing my thesis on the company, or my rating, despite a 7-8% growth since my last piece.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I go back and forth between cheap or no, but ultimately I don't want to call Capgemini cheap, only undervalued.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of CGEMY, IBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.