IYF Needs More Insurance To Be A Buy

Summary

- While substantial holdings in BRK gives IYF some insurance profile, after that there's only banks down the holding list.

- Companies in IYF are not going to be able to hide from the hits to the market that will come with higher rates and higher required returns.

- P/E ratios are also too high on this ETF now that reference rates are coming up and in a more enduring way, as signaled by FOMC member comments.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

DNY59

The iShares U.S. Financials ETF (NYSEARCA:IYF) is a financials ETF with more focus on banking than insurance. With the current macroeconomic dynamics, insurance is the more attractive of the two, and we'd have liked to see more of it in the portfolio. The PE implies growth that is unlikely to be achieved even by longer-term GDP forecasts, and especially given the pressures faced by the global economy over the next couple of years. This is not a particularly compelling play and iShares Insurance ETF (IAK) would be a preferable option, also since they have the same expense ratios at 0.39%.

IYF Breakdown

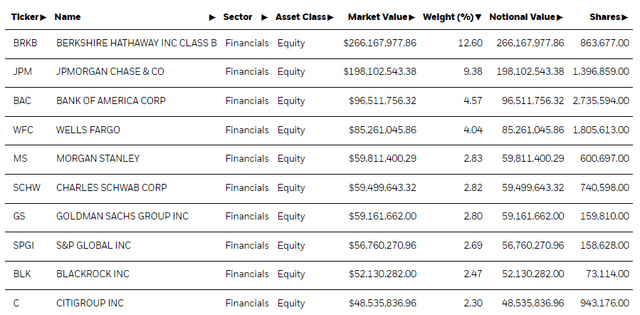

The following are some of the top holdings of the IYF:

IYF Top Holdings (iShares.com)

Berkshire Hathaway (BRK.B) takes the top spot with almost a 13% allocation. This is substantially and insurance business, but it also of course holds a portfolio of equities managed by Warren Buffett & Co. After that it's a bunch of full-service US banks, with quite a bit of IB revenues, quite a bit of retail banking and maybe a little bit of asset management too.

In the first page of top holdings 40% are companies that are pro-cyclical and the 13% is an insurance company, which in the current macroeconomic setting is actually countercyclical, because the cycle is ended by higher rates and higher rates are good for insurance portfolios.

Investment banking is not an irrelevant portion of the businesses of JPMorgan (JPM), BAML (BAC), Morgan Stanley (MS) and these other full-service listed banks. That has already taken a hit in ECM, DCM and M&A as interest rates have ground the financing environment to a halt. Retail banking doesn't benefit much either from higher rates. Firstly, there is the issue of economic pressures reducing loan growth. But then there's the issue even on net interest margin, because deposit rates will have to come up - people aren't stupid.

After the banks there's companies that are unequivocally pro-cyclical. BlackRock (BLK) depends of course on fund flows into equities, and S&P (SPGI) depends on DCM volumes, because it rates that credit.

The only company here that does well if there's economic strife is Charles Schwab (SCHW) because they win on volatility, and of course partially BRK. The BRK equity portfolio has nowhere to hide if rates come up, but the reserve portfolio in insurance is usually a lot of short-term bonds that will roll over nicely at these higher prevailing rates. Moreover, pricing in insurance has held up, and there's been a lot of premium growth over the last couple of years to reap the benefits of newly signed policies at good rates for years to come.

Bottom Line

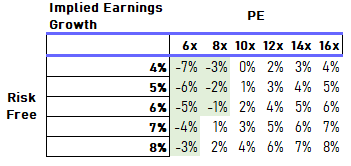

There's also the issue of valuation in the markets, certainly in this segment of them. A multiple nearing 13x as the 1Y rate goes above 5% and nothing lies below 4% anymore on the US yield curve. The implied earnings growth to justify the yield that comes with 12-14x PE is substantially ahead of the GDP growth that the US would be used to from before deglobalisation.

ETF Valuation Chart (VTS)

The odds of some sort of knockout results from banks are not so likely, especially over a more durable period as the Fed continues to be concerned over rates not coming down fast enough, and showing that they'll do whatever they need to avoid wage-price spiraling.

Overall, even if at least there's some positive to IYF and the expense ratio is quite low at 0.39%, the place to be is in insurance and IAK.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Valkyrie Trading Society seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.