Oil States International: Shareholder Returns Finally Reinstated, More Is Likely Coming

Summary

- Oil States International endured tough times during the past three years due to the severe downturn following the Covid-19 pandemic.

- After seeing a cash flow drought during 2021, their results during 2022 saw them turning a corner.

- As a result, their shareholder returns have been finally reinstated now in early 2023, thereby starting with a $25m share buyback program.

- Even though I suspect more is likely coming given their positive outlook and solid financial position, I am nevertheless disappointed by the lack of dividends.

- I feel these provide a preferred path for shareholder returns in their cyclical industry and, therefore, I only believe that a hold rating is appropriate.

MicroStockHub

Introduction

There were few tougher times in living memory for the oil and gas services industry than those resulting from the Covid-19 pandemic, something that Oil States International (NYSE:OIS) and their shareholders know all too well after a three-year hiatus from shareholder returns. Thanks to their financial performance turning a corner as 2022 closed out its final days, markets have rejoiced with their shareholder returns finally reinstated and given their positive outlook, I suspect more is likely coming as 2023 progresses.

Coverage Summary & Ratings

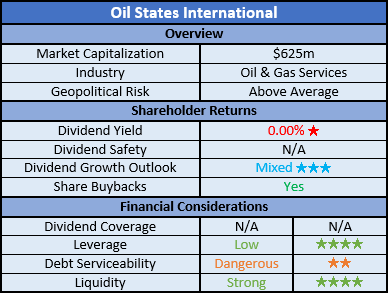

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

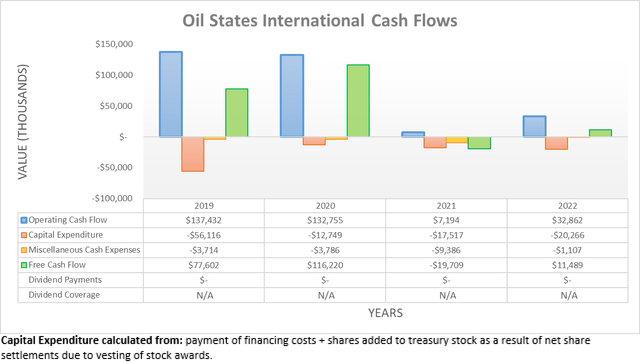

When the Covid-19 pandemic started wreaking havoc in early 2020, it posed never-before-seen challenges for virtually every company, government, and household alike, although few industries suffered as immensely as oil and gas services. Even though their operating cash flow of $132.8m during 2020 was almost identical to their previous result of $137.4m during 2019, this was merely down to the inherent lag their company endures, as 2021 saw cash flow drought with a result of only a tiny $7.2m. Thankfully this works both ways with 2022 turning a corner with their operating cash flow beginning to climb higher to $32.9m, despite obviously remaining far beneath their earlier results.

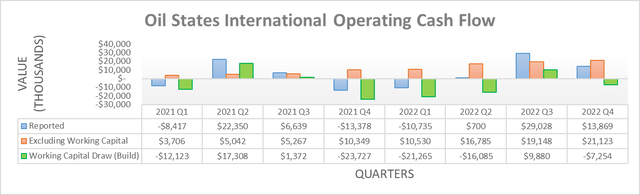

Whilst not entirely the reason, their working capital movements did hinder their reported operating cash flow during 2022. When looking at their results for each quarter, it shows the first, second and fourth quarters saw various working capital builds. If aggregated and netted off against their draw during the third quarter, it sees a working capital build of $34.7m for the full year that is slightly more than their reported result. Even excluded, their underlying result of circa $70m remains materially beneath their earlier results of circa $130m before the Covid-19 pandemic. Whilst only time will tell where their operating cash flow lands during 2023, at least they intend on keeping their capital expenditure modest, as per the commentary from management included below.

“For the full year 2023, we expect to invest approximately $25 million in capital expenditures.”

-Oil States International Q4 2022 Conference Call.

If looking at their capital expenditure guidance for 2023, they forecast circa $25m that is reasonably close to their spending of $20.3m during 2022 and far beneath the $56.1m seen during 2019. As a result, this will help enhance their ability to generate free cash flow and excitingly, finally helps see their shareholder returns reinstated, as per the commentary from management included below.

“But the point of that being the industry outlook, our backlog development, our free cash flow history and our outlook for free cash flow suggests you can now begin more thoughtful approach to cash return to shareholders.”

-Oil States International Q4 2022 Conference Call (previously linked).

After three years hiatus from shareholder returns, this is finally changing with management rolling out a $25m share buyback program. Given their positive outlook and subsequently discussed solid financial position, I suspect more is likely coming as the year progresses. Each investor is entitled to their own views, although it firmly remains my view that dividends are a preferable way to return cash to shareholders. Apart from being more tangible in general, they are especially better suited to companies operating in cyclical industries, such as anything relating to oil and gas. Unless very skillfully timed, they risk conducting the majority of share buybacks when their share price is around the upper end of its cycle and therefore, it hinders their effectiveness and thus the appeal of their shares.

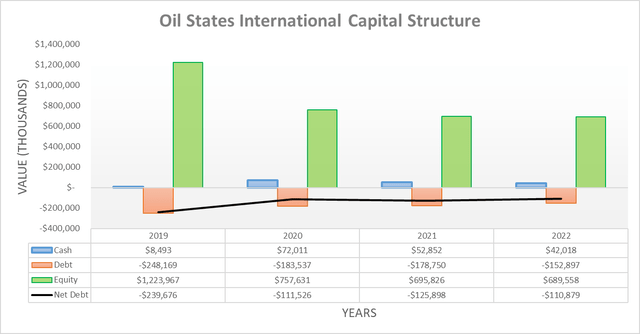

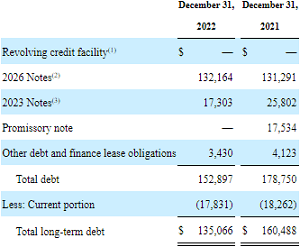

When it comes to their capital structure, their move to eliminate their shareholder returns saved the day in the face of the cash flow drought. In fact, thanks to moving swiftly in 2020 before the full effect was later felt, they were able to shave away more than half of their net debt that was previously $239.7m at the end of 2020, whereas it now stands at only $110.9m at the end of 2022. Going forwards, their positive outlook for free cash flow during 2023 and continued modest capital expenditure means their net debt should remain under control, if not possibly sink even lower.

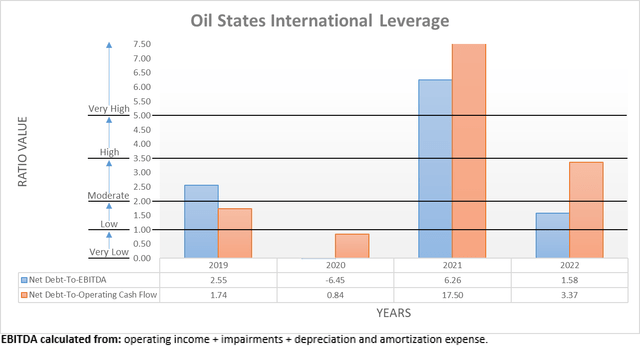

When it comes to their leverage, shaving away more than half of their net debt since the end of 2019 works wonders and thus creates a solid base for shareholder returns. Even though their financial performance is still not back to where it was during 2019, their net debt-to-EBITDA at the end of 2022 was only 1.58 and thus already within the low territory of between 1.01 and 2.00. Whilst their accompanying net debt-to-operating cash flow is far higher at 3.37, this is simply due to their aforementioned working capital build that if excluded, would see a result of 1.64. If their financial performance continues improving going forwards into 2023, their leverage should be pushed even lower in tandem, even without their net debt sinking lower.

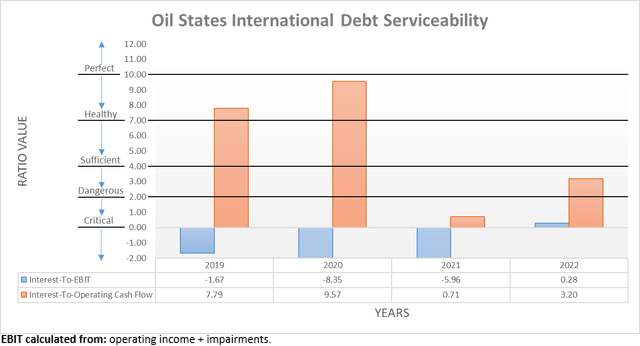

Despite their low leverage, disappointingly their debt serviceability is not nearly as positive with their interest coverage seeing a dangerous result of only 0.28 when compared against their EBIT. Whilst the comparison against their operating cash flow sees a sufficient result of 3.20, I prefer to judge on the worse side. That said, this less-than-ideal situation should be rectified throughout 2023 on the back of their improving financial performance, thereby easing this burden and making way for shareholder returns.

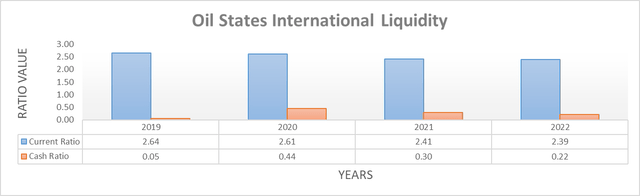

To further lower risks, they sport strong liquidity with a current ratio of 2.39 and its accompanying cash ratio of 0.22. Given their positive outlook for free cash flow, they should not require their credit facility going forwards into 2023 but if required, it stands ready with a further $92.1m of availability and does not mature until February 2025. Elsewhere, the $17.3m relating to their 2023 Notes have already been repaid thus far into the year, as per their 2022 10-K and thus, they see no further debt maturities until April 2026. Since this provides ample breathing room, it clears the way for management to reward their shareholders in 2023 and beyond before having to even start thinking about repaying or refinancing debt.

Oil States International 2022 10-K

Conclusion

Following a painful wait in the years since the Covid-19 pandemic started wreaking havoc, it was thankfully not in vain with more than half of their net debt now shaved away. In conjunction with their low leverage and strong liquidity, this provides a solid base going forwards into 2023 to finally facilitate their shareholder returns being reinstated after this hiatus. Whilst positive, I personally feel the lack of dividends materially hinders their appeal given the cyclical nature of their industry and thus, I only believe that a hold rating is appropriate for OIS stock.

Notes: Unless specified otherwise, all figures in this article were taken from Oil States International’s SEC Filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.