Risks Of 'No Landing'

Summary

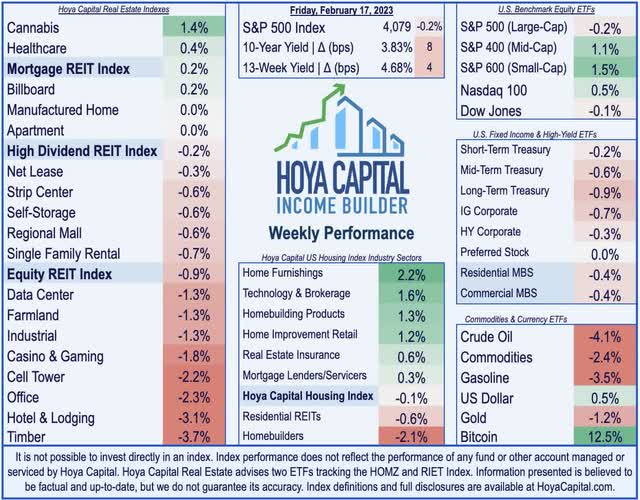

- U.S. equity markets were mixed on a choppy week as investors readjusted expectations for inflation and interest rates following data indicating an uptick in economic activity and persisting price pressures.

- Posting its first back-to-back weekly declines of the year, the S&P 500 slipped 0.2% this week, but other major benchmarks fared better. The Mid-Cap 400 and Small-Cap 600 both gained.

- Real estate equities were among the laggards this week as upward pressure on benchmark interest rates offset a generally solid slate of earnings results and encouraging dividend news.

- Real estate earnings season kicked into a higher gear with reports from nearly 40 REITs. Dividend hikes were a focus with another seven REITs raising their dividend while one REIT lowered its payout.

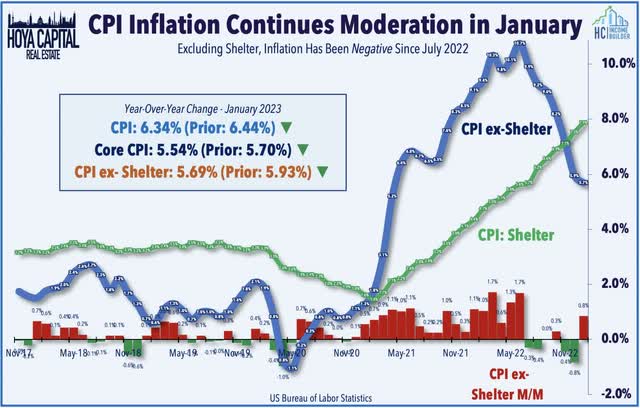

- A critical slate of inflation reports provided a mixed signal on the path of inflation - and by extension the Fed's monetary policy course - with both the CPI and PPI indexes showing a month-over-month uptick in inflation in January but a continued moderation in the annual rate.

- This idea was discussed in more depth with members of my private investing community, Hoya Capital Income Builder. Learn More »

Olga Kaya

Real Estate Weekly Outlook

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on February 17th.

U.S. equity markets were mixed on a choppy week as investors readjusted expectations for inflation and interest rates following a busy slate of data indicating an uptick in economic activity and persisting price pressures. A critical slate of inflation reports provided a mixed signal on the path of inflation - and by extension, the Federal Reserve's expected monetary policy course - with the Consumer and Producer Price indexes each showing a month-over-month uptick in inflation in January, but a continued moderation in the annual rate, providing fodder to both sides of the inflation debate and discussion of a "no landing" scenario of stubbornly elevated inflationary pressures.

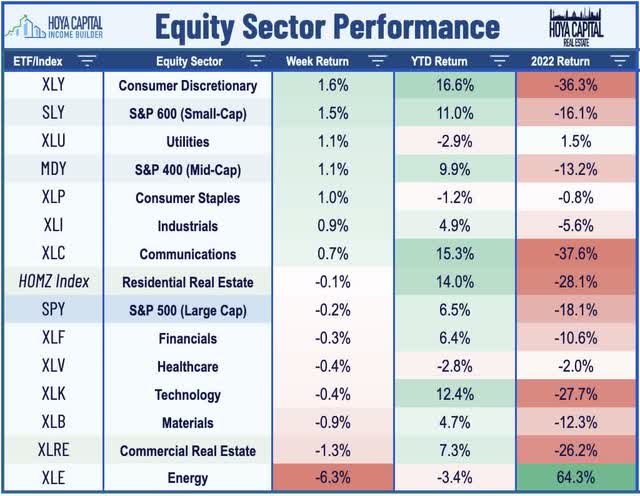

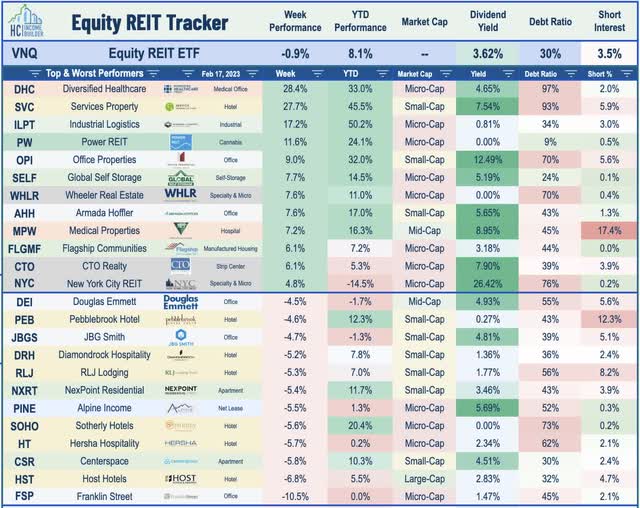

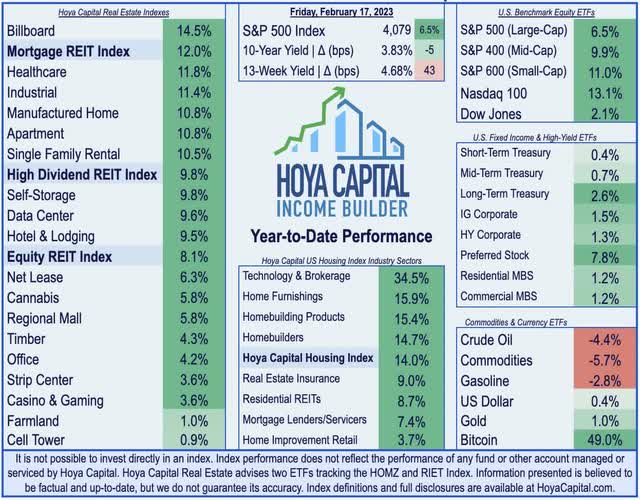

Posting its first back-to-back weekly declines of the new year, the S&P 500 slipped 0.2% on the week, but other major benchmarks fared better including the Mid-Cap 400 and Small-Cap 600, which each advanced over 1%, while the tech-heavy Nasdaq 100 gained 0.5%. Real estate equities were among the laggards this week as upward pressure on benchmark interest rates offset a generally solid slate of earnings results and encouraging dividend news. The Equity REIT Index declined 0.9% with 13-of-18 property sectors in negative territory, but the Mortgage REIT Index advanced 0.2%. Homebuilders were under renewed pressure on concerns that the recent rebound in mortgage rates could negate some of the positive momentum emerging in early 2023.

Hotter-than-expected inflation data put downward pressure on fixed-income markets across the credit and maturity curve this week. After dipping to four-month lows of 3.39% before the stronger-than-expected nonfarm payroll report, the 10-Year Treasury Yield climbed above 3.83% this past week while the 2-Year Treasury Yield rebounded to its highest level since November at 4.62%. The choppy action in commodities markets continued this week as well with Crude Oil and Natural Gas prices falling sharply following a rebound last week. Critical for the inflation outlook, Crude Oil prices are nearly 20% lower on a year-over-year basis while Natural Gas prices are lower by nearly 50% from last year, serving as significant disinflationary forces. Energy (XLE) stocks fell sharply on the week while Consumer Discretionary and Utilities (XLU) led the gains on the upside.

Real Estate Economic Data

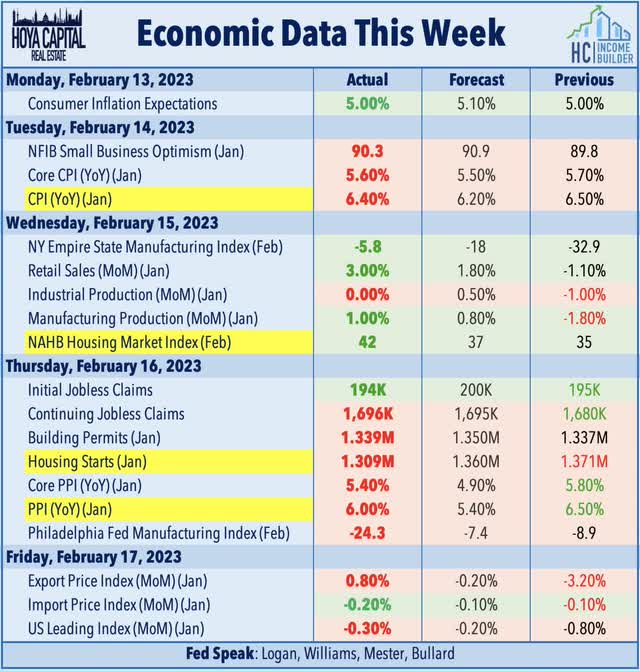

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

As expected, the Consumer Price Index showed a modest month-over-month uptick in inflation in January but a continued moderation in the annual rate, providing fodder to both sides of the inflation debate. The metric that we watch most closely - CPI-ex-Shelter Index - showed a seventh straight month of cooling in the year-over-year rate. and since July, this CPI ex-Shelter Index has declined by about 1%. The delayed recognition of shelter inflation continues to distort the headline and core metrics heavily. Despite real-time rent and home prices metrics showing muted - or negative - increases since mid-2022, the CPI Shelter Index soared 7.9% - the highest in four decades - and accounted for nearly half of the monthly CPI increase.

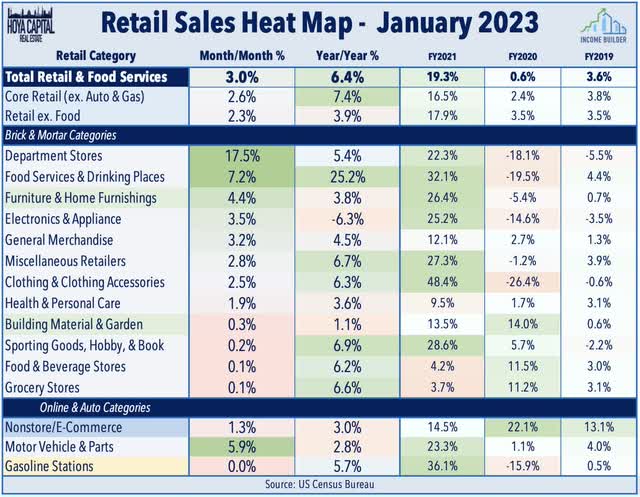

U.S. retail sales data also showed a modest reacceleration in activity in January - rebounding after a relatively soft holiday season - as unseasonably warm weather and improving consumer sentiment lifted spending in several key discretionary categories. The Census Bureau reported that total retail sales jumped 3.0% in January from the prior month - the largest monthly increase since March 2021 - to levels that were 6.4% above January 2021. Sales at department stores, restaurants, motor vehicles, and furniture retailers recorded the largest monthly gains. Data indicates that consumers have returned to brick-and-mortar retail locations at the highest rates in several years as the annual increase in the online sales (non-store retail) category was just 3.0%, which was the lowest in over four years.

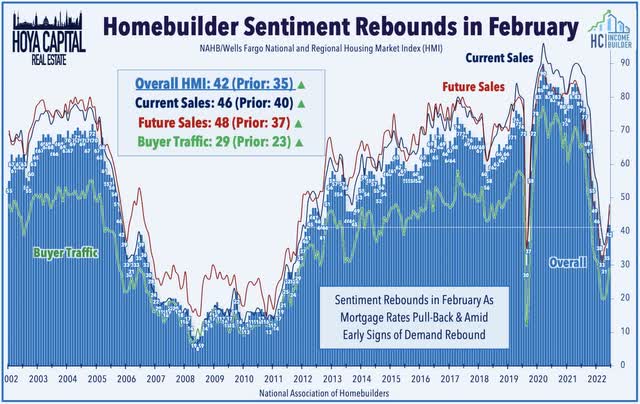

We also saw relatively strong housing market data this week with the NAHB Homebuilder Sentiment Index rising 7 points to 42 in February - the highest monthly gain since July 2013 - with notable increases in all three subcategories and across all four geographical regions. The recent moderation in mortgage rates has breathed some renewed life into the icy-cold housing market, but not enough to halt the downward pressure on new development. The Census Bureau reported that Housing Starts slid for a fifth-straight month to an annual rate of 1.31 million units - the lowest level since 2020 - while Building Permits were little changed at an annualized rate of 1.34 million units.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

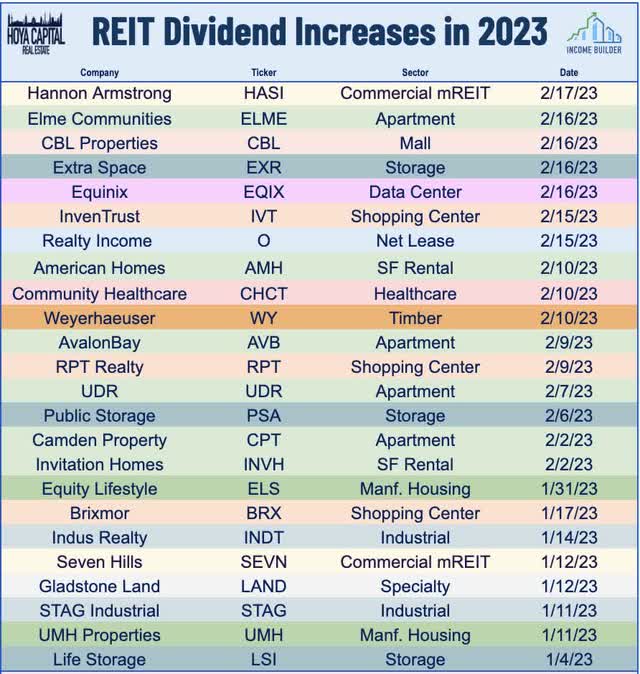

Real estate earnings season kicked into a higher gear this past week with reports from 32 equity REITs and 6 mortgage REITs. We've now heard from roughly 65% of the U.S. real estate sector by market capitalization. Dividend hikes were again a focus this past week with another seven REITs raising their payouts, highlighted by a 50% dividend hike from mall REIT CBL & Associates Properties (CBL), a 10% dividend hike from data center REIT Equinix (EQIX), an 8% raise from storage REIT Extra Space (EXR), and a 6% dividend hike from apartment REIT Elme Communities (ELME). Additionally, InvenTrust (IVT) and Hannon Armstrong (HASI) each raised their payouts by about 5% while Realty Income (O) raised its monthly dividend by 2.4%. Following two consecutive years of over 120 REIT dividend hikes in 2021 and 2022, we've seen 24 REITs hike their payouts through the first seven weeks of 2023 - roughly tracking the pace of the past two years - while four REITs have reduced their distributions including ARMOUR Residential (ARR) this week.

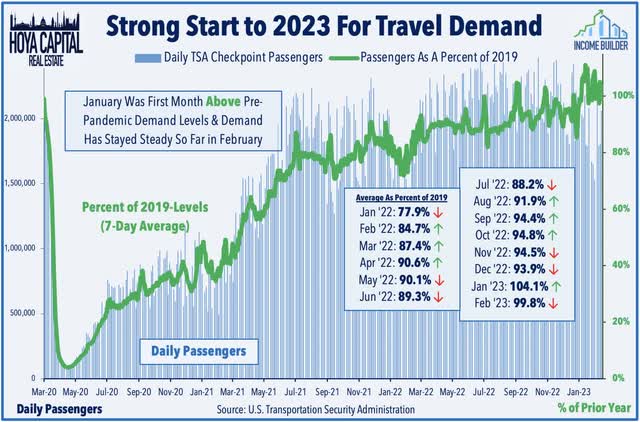

Hotels: Starting with M&A news, Service Properties (SVC) surged nearly 30% after BP (BP) agreed to acquire TravelCenters of America (TA) at an 84% premium to its prior close - an operator of convenience stores that is partially owned by SVC and its external advisor RMR Group (RMR). The remainder of the hotel sector was under pressure this week including Host Hotels (HST), which dipped nearly 7% after reporting mixed results with a relatively strong final quarter of 2022 offset by a cautious outlook for 2023. HST noted that its FFO slightly exceeded its pre-pandemic level for the full-year 2022 at $1.79/share, but projects that its FFO will decline by about 4% in 2023. HST sees flat RevPAR for full-year 2023 and expects its margins to decline in 2023 due to wage inflation, higher staffing levels, higher insurance and utility expenses, lower attrition and cancelation fees, and occupancy below 2019 levels. Hersha (HT) also declined 6% despite providing a more upbeat outlook, noting that it saw strong demand trends in early 2023 with January and February RevPAR ahead of 2019-levels by 3.9% and 5.5%, respectively. Travel demand trends have been relatively strong in early 2023 per recent TSA Checkpoint data with January throughput exceeding pre-pandemic levels.

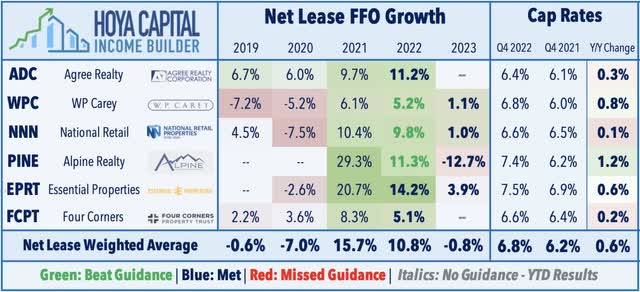

Net Lease: A pair of net lease REITs were among the leaders this week after reporting solid fourth-quarter results. Essential Properties (EPRT) rallied more than 3% after reporting full-year FFO growth of 14.2% for full-year 2022 - the highest in the net lease sector - and projecting FFO growth of 3.9% for 2023, also the highest among the REITs to report results thus far. Agree Realty (ADC) advanced 3% after reporting full-year 2022 FFO of 11.2% and noting that it continues to plow ahead with acquisitions despite the surge in interest rates over the past year. ADC noted that it acquired 131 properties in Q4 at a weighted-average capitalization rate of 6.4% - up only about 30 basis points from its average cap rate in Q4 of 2021. Among the six net lease REITs to report results, reported acquisition cap rates have climbed only 60 basis points compared to a year ago, during which time the 10-Year Treasury Yield climbed 230 basis points. ADC commented that "cap rates crept higher but bid-ask spread remains [wide] as sellers are slow to adjust to current market dynamics. We have yet to see a commensurate cap rate expansion."

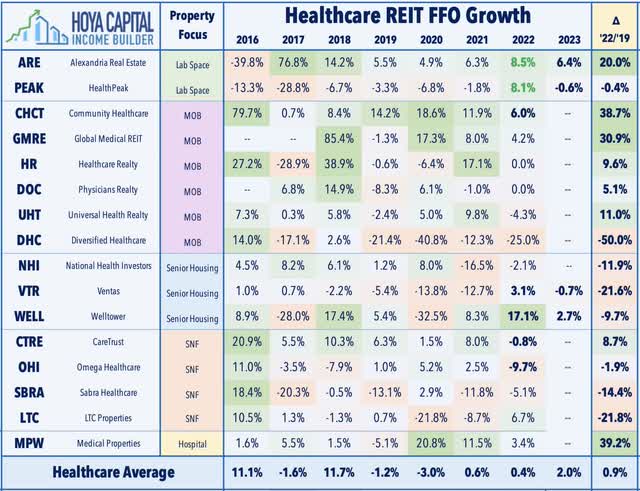

Healthcare: Also on the upside this week, Welltower (WELL) rallied nearly 3% after reporting better-than-expected results driven by a continued occupancy recovery and strong pricing trends in its senior housing portfolio. WELL noted that its FFO rose 17.1% in 2022 and projects growth of 2.7% in 2023 which would bring its FFO to within about 5% of pre-pandemic levels by the end of the year. Hospital owner Medical Properties Trust (MPW) - a "battleground" REIT that is among the most heavily shorted - surged more than 7% this week after it announced that Catholic Health Initiatives Colorado will lease its Utah hospital portfolio subsequent to CHIC’s acquisition of the business from Steward Health Care. MPW's high tenant concentration in Steward has been a primary source of investor concern. Centura Health will manage the facilities during the 15-year initial lease term.

Sticking in the healthcare sector, Diversified Healthcare (DHC) - another RMR-advised REIT - soared nearly 30% following the aforementioned TravelCenters acquisition while also announcing an amended credit facility that provides covenant relief in exchange for certain restrictions and higher interest rates. Elsewhere, Strawberry Fields (OTCQX:STRW) - which has traded OTC since its direct listing last year - announced it will officially begin trading on the New York Stock Exchange American on Wednesday, February 22, 2023 and will continue to trade under its current symbol.

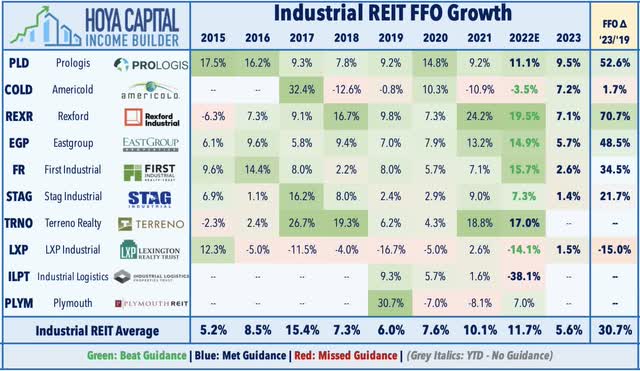

Industrial: Another RMR-advised REIT - Industrial Logistics (ILPT) - gained more than 17% this week after reporting decent results with strong property-level fundamentals helping to partially offset the effects of higher interest expense from its elevated debt burden resulting, in part, from its ill-time acquisition of Monmouth in 2021. ILPT reported solid leasing trends in Q4, signing 1.4M SF of space at 18.7% higher rental rates on a GAAP basis, bringing its full-year releasing activity to 7.8M square feet at rents that were 47.3% above expiring leases. Positively, ILPT was able to push several looming debt maturities out to 2027, but the firm noted that it has made little progress in finding a JV partner to raise additional capital to pay down debt. Cold storage operator Americold (COLD) rallied nearly 4% after reporting better-than-expected results and providing a positive outlook for 2023 following several challenging years of negative pressures resulting from higher labor costs and lower occupancy rates - one of the only sub-segments of the industrial market that struggled during the pandemic. COLD reported that its full-year FFO declined 3.5% for full-year 2022 - 90 basis points above its prior guidance - and sees relatively strong FFO growth of 7.2% for full-year 2023 and expects same-store NOI growth of 6.6% for the year.

Staying in the industrial sector, STAG Industrial (STAG) was also among the better performers after reporting that its FFO climbed 7.3% for full-year 2022 - 50 basis points above its prior guidance. STAG reported cash leasing spreads of 14.2% in Q4 and noted in its earnings call that its seen spreads accelerate to "25% to 30%" thus far in 2023. STAG's outlook for 2023 appears quite conservative given these strong pricing trends, calling for FFO growth of 1.4% for the full-year 2023 as negative impacts from higher interest expense offset its expected same-store NOI growth of nearly 5%. LXP Industrial (LXP) finished lower on the week after reporting mixed results, noting that its full-year 2022 FFO declined 14.1% - slightly better than its prior guidance - as it sold down its non-industrial assets throughout the year as part of its strategic shift away from a diversified REIT and towards a pure-play industrial REIT. LXP reported leasing spreads of 42.6% - an acceleration from the 40.7% last quarter.

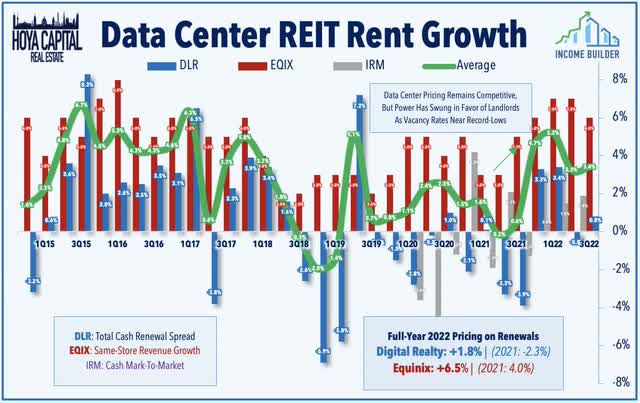

Data Center: We heard results from both major data center REITs this week. Equinix (EQIX) declined about 2% on the week despite reporting very strong results and announcing a 10% increase in its dividend. EQIX recorded full-year FFO growth of 11% on a constant-currency basis and projects a growth of 9% in 2023. EQIX noted strength in its Americas region which "had another quarter of strong gross bookings, lower MRR churn, and continued favorable pricing trends." Digital Realty (DLR) finished flat on the week after reporting mixed results, noting that its full-year 2022 FFO rose 2.6% - below its prior guidance of 3.0% - and provided a soft outlook for 2023 with expectations of flat FFO growth at the midpoint of its range. Leasing volumes were lighter-than-expected with $117M of incremental annualized revenue - down from $176M in the prior quarter - but pricing on renewals was decent with rent increases of 0.8% on a cash basis with particularly strong pricing power on smaller leases below 1MW. While the FFO outlook for 2023 was soft, DLR does expect an upward inflection in property-level fundamentals, projecting same-capital NOI growth of 3-4% for full-year 2023 - a notable improvement from the -5.8% decline in 2022. DLR commented, "we’ve seen this pendulum on pricing moving in our favor now for several quarters... This year [marks] an inflection to positive territory and we’re guiding for 2023 to be the best cash mark-to-market inflection in close to 10 years for our business."

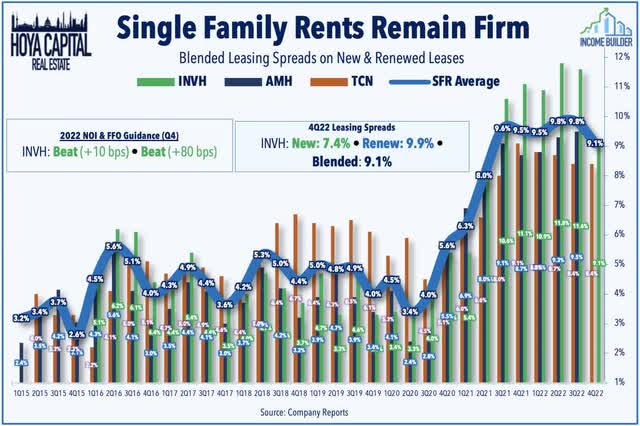

Single-Family Rental: Invitation Homes (INVH) was among the better performers this week after kicking off SFR REIT earnings season with a decent report, noting that its FFO rose 10.2% for full-year 2022 - 80 basis points above its prior outlook - and forecast FFO growth of 4.3% for full-year 2023. Rental rates remained quite firm in late 2022 despite the broader cooldown in national rent growth. INVH recorded blended rent growth of 9.1% in Q4 - comprised of renewal spreads of 9.9% and new lease spreads of 7.4%. INVH's revenue collection did see a modest decline in the back half of 2022 - primarily related to the ongoing eviction moratorium in California - with rent collection declining to 97% in Q3 and Q4, down from its long-term average of 99%. Earlier this month, INVH hiked its dividend by 18% to $0.26/share.

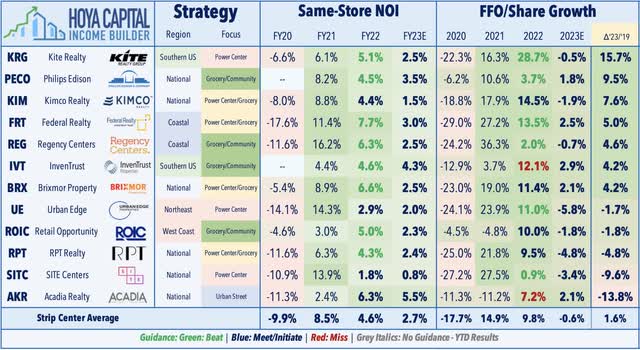

Strip Centers: The strong earnings season for the strip center REIT sector continued over the past week as well. Kite Realty (KRG) - which we own in the REIT Focused Income Portfolio - advanced nearly 3% after reporting full-year FFO growth of 28.7% in 2022 - 330 basis points above its prior guidance - and expects its FFO to be roughly flat in 2023. InvenTrust (IVT) advanced 2% after announcing slightly better-than-expected results and announcing that it will hike its dividend by 5% starting with its April payment. Brixmor (BRX) gained 1% after reporting solid results as well, noting that it achieved full-year FFO growth of 11.4% in 2022 - matching its prior guidance - and expects full-year FFO growth of 2.1% in 2023, the best in the sector thus far. Urban Edge (UE) gained 1% after reporting 2022 FFO growth of 11.0% - 280 basis points above its prior guidance - but provided relatively soft guidance for 2023 with expectations of a 5.8% decline in FFO resulting from expected vacancy impacts from Bed Bath, Party City, and Regal Cinema.

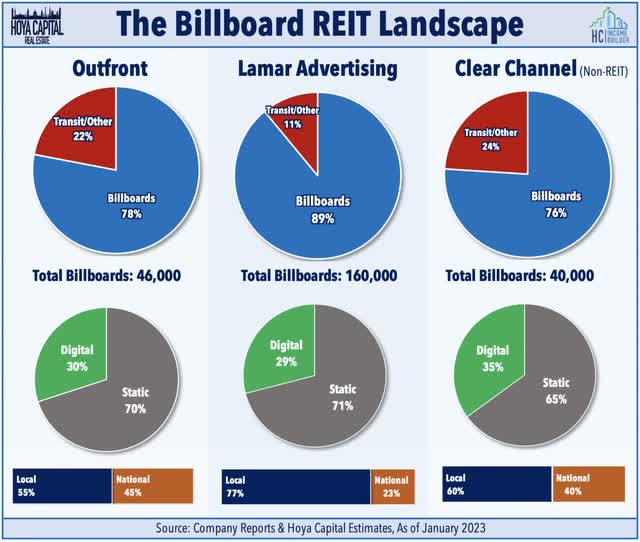

Billboard: This week we published Billboard REITs: We're Paying Attention. From the bright lights of Times Square to the iconic signage on LA's Sunset Strip, advertising billboards have been an inescapable fixture of the typical American commute for decades. Billboard REITs own a commanding share of the nation's 500,000 outdoor advertising displays - a surprisingly resilient business that has seen revenues and profitability fully recover to pre-pandemic levels. Unlike other increasingly-cluttered digital formats, there's "only one channel" on the highway and these Billboard REITs are well-positioned to capture the steadily growing share of marketing spending towards Out-of-Home advertising. We like the supply constraints and the importance of scale in the billboard business – granting these REITs a meaningful competitive advantage and legitimate economic moat.

Mortgage REIT Week In Review

Stabilizing following their worst week of the year, mortgage REITs were mostly-higher this past week with the iShares Mortgage Real Estate Capped ETF (REM) advancing 0.2% - holding onto gains of roughly 12% on the year. We heard reports from six mREITs this past week. Arbor Realty (ABR) rallied more than 6% on the week after reporting strong results, noting that its distributable EPS rose to $0.60 - surpassing the $0.46 estimate - while its Book Value Per Share ("BVPS") rose 1% to $12.92. Of note, however, ABR held its dividend steady at $0.40/share, snapping a streak of 10 straight quarters of dividend increases. Seven Hills Realty (SEVN) gained 1% on the week after reporting that its BVPS increased about 1% in Q4 while its adjusted distributable earnings per share rose to $0.37/share - up from $0.27 last quarter. SEVN is one of two mREITs to have raised its dividend this year, hiking its payout by 40% in January. Chimera (CIM) gained about 1% on the week after it reported that its BVPS increased about 1% in Q4 to $7.49/share and commented, "right now, we feel good about that $0.23 dividend."

The other mREIT to raise its dividend this year - Hannon Armstrong (HASI) - finished lower by 2% after reporting mixed results, noting that its distributable EPS fell to $0.49 from $0.47 in the prior quarter. HASI also announced that it will raise its quarterly dividend by 5.3% to $0.395/share. Ares Commercial (ACRE) slipped 1% despite reporting better-than-expected EPS of $0.44 - above the $0.37 consensus - and declaring a supplemental dividend of $0.02/share on top of its regular dividend of $0.33. On the downside this past week, ARMOUR Residential slid more than 3% after trimming its monthly dividend by 20% to $0.08/share. ARR reported that its BVPS was roughly flat in Q4 at $5.78/share while its Distributable EPS stood at $0.27/share, below its prior $0.30 distribution rate. Residential mREITs have reported an average 1.6% increase in BVPS in Q4, led by a rebound in agency-focused mREITs, while commercial mREITs have reported a 0.8% decline.

2022 Performance Recap & 2023 Check-Up

Through the first seven weeks of 2023, the Equity REIT Index is higher by 8.1% on a price return basis for the year while the Mortgage REIT Index is higher by 12.0%. This compares with the 6.5% gain on the S&P 500 and the 9.9% advance on the S&P Mid-Cap 400. Within the real estate sector, all 18 property sectors are in positive territory on the year led by Billboard, Healthcare, Industrial, and Residential REITs. At 3.83%, the 10-Year Treasury Yield has declined 5 basis points since the start of the year - above the closing low of 3.39% in early February - but well below its 2022 highs of 4.30%. The US bond market has rebounded following its worst year in history as the Bloomberg US Aggregate Bond Index has gained 1.1% this year.

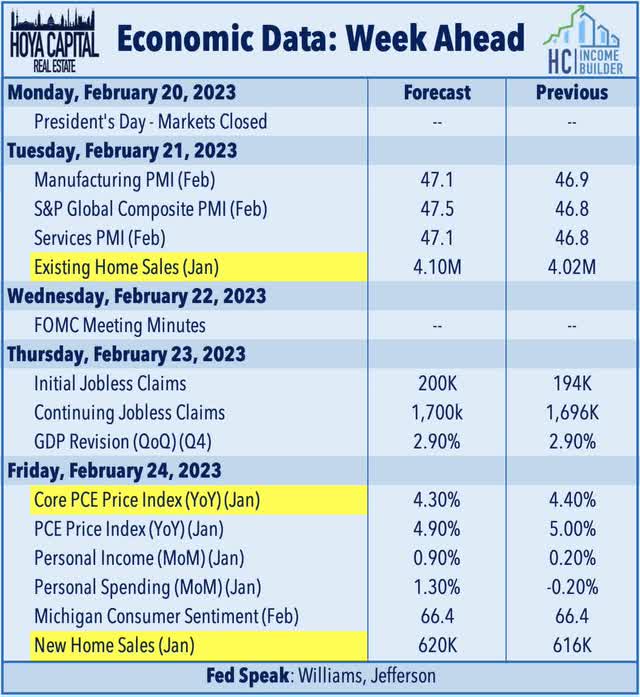

Economic Calendar In The Week Ahead

We'll see another busy week of economic data in the holiday-shortened week ahead. U.S. equity and bond markets will be closed Monday for President's Day. Home sales will be in focus in the coming week with Existing Home Sales data on Tuesday and New Home Sales data on Friday which are each expected to show a modest thawing in housing market activity following a sharp rate-driven cooldown amid a surge in mortgage rates to two-decade highs. The weekly average 30-Year Mortgage Rate peaked in November at 7.08% and declined to 6.09% in early February before rebounding last week to 6.32%. Minutes from the Federal Reserve's early-February meeting will be released on Wednesday. Jobless Claims and the first revision to fourth-quarter Gross Domestic Product data will be released on Thursday. The most closely-watched report of the week will be the PCE Price Index on Friday - the Fed's preferred gauge of inflation - which is expected to show similar mixed signs of declining annual inflation but perky inflation in January as were on display in the CPI and PPI Price Indexes this past week.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth.

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, ALL HOLDINGS IN THE INCOME BUILDER REIT FOCUSED INCOME & DIVIDEND GROWTH PORTFOLIOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receive compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.