ABM Industries: Riding The Wave Of Return-To-Office Trends

Summary

- ABM Industries has seen some weak growth in recent quarters but I believe this is positioned for a recovery supported by strong tailwinds.

- ABM will benefit from a sharp services rebound.

- Return to office trends will reignite growth.

- ABM is attractively valued at a discount.

Three businesswomen walking through an office in the morning jacoblund/iStock via Getty Images

Thesis

ABM Industries (NYSE:ABM) has seen weak growth in its main segment over the past 3 quarters. However, I believe it is set for a recovery due to three key hypotheses:

- ABM will benefit from a sharp services rebound

- Return to office trends will reignite growth

- ABM is attractively valued at a discount to peers

ABM will benefit from a sharp services rebound

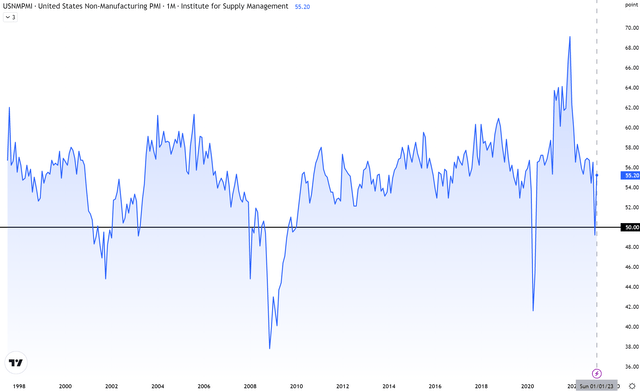

Being in the facilities management services industry with 94% of revenues generated in the United States, ABM is geared towards the health of the US services industry. The Institute of Supply Management's Services PMIs are known to be leading indicators for the services sector:

US Services (Non-Manufacturing PMI) (TradingView, Author's Analysis)

In January 2023, the Services PMIs rebounded from contraction back into growth territory as it moved from 49.2 to 55.2. The Business Activity/Production and New Orders sub-indices are further leading indicators of the overall Services PMI. These indices showed an even sharper rebound from 53.5 to 60.4, and 45.2 to 60.4 respectively. This increases my confidence in continued strong growth in the services industry ahead.

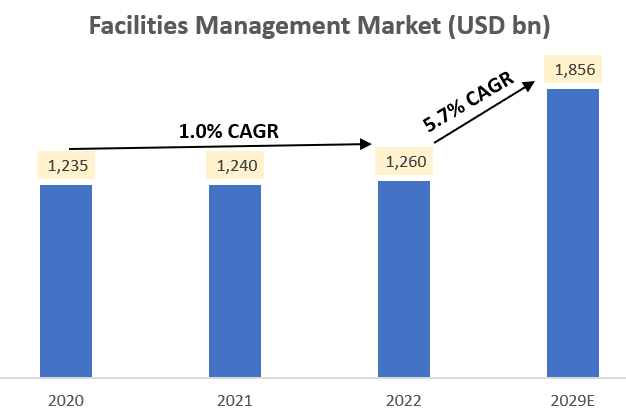

I believe ABM will be able to capture its fair share of this growth. According to Fortune Business Insights, the facilities management market is expected to see a growth acceleration in the years ahead:

Facilities Management Market (Fortune Business Insights, Author's Analysis)

A key structural growth driver for the growth acceleration is increased outsourcing penetration of janitorial services. According to a 2022 In-House/Facility Management Benchmarking Survey Report by Cleaning and Maintenance Management Magazine, outsourcing of cleaning and janitorial services increased from 26.3% to 29.9% in 2022.

Another major growth driver includes a return to the office:

Return to office trends will reignite growth

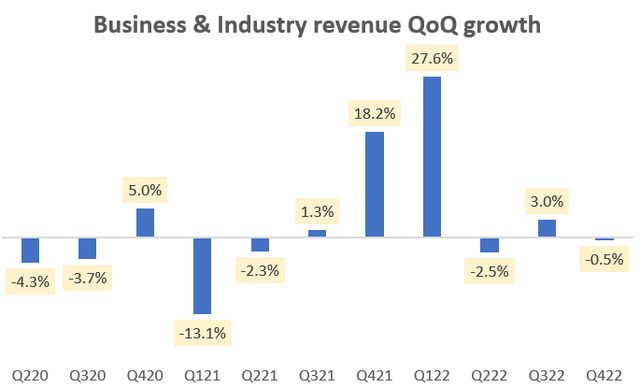

Business & Industry revenue QoQ growth (Company Filings, Author's Analysis)

ABM's Business & Industry segment is the largest segment making up 51.2% of revenues in Q4 FY22. As the chart above shows, this segment has seen slower QoQ growth over recent few quarters. Management attributed this to low office occupancy rates in the earnings call. The data matches their commentary:

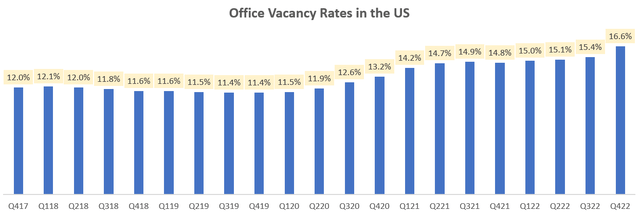

Office Vacancy Rates in the US (Statista, Commercial Edge, Author's Analysis)

Q4 CY22 saw a sharp increase in office vacancy rates in the United States to 16.6%. However, I suspect that is an overstated and potentially temporary phenomenon. I note that the majority of tech-layoffs started in Q4 FY22, which may explain some part of the spike in lower vacancy rates.

It is difficult to believe that higher office vacancy rates and hence lower office occupancy rates is due to increased work-from-home (WFH) trends because eclectic pieces of evidence shows that the momentum is in the opposite direction; people are returning back into the office.

According to Commercial Real Estate research firm CoStar, after the layoffs, large technology companies are reversing remote work policies to have tighter checks and balances on employee productivity. As CoStar journalist Katie Burke noted:

If 2021 was the year of operating remotely and 2022 the year of trying to ease employees back to in-person work, real estate professionals say the next 12 months are expected to feature companies investing in long-term real estate decisions as they begin requiring more consistent office attendance.

(Author's bolded emphasis)

ABM's CEO Scott Salmirs called out the same trend in the Q4 FY22 earnings call:

And I could just tell you anecdotally, as I travel in my circles and talk to some peer CEOs, there's definitely a push to get people back to the office.

Importantly, there is evidence that these commentaries are materializing into actual changes in behavior. For example, facility security firm Kastle noted that in January 2023, office occupancies have rebounded to 50% for the first time since the pandemic in March 2020.

All this gives me confidence that office occupancies are on an uptrend, which makes ABM's Business & Industries segment poised for reignited growth.

ABM is attractively valued at a discount

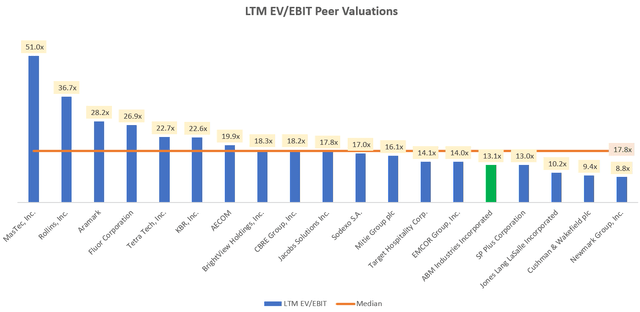

LTM EV/EBIT Peer Valuations (Company Filings, Capital IQ, Author's Analysis)

Peer set includes Fluor Corporation (FLR), AECOM (ACM), EMCOR Group (EME), BrightView Holdings (BV), KBR (KBR), Tetra Tech (TTEK), MasTec (MTZ), SP Plus Corporation (SP), Jacobs Solutions (J), Mitie Group (OTCPK:MITFF) (OTCPK:MITFY), Newmark Group (NMRK), Target Hospitality Corporation (TH), CBRE Group (CBRE), Jones Lang LaSalle (JLL), Cushman & Wakefield (CWK), Rollins (ROL), Aramark (ARMK) and Sodexo (OTCPK:SDXOF) (OTCPK:SDXAY)

The bolded names above include competitors of ABM Industries, as identified by mentions in the respective companies' source filings.

ABM Industries currently trades at a 13.1x LTM EV/EBIT multiple, which implies a 26.7% discount to 17.8x median multiple of the service management peer set.

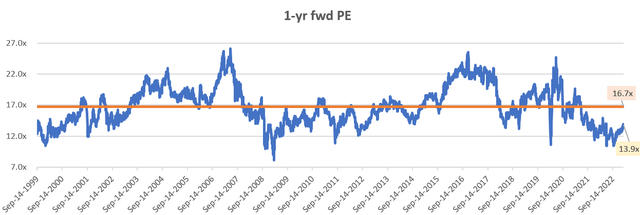

Relative to its historical trading average too, ABM is trading at 1-yr forward PE multiple of 13.9x; a 17.2% discount to its long-term average of 16.7x:

ABM Industries 1-yr forward PE (Company Filings, Capital IQ, Author's Analysis)

I believe a return to the long-term PE of 16.7x is feasible, especially given the mean-reversion back toward the office and an impending roaring rebound in the US services sector, as suggested by leading service PMI sub-indices.

Taking a 16.7x target PE and applying it to a FY23 EPS of $3.52 based on consensus estimates, the implied target price comes out to be $58.8, which corresponds to a 20.5% upside in the stock.

Positioning

Overall, I think ABM Industries is a good investment to ride the wave of return-to-office trends. I anticipate a sharp rebound in the company's growth profile, driven by a roaring rebound in the leading US Services activity indicators. I expect the rebound to be sustainable as the evidence shows office occupancies are back on the way up, thus generating more facilities management business for ABM Industries. Valuations indicate a discount to historical trading multiples and to the broader peer-set, however I believe this is not warranted given the recovery outlook ahead.

To continuously monitor the health of my thesis during my investment on ABM, I will keep a close eye on the Services PMIs and office occupancy numbers. These two drivers are core to my thesis and a degradation in these metrics would pose the biggest risks to my thesis.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.