Where Fundamentals Meet Technicals

Summary

- The U.S. stock market is unlikely to do as well in the 2020s as it did in the 2010s.

- Some high-yielders, like Enbridge, could provide decent returns through compounded dividend payouts.

- Others, like Walmart, may have decent earnings growth but still provide lackluster returns.

- Looking for a helping hand in the market? Members of Stock Waves get exclusive ideas and guidance to navigate any climate. Learn More »

Wolterk

Fundamental analysis can give us a good idea if a stock is likely to do well over a 5-year period.

Technical analysis and various measures of liquidity and sentiment, meanwhile, can points towards things being overly stretched to one side or the other, and due for a rebound in the more tactical sense.

For Stock Waves, I provide occasional short-form highlights for where both fundamental analysis (my focus) and technical analysis (by Zac Mannes and Garrett Patten) suggest that the probabilities are in the favor of a stock to move one way or another. And for some of them, like this one, I make the piece public.

This issue takes a look at two stocks that have different forward-looking expectations.

Lyn Alden

A High-Level View

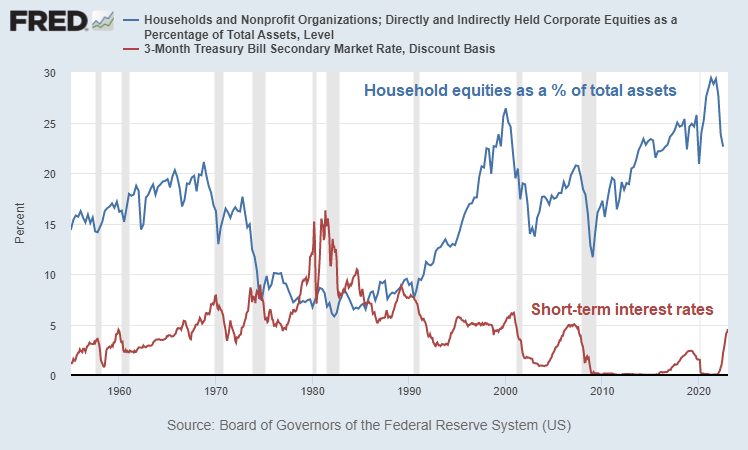

In late 2021, American households had the highest allocation to equities that they have ever had. People had nearly 30% of their assets in equities, which was slightly higher than even the Dotcom Bubble of 2000. With cash equivalents yielding nothing, there was seemingly no alternative but to own equities.

St. Louis Fed

As the Fed began raising interest rates in an attempt to quell inflation throughout 2022, it increased the discount rate for the stock market. Rather than comparing the forward return expectations of a given stock to the alternative of earning zero, investors can now compare a stock to a hurdle rate of around 4%, depending on what part of the yield curve they are interested in.

My expectation is for U.S. stocks to do rather poorly in inflation-adjusted terms this decade. There will be highs and lows and likely some nominal gains, but I don't view the S&P 500 to be the best place to park money for a decade. In part, this will be because interest rates are likely to trend sideways or perhaps up, rather than structurally downward, and thus will not incentivize ever-higher valuations.

On the other hand, I do think there are some sectors (specifically, some of the ones that didn't have a great 2010s decade) to be reasonably well-positioned to provide decent returns. In general, I think quite a bit of the return from some of those sectors will be from their dividends, rather than primarily through capital appreciation.

Enbridge

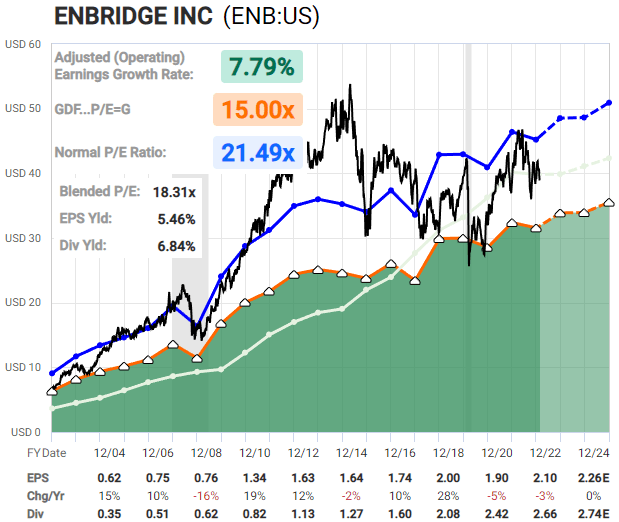

One of the areas that I think can do pretty well this decade is pipeline stocks. My favorites are Enterprise Products Partners (EPD) and Energy Transfer (ET), but because they are partnerships rather than corporations, they're not for everyone. There are, however, some ETFs and corporations that focus on pipelines.

It's not that I expect massive growth from pipelines, but rather, I expect them to chop along sideways while paying 6-7% yields or more, and slightly increasing their distributions each year. The industry has been washed out a number of times, with excess valuations cleared out, resulting in decent income plays going forward.

Enbridge (ENB) is one of the biggest, with a BBB+ credit rating (tied for the top rank in the industry), and offers a yield well north of 6%. My expectation is that, much like the S&P 500, Enbridge's share price will likely muddle along this decade, with the difference being that it'll pay a sizable dividend along the way.

F.A.S.T. Graphs

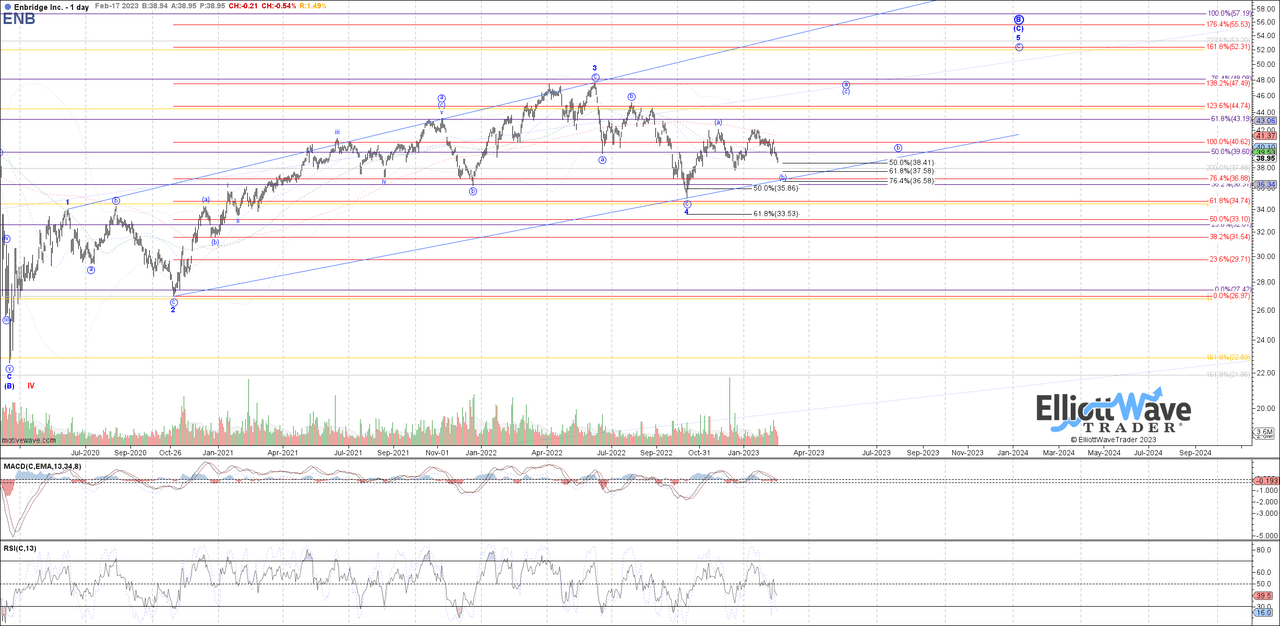

Garrett recently posted a technical setup for Enbridge that is rather favorable:

Garrett Patten, Stock Waves

Walmart

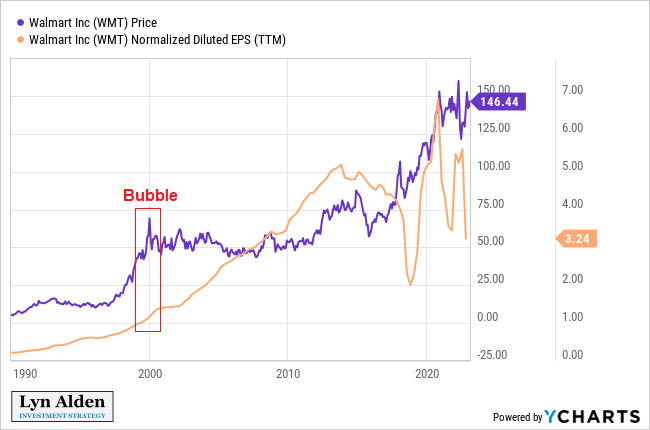

Walmart (WMT) stock became a bubble back in the late 1990s and early 2000s, and subsequently trended sideways in share price for a decade even as earnings kept growing.

YCharts

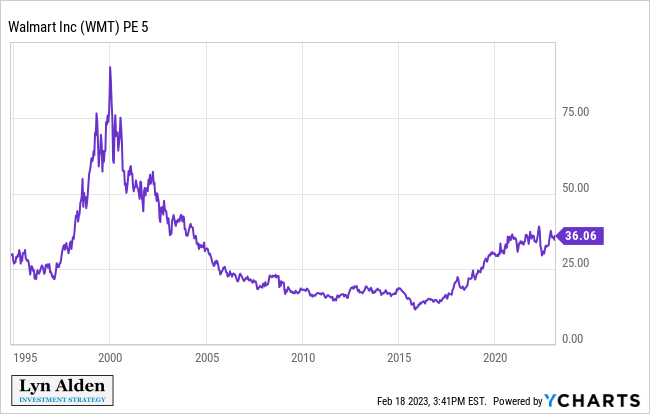

Here is the price-to-earnings ratio, using the 5-year inflation-adjusted average of earnings as the denominator, to smooth out noise:

YCharts

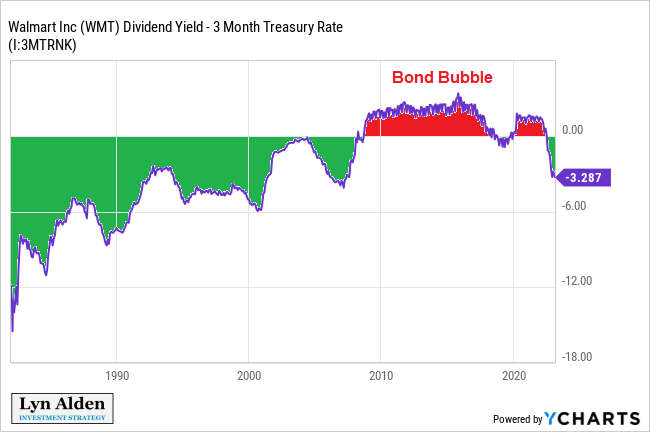

By the 2010s, it became rather cheap. In fact, with interest rates so low, an investor could earn a higher yield with Walmart dividends than they could with T-bills, while also enjoying the fact that Walmart's dividends increased each year. Higher yield and growth? What was not to like?

YCharts

Unfortunately, Walmart has become rather richly-priced again. It's not nearly at problematic levels that it was during the dotcom bubble, but it's growing slower than it was back then, and the excess attractiveness over Treasuries in terms of yield has been removed.

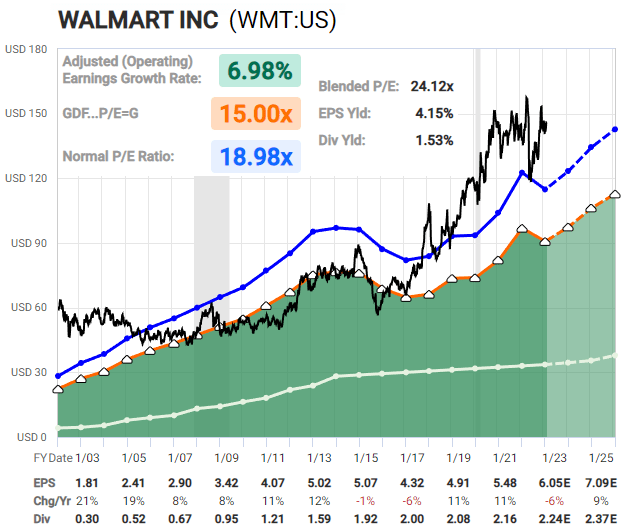

F.A.S.T. Graphs

While I'm not exactly bearish on Walmart, the risk/reward no longer looks particularly favorable. Topline growth should continue to be decent, but some margin pressures combined with valuation pressures present some downside risk.

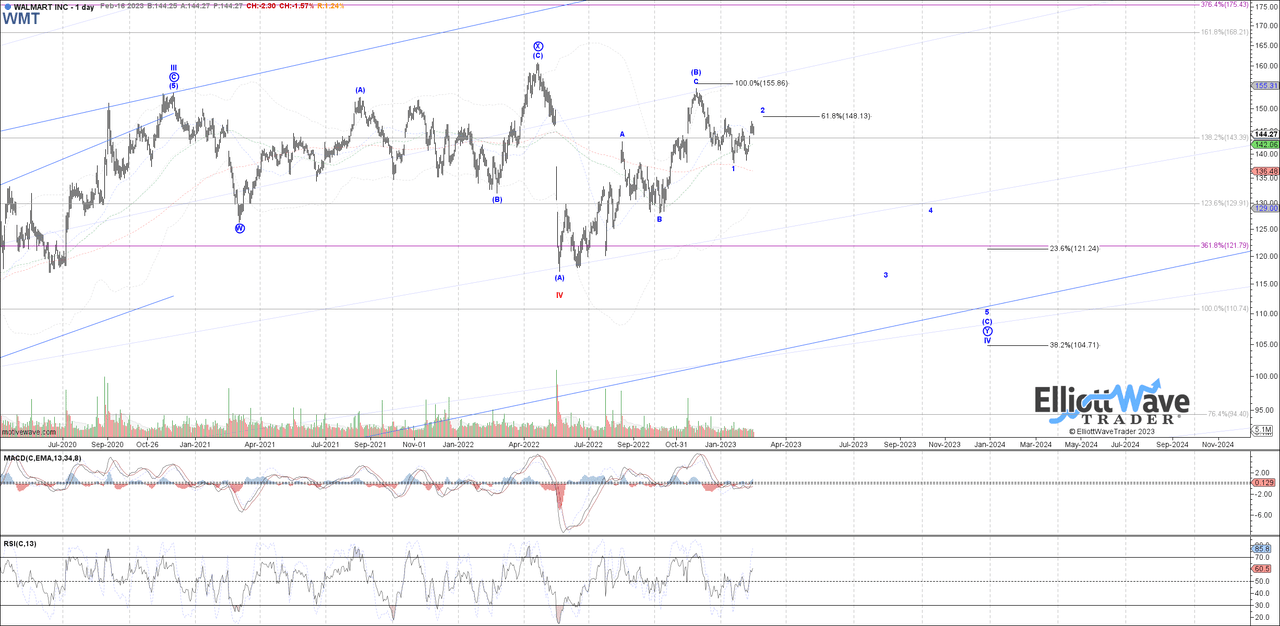

Garrett has a setup in place that is bearish in the intermediate term. I don't have any particular views on price levels over this time period but it's interesting to see that the technicals align with the fundamentals:

Garrett Patten

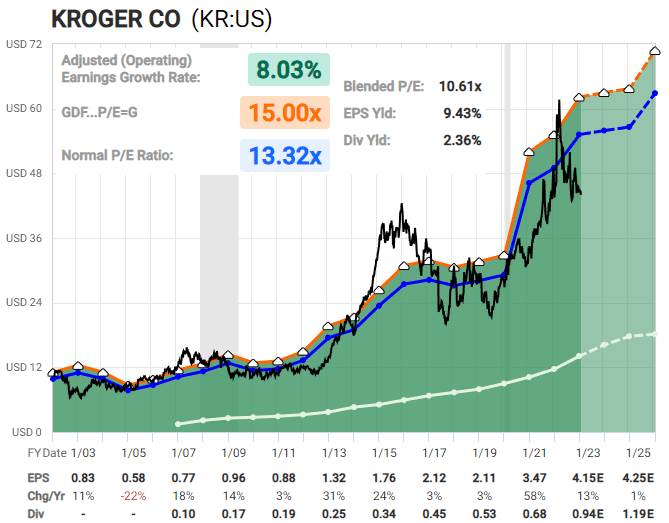

To the extent that I'd want to own retail stores or grocery stores as part of a diversified portfolio, I'd be inclined to look at something like Kroger (KR) instead of Walmart.

F.A.S.T. Graphs

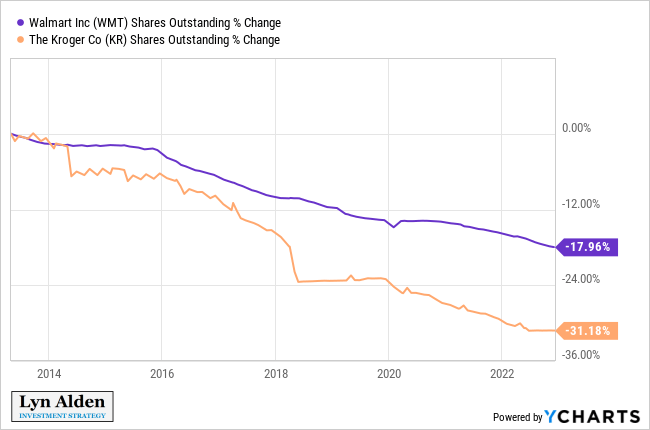

While Kroger has similar margin risks as Walmart, Kroger has less valuation risk at these levels, and due to its lower valuation its share buybacks are able to reduce the share count at a much quicker rate.

YCharts

I share model portfolios and exclusive analysis on Stock Waves. Members receive exclusive ideas, technical charts, and commentary from three analysts. The goal is to find opportunities where the fundamentals are solid and the technicals suggest a timing signal. We're looking for the best of both worlds, high-probability investing where fundamentals and technicals align.

Start a free trial here.

This article was written by

.

My work can be found at LynAlden.com, ElliotWaveTrader.net, and within the Seeking Alpha marketplace where I work with the Stock Waves team to blend their technical analysis with my fundamental analysis for high-probability long-term setups.

Disclosure: I/we have a beneficial long position in the shares of ENB, EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.