Nexstar Media Group: A Surprisingly Resilient TV Business

Summary

- Nexstar has been a tremendous performer over the past decade.

- This might seem surprising, as the company primarily owns broadcast TV stations.

- Here's how the company is making the most of a seemingly difficult situation.

- While I don't see the business growing indefinitely, shares seem cheap enough here to mitigate the risk.

- Looking for a helping hand in the market? Members of Ian's Insider Corner get exclusive ideas and guidance to navigate any climate. Learn More »

zamrznutitonovi/iStock via Getty Images

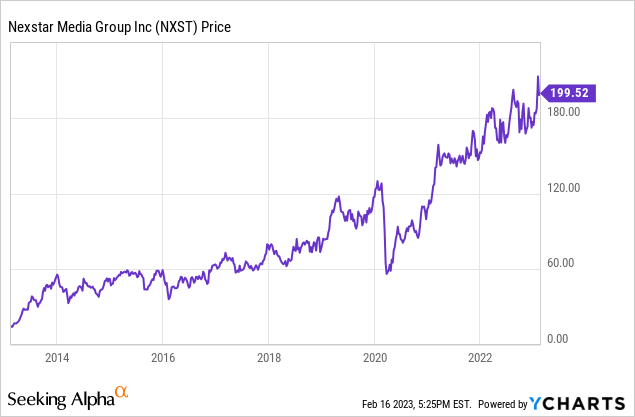

There can be a lot of money in declining industries. By any reasonable expectations, if you thought of a broadcast television company in the year 2023, you'd probably expect that its share price was struggling. Instead, TV channel owner Nexstar Media Group (NASDAQ:NXST) is delivering tremendous results, both in terms of earnings and its share performance:

I'd forgive you for assuming this was a stock chart of a hot tech or social media company.

Instead, it's Nexstar, whose primary asset are its 200 TV stations across more than 100 different American media markets. It is not especially aligned with any one major TV network. Nexstar operates 29 ABC, 35 NBC, 42 FOX, and 49 CBS channels, respectively.

In addition, it operates its own paid cable channel, NewsNation, in addition to owning minority stakes in the Food Network and Cooking Channel along with various digital properties.

How is this collection of assets delivering such a tremendous stock performance? Four main reasons.

How Nexstar Is Making The Most Of A Challenging Environment

Broadcast TV might seem like an anachronism at this point, especially to younger investors. In an age where streaming and YouTube are king, what's the appeal of owning broadcast TV stations? Even cable is struggling with the cord-cutting movement, and cable has a lot more options than the traditional big broadcast TV channels.

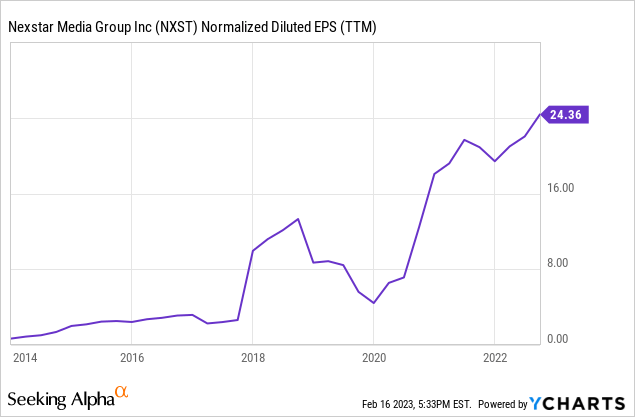

Yet, Nexstar has delivered exemplary earnings growth over the past decade:

Indeed, earnings per share grew from close to $0 in 2014 to $24 per share last year. This is simply amazing.

There are four main factors driving this:

- Consolidation

- Political Advertising

- Retransmission Revenues

- Digital Assets

The first key factor is industry consolidation. We've seen massive declines in profitability for newspapers, broadcast radio, magazines, and other legacy media formats. Understandably investors have developed an aversion to traditional media stocks, and valuations have been low.

While this is generally bad news for investors, the low valuations create opportunities to consolidate industries on the cheap. To that end, Nexstar added 65 stations to its operations in 2017 with the Media General purchase and another 31 stations in 2019 with the Tribune deal. Nexstar is now at the regulatory cap on the overall number of stations it can own, but it can trade stations in smaller markets for ones with larger audiences.

There are the obvious cost savings you get from removing redundant labor and overhead costs with this sort of consolidation. There's another factor at work, though.

Traditionally, broadcast TV has gotten the majority of its ad dollars from local clients. Think of your local restaurants, car dealerships, medical professionals, and so on. However, as Nexstar has built out its network, it has been able to increasingly draw in national advertisers. While Nexstar doesn't cover the whole country, it can reach the majority of American households and has sufficient scale and scope to serve as a broad-based advertising outlet. That's a stark contrast to the old days where a TV company would only be present in a couple of markets and not be worth the attention of a major Fortune 500 advertiser.

Next up, there's political advertising. It's no secret that political polarization has increased in recent years. The rise of wealthy outside groups funding political campaigns has greatly increased the total amount of ad dollars going to contest elections.

While a fair chunk of political advertising has gone to digital channels, the social media companies have put limits on political advertising in the wake of various scandals. In addition, TV advertising continues to give political campaigns a well-targeted means of going after voters living in particular geographic areas. As a result, TV has continued to absorb a large chunk of the total (and growing) political advertising pie. With the 2024 presidential election set to start heating up, Nexstar can look forward to another bump in revenues as that event plays out.

On a related front, Nexstar has digital assets. The most obvious are websites and apps tied to its local TV stations. There is a significant monetization opportunity from using a local TV station's presence to drive engagement on social media and elsewhere.

Additionally, Nexstar has leaned into the online market with its purchase of The Hill, an online news platform, for $130 million. The Hill seeks to provide a less biased news source to consumers while offering unique insider reporting about American politics.

Retransmission is an intriguing and underappreciated revenue source for Nexstar. FCC regulations force paid TV operators (such as cable networks but also streaming channels) to carry local retransmissions of the broadcast TV channels. Meaning, for example, that if you live in Milwaukee, your cable operator has to provide the Milwaukee version of CBS instead of a national feed.

As the broadcast TV channels still have some huge events that people demand to see (live sports for example) paid-TV operators are essentially compelled to carry the local broadcast channels. This means guaranteed revenue for Nexstar across its wide assortment of local channels in dozens of markets.

Nexstar generated a shocking 53% of its total revenues from retransmission rights for full-year 2021, and it said in its 10-K that it expects to be able to continue to grow this revenue stream.

Keep that in mind when thinking about the business. The majority of revenues here are no longer from advertising at all, but rather from having the ownership of the local TV feeds that cable and paid streaming services in turn pass on to their subscribers.

Risks To The Business Model

Ultimately, Nexstar's ability to keep growing is reliant on the fortunes of the big broadcast channels like CBS and FOX. They need to have compelling content so that the retransmission fees keep rolling in.

I'd argue that the most important battle to watch is in live sports. We've seen digital-first players like Amazon start bidding on key sporting events such as National Football League games. If the likes of Amazon, Netflix, or Apple end up taking too much of live sports, people might not value having CBS, FOX, etc. as part of their cable package anymore. If that threshold is crossed, then retransmission fees would likely plummet.

For now, I don't think we're at the point that the cable operators could realistically jettison broadcast TV. And given the fairly slow rate at which sporting event rights turn over (contracts tend to be quite long) there should be some sticking power to the current arrangement. However, realistically, the likes of FOX and CBS are probably going to be much less influential in 10 or 15 years than they are today, and that carries serious risk for Nexstar in turn.

Local news is another of the main drivers for the broadcast TV channels. There is risk to this from other alternatives, including digital sites. However, local TV news remains a compelling offering for a significant portion of the American population, and that habit will likely persist for quite a while.

There is the risk that advertising dollars fall, particularly in a recession scenario. The available amount of money (excluding political ads) for legacy media is likely flat or falling slightly. Nexstar probably will see its organic advertising revenues slip over time. But as long as the declines can be kept to the low single digits annually, it shouldn't hurt the business too much. After all, retransmission is now the bigger factor at play.

Nexstar is also investing in other ventures, such as The Hill, NewsNation, and its other digital properties. From what I've seen so far, they appear to be spending in a rational manner on these properties and operating from a profit-seeking rather than empire-building perspective. Still, investors should make sure that Nexstar's other investments obtain reasonable returns on investment rather than being vanity projects or distractions from the main business.

Finally, Nexstar has a ton of debt for a company of its size. As the company keeps buying more assets in addition to running its buyback program, it seems that the balance sheet will remain on shaky footing going forward. This is fine as long as the company continues to grow, but could magnify problems if the advertising market or cable ecosystem turn downward more quickly than expected.

Nexstar's Bottom Line

I don't think Nexstar can keep growing forever, at least not with the current business model. There is real obsolescence risk here.

That said, the ice cube appears to be melting a lot more slowly than people (myself included) would have expected. There is value in habit; there's a certain demographic that still really likes broadcast TV and enjoys it for what it is. And there's another group of folks that need access to the live sports, and will keep demand going from that direction. Local news is another distinctive feature.

These factors give Nexstar time to keep investing its prodigious cash flows in other earnings assets. Be it more TV channels, digital assets, or other opportunities, Nexstar has a reasonably long time frame to evolve its business model. There are also long-term projects, such as Nexstar's spectrum initiative Bitpath, which are hard to quantify now, but could end up having tremendous value in the distant future if things play out favorably.

In the meantime, Nexstar shares remain cheap, as they trade for just eight times forward earnings. In addition, the company has become a significant dividend play. Shares yield 2.7% following a massive 50% dividend hike in January.

Having watched what happened to newspapers and local radio, my mind keeps saying that broadcast TV must be a value trap as well. But, it's hard to argue with the numbers. Nexstar has done an incredible job consolidating the industry and making the most of the hand it was dealt. For value investors that don't mind the long-term industry decline risk, Nexstar shares seem appealing.

If you enjoyed this, consider Ian's Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

This article was written by

Ian worked for Kerrisdale, a New York activist hedge fund, for three years, before moving to Latin America to pursue entrepreneurial opportunities there. His Ian's Insider Corner service provides live chat, model portfolios, full access and updates to his "IMF" portfolio, along with a weekly newsletter which expands on these topics.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.