Better High-Yield Midstream Buy: Enbridge Or ONEOK?

Summary

- Enbridge and ONEOK are two high-yield midstream businesses.

- Both boast investment-grade credit ratings.

- We compare them side by side and offer our take on which is a better buy right now.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

adaask

Both Enbridge (NYSE:ENB) and ONEOK (NYSE:OKE) are high-yield investment grade midstream businesses.

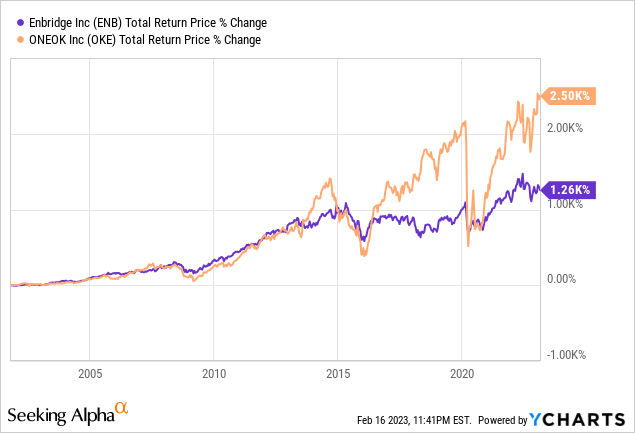

OKE has significantly outperformed ENB over the time period that both have been publicly traded:

That said, ENB has grown its dividend for 28 consecutive years, while OKE has recently paused its dividend growth as it has needed to prioritize growth investments and deleveraging its balance sheet.

In this article, we will compare them side by side and offer our take on which one is a better buy right now.

Enbridge Vs. ONEOK: Business Model

ENB boasts a large and diversified asset portfolio that provides the company with several advantages, including economies of scale, protection against individual asset, commodity, or geographic concentration risk, a range of growth investment opportunities, and a vital role in North America's energy value chain.

The company's assets give ENB ownership of the second-longest natural gas transmission pipeline network in the U.S. as well as North America's largest natural gas distribution business and longest crude oil pipeline network. Additionally, ENB is expanding its renewable power business in order to adapt to the Canadian government's environmental mandates, providing it with another avenue for long-term growth.

ENB has an exceptionally stable cash flow profile, with 98% of its cash flow linked to contracts that are not affected by commodity price fluctuations, and 95% of its cash flow supported by investment-grade counterparties.

Meanwhile, OKE's focus is on natural gas and NGL assets, from which it generates 100% of its EBITDA.

Given its emphasis on cleaner hydrocarbon energy commodities, OKE is well-positioned to benefit from the current boom in demand for these energy commodities as the global economy transitions towards cleaner energy sources.

Furthermore, OKE's cash flow profile is highly stable with no unhedged commodity price exposure, resulting in cash flow generation that is comparable to that of a utility. The company has consistently seen growth in its distributable cash flow per share, with the exception of a 10.1% decline during the COVID-19 energy market crash in 2020. This is due to the fact that approximately 90% of its cash flows originate from fixed-fee take-or-pay contracts that are resistant to commodity price and/or volume fluctuations, with 85% of its counterparties holding investment-grade ratings.

Enbridge Vs. ONEOK: Balance Sheet

ENB has a very strong balance sheet as evidenced by its BBB+ credit rating. The fact that 90% of its debt has fixed interest rates and does not mature until the 2030s, 2040s, 2050s, 2060s, and even 2080s illustrates just how strong ENB's financial position is. ENB also has a leverage ratio of 4.7x, which falls in the lower half of its target debt/EBITDA range (4.5x - 5.0x). When combined with its very stable cash flow picture and significant asset diversification, ENB has little to no risk of financial distress for the foreseeable future.

OKE's credit rating is almost as strong as ENB's at BBB with plenty of liquidity. Meanwhile, its strong growth alongside management efforts to deleverage are bringing down its leverage ratio quite rapidly. As of the end of Q3 2022, leverage stood at 3.8x and it is on track to fall to 3.2x by the end of 2023 and 3.0x in 2024. When combined with its high-quality asset portfolio and solid growth profile, OKE's financial positioning looks quite stable.

Enbridge Vs. ONEOK: Dividend Outlook

Both businesses are expected to grow their dividends at low to mid-single digit rates moving forward and enjoy very strong coverage ratios on a DCF basis. Furthermore, their investment grade balance sheets and strong asset portfolios and cash flow growth profiles indicate that their dividends should be safe for many years to come. Analysts project that OKE will grow its dividend at a 2.1% CAGR through 2026 while its DCF per share is expected to grow at a 6.3% CAGR over the same period. ENB is forecasted to grow its dividend at a 2.0% CAGR through 2026 while its DCF per share is expected to grow at a 2.2% CAGR over the same period.

While OKE has a stronger growth profile, we believe that ENB will likely outperform analyst projections over this period. Management itself expects to grow its DCF per share at a ~5% average annualized rate in the near-term.

Enbridge Vs. ONEOK: Catalysts And Risks

Both companies have a low-risk profile in dealing with potential challenges facing the energy industry, and we do not expect any significant risks in the near to medium term.

If the energy sector experiences significant growth over the long term, both companies will likely benefit from higher contract fees and an increase in organic growth opportunities. Additionally, both companies may pursue growth through strategic acquisitions.

Alternatively, if the energy transition occurs more rapidly than expected (which we doubt), both companies may face reduced contract fees and excess capacity in their networks, with limited opportunities for growth investment.

Enbridge Vs. ONEOK: Valuation

Based on the data below, we see that OKE is cheaper relative to ENB on both a comparative and historical basis based off of EV/EBITDA. That said, ENB is clearly cheaper than OKE on a P/DCF and dividend yield basis.

| Metric | ENB | OKE |

| EV/EBITDA | 12.14x | 10.91x |

| EV/EBITDA (5-Yr Avg) | 12.56x | 12.21x |

| P/2023E DCF | 9.50x | 10.07x |

| Dividend Yield | 6.7% | 5.5% |

Investor Takeaway

Both companies have low-risk profiles and impressive asset portfolios, and their attractive income yields are expected to remain secure for the foreseeable future. While ENB is in a relatively stronger financial position, OKE has a lower valuation. We consider their asset portfolios to be of similar strength with stable cash flow profiles.

ENB has the stronger track record in terms of its dividend growth, while OKE's total return track record is superior, and it also has a slightly better forward growth outlook. As a result, investors can choose between slightly higher overall quality in ENB or slightly lower valuation in OKE...or they can choose both.

An important final consideration is that ENB is based in Canada (so is subject to tax withholding on dividends), whereas OKE is based in the United States. Investors should keep the tax and currency exchange implications in mind when deciding which investment makes the most sense for them.

Based on our midstream portfolio at High Yield Investor, we do not consider either of them to be the best investment options for us currently. However, we still rate ENB and OKE as Buys at the moment and think it makes sense to hold both in a well-diversified low-risk dividend focused portfolio.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Our 2023 Blowout Sale of the Year is Here!

For a Limited-Time - You can join Seeking Alpha’s #1 rated community of high-yield investors at a steep discount!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our high-yield strategies.

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our high-yield strategies.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

(Limited to only 50 spots!)

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.