Heidrick & Struggles Is A High-Quality Company That Could Deliver High Returns

Summary

- Heidrick & Struggles is performing well during the macro headwinds in 2022.

- HSII employs a capital-light approach to operate its business with greater agility.

- The on-demand talent business and change of bonus payment structure make a lot of sense.

- The stock has a strong balance sheet with lots of cash. It generates 1.1B sales with only 240M enterprise value.

Andrii Yalanskyi/iStock via Getty Images

As a leading provider of global leadership advisory and talent solutions, Heidrick & Struggles (NASDAQ:HSII) caters to the senior-level talent and consulting needs of the world's foremost organizations. I think the stock has lots of good qualities, and it performs well during recent macro headwinds. Some of the recent moves by the management could also strengthen the future performance of the business. Here, I will discuss some of my thoughts.

Business updates

HSII's financial performance is actually not bad given the softness in the macro environment. The total revenue for the current quarter was $255.2 million, which is 3.4% lower than the record consolidated net revenue of $263.8 million achieved in the third quarter of 2021. However, if we exclude the negative impact of exchange rate fluctuations, the consolidated net revenue actually increased by $2.0 million or 0.7% compared to the third quarter of 2021.

The net revenue of Executive Search, which is the recruitment business ,was $212.8 million in the third quarter of 2022, which represents a 4% decrease compared to the previous year. Number of searches consultants increased to 389 from 368 last year. The Executive Search net revenue per consultant, measured on an annual basis, reflected a productivity of $2.2 million, which was slightly lower compared to the $2.4 million recorded in the third quarter of 2021. Moreover, the confirmed searches reduced by 17.1% from the same period in the previous year.

The On-Demand Talent business offers temporary solutions and interim positions for top independent talent. The quarterly net revenue was $23.2 million, lower than last year. But the year-to-date revenue is 69M, which is actually up 60% than 2021. The Consulting business net revenue was $19.1 million. The company had 72 Heidrick Consulting consultants, which is an increase from the 66 consultants it had at the same time last year.

HSII doesn't need lots of fixed assets to run its business

HSII is a business that relies heavily on its knowledgeable consultants to serve its customers. Unlike other businesses, it does not require a lot of fixed assets to operate, and the majority of its costs come from variable expenses such as salaries and benefits. It can generate sales for around 1.1B while only need net tangible asset of 239.3M. This allows HSII to remain lean and agile while also being able to cut costs if needed. In recent years, the company has made great strides in improving its operational margins, with a growth from 4.9% in 2012 to 11% in the previous year. Most recently, HSII has successfully lowered its salary and benefits expenses by 7.8%, which accounts for 67.2% of its revenue, compared to 70.5% in the previous year. These changes demonstrate the company's ability to adapt to market conditions and remain competitive in the industry.

The push for On-Demand Talent program

The On-Demand Talent business is gaining momentum, and management is passionate about its potential in the current labor market. As companies strive to operate with a focus on variable versus fixed costs, the On-Demand Talent business offers flexibility and agility. Additionally, the management team has noted that the On-Demand Talent business has been better able to weather economic downturns. While the business has had some cyclical challenges in the past due to its reliance on Executive Search, the non-search businesses are seen as having counter-cyclical attributes. HSII is evidently aiming to establish more dependable revenue streams, to reduce reliance on Search to 50%, a strategy that is quite reasonable to me. Nevertheless, not all of its new business segments are performing up to expectations. The success of the On-Demand Talent business requires a bit more time to validate their viability.

Change of bonus policy may be a good thing

Recently, HSII's balance sheet has displayed fluctuations in its accrued expenses, which can be attributed to the changes made to its bonus deferral management policy. In the past, a portion of the cash bonuses earned by the Company's consultants and management were deferred and paid over a three-year vesting period. However, in 2020 and 2021, the Company terminated the cash bonus deferral for consultants and management, respectively. As a result, the Company now pays 100% of the cash bonuses earned by consultants and management in the first quarter of the following year.

In order to pay out bonuses in the first quarter and retain consultant talent more effectively, HSII must aim to accumulate a maximum amount of cash during the fourth quarter. By adjusting the deferred bonus program in this manner, employees receive their compensation sooner, making the company appear more invested in its workforce. This makes HSII more attractive to retain talent which might be the key aspect of its business.

A strong balance sheet with liquidity

HSII's balance sheet boasts a robust cash balance of 456m and is devoid of long-term debt, indicating excellent financial health. Hence, bankruptcy is not a possibility at present. Nonetheless, the actual liquidity status will be revealed in the second quarter of 2023, when the company will need a substantial cash reserve to fulfill its bonus program commitments.

Risks

Despite HSII's impressive growth, its long history of acquisitions has not always resulted in the most favorable capital allocation decisions. Some acquisitions, such as Senn Delaney, Philosophy IB, JCA Group, and Amrop Denmark, had the goal to bolster the company's cultural shaping consulting businesses. In fact, they failed to meet expectations and has resulted in impairment charges for those acquisition moves. When it comes to investing, I am skeptical of the notion of a "next game-changer". The reality is that true breakthroughs in business are incredibly challenging to achieve, with many unknown variables in the investment. As such, I often see HSII's major acquisitions as risk items.

Secondly, It is crucial for the company to keep a close eye on its workforce and prevent high turnover rates. In this line of work, consultants tend to reap most of the rewards and could potentially steal client relationships from the company. HSII doesn't have much leverage as a company to retain talent.

Lastly, HSII faces significant threats from the rise of novel recruitment channels such as LinkedIn, which may prompt some businesses to hire candidates without the need for HSII's services. This could potentially result in a reduction in the volume of searches conducted. Furthermore, the edge that HSII had previously gained through its intellectual property and data could be diluted.

Bottom line

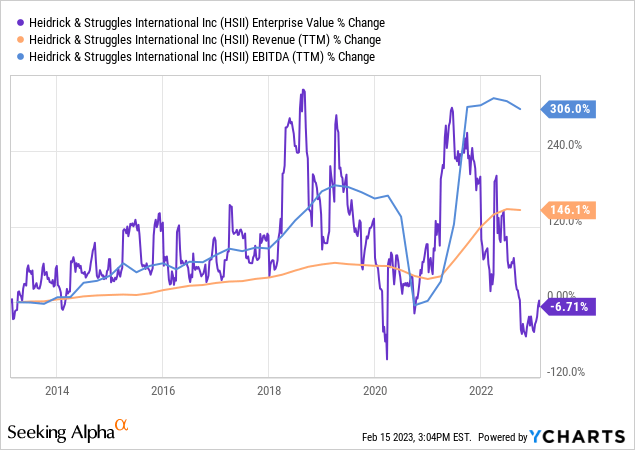

HSII is a prominent player in its specialized industry, with a strong reputation and well-established relationships with top-tier clients that new companies would struggle to match. While it may not be a high-growth stock, it still has the potential to deliver returns exceeding GDP growth. Considering the fact that it generates over 1.1 billion in revenue and 123 million in EBITDA, yet has an enterprise value of only 240 million, it is an undervalued stock with a lot of room for growth. Currently, the depressed state of the market shows that HSII's enterprise value is lagging behind its revenue and EBITDA growth (chart below), making it an even more attractive and affordable investment opportunity. Personally, I felt HSII's enterprise value (purple) has the potential to grow to a higher level than EBITDA (blue).

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.