Industrial Logistics Properties: Potential High Risk/Reward Opportunity For Contrarian Investor

Summary

- ILPT is trading at a very deep discount to its peers, due to various reasons, including the bad reputation of the company's external manager.

- The company is very leveraged but tries to keep financing costs down by securing interest rate caps.

- I believe that the high debt issue will be tackled by a combination of asset sales and share offerings.

- The external management deal has clauses that link the manager's remuneration directly to market cap, in a positive manner.

- Thus, a speculative investment in ILPT could make sense, at least until the P/FFO gap closes by 200 bp.

gremlin

It is no secret to people that have been investing for more than 15 years that the stock exchange is full of stories of greed and conflict of interest. Future readers should specifically read the story of Industrial Logistics Properties Trust (NASDAQ:ILPT). It is a story of a high quality industrial REIT that is caught in the storm due to an unwise decision: The decision to get severely leveraged. And when a banker knocks on your door, the first thing to do is to slice your dividend. A few months ago, I had written an article about a hospitality REIT that had also slashed its dividend during the pandemic, but with the explosive growth that came after, was able to restore it. Today, I'm going to explain why I believe that a contrarian investor could open a small, speculative position in ILPT, with increased number of chances for confirmation.

ILPT's Q4 2022 earnings: Some insights

The reason for the company's present picture was the Monmouth deal, which cost the company $4 billion and brought to the table more than $300 million of debt. According to Q4 2022 earnings, Industrial Logistics Properties Trust has $48 million available in cash and cash equivalents (excluding cash held on their JV), a figure increased by more than 50%, compared to 2021. The company also reported FFO per share of $0.08, representing a P/FFO multiple of 4.1x, on a TTM basis. However, due to the rapid decrease in quarterly FFO figures, such a calculation would be misleading. Assuming the same figure for Q1 2023, and $0.10 per share for Q2 and Q3 2023, we reach a yearly FFO/share estimate of $0.36, which implies a much worse P/FFO multiple of 13.3x. This figure is significantly more conservative than the industrial REITs average valuation, which, according to Simon Bowler's article "The State of REITs: January 2023 Edition", are trading at 19.2 times their FFO, on average.

There are several reasons for this underperformance. The first one has to do with ILPT's external manager, RMR Group (RMR). In general, externally managed REITs tend to trade at a discount to their internally managed peers, due to reasons interest conflict. Especially with RMR as the external manager, this effect seems to gain more traction, and, in my opinion, with a fair degree of justification. External managers are compensated in terms of assets under management, while, at best, they include compensation bumps tied to specific performance milestones. Based on that, it is no mystery that ILPT's General and Administrative expenses almost doubled in 2022, compared to 2021, reaching $33 million.

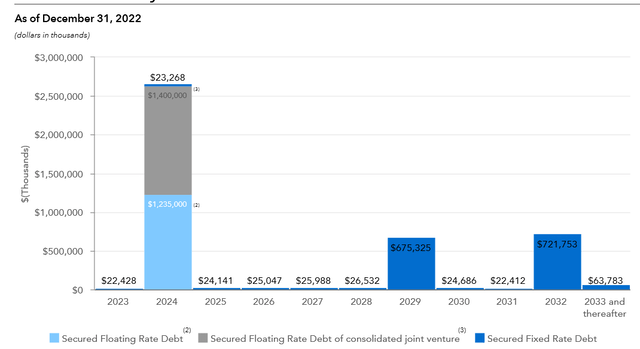

Another reason why the company's valuation is compressed is its tremendous leverage. Industrial Logistics Properties Trust has a total debt of approximately $4 billion, while its present market cap is $310 million. In other words, the Debt to Market Cap ratio has reached almost 13x. However, while too much of leverage is definitely something to be concerned about, the timing that this debt becomes due, is an equally important factor.

ILPT's Debt Maturity Schedule (Industrial Logistics Properties Trust Q4 2022 Earnings Supplement)

Based on this statement, the above graph becomes terrorizing. However, that maturity wall that is showed in 2024, can (and will) be moved forward in time. Both these types of debt are subject to three, one - year extensions, so the effective maturity date moves into March and October of 2027. In the company's Q4 2022 earnings call, ILPT's CFO, Brian Donley, was asked if there are any covenants that have to be met for the extensions to take place, and the answer was that the only thing required was to set a new interest cap for the extension period. So, we can assume that the maturity extension is quite certain.

The bad news is that, in 2022, the company's interest expense reached $280 million, implying an effective interest rate of 7%. However, the company has taken steps towards the reduction of their interest expense, buy securing interest rate caps. That is especially true for their $1.4 billion, floating rate debt maturing in 2024, for which they have secured an interest cap of 6.17%. According to the company's latest earnings supplement, the average weighted interest rate is 5.43%.

Our options

The way I see it, the company is caught in a difficult situation. While the "REIT" status is associated with decent dividends, this is not the case here. However, some degree of the previous dividend should be restored, sooner, rather than later. Given that, as well as the company's current status and its external management agreement with RMR, I can see XXXX options going forward:

- The company will liquidate some of its assets and use the proceeds to pay down some of its debt. In the latest earnings call, ILPT's President and COO said that the value of some of their Hawaiian assets are tempting for a sale.

- The company will issue shares and dilute their common shareholders.

- The company will select a combination of (1) and (2).

This is where the external management comes into play. That is, I fear that whichever solution will be selected, it will be the one that best suits the external manager, at least primarily. In my opinion, the best solution is the sale of some properties and the subsequent debt reduction. The good news is that, probably, this is the best solution for RMR too. Without wanting to enter into extremely complicated details, I shall say that a good part of RMR's fee (base fee plus incentive fee) is positively correlated to ILPT's market cap, especially when it is higher than $250 million (currently $313 million). So, it is to their best interest to keep the market cap about that point.

The second best solution is to issue new shares, because the debt payments will improve the share's prospects. So, I think that the company will select option (3), and do both: Issue shares and sell some properties. As a final remark, let me say that there is a degree of interest alignment between RMR and ILPT's shareholders, as the external manager also gets more fees with higher returns per share.

Conclusions

Times are tricky, and I usually tend to avoid cases like ILPT. However, due to the reasons I described earlier, this smells like a contrarian play. It is definitely not a dividend holding, but rather a high risk / high reward investment. If the P/FFO gap between ILPT and the rest of the industrial REITs was to be reduced by 200 basis points, that would imply a share price increase of 15%. Besides that, a higher market cap also favors RMR, and that is why I believe that asset sales will come before a share offering.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ILPT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written for information purposes only. You should not, in any case, take the contents of this article to be an urge to buy, hold or sell securities. Always perform your own research before investing in the stock market.