Dominion Energy Looks Like A Good Deal

Summary

- Dominion Energy is demonstrating respectable results with bottom line growth.

- It's making solid progress towards clean energy goals, and this should benefit the company and customers over the long run.

- Recent share price weakness has pushed the dividend yield up to an attractive level, setting up investors for potentially rewarding returns.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

MarsBars

Income generating stocks are a great way to balance out a portfolio. However, not all income is created the same, as some are more risky than others. For example, hotel REITs were a canary in the coal mine in 2020, and their investors had to go a couple years without a dividend.

This brings me Dominion Energy (NYSE:D), which comes with a strong collection of utility assets that's well-positioned for what the future may bring. In this article, I explore what makes Dominion a solid buy for long-term income and growth.

Why Dominion?

Dominion Energy is a leading utility company that operates in 16 states across the U.S., providing electricity and natural gas to 7 million customers. It has over 30 GW of electric generation capacity and more than 90K miles of electric transmission. In addition, Dominion also owns an LNG export facility in Cove Point, Maryland and is constructing renewable energy assets.

Dominion recently produced respectable results, with full year 2022 operating EPS growing by 6.5% YoY to $4.11, meeting its previously provided guidance. This growth was driven by weather, continued growth in the regulated business, and absence of one-time events that happened in 2021, such as the Millstone planned outage.

Headwinds for Dominion include unpredictability around fuel costs, which may pressure margins should it not be able to pass on the costs to consumers. However, that's where Dominion's renewable energy investments come into play. This has the potential to benefit Dominion and its customers over the long run as renewable energy doesn't have input costs in the same way that traditional energy sources like fossil fuels does.

Management has set the goal of achieving net zero emissions by 2050 by providing reliable, affordable, and sustainable energy, and has already made significant progress towards that. This is reflected by reducing its Scope 1 carbon emissions from electric operations by 46% since 2005, and Scope 1 methane emissions from gas operations by 38% since 2010. Moreover, Dominion also made significant progress towards its clean energy goals last year, as noted during the recent conference call:

In Virginia, the State Corporation Commission approved several rider-eligible investment programs, including our offshore wind project, subsequent license renewals of our four nuclear units, our second clean energy filing of new solar and energy storage projects and Phase 2 of our grid transformation program.

In our Gas Distribution segment, we invested over $300 million, modernizing infrastructure that is safer, more reliable and better for the environment. We completed our LNG peaking supply facility in Utah, and we increased the number of our renewable natural gas projects in operation or under construction to 21.

All told, our nuclear units produced about 50 million-megawatt hours of low-cost zero-carbon baseload power. That's roughly 40% of our total generation production as a company. Our fleet's performance continues to be exemplary, especially in periods of extreme weather, during which our stations provide vital stabilizing support to the grid and price stability in their respective regions.

Looking forward, Dominion maintains a strong BBB rated balance to fund its capital investments, and this includes $2.2 billion in cash and receivables as of the start of this year. It also pays an attractive 4.6% dividend yield that's well covered by a 64% payout ratio.

Given Dominion's earnings growth last year and its capital investment plans into renewable energy, I believe a long-term mid-single digit EPS growth rate would be feasible, and this could translate to potential ~10% total annual returns, matching that of the long-term S&P 500 (SPY) CAGR all while giving investors a far higher dividend payout.

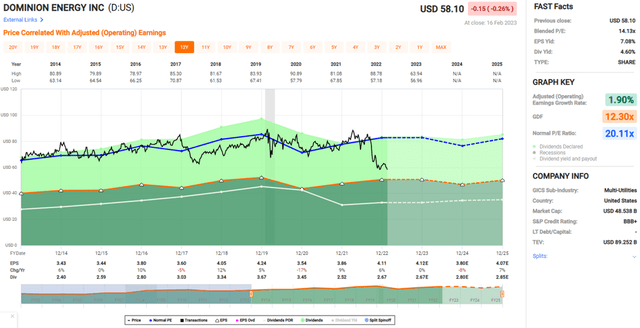

Dominion's stock also appears to be undervalued from a historical standpoint. At the current price of $58.71 and PE of 14.6, it trades materially below its normal PE of 20.1 over the past decade, as shown below. Analysts have a conservative $64.69 price target, which could still translate to a potential total return in the mid-teens over the next 12 months.

Investor Takeaway

Dominion Energy is demonstrating respectable growth in its bottom line, and is making solid progress towards clean energy goals, which should benefit both the company and its customers over the long run. Considering the relative undervaluation of the shares, investors today get a solid starting yield coupled with long-term growth potential that could match or beat that of the S&P 500.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of D either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.