Hilton Worldwide Holdings: RevPAR Growth For Conrad Hotels & Resorts Brand Encouraging

Summary

- Hilton Worldwide Holdings saw strong growth in earnings in the most recent quarter.

- While RevPAR growth for the Waldorf Astoria brand seems to be plateauing, that of Conrad Hotels & Resorts continues to see growth.

- I take a bullish view on Hilton Worldwide Holdings.

tupungato

Investment Thesis: I take a bullish view on Hilton Worldwide Holdings (NYSE:HLT) given significant RevPAR growth across the Conrad Hotels & Resorts brand as well as strong earnings growth.

In a previous article back in January, I made the argument that while Hilton Worldwide Holdings could see significant revenue growth potential from China due to the lifting of COVID restrictions - there is a risk that overall RevPAR (revenue per available room) growth could start to plateau - and Q4 2022 results could be a significant telling point as to whether this might materialise.

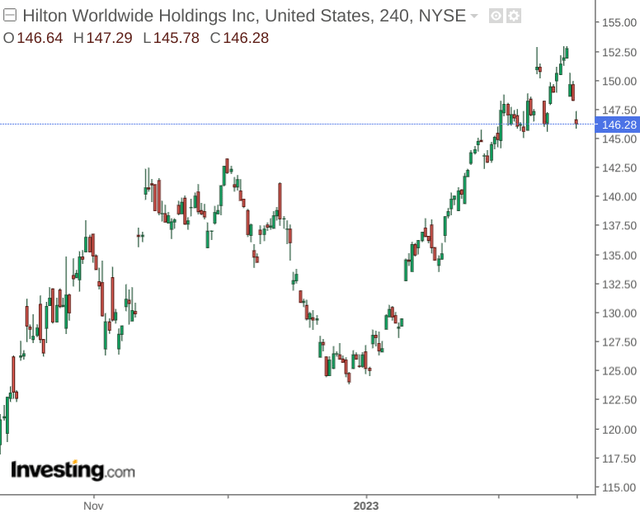

The stock is up by just over 8% since my last article:

The purpose of this article is to assess whether the growth we have seen over this period could be set to continue taking recent earnings results into consideration.

Performance

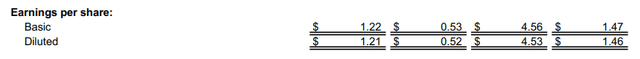

Earnings growth for Q4 2022 was quite impressive for Hilton Worldwide Holdings - up from $0.52 to $1.21 on a quarterly basis and up from $1.46 to $4.53 on a yearly basis.

Hilton Worldwide Holdings: Q4 2022 Earnings Results

When looking at RevPAR by quarter for Waldorf Astoria Hotels & Resorts (which is a luxury brand and Hilton's most expensive by ADR), we can see that while RevPAR for Q4 2022 is up from that of the previous quarter to $300.74 - this still remains below that of the $328.51 as recorded in Q4 2021.

Figures sourced from previous Hilton Worldwide Holdings Quarterly Reports. Heatmap generated by author using Python's seaborn library.

This might be an indication that the ability of customers to absorb price increases is becoming increasingly limited. For instance, ADR (average daily rate) was $596.43 in Q4 2021 but had decreased to $495.99 in Q4 2022. The fact that ADR has come down significantly and we have still seen a drop in RevPAR may indicate a plateau in demand across this brand.

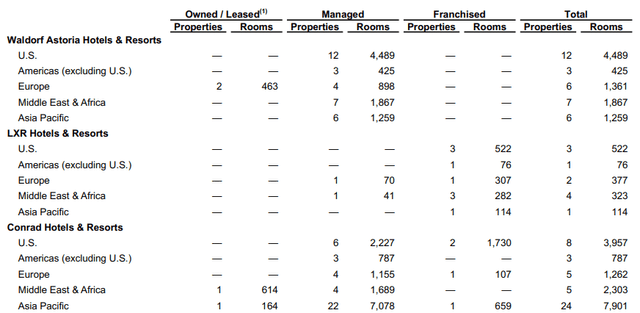

On the other hand, it is also notable that Conrad Hotels and Resorts saw an increase in RevPAR from $132.32 in Q4 2021 to $192.52 in Q4 2022 (with an increase in ADR from $238.27 to $300.96 over this period). It is also notable that Conrad Hotels and Resorts has the highest number of rooms in the Asia region, unlike the Waldorf Astoria where the majority are in the United States:

Hilton Worldwide Holdings: Q4 2022 Earnings Release

From this standpoint, while RevPAR growth across brands with a majority exposure to the United States might be peaking - those brands with more exposure to the Asian region could well have room for further growth from here.

When considering the share of RevPAR for each brand for the period Q1 2019 to Q4 2022 inclusive, we can see that the Waldorf Astoria accounts for just below 18% of overall RevPAR, while that of Conrad Hotels & Resorts accounts for just over 10%:

| Brand | Share of total RevPAR (%) |

| Waldorf Astoria Hotels & Resorts | 17.97 |

| Conrad Hotels & Resorts | 10.5 |

| Curio Collection by Hilton | 8.95 |

| Homewood Suites by Hilton | 7.85 |

| Embassy Suites by Hilton | 7.71 |

| Hilton Hotels & Resorts | 7.19 |

| Home2 Suites by Hilton | 6.85 |

| Hilton Garden Inn | 6.17 |

| Hampton by Hilton | 6.01 |

| DoubleTree by Hilton | 5.66 |

| Tru by Hilton | 5.57 |

| Canopy by Hilton | 4.88 |

| Tapestry Collection by Hilton | 4.68 |

Source: Calculations made by author using SQL.

Please note that the above calculations were made by summing up quarterly RevPAR figures across each brand from Q1 2019 to Q4 2022. RevPAR across each brand was then divided by the total RevPAR across all brands over these periods. The calculations were done using SQL, and can be found along with the original data here.

That said, it is noteworthy that the share of total RevPAR for the Waldorf Astoria has dropped slightly - from 19.47% in Q4 2019 to 17.93% in Q4 2022.

In this regard, it will be interesting to see if Conrad Hotels & Resorts accounts for a larger portion of overall RevPAR in subsequent quarters. Such a finding would indicate a significant contribution across the Asian region to overall growth for the brand, and it could indicate that Hilton Worldwide Holdings can continue to see further RevPAR growth overall - even if we are starting to see a plateau in the market across the United States.

Looking Forward

Going forward, I continue to take the view that the reopening of the Chinese market along with a broader recovery in the Asian region can continue to propel growth for Hilton Worldwide Holdings overall.

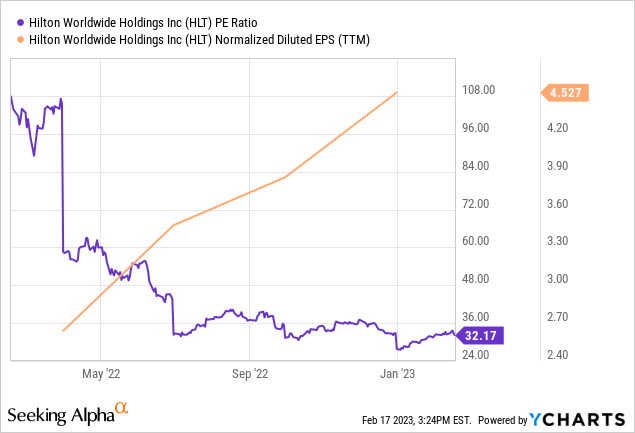

Additionally, we can see that the stock's P/E ratio is down sharply on that of last year while earnings per share has seen strong growth:

ycharts.com

In this regard, I take the view that Hilton Worldwide Holdings could be trading at an attractive value from an earnings standpoint - after having seen potential overvaluation following the post-COVID recovery.

Conclusion

To conclude, RevPAR growth for Hilton Worldwide Holdings has been impressive and the stock seems to be attractively valued from an earnings standpoint. Given the strong performance that we have seen across the Conrad Hotels & Resorts brand - I take the view that Hilton stands to benefit significantly from a further recovery across the Asian market. I take a bullish view on Hilton Worldwide Holdings.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of HLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written on an "as is" basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.