GDXJ: Having Gold Exposure Through Miners

Summary

- Depending on which camp you "subscribe" to, inflation will either get entrenched in the economy or completely vanish.

- I don’t belong to either camp and think less about what could happen and worry more about protecting myself if it happens.

- Gold as a store of value has proven itself time and again for the last 5000 years and this cannot be disputed.

- I prefer to get my gold exposure by owning miners.

jroballo

Thesis

The news cycle keeps spinning narratives based on the flavor of the day. Over the last year, inflation was in focus and some pundits were already calling for disinflation. This year depending on who you ask either you will continue to have inflation for a while or the Federal reserve's actions have already successfully broken the back of inflation. One could easily get paralysis by analysis going through all the news out there. So I worry less about what could happen and position myself on what if it happens. Positioning to get inflation protection is a small percentage of my portfolio and I have nothing to lose and only everything to gain from this part of my portfolio.

Gold's position as a store of value is indisputable. Comparing anything to gold is absurd as no asset class has survived or stood the test of time as much as gold. Even in recent history, Gold has performed well during periods of inflation. But why miners instead of direct Gold exposure?

- Gold miners have historically provided leveraged exposure to gold prices

- Gold miners have positive exposure to gold prices and buying gold miners at the start of a new cycle gives me the highest upside in the short to medium term

- A gold mining ETF is the easiest way to own miners and offers the least risk exposure

In my analysis below, we will dig deeper into the advantages of owning the VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ).

Owning the ETF

Owning the mining ETF GDXJ comes close to owning the metal itself. Although the ETF tends to experience greater price declines than gold during market corrections, when both gold and mining stocks begin to rise, the junior gold mining ETF has the potential to accelerate rapidly and surpass the performance of both the precious metal and larger mining corporations. Comparing GDXJ's limited history with GLD (Gold metal ETF), two instances stand out -

- Between January 2016 and July 2016 when the price of the metal rose by more than 25%, GDXJ went up by almost 150%

- Between March 2020 and August 2020 GLD went up by almost 30%, and GDXJ appreciated by almost 150%

Is this a start of a new cycle? Certain indicators point towards this being one. Inflation is the highest it has ever been in over a few decades. The last read for PPI again trended up, indicating that inflation could be sticky over the next few years. The last time inflation proved to be sticky ended up being a big positive for gold prices and gold provided more than 2000% returns. While there is no crystal ball to say where we are headed next, the indicators make the argument in our favor.

Sidestepping the risks of a miner

Owning a commodity player is not for the faint of heart and a junior player comes with additional risks as it would not have the capital to survive any setback in its business. Even for the best mining stocks some of the risks below are inescapable.

Geopolitical Risks

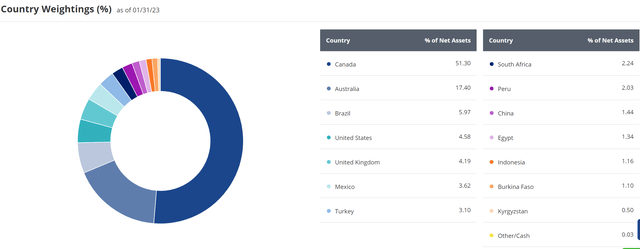

One of the biggest risks of a miner and or commodity player is the jurisdiction it operates in. Some countries are notorious for their corruption and bureaucracy while others are more susceptible to internal turmoil. It's also not uncommon to see politics getting involved where populism takes the center stage in spinning up the rhetoric that miners are destroying the country. These end up in forceful partnerships with the miners or extreme cases the assets get expropriated under the same pretense. In the recent case of Russia, the assets you owned had to be just written off or operations exited at any price you can get (Kinross Gold sells off Russian mines but at half the agreed price)

Operational risks

These plague miners differently depending on what cycle their assets are in. There are five mining life cycle stages: exploration to a mining life cycle - Exploration, discovery, development, production, and reclamation.

Exploration & Discovery

These stages can last one to ten years and less than 0.1% of prospected sites lead to a productive mine. A lot of junior miners can get caught in a downward spiral in this stage and this is the riskiest stage for any miner

Development

The development stage takes about one to five years and challenges here occur when it comes to building the infrastructure and getting the required permits and leases. These can test the patience of any investor.

Reclamation Stage

Another risky area for a junior miner and if due process is not followed it can come back to bite the company.

While the big commodity players or miners can survive such setbacks, many smaller players could go completely under. But a gold miner ETF such as GDXJ distributes this risk across multiple stocks. Asset loss or operational risk faced by any one miner will barely make a dent in the ETF as a whole.

Action

There are two ways to get in on the action. ETF is the easiest way to own multiple miners but it comes with a low dividend and an expense ratio that eats into your return.

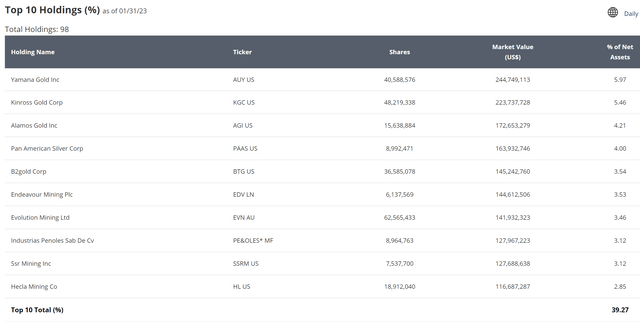

For the investors willing to go the extra mile you can replicate the holdings of ETF yourself (since most brokerages are zero commission) You can also restrict the number of holdings and aim for a better average dividend and also not have to pay the expense ratio! I do have to warn that the risks of this approach are relatively more than outright holding the ETF itself. Below are the top holdings of the GDXJ ETF.

GDXJ is already a small part of my portfolio and if the worst-case scenario for inflation plays out, I am hoping owning GDXJ has the desired effect on my portfolio.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GDXJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.