Baron Funds Q4 2022 Report - Letter From Linda

Summary

- Baron is an asset management firm focused on delivering growth equity investment solutions known for long-term, fundamental, active approach to growth investing.

- People are the core of our business, consistent with our motto “we invest in people:” our investors, partners, management teams of the companies in which we invest and, most importantly, our employees.

- The longer the investment horizon, the higher the certainty around the outcome – or at least this has been the case in the past.

PM Images

Year ends are time for review and reflection… but, following the tough markets of 2022, I doubt there are many growth equity investors who want to look back at the past 12 months. Such periods of extended market declines and volatility are an unpleasant but necessary reminder that success does not come in a straight path and that markets move in cycles.

The year was challenging for our business too, particularly for the Baron Funds invested in higher-growth and technology-driven companies. Those of you who have read our recent quarterly letters, or listened to Ron and our research team speak, would know that the poor market performance of the past year has not affected our long-term outlook. We remain optimistic about the future of the U.S. economy and the long-term opportunities for equity investors and our shareholders.

Last year, Baron celebrated its 40-year anniversary. Our four decades in business have been filled with memorable experiences, successes, and occasional stumbles, all of which have taught us something – not just as investors but also as stakeholders in a continuously growing business. During difficult times, the lessons we have learned have given us confidence and reassurance to stick to our values and investment approach. At the Baron Conference this past November, I shared with the audience some valuable lessons we have learned about our business, and below is an edited version of my speech.

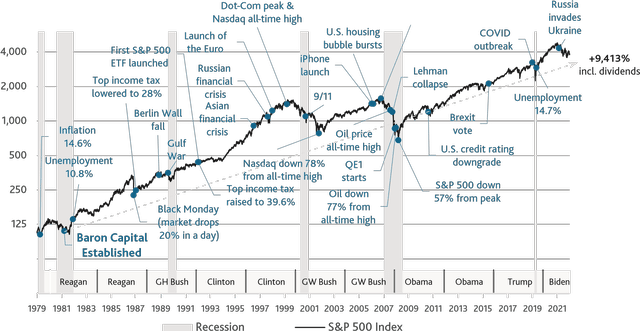

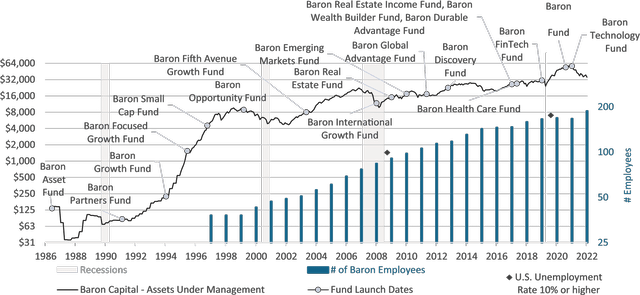

The past four decades have been quite eventful. As the chart below shows, we have witnessed multiple recessions, market crashes, wars, a pandemic, record inflation and unemployment, and crazy elections, among other things. But we have also seen immense technological progress, medical advancements, better information and market accessibility for investors, and the longest bull market ever. Since the inception of Baron Capital on 3/16/1982, the S&P 500 Index has returned a staggering 9,413% (including dividends).

The Past 40 Years Have Been Eventful12/31/1979 - 12/31/2022S&P 500 Index and Various Events

S&P 500 Index and Various Events (12/31/1979 - 12/31/2022)

Sources: FactSet, The National Bureau of Economic Research, Baron Capital.

Notes: The performance data quoted represents past performance. Past performance is no guarantee of future results. It is not possible to invest in an index. |

Since I have been at Baron for four decades, I have a unique perspective, and I also asked some of our employees what they have learned. The common denominator behind every lesson is people.

People are the core of our business, consistent with our motto “we invest in people:” our investors, partners, management teams of the companies in which we invest and, most importantly, our employees. Here are five of the lessons that we have learned.

Lesson #1: Build the Right Team and Cultivate a Healthy Work Culture

When you build the right team, 1 + 1 is greater than 2. We have built a team that is more than the sum of its individuals. And, just like the way we construct portfolios, we have built the Baron team one person at a time. Finding the right people and training them takes time, but we have learned to be patient and take a long-term view. It is important for us to hire smart, intelligent, and curious individuals, with diverse backgrounds and shared values. It is also important that they complement the team we have built. We believe these fundamentals have helped us achieve success. We always look for more than just good workers. As Jim Barrett, our head of institutional sales said, doing business in our industry with humanity makes a difference. So we also look for personality traits like honesty, empathy, and even humor; and we believe this has helped us assemble an exceptional team. We don’t always get it right, but we do always learn.

To have the right team, you need the right culture. Teamwork is at the heart of Baron’s culture, and teamwork starts with trust. I agree with Alison Bray, our director of investor information, that “Trust is the most important currency at work – meaning – you’ll do what you say, you’re paying attention, and you care about what other people are trying to accomplish.” Trust allows our employees to be open-minded and to listen to what others have to say. Creating an environment that encourages exchange of ideas builds morale and growth, and fosters innovation.

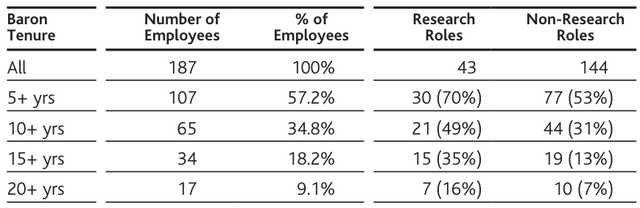

Our average retention rate over the past 15 years has been over 90%, which attests that we must be doing something right. We have many long-tenured employees, and our initial team is still here: Peggy Wong (CFO), Susan Robbins (a long-time senior research analyst), David Schneider (Head of Trading), Ron (of course), and me.

As the table shows, as of 12/31/2022 more than half of Baron’s total employees and more than two-thirds of our research personnel have been at the Firm for five years or more. Over a third of all employees have been here for at least a decade, and 17 have been here for over 20 years. For context, 20 years ago Baron’s team consisted of just 49 employees.

Baron’s Employees Have Been at The Firm for a Long Time

In addition, the vast majority (12 out of 15) of Baron’s non-research group heads have been at the Firm for at least seven years. Something I am particularly proud of is that eight out of the 15 groups are headed by women (myself not included) and about half (19 out of 40) of Baron’s managerial roles are held by women. In addition, Baron’s Director of Research is a woman, and four out of the 10 Board members of the Baron Funds are women.

Lesson #2: Learn to Make Tough Decisions

We strive to provide exceptional investor service and investment results. Particularly in our industry, achieving this requires a delicate balance of opportunity and risk, and often there are some tough choices to be made.

During the Financial Crisis in 2008, our assets had dropped from $23 billion to under $10 billion and the financial world was collapsing. We had three options:

A) do nothing – and hope for the best;

B) cut costs, including laying off employees; or

C) invest in growing our business.

Notwithstanding our limited resources, we picked option C. Here is why: if you build the best widget in the world and it sits in your factory, people aren’t going to buy it unless it gets marketed and distributed. While everyone in the asset management industry was picking option B, we saw an opportunity to expand our sales effort – a difficult decision that has paid off handsomely.

But this wasn’t the first or the last time we made a difficult choice. The next chart shows that we have launched new products during good and bad economic conditions, and right before – or after – or in the middle of market declines. Our decisions to grow Baron’s business have always been driven by our long-term views and conviction. The bars on the chart show that our team has expanded gradually and consistently with our business.

Baron’s Team and Business Have Grown Steadily

| Baron Capital – Employees and Assets Under Management (3/31/1987 – 12/31/2022)

New Asia |

| Sources: Baron Capital, The National Bureau of Economic Research. Note: Employee data not available prior to 1997. |

When it comes to making decisions – whether about growing our operations, launching new products, or optimizing our organization – we have learned that it pays off to rely on our long-term view and big picture focus, and stick to our values.

Lesson #3: Time is On the Side of Long-Term Thinkers

Achieving challenging goals requires time. Achieving growth also requires time. But time alone is not enough – patience, discipline, and conviction are also essential, as they allow for potential to materialize and the power of compounding to work its magic.

Time and compounding sound like simple concepts, yet few asset managers have been able to harness them to their advantage. During times of market volatility – like right now – it becomes difficult to maintain discipline and conviction, which often leads to myopic investment choices, like market timing. As our head of trading, David Schneider says, during such moments we like to put on our Baron goggles, which help us see through the shortterm noise and maintain focus on the long term.

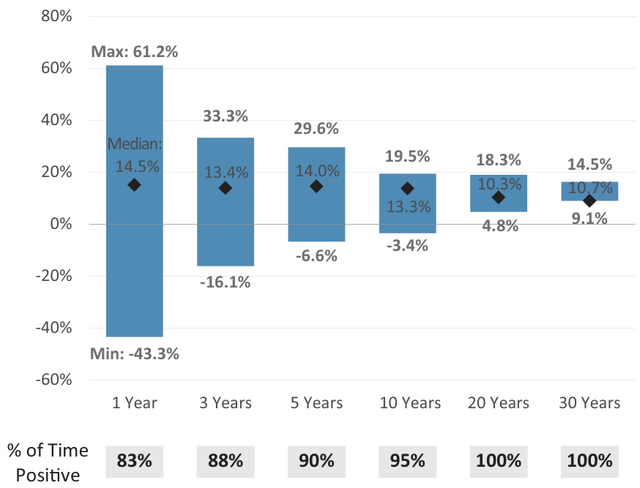

The data in the chart on the right visualizes David’s point well. Over the past 40 years, 83% of the one-year rolling periods for the S&P 500 Index have resulted in positive returns. While the median return was 14.5%, the possible range of one-year returns was anywhere between -43.3% and 61.2%, a vast range of uncertainty.

Expanding the investment horizon to three years resulted in a higher percentage of time with positive returns (88%) and an ostensibly tighter range of outcomes. Having an investment horizon of 10 years or more significantly minimized the potential for negative returns and resulted in an even tighter range of outcomes. In short, the longer the investment horizon, the higher the certainty around the outcome – or at least this has been the case in the past.

Long-Term Investors Have Had Better Chances of Positive Returns

S&P 500 Index – Minimum, Maximum, and Median annualized total returns over various periods (Based on monthly rolling periods, 12/31/1982 – 12/31/2022)

Sources: FactSet, Baron Capital.

| Notes: The performance data quoted represents past performance. Past performance is no guarantee of future results. It is not possible to invest in an index. |

Long-term perspective, patience, and discipline are at the core of our approach. We believe the power of compounding applies to accumulating knowledge and experience just as strongly as it applies to investment returns. To paraphrase Warren Buffet, you cannot acquire nine years of experience by hiring nine first-year associates. This is why we continuously invest in our employees and do our best to help them grow, unlock their potential and, hopefully, keep them as Baron employees. As a Firm, this has allowed us to accumulate generational knowledge, which we consider one of our strongest competitive advantages.

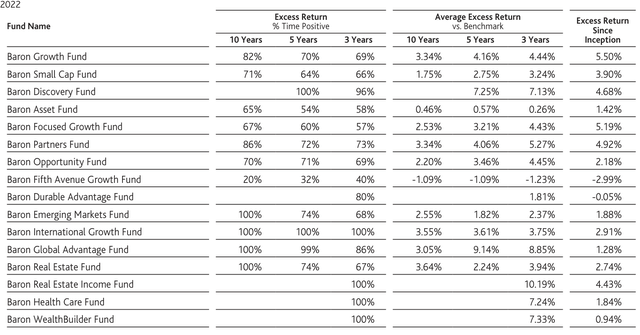

The scorecard below attests to our long-term success. Almost all of the Baron Funds have outperformed their relevant benchmarks the majority of the time, delivering substantial excess returns. Similar to the chart above, the likelihood of outperformance of the Baron Funds has increased when the holding period has been longer. Our Funds have generated strong excess returns since their respective inception dates.

The Baron Funds Have Generated Impressive Results

Baron Funds Scorecard (Based on monthly rolling returns since inception as of 12/31/2022)

| Note: Only the Baron Funds with at least three-year track record and at least 12 monthly rolling 3-year return observations are included in the table above. The performance data quoted represents past performance. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. As of 12/31/2022, the annualized 1-, 5-, and 10-year (or since inception, for the Funds that do not have a 10-year track record) performance of the Institutional Shares of the Funds shown in the chart above was as follows: Baron Growth Fund: (22.40)%, 11.15%, and 12.33%, respectively; Baron Small Cap Fund: (31.05)%, 7.07%, and 10.21%, respectively; Baron Discovery Fund: (35.12)%, 7.61%, and 11.37%, respectively; Baron Focused Growth Fund: (28.14)%, 20.94%, and 15.39%, respectively; Baron Asset Fund: (25.87)%, 9.29%, and 12.40%, respectively; Baron Partners Fund: (42.41)%, 21.98%, and 19.49%, respectively; Baron Opportunity Fund: (42.83)%, 13.11%, and 13.13%, respectively; Baron Fifth Avenue Growth Fund: (50.49)%, 2.48%, and 9.39%, respectively; Baron Durable Advantage Fund: (24.81)% for the 1-year period and 9.37% since inception; Baron Emerging Markets Fund: (25.82)%, (2.70)%, and 3.10%, respectively; Baron International Growth Fund: (27.29)%, 2.17%, and 6.50%, respectively; Baron Global Advantage Fund: (51.57)%, 4.21%, and 9.43%, respectively; Baron Real Estate Fund: (28.44)%, 7.65%, and 10.28%, respectively; Baron Real Estate Income Fund: (27.47)% for the 1-year period and 6.91% since inception; Baron Health Care Fund: (16.90)% for the 1-year period and 13.90% since inception; and Baron WealthBuilder Fund: (32.59)% for the 1-year period and 10.36% since inception. Fund Primary Benchmarks: for Baron Growth Fund, Baron Small Cap Fund, and Baron Discovery Fund – Russell 2000 Growth Index; Baron Focused Growth Fund – Russell 2500 Growth Index; Baron Partners Fund and Baron Asset Fund – Russell Midcap Growth Index; Baron Opportunity Fund – Russell 3000 Growth Index; Baron Fifth Avenue Growth Fund – Russell 1000 Growth Index; Baron Durable Advantage Fund – S&P 500 Index; Baron Emerging Markets Fund – MSCI EM Index; Baron International Growth Fund – MSCI ACWI ex USA Index; Baron Global Advantage Fund – MSCI ACWI Index; Baron Real Estate Fund – MSCI USA IMI Extended Real Estate Index; Baron Real Estate Income Fund – MSCI US REIT Index; Baron Health Care Fund – Russell 3000 Health Care Index; Baron Wealth Builder Fund – S&P 500 Index. Fund Inception Dates: Baron Growth Fund – 12/31/1994; Baron Small Cap Fund – 9/30/1997; Baron Discovery Fund – 9/30/2013; Baron Asset Fund – 6/12/1987; Baron Focused Growth Fund – 5/31/1996; Baron Partners Fund – 1/31/1992; Baron Opportunity Fund – 2/29/2000; Baron Fifth Avenue Growth Fund – 4/30/2004; Baron Durable Advantage Fund – 12/29/2017; Baron Emerging Markets Fund – 12/31/2010; Baron International Growth Fund – 12/31/2008; Baron Global Advantage Fund – 4/30/2012; Baron Real Estate Fund – 12/31/2009; Baron Real Estate Income Fund – 12/29/2017; Baron Health Care Fund – 4/30/2018; Baron WealthBuilder Fund – 12/29/2017. Annual expense Ratios for Inst. Shares as of 9/30/2022: Baron Asset Fund, 1.04%, Baron Growth Fund, 1.04%, Baron Small Cap Fund, 1.04%, Baron Opportunity Fund, 1.05%, Baron Fifth Avenue Growth Fund, 0.76% but the net annual expense ratio was 0.75% (net of the Adviser’s fee waivers), Baron Discovery Fund, 1.06%, Baron Durable Advantage Fund, 1.10% but the net annual expense ratio was 0.70% (net of the Adviser’s fee waivers). Annual expense Ratios for Inst. Shares as of 12/31/2021: Baron Partners Fund, 1.11% (comprised of operating expense of 1.05% and interest expense of 0.06%), Baron Focused Growth Fund, 1.05%, Baron International Growth Fund, 0.96%, but the net annual expense ratio was 0.95% (net of the Adviser’s fee waivers), Baron Real Estate Fund, 1.05%, Baron Emerging Markets Fund, 1.08%, Baron Global Advantage Fund, 0.90%, Baron Real Estate Income Fund, 1.08%, but the net annual expense ratio was 0.80% (net of the Adviser’s fee waivers), Baron Health Care Fund, 0.89%, but the net annual expense ratio was 0.85% (net of the Adviser’s fee waivers), Baron WealthBuilder Fund, 1.08%, but the net annual expense ratio was 1.05% (includes acquired fund fees of 1.00%, net of the Adviser’s fee waivers). |

Lesson #4: Building Trust is Critical

Honesty and transparency earn trust, and trust is fundamental to long-term relationships. We think of our clients and investors as long-term partners with whom we want to have lasting relationships. This starts with providing clear, timely, and high-quality communications. We spare no resources to deliver what is important to our investors, and we have committed to provide information well beyond what our competitors do. As our head of RIA sales, Frank Maiorano put it, “We work in an industry where sometimes you want to hide from the truth, especially in years like this. But as hard as it is, delivering honest truth and communication both in good and bad times earns trust which leads to long-term relationships.”

Like knowledge, trust takes time to build. And, like British Prime Ministers, it can disappear in an instant. We are proud of the reputation we have established, and we do not take it for granted. We are constantly working to prove ourselves as a trustworthy long-term partner to our clients, our business relationships, and the companies in which we invest.

And, finally, #5: Lessons from Ron

Having spent 40 years working with Ron, there is a thing or two that I have learned from him.

For example, I have learned “It is apparently ok to call people at 6am or 11pm, as long as you ask “Is this a good time?” when they answer the phone.”

Or, “It’s ok to tell the same stories over and over again – maybe no one paid attention the first 10 times.”

I’ve also realized there is a thing or two Ron should have learned.

Such as, “Nothing happens at the push of a button.”

And “No, the computer did not lose the draft of your shareholder letter – again. You did. Again.”

And “You can’t always get what you want.”

On a more serious note, one of the most valuable lessons I have learned from Ron is about the importance of people in a business. It is a simple concept – that only people can make a business successful. At Baron, our business is our people. Finding the right people and investing in them – time, resources, emotions – is difficult and takes time. If it were easy, everyone would run successful businesses. But it is the difficult things that add true value in the long term. And this is why We Invest in People.

Sincerely,

Chairman, President, and COO

| Investors should consider the investment objectives, risks, and charges and expenses of the investment carefully before investing. The prospectus and summary prospectuses contain this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99BARON or visiting www.BaronFunds.com. Please read them carefully before investing. The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. The Adviser reimburses certain Baron Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month end, visit www.BaronFunds.com or call 1-800-99BARON. Performance for the Institutional Shares prior to 5/29/2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns for the Institutional Shares prior to 5/29/2009 did not reflect this fee, the returns would be higher. Baron Discovery Fund’s 3- and 5-year, Baron Emerging Markets Fund’s 10-year, Baron Fifth Avenue Growth Fund’s 3-, 5- and 10-year, Baron Fin Tech Fund’s 3-year, Baron Global Advantage Fund’s 3-, 5- and 10-year, Baron Health Care Fund’s 3-year, Baron International Growth Fund’s 3- and 5-year, Baron Opportunity Fund’s 3-, 5- and 10-year and Baron Small Cap Fund’s 3-year historical performance were impacted by gains from IPOs and there is no guarantee that these results can be repeated or that the Funds’ level of participation in IPOs will be the same in the future. Risks: All investments are subject to risk and may lose value. Growth stocks can react differently to issuer, political, market and economic developments than the market as a whole. Non-U.S. investments may involve additional risks to those inherent in U.S. investments, including exchange-rate fluctuations, political or economic instability, the imposition of exchange controls, expropriation, limited disclosure and illiquid markets, resulting in greater share price volatility. Securities of small and medium-sized companies may be thinly traded and more difficult to sell. The discussion of market trends is not intended as advice to any person regarding the advisability of investing in any particular security. The views expressed in this document reflect those of the respective writer. Some of our comments are based on management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. Our views are a reflection of our best judgment at the time and are subject to change at any time based on market and other conditions and Baron has no obligation to update them. The S&P 500 Index measures the performance of 500 widely held large-cap U.S. companies. The Nasdaq Composite Index is the market capitalization weighted index of approximately 3,000 common equities listed on the Nasdaq stock exchange. The Russell 1000® Growth Index measures the performance of large-sized U.S. companies that are classified as growth. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth. The Russell 2500® Growth Index measures the performance of small to medium-sized U.S. companies that are classified as growth. The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe comprised of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Russell 3000® Health Care Index is an unmanaged index representative of companies involved in medical services or health care in the Russell 3000 Index, which is comprised of the 3,000 largest U.S. companies as determined by total market capitalization. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trade mark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. MSCI USA IMI Extended Real Estate Net Index is an unmanaged custom index calculated by MSCI for, and as requested by, BAMCO, Inc. The index includes real estate and real estate-related GICS classified securities. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed or produced by MSCI. The MSCI EM (Emerging Markets) Index is designed to measure equity market performance of large and mid-cap securities across 24 Emerging Markets countries. The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets countries (excluding the US) and 26 Emerging Markets countries. The MSCI ACWI Index measures the equity market performance of large and midcap securities across developed and emerging markets, including the United States. MSCI US REIT Index is an unmanaged free float-adjusted market capitalization index that measures the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Funds include reinvestment of dividends, net of withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. BAMCO, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Baron Capital, Inc. is a broker-dealer registered with the SEC and member of the Financial Industry Regulatory Authority, Inc. (FINRA) |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Additional disclosure: Investors should consider the investment objectives, risks, and charges and expenses of the investment carefully before investing. The prospectus and summary prospectuses contain this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99BARON or visiting www.BaronFunds.com. Please read them carefully before investing.

Risks:All investments are subject to risk and may lose value.

The discussion of market trends is not intended as advice to any person regarding the advisability of investing in any particular security. The views expressed on this page reflect those of the respective writer. Some of our comments are based on management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. Our views are a reflection of our best judgment at the time and are subject to change at any time based on market and other conditions and Baron has no obligation to update them

Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk.

© Baron 2023 All rights reserved