JEPI: This 12% Yielding ETF Is Perfect For 2 Kinds Of Investors

Summary

- JEPI was one of the most beloved ETFs of 2022, thanks to its low volatility and sky-high monthly yield.

- But JEPI is a powerful tool that must be used correctly. Otherwise, you can lose a lot of money over time.

- JEPI is a good choice for three kinds of investors and a perfect choice for two kinds of investors.

- For everyone else, it's a poor choice and can even be a guaranteed way to lose money for some types of investors.

- Understanding JEPI's limitations and the fine print of how it works within your specific portfolio is critical. It could literally be the difference between retiring in safety and splendor and never retiring at all.

- Looking for a portfolio of ideas like this one? Members of The Dividend Kings get exclusive access to our subscriber-only portfolios. Learn More »

Deagreez

This article was published on Dividend Kings on Monday, February 13th, 2023.

---------------------------------------------------------------------------------------

Few high-yield ETFs fired the imagination of income investors in 2022, like (NYSEARCA:JEPI), the JPMorgan Premium Income ETF.

This article is an introduction to JEPI and its pros and cons, including how it works and how it can currently offer that 12% monthly yield.

However, in the comments, all 629 and counting, it became obvious that there is still a lot of confusion about JEPI. Specifically, both SA and Dividend Kings members want to know who should, and shouldn't own JEPI.

Obviously, your portfolio is a deeply personal thing, and legally I'm not allowed to offer personalized investment advice.

- It's an SEC rule

However, I am able to analyze companies, markets, and the economy and provide general advice of what the average reasonable and prudent investor could do in any situation.

So let's take a closer look at who this 12% yielding ETF is perfect for and why. And most importantly, I'll show you what kinds of investors should avoid JEPI.

Who Shouldn't Own JEPI: Those Who Want To Match Or Beat The Market

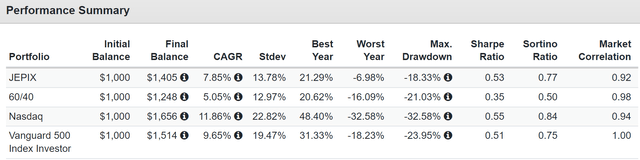

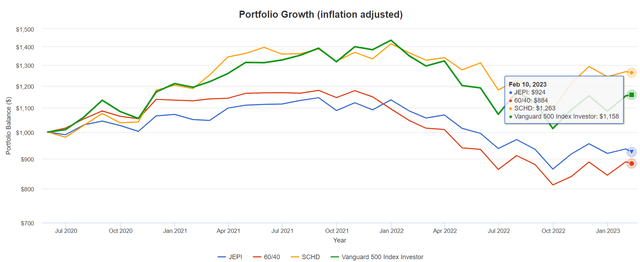

Total Returns Since June 2020

Until recently, JEPI beat the S&P and has been beating the Nasdaq since its inception. Some investors who were traumatized by the 2022 bear market and who don't realize what JEPI is, have the incorrect belief that this is a 1% monthly paying stock that can keep delivering 12% long-term returns.

Let's be very clear: JPMorgan says it can't, and here's why.

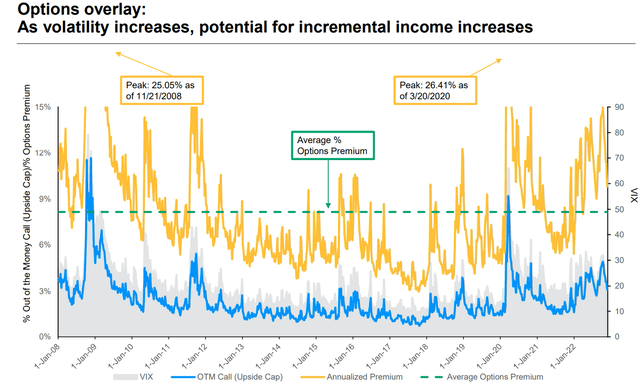

JEPI is 80% to 85% blue-chips that yield around 2%. 15% to 20% of its portfolio is ELNs or equity-linked notes. These are a more advanced version of covered calls. Almost all the income JEPI generates and pays out each month is based on the option premium it can receive on these ELNs.

As you can see above, the average premium over the last 15 years was just under 9% on an ELN-based income strategy.

Ok, so does that mean JEPI can be expected to average just under 9% yields paid month? No, it does not.

When volatility is at its peak, option income premiums go up significantly. Note how during the Great Recession, they hit 15% and then hit 17% in the debt-ceiling showdown bear market of 2011.

During the 2018 bear market, they hit 15%, and during 2022 they averaged 12% with a peak of 15%. We've had five sharp downturns in 15 years. That's an average of one every three years, twice the historical rate.

But we've had three within the last three years.

Based on historical market option volatility outside of such extreme periods, JPMorgan says that JEPI should deliver 5% to 8% yields, or 6.5% at the midrange.

JEPI is far from the "miracle" ETF, which many investors seem to think it is.

I've found posts on Reddit about people going "all in" to JEPI with their life savings, thinking they've found the secret to a rich retirement. While JEPI is a great ETF for two specific kinds of investors, and is perfect for exactly one, it's not a long-term market beater.

What proof do we have of this?

For one thing, JEPI management says this ETF is designed to deliver 1% to 2% annual growth plus 5% to 8% yield or 6% to 10% annual returns. That's an 8% mid-range return.

What if JPMorgan is sandbagging? What if they can deliver far more than 10% and want to look like heroes when they do?

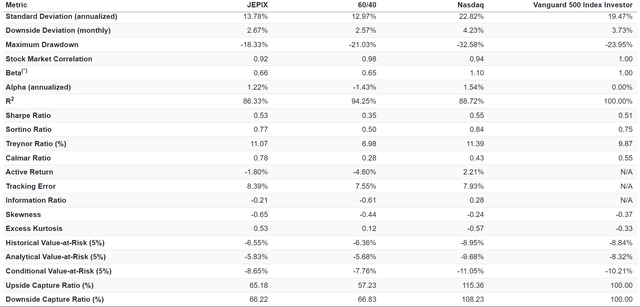

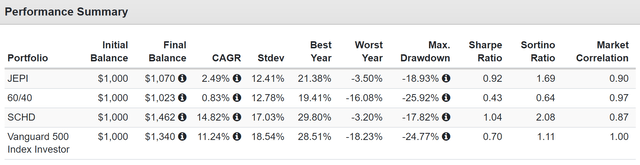

Let's consider JEPIX, the institutional mutual fund version of JEPI. Besides its mutual fund structure, it's the same portfolio strategy and stocks.

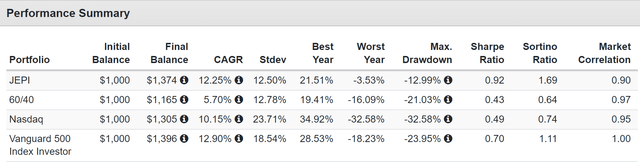

Historical Total Returns Since September 2018

JEPIX delivered 8% historical returns, exactly what JPMorgan says to expect from JEPI in the future.

It did so with far less volatility than the S&P, Nasdaq, or the 60/40 retirement portfolio.

JEPI is designed to capture about 65% of the market's downside and about 80% of its upside.

JEPI is designed to deliver superior volatility-adjusted returns to the S&P and the 60/40; historically, it's done that.

JEPIX has historically delivered 65% of the market's upside and 66% of the downside, which is why its volatility-adjusted returns are the same as the S&P.

Who Shouldn't Own JEPI: Those Needing Rock Steady Dividend Income

Remember those people on Reddit? The ones parking 100% of their life savings into JEPI? They think they have achieved rich retirement nirvana because of JEPI's incredible dividend history so far.

Here were the dividend hikes from popular ETFs last year:

- 2022 full-year inflation: 8.0%

- S&P: 11%

- VIG: 14%

- SCHD: 18%

- Dividend Kings ZEUS Income Growth (my family hedge fund): 21%

- Nick Ward's dividend portfolio: 24%

- JEPI: 67%

67% income growth! That's 8X more than inflation! And JEPI's annual income has been growing every year since inception!

Seems miraculous right? Indeed, it's too good to be true.

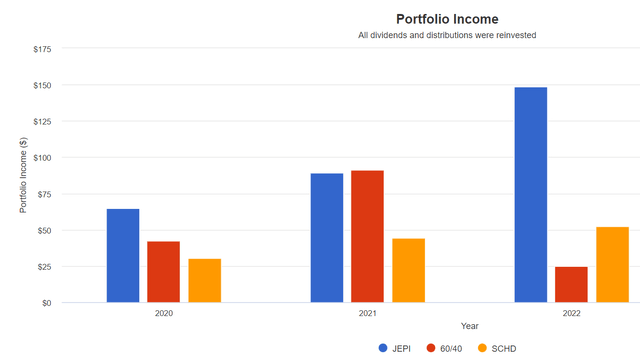

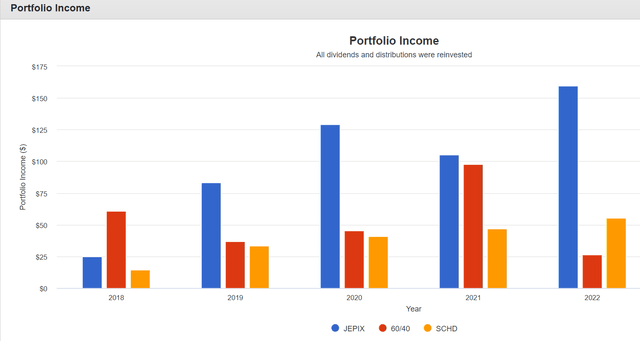

Here's what JEPIX's income growth looks like.

OK, so maybe JEPIX doesn't have dividends that grow every year, but 24% annual income growth is amazing! Indeed it is, and it's not sustainable.

Remember when JEPIX began, in August 2018, right before the 2018 bear market.

In 2018 stocks crashed 17% in three weeks.

In 2019 they soared by 30%.

In 2020 they crashed by 34% in a month.

And then soared by 70% in the next year.

In 2021 stocks were up 28%.

And then fell as much as 28% in 2022.

And they just had their 8th-best start to the year in US market history in 2023.

In other words, JEPI and JEPIX, which do best when volatility is highest, have been living in a golden age for ELN-based funds.

One that can only continue if we average a bear market every three years, which is twice the historical norm since WWII.

It might seem impossible to believe after the last five years we've had, but stocks are not usually this exciting. And option income isn't usually so high, and thus JEPI and JEPIX are likely to see a major decline in their dividends in 2023.

In 2020 option income jumped to 15%, and within about a year, it was down to 6% due to that epic market rally.

In other words, JEPI's 2023 dividends could end up being about 66% lower than they were last year, averaging around 4% if the market keeps up its sentiment-driven rally.

OK, but what could that mean for JEPI in terms of returns in a raging bull market?

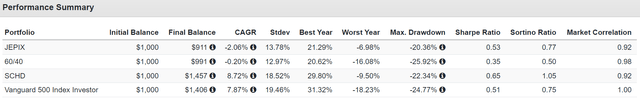

Portfolio Visualizer

Those who fell in love with JEPI in 2022, when value was the new hotness and pretty much nothing was going up, have been very disappointed in 2023's returns so far.

JEPI is on track for a 4% to 6% yield in 2023, and so far, it's been lagging pretty much everything this year.

This isn't an issue for an income investor with a diversified portfolio. But if you're one of those Reddit folks who are 100% JEPI, you probably feel a lot of frustration right now.

And guess how bad those people will feel in a few months when those 1% monthly dividends likely fall 50% to 66%.

Who Shouldn't Own JEPI: Anyone With A Taxable Portfolio

My CFA has looked at JEPI and tells his clients, "under no circumstances should you EVER own this in a taxable account."

Why? Two reasons.

First, ELN income and covered call income are taxed at ordinary income rates, just like REIT non-qualified dividends.

Rather than 0%, 10%, 15%, 20%, or 23.8% tax rates, as is the case with qualified dividends, just 15% to 20% of JEPI's dividends are qualified.

This means owning it in a tax-deferred retirement account is optimal.

The effective JEPI tax rate for high-income investors is close to 50% if owned in taxable accounts.

- A post-tax yield of closer to 6% for investors in the top tax bracket

- Management guidance for post-tax 2.5% to 4% long-term yields

A 3.25% effective yield is a lot less impressive than a 12% one and certainly not something you should go "all in on," as some investors did last year.

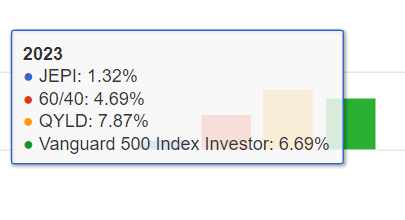

JEPI Prospectus

In 2021 40% of JEPI's returns were eaten up by taxes and internal trading costs.

In other words, for anyone who could ignore taxes and trading costs (from JEPI, not your own commissions), JEPI did amazing, capturing 80% of the market's upside in a fantastic year for stocks.

For real investors in taxable accounts, it captured just 60%. And that's for the average American. If you're in the top tax bracket half, your returns are going to the IRS.

But here is another reason JEPI shouldn't be owned in a taxable account. According to my CFA, who LOVES JEPI and considers it the best-covered call ETF he's ever seen, you can't take out much of the income and spend it.

Since inception, if you had invested in JEPI and taken your dividends in cash, then even ignoring high taxes, you'd be down 7% when adjusting for inflation.

- Reinvesting 50% of the dividends into more JEPI shares would have kept your principal whole

- The same % as XYLD since 2013

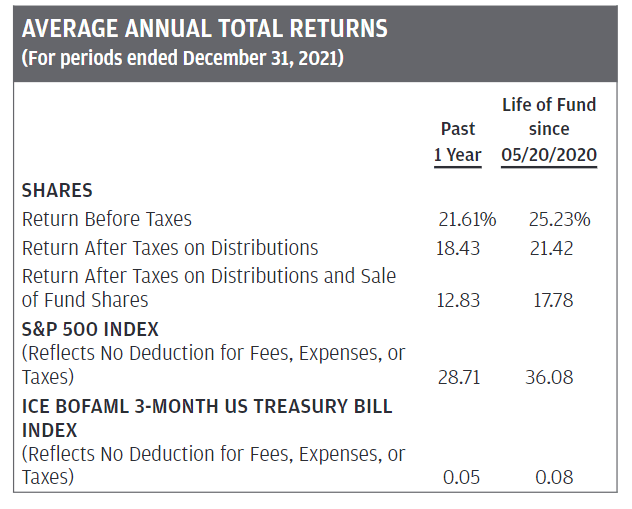

Total Returns Since June 2020 (No Dividend Reinvestment)

JEPI's returns don't look nearly as impressive if you took all those dividends in cash, even ignoring taxes.

Adjusting for taxes and inflation, JEPI investors who took their dividends in cash have lost about 7% to 8% annually with this ETF.

What about JEPIX? Does a longer history make these numbers look any better?

Total Returns Since September 2018 (No Dividend Reinvestment)

No, it makes JEPI look even worse. Even ignoring inflation and taxes, JEPIX investors have lost money over the last 4.5 years.

Adjusted for inflation and ignoring taxes, JEPIX investors are down 9.7% per year. And factoring in taxes, they are down almost 14% annually.

What about the income JEPIX investors enjoyed?

Once you adjust for inflation and taxes, even reinvesting the dividends delivered 3% annual real returns.

Guess what management's guidance is for? 2.5% to 5% post-tax returns and 0.3% to 2.7% annual inflation and tax-adjusted returns are what JPMorgan says to expect in a taxable account.

Who Should Own JEPI: Income Investors With Tax-Deferred Retirement Accounts

If you reinvest your dividends, then JEPI is a fine investment, though one that will generate far lower returns than most investors currently expect.

But guess what? You still have to pay those high taxes even if you DRIP your dividends.

So if you own JEPI in a 401K, IRA, or 403B, or other kinds of tax-deferred accounts, then you can avoid the big tax bill, and DRIP JEPI without worry.

Just remember that tax-deferred accounts won't impact JEPI's income volatility over time. Option income premiums are naturally volatile and are expected to average 5% to 8% long-term.

Who JEPI Is Perfect For: Volatility Averse Income Investors Looking For A Superior Alternative To A 60/40

Do you hate picking stocks? Many people do.

Do you hate rebalancing your retirement accounts, even if they are 100% ETFs and if you only do it once or twice yearly? Many people do.

Well, then a one-stock retirement portfolio is your ideal solution.

Buffett recommends the S&P 500 via something like VOO for such a one-stock retirement plan.

SCHD is a far better solution for high-yield investors than the S&P 500. In fact, with 12% long-term expected returns, SCHD is a potentially superior S&P alternative, hands down, for anyone.

If you want to own the best fast-growing aristocrats and future aristocrats, VIG is another great one stock retirement solution.

And, of course, if you want a balanced portfolio that adapts to your general risk profile over time, a target date fund like what TROW or Vanguard offers, is a great one-stock retirement plan.

But what if you're a young investor who's new to the market and was traumatized by 2022? What if a young person's target date fund, with 90% stocks, is just too volatile for you?

What if, despite what all the math, charts, tables, and studies prove, you just can't sleep well at night with a one-stock solution that is 90% to 100% stocks?

What if perfectly normal bear market volatility causes you to panic sell at the exact wrong time?

Then there is one single stock retirement plan that you might like, and for over a decade, it's been your best choice.

- BAGPX is BlackRock's 60/40 mutual fund

But now that JEPI is here, there is a far better solution for anyone who owns it in a tax-deferred account.

Why Owning JEPI As A Single Stock Retirement Plan In A Roth IRA Is The Ideal Way To Use This ETF... Or 401K And Then Donate The Account To Charity

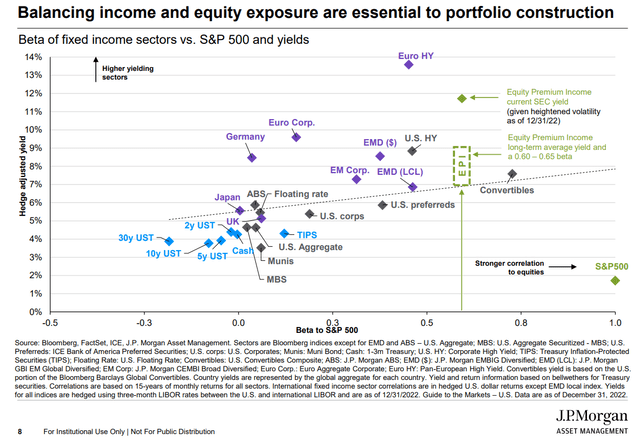

What is the 60/40's historical return? 7% per year.

What is the expected future return? About 7.2% per year.

What does the 60/40 yield today? 2.2% through its annual income is very volatile based on bond yields.

What about JEPI?

- 5% to 8% long-term yield (if you avoid taxes and DRIP it) vs. 2.2% 60/40

- 6% to 10% long-term returns (if you avoid taxes) vs. 7.2% 60/40

- 65% of the market's downside vs. 80% 60/40

If you need a single-stock retirement portfolio and can avoid paying taxes, JEPI is a great choice.

If you have decades to DRIP and thus avoid principal inflation erosion, JEPI is a potentially great choice.

And if you own it in a Roth IRA? Then you never have to pay taxes on JEPI... ever.

In a 401K or IRA or 403B, you'll eventually have to pay taxes on your required minimum distributions.

- Except if you donate all your RDM to charity

Bottom Line: Only One Kind Of Investor Should Own JEPI, And It's Perfect For Exactly Two Kinds Of Investors

JEPI is a powerful tool if used correctly. If used incorrectly, you will lose money owning it; that's a mathematical certainty.

If you need a rock-steady stable income, like what you can get from a diversified high-yield or aristocrat portfolio, JEPI isn't right for you.

If you need long-term returns that match or beat the S&P, JEPI isn't for you.

If you don't have a tax-deferred account and have to pay taxes, JEPI isn't for you.

If you need to take all your dividends in cash and spend them, then JEPI isn't for you.

But three kinds of investors can or even should own JEPI, as a great or even ideal choice.

- Only own JEPI in a tax-deferred account (a good to great choice in this case)

- Roth IRA investors who want a single stock retirement plan with better returns, yield, and lower volatility than a 60/40 (perfect solution)

- Tax-deferred (401K, IRA, 403B) investors who want a single stock retirement plan better than the 60/40 AND plan to donate their entire account to charity (perfect solution)

If you're one of these three kinds investors, then JEPI is a potentially good or even ideal solution for your needs.

However, even ideal investment solutions still have pros and cons. You must understand how every ETF you own works and its realistic and likely capabilities.

JEPI can't deliver 12% long-term returns and a 12% yield that rises every time. But if you know what you're buying and buy it in a retirement account? Then you can buy confidently that you're making a reasonable and prudent long-term investment choice.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.