DigitalOcean: The High Valuation May Not Be Justified

Summary

- At first glance, it looked like a good year as DigitalOcean is FCF positive and has achieved good growth figures.

- However, its share repurchase program was only able to slightly cushion the increase in total shares outstanding.

- And if you take a closer look, you will see that the figures should be viewed more critically at a second glance.

TU IS

Thesis

DigitalOcean (NYSE:DOCN) has what it takes to become a major player in its niche market. In my opinion, however, the 2022 annual figures look worse than they appear at first glance. The positive free cash flow figures are overshadowed by SBCs and the consumption-based revenue model could lead to problems. Let me explain this in more detail in the next sections.

Short Introduction

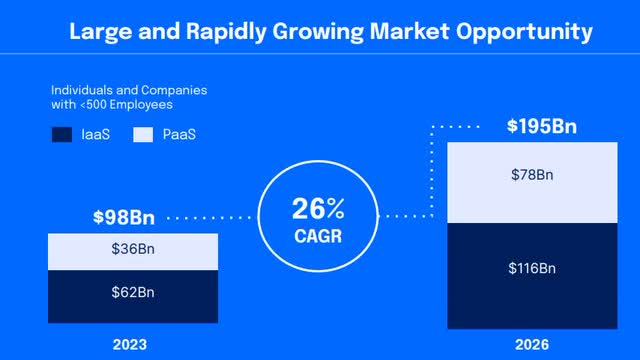

DigitalOcean is a cloud computing platform for SMBs. With the acquisition of Cloudways, they now also have a managed cloud hosting platform. They operate in the Infrastructure-as-a-Service and Platform-as-a-Service markets, which are two of the largest and fastest growing markets.

Analysis

DOCN is trying to differentiate itself from the competition by solving the problems you see in the picture above. They offer clear and simple pricing, a simple and intuitive platform / infrastructure, live support for all customers and a large community with tutorials and a knowledge database. But it is difficult to differentiate from the competition because there is no real moat. Nevertheless, they have found their niche, the SMB market in which they operate.

The IaaS and PaaS markets are forecast to grow at a CAGR of 26% to 2026. The markets have room to grow, but other players such as Google (GOOG) (GOOGL), Amazon (AMZN) and Microsoft (MSFT) are also participating in this market and are really strong competitors. Some would call it overwhelming competition.

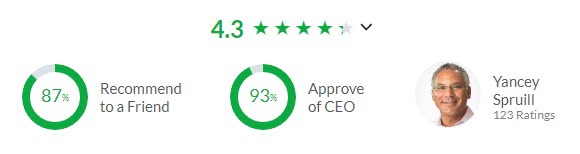

Glassdoor.com

With a 93% CEO approval rating and a 4.3 star rating, DOCN's Glassdoor rating is quite good. There are some negative comments, but as you can see, the overall rating is quite positive. According to the comments, most employees say that management knows what it is doing.

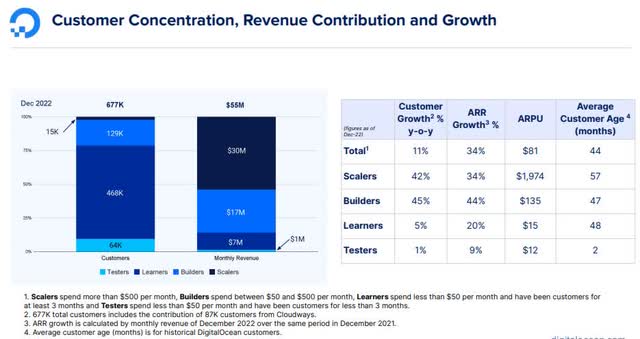

A quick look at the key performance indicators shows that it was quite a good quarter. They improved all their metrics. But they also saw slower growth in new customer acquisition, and this trend is likely to continue in 2023. Most new revenue comes from existing customers who spend more. This will be an interesting point in the future to see if they struggle to acquire new customers and just rely on getting more revenue from the old ones. The following graphic illustrates this. The learners and testers, who are largely new customers, have a much lower y-o-y growth than the builders and scalers. So old customers have been effectively moved to higher levels but the acquisition of new customers has slowed down.

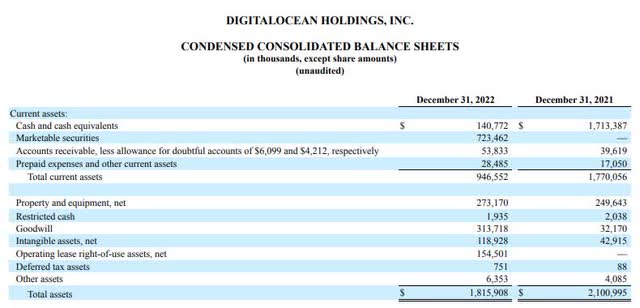

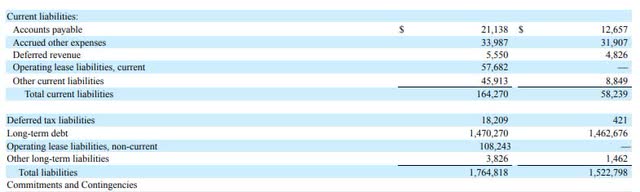

At the end of 2022, the balance sheet does not look as good as at the end of 2021. Current assets have fallen, especially the cash position, and total liabilities have increased. At the moment, however, this change in the balance sheet does not put them at risk.

DOCN Presentation Q4 DOC Presentation Q4

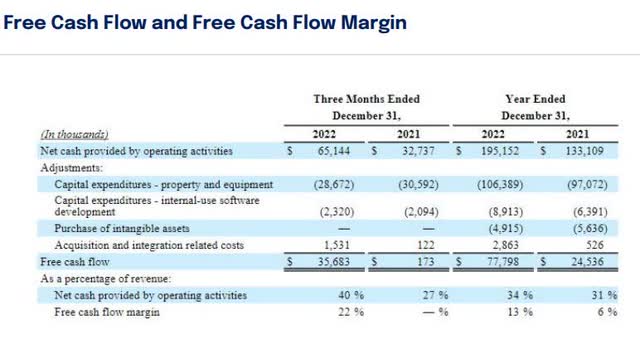

Free cash flow seems to be the most important factor for DOCN. It is also the focus of many investors. So this should be a good sign and they have a free cash flow of $78m in 2022, which is a margin of 13%. But the big problem is that they also have stock-based compensation of $105 million in 2022. And in my opinion, SBC is an expense and you should subtract it from free cash flow, which would result in negative free cash flow for DOCN in 2022. A lot of tech companies use too much SBC to make their free cash flow look better than it really is.

Presentation Q4 Presentation Q4

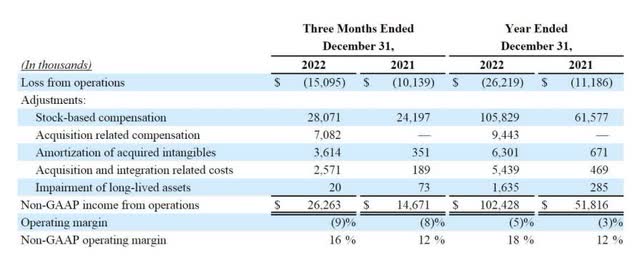

You can clearly see the ~70% increase in SBC in 2022 in the table above. And you can also see that the operating margins in 2022 are worse than in 2021. The adjusted non-GAAP margins look better, but I'd like to continue to watch that in future presentations.

Unusually for a growth company like DOCN, the company has a share buyback program. On 14 February 2023 they approved the repurchase of up to $500 million of shares in 2023. In 2022 they bought back $600m of shares. But despite the buyback program, there were more shares outstanding at the end of 2022 than at the beginning of the year. So this buy-back program only slightly reduces shareholder dilution. The company's employee base was reduced by 11% as it, like most tech companies, laid off employees in late 2022 and early 2023. It will be interesting to see how this will affect the cost structure and the SBC in 2023. If SBC were to increase by ~70% again in 2023, it would be a bad sign. Their guidance is that there will be more shares outstanding at the end of 2023 than there are now outstanding.

If you take a closer look at the Valuation tab on the Seeking Alpha page, you will see that DOCN is richly valued by almost every metric there. Even if you factor in the guidance of 20%+ YoY growth over the next few years. Especially because there are companies with the same growth potential in the small cap world and a much cheaper valuation.

Growth Opportunities

There are a few growth opportunities, the expansion of storage capabilities and of course the opportunities with Cloudways. At the moment, only 10% of revenue is generated by existing storage products, but this is expected to double in the future. This also offers an attractive opportunity to increase ARPU, as storage customers spend 25x more than other customers.

Risks

One advantage of DOCN is that its top 25 customers account for less than 10% of sales and are spread across many different industries. But they work with a consumption-based revenue model, which means that in the event of general economic difficulties or even difficulties in individual industries, revenues can fluctuate greatly. The currently tense economic situation has also led to the 1 billion revenue target having to be pushed back by 1 year. There is also the risk that they can only increase their sales through price increases and no longer through new customers. And in this business it will be difficult to keep raising prices in the long run, because at a certain point there is a lack of pricing power.

Conclusion

In my view, management places a high value on the share price. This is illustrated by the fact that they put a lot of emphasis on FCF and also on share repurchases. Both things are popular with investors. But do they only value short term share prices or also the long-term business? DOCN definitely has the potential for handsome returns, but this investment is no slam dunk right now. The financially strong competitors, if they were to make their offers a bit more SMB friendly, could become a significant threat to DOCN as there is no real moat. In my opinion, the switching costs in this market are not as high as in other markets. Furthermore, one should take a close look at the outstanding shares as well as the sales in the future. Can new sales be attributed to new customers or to price increases? Will there be a significant decline in revenues?

In addition, one should look at whether the future free cash flows were only achieved because the employees were paid SBC instead of appropriate salaries and how the consumption-based model behaves in the event of economic difficulties. The GAAP margins should also be compared, as these usually give a better insight than adjusted figures. Furthermore, it should be considered that there are companies that show the same growth rates and are cheaper to get. It is only because DOCN is in a popular market that it has a premium price.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DOCN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.