Source Rock Royalties: An 8.2% Yield And 40% Per Share In Net Cash

Summary

- Source Rock Royalties is a small oil royalty company.

- It needs to grow to create economies of scale and spread its overhead costs over more attributable barrels of oil production.

- The stock remains cheap, likely due to the small size.

- The quarterly dividend is fully covered, and about 40% of the market cap consists of net cash.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

GeorgiNutsov/iStock via Getty Images

Introduction

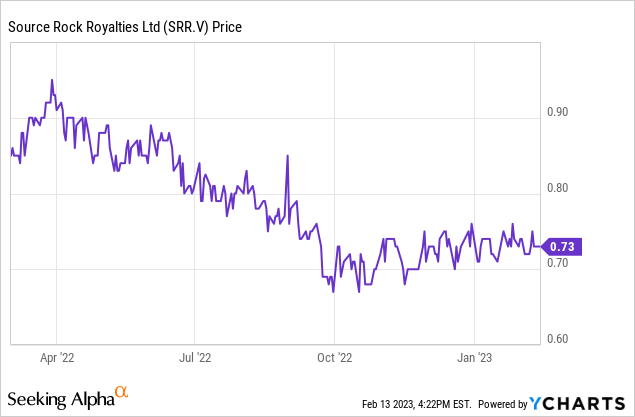

Back in August of last year, I wrote a first article on Source Rock Royalties (OTC:SRRRF) (TSXV:SRR:CA). I had participated in the company's IPO earlier in 2022 and averaged down in the mid-70 cent range over the summer as I believed the nanocap oil royalty company offered good value for the money and a more than acceptable risk/reward ratio. One of my main issues was the size of the company: In order to create economies of scale it needed to grow. But oil royalties small enough for Source Rock were hard to come by, especially in a US$100 oil environment. Fortunately, the company remains attractive even without those economies of scale.

The third quarter was strong, but the low oil price will obviously be a drag

During the third quarter of 2022 (we still have to wait for Source Rock to provide its Q4 and FY 2022 results), the net attributable oil-equivalent production rate was 160 barrels per day. About 92% of the oil-equivalent production consisted of oil and natural gas liquids and the average realized price was C$105.69 per barrel of oil-equivalent.

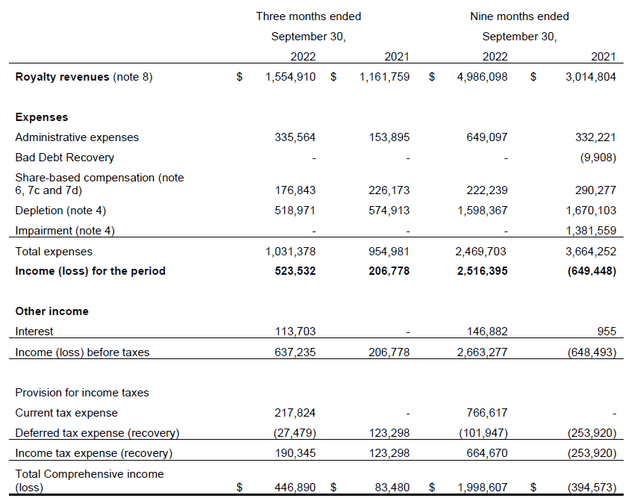

This resulted in a total revenue of C$1.55M and after deducting the C$1.03M in operating expenses, Source Rock generated an operating income of just over C$0.5M. As you can see in the image below, almost 70% of the operating expenses are related to non-cash items: In excess of half a million Canadian Dollars was related to the depreciation charges while the share-based compensation of almost C$180,000 obviously is a non-cash charge as well.

Source Rock Investor Relations

As Source Rock has a net cash balance, it's actually earning interest on its cash, and I expect the interest income to increase this year. The C$113,700 in net interest income during Q3 was nice and this boosted the pre-tax income to C$637M and this resulted in a net income of C$446,890. With a total share count of just under 45 million shares, this worked out to be exactly 1 cent per share.

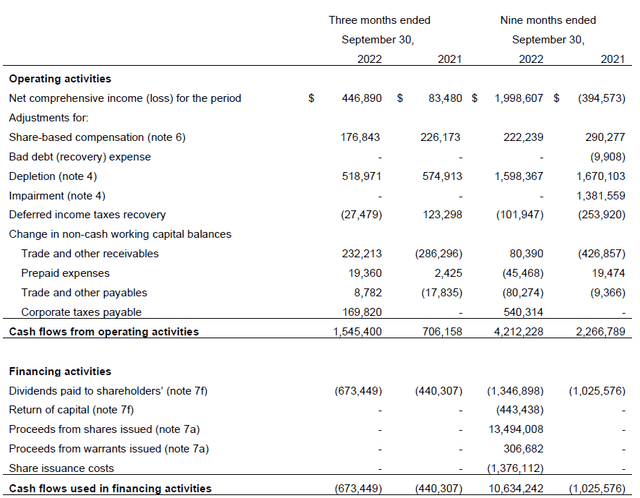

But considering a large portion of the operating expenses were non-cash expenses, it makes more sense to have a closer look at the cash flow statement considering operating a royalty player does not require any sustaining capex beyond the initial investment (the acquisition of a royalty). The reported operating cash flow was C$1.55M, but this included a net contribution of approximately C$0.43M from working capital changes, and on an adjusted basis, the operating cash flow was approximately C$1.1M.

Source Rock Investor Relations

We also see the total capex was less than C$0.1M, resulting in a free cash flow result of approximately C$1.05. That's more than twice as high as the reported net income, mainly due to the impact of the non-cash items weighing on the bottom line of the income statement but which don't have any impact on the potential to generate cash flows.

The majority of the free cash flow was used to cover the dividend: Source Rock Royalties pays a quarterly dividend of C$0.015 per share and the annualized dividend of C$0.06 currently represents a yield of north of 8%.

The dividend should be safe and sustainable, even if the oil price loses 40% compared to the Q3 prices (the average WTI oil price was US$91.43 per barrel while the Edmonton par oil was C$117/barrel during Q3. Another 40% drop would equal just US$55/barrel on a WTI basis). While the royalty company would lose about C$0.6M in revenue, it also would hardly pay any income taxes anymore as the operating expenses and the quarterly depletion expenses will likely push the pre-tax income to zero. That being said, the increasing interest rates will likely boost the net interest income to approximately C$0.15M per quarter and this will provide additional breathing room.

The recent acquisition looks expensive at first sight, but the drill commitment makes up for it

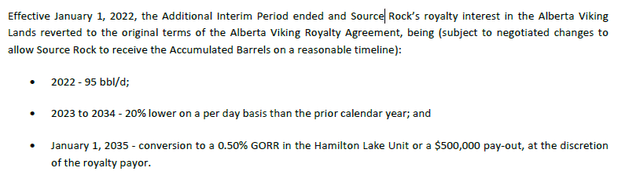

I wanted Source Rock to grow, but I wanted it to grow responsibly. I'm glad the company did not decide to pursue growth when oil prices were trading north of US$100/barrel, but in November, the company announced the closing of an acquisition with an effective date of Oct. 1 (which means the Q4 results). This acquisition was necessary to mitigate the impact of the lower anticipated attributable production from one of the royalties. The 95 barrels per day from the Viking lands royalty will decrease by 20% per year until 2035 as per the following step-down schedule.

Source Rock Investor Relations

While losing 19 barrels per day (20% of 95 barrels per day) doesn't sound like a big deal, it does mean something had to happen to protect the production rate.

The company acquired a 2% gross overriding royalty on 10 sections of land (6,400 acres) in Southeastern Saskatchewan for C$3.5M. The lands are currently operated by Anova Resources and Elevation Oil and Gas. The current gross production is 500 barrels of light oil per day, and the 2% GORR result in an attributable production rate of 10 barrels per day for Source Rock.

While that's not high enough to compensate for the loss of 19 barrels per day as per the Viking royalty agreement, the royalty acquisition comes with a commitment to drill. The operator has entered into an agreement to drill at least 15 new horizontal wells by the end of next year (while eight recently-drilled wells should be online now) and for every well it comes up short it has to make a C$125,000 penalty payment to Source Rock. While there are no guarantees the new wells will be extremely successful, recent wells and program completions on the Frobisher formation by Rok Resources indicate an initial average production rate of 200-300 boe/day before experiencing a decline and I think the acquisition will be sufficient to cover the attributable oil production reduction from 2023-2025 on the Viking lands (which is estimated at 45 barrels per day). Rok Resources expects its Frobisher oil wells to have an ultimate recoverable oil result of 85,000 barrels of oil-equivalent. Of course that's not a guarantee the wells Source Rock owns a royalty on will have the same performance, but at least there's plenty of data on drilling the Frobisher zone.

Investment thesis

I expect Source Rock to have ended 2022 with in excess of C$13M in net cash (after taking the impact of the acquisition into account) which represents approximately C$0.29 per share. That's a comfortable cash cushion and it also means the enterprise value of Source Rock Royalties is just C$0.44 per share (based on a C$0.73 share price). If it wasn't for the cash cushion I probably wouldn't be too interested in Source Rock Royalties due to its small production profile. But knowing there's a substantial cash position and knowing the current dividend yield is covered all the way down to less than US$60 WTI, I feel pretty comfortable collecting my quarterly dividend checks.

I have a long position in Source Rock Royalties and would not mind adding to this position on additional weakness (of course on the condition there are no material changes).

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SRR:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.