Palantir: AI Market Leader For Data Management/Analytics - In The Buy Zone

Summary

- While the world celebrated ChatGPT's AI capabilities, PLTR had already been using Artificial Intelligence for its data processing platform since inception.

- Its growing use case was best exemplified by the stellar total deal remaining value of $3.7B, net dollar retention of 115%, and growing consumer base to 367 (+55% YoY).

- PLTR remains well poised for growth and adoption moving forward, significantly aided by the zero debt and robust balance sheet of $2.6B in liquidity as of FY2022.

- Notably, it's more than decent forward FQ1'23 guidance appears to have boosted market sentiment as well.

m-gucci/iStock via Getty Images

The AI Investment Thesis Is Booming

ChatGPT by OpenAI had taken the world by storm since its public debut in November 2022. Many investors and tech companies alike have frenziedly jumped on the AI bandwagon, as with Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Baidu (NASDAQ:BIDU), and Alibaba (NYSE:BABA).

However, one must not forget that Palantir Technologies Inc (NYSE:PLTR) had been utilizing AI for data management and analytics since inception, while similarly training AI algorithms for a variety of end uses such as military, tech companies, healthcare, and oil/gas industries, amongst others.

A similar ambition had been observed with Tesla (TSLA), which aimed to produce a full self-driving vehicle by relying on AI capabilities with a vision-based approach and the world's first humanoid AI robot, Optimus, revealed in October 2022.

While we have reservations on the latter, attributed to the more advanced AI-equipped Atlas robot from Boston Dynamics and Unicorn robot from XPeng Inc (NYSE:XPEV), it is apparent that the AI market competition will be heating up indeed, with a massive end-to-end use case in a variety of industries.

In the meantime, while PLTR's software might not be publicly available for free demo compared to the online chatbots, its AI tools had been highly useful to existing consumers indeed. This was attributed to the excellent net dollar retention of 115% in FQ4'22. The wide-ranging use case had been expertly summed up by ChatGPT as such:

One of Palantir's flagship products is Palantir Gotham, a big data analysis platform that allows organizations to integrate, manage, and analyze large datasets from various sources. It is designed to help users make sense of complex data by providing a single, centralized interface for accessing and querying multiple data sources... This allows users to create a comprehensive view of their data and gain insights that would not be possible with more traditional analysis tools. (Daily Palantir)

At the same time, its remaining deal value proved excellent at $3.7B by FY2022, somewhat in line YoY from FY2021 levels of $3.8B, while increasing by 32.1% from FY2020 levels of $2.8B. Notably, the company expects to recognize the sum over the next three years, implying the sustainability of its multi-year contracts, no matter the short-term macroeconomic outlook.

Therefore, while PLTR might temporarily suffer from a deceleration in commercial demand during tightened corporate spending, it is not a true reflection of the company's technological offerings in our view, due to its wide moat in the data processing market.

Prior to the market pessimism, the US commercial market had recorded a stellar revenue growth of 136% YoY in FQ1'22, before moderating to 120% YoY in FQ2'22, 53% in FQ3'22, and 67% in FQ4'22. However, we must also highlight that it built upon a tougher YoY comparison with 132% YoY revenue growth recorded in FQ4'21. We reckon things may improve once the overall market sentiment lifts, possibly by H2'23 and we think the Fed will pivot by Q1'24.

Coincidentally, we agreed with the management's strategic choice to partner with Cloudflare (NYSE:NET) to help organizations optimize costs at a time of peak recessionary fears. This partnership might boost PLTR's commercial demand in the long-term, since it was expected to generate significant cost savings and improve operating efficiencies across cloud providers.

This sentiment was concurred by Amazon (NASDAQ:AMZN) in the recent FQ4'22 earnings call:

Some of the key benefits of being in the cloud compared to managing your own data center are the ability to handle large demand swings and to optimize costs relatively quickly, especially during times of economic uncertainty. Our customers are looking for ways to save money, and we spend a lot of our time trying to help them do so. This customer focus is in our DNA and informs how we think about our customer relationships and how we will partner with them for the long term. (Seeking Alpha)

Notably, Palantir Foundry had already been integrated with AMZN's Amazon Web Services [AWS] AI and Machine Learning tools, on top of GOOG's Google Cloud and MSFT's Azure Intelligent Cloud. With these cloud providers comprising 66% of the global market share by December 2022, it was no wonder that PLTR had ranked No. 1 in Artificial Intelligence software platforms for both market share and revenue in 2021, based on the IDC (International Data Corporation) results released on September 2022.

These demonstrate that PLTR is a stellar platform for investors to invest in AI capabilities, now that the market is similarly recognizing and embracing the excellent potential globally. The CEO had already posited in the recent World Economic Forum that, "the country that advances the fastest in AI capabilities is going to define the law of the land." For now, that seems to be in the US, where 63.1% of its FY2022 revenues were based.

There is a reason why PLTR seemingly continues to gain the US government's confidence, with $826M of revenues reported in FY2022, growing by 22% YoY. Notably, the company already achieved the highest possible DoD Impact Level 6 (IL6) PA from the Defense Information Systems Agency in October 2022, along with MSFT and AMZN, suggesting their robust military partnership over the next few years.

So, Is PLTR Stock A Buy, Sell, Or Hold?

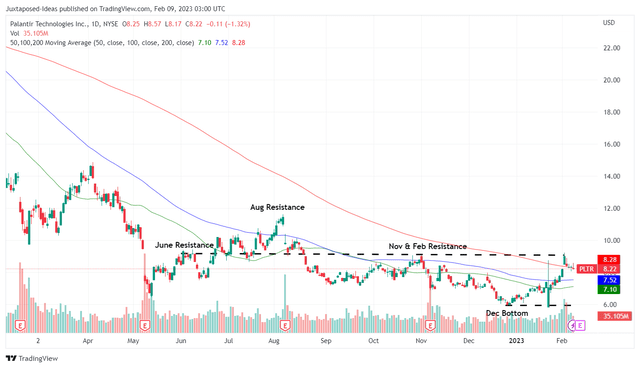

PLTR 1Y Stock Price

The PLTR stock is currently trading at around $10, recovering by over 60% from the December bottom of $6. Naturally, this leads the stock to trade above its historical 50-day moving average, and we remain bullish due to the factors discussed above.

The management has also competently delivered on the promise of reducing its Stock-Based Compensation expenses to $564.79M by FY2022, declining by -27.4% from FY2021 levels of $778.2M and -55.5% from FY2020 levels of $1.27B. Alex Karp, CEO of PLTR, said:

They're legitimate concerns. We have to address to dilution, what are the revenues going to be, where the revenue is going to develop, how transformative the products are. All legitimate concerns. What we believe is our business is stronger that's ever been and we have a lot of evidence that convinces us. We believe our conviction will convince the world over a multi-year period and that's what I care about. (CNBC Television)

While PLTR has not embarked on stock repurchases to reduce its elevated share count of 2.06B, the rate of growth has satisfactorily decelerated to 2.4% YoY by FQ4'22, compared to 5.5% in FQ3'22, 8.5% in FQ2'22, and 11.8% in FQ1'22.

Though the company reported GAAP net income of $31M in FQ4'22, it was particularly attributed to $13M from investment income and $44M gain from the Palantir Japan joint venture. For this exact reason, investors may be well advised to refer to its adjusted numbers for a better understanding of its financial performance. However, analysts expect an adj. EPS of $0.16 for FY2023, suggesting an excellent growth of 166.6% YoY from $0.06 in FY2022.

As a final point, its lack of debt exposure and robust liquidity of $2.6B in the latest fiscal year indicated excellent insulation against the prolonged sales cycles in the uncertain macroeconomic conditions.

Therefore, we continue to rate PLTR as a Buy here. Naturally, the stock is only suitable for investors with higher risk tolerances, attributed to the opaque nature of its contracts and lack of projected GAAP profitability through FY2024.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PLTR, AMZN, MSFT, GOOG, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.