QQQE: It's Time To Equal-Weight The Nasdaq-100

Summary

- QQQE is the equal-weighted version of QQQ, the most popular ETF tracking the growth-heavy Nasdaq-100 Index. QQQE's expense ratio is 0.35% and the ETF has $507 million in assets.

- QQQE's growth potential now exceeds QQQ's and trades at a cheaper 30x forward earnings, with profitability hardly impacted.

- It's prudent to spread out risk in uncertain markets. Besides, as earnings results trickle in for Q4 2022, Wall Street now favors the lesser-known stocks not on QQQ's front page.

- QQQE now forms part of the Active Equity ETF Model Portfolio on the Hoya Capital Income Builder Marketplace. This article explains the reasons for the recent add.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

Massimo Giachetti

Investment Thesis

As mega-cap growth stocks slowly give back some impressive year-to-date gains, I want readers to consider the Direxion NASDAQ-100 Equal Weighted ETF (NASDAQ:QQQE) as an alternative to the more popular Invesco QQQ ETF (QQQ). QQQE trades at a cheaper valuation, has a three-point edge on growth and has stronger earnings momentum. It's also prudent to spread risk in uncertain markets, as Q4 2022 earnings results indicate most mega-cap stocks aren't out of the woods yet. This article compares the two ETFs' current fundamentals and historical performance, followed by an update on how well Nasdaq-100 constituents are handling the current earnings season.

QQQE Overview

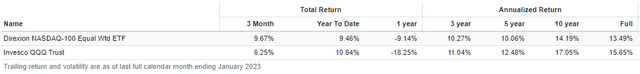

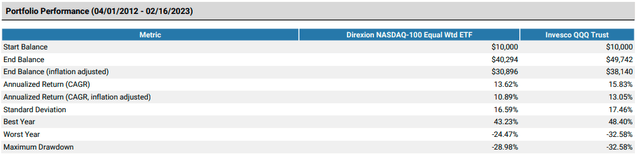

QQQE tracks the NASDAQ-100 Equal Weighted Index, selecting 100 of the largest non-financial companies listed on the Nasdaq based on market capitalization. Based on historical performance alone, long-term investors will likely choose the cheaper market-cap-weighted QQQ. QQQ has a more reasonable expense ratio (0.20% vs. 0.35%) and has outperformed QQQE by nearly 3% per year over the last ten years. That equates to approximately 106% in total return.

However, QQQE improved last year, declining 9.14% compared to 18.25% from February 2022 to January 2023. QQQE also performed nearly all other large-cap growth ETFs in the previous year. The following is a performance summary alongside 29 peers through January 2023. QQQE ranked #3 behind the Invesco S&P 500 GARP ETF (SPGP) and the First Trust Large Cap Growth AlphaDEX ETF (FTC).

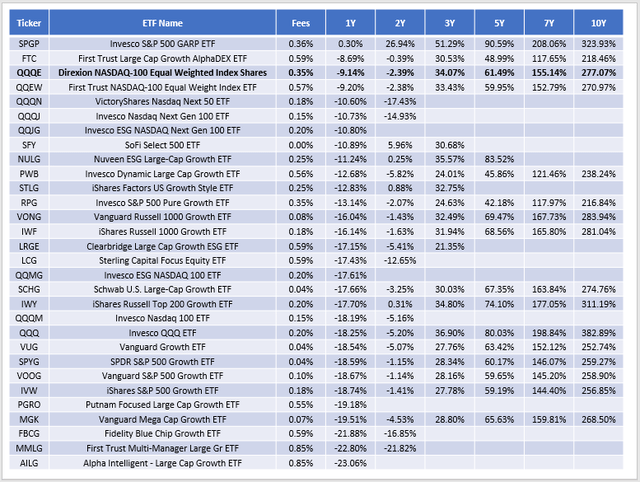

Historical performance is sometimes helpful, but those relying on it likely avoided QQQE one year ago. Current fundamentals matter more because they reflect what you own or plan to own today. With that said, let's look at the fund's composition today at the sector level.

QQQE has 11% less exposure to Technology stocks than QQQ but is still overweight by 12% compared to the SPDR S&P 500 ETF (SPY). Another difference is higher Health Care exposure (12.48% vs. 6.38%) while underweighting Communication Services stocks by the same amount. Otherwise, there are only minor differences from this perspective.

QQQE Analysis

Industry Fundamentals vs. QQQ

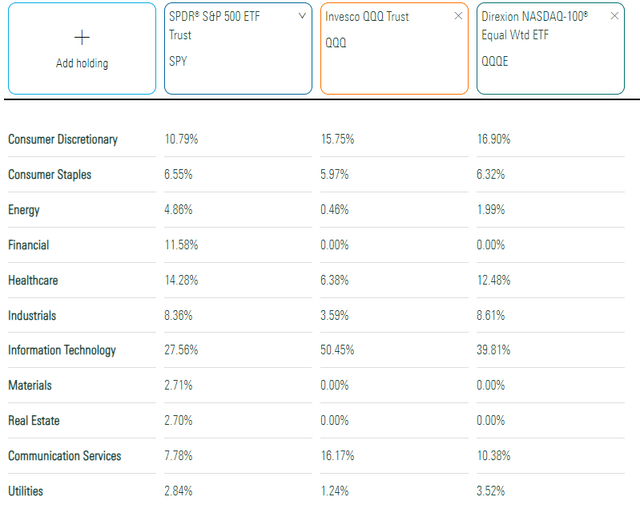

The following table highlights selected fundamental metrics for QQQE's top 25 industries. This view is beneficial since it's challenging to appreciate the composition of a fund by scanning through 100 securities. Semiconductors is the leading industry with a 12.68% total weighting compared to 13.52% in QQQ. Systems Software stocks combine for 7.24%, less than half the exposure in QQQ, whereas Microsoft (MSFT) has a 12.11% weighting. Finally, Apple (AAPL) and its 12.23% weighting in QQQ is reduced to 1.03% in QQQE. The fund's relatively low $155 billion weighted-average market capitalization reflects this movement from the mega-caps.

Three observations:

1. QQQE's 1.08 five-year beta indicates less market volatility than QQQ. This metric aligns with historical volatility and drawdown figures, per below.

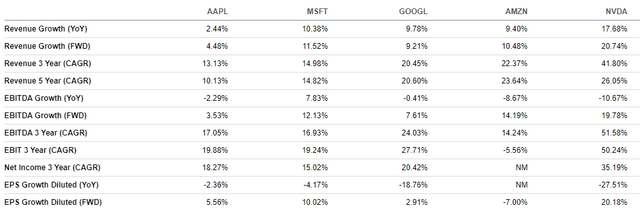

2. QQQE's estimated revenue and earnings growth rates are approximately 13.5%, 2.5%-3.5% higher than QQQ's. Interestingly, QQQ's 9.85% earnings growth rate is hardly better than SPY. To understand why, consider the growth rates for QQQ's top ten holdings, which total 47% of the portfolio.

Notice how only NVIDIA (NVDA) has an estimated earnings growth rate exceeding 20%. In all cases, estimated sales growth is less than annualized rates over the last three and five years. Investors shouldn't rely on historical performance to make investment decisions. Markets are forward-looking, and they indicate QQQ has no more growth than SPY. Better opportunities are with lesser-known companies, to which QQQE has more exposure.

3. Better growth opportunities usually come with sacrifices. With value ETFs, it's typically higher volatility. With growth ETFs, the trade-off frequently manifests in more expensive valuations or weaker profitability scores. QQQE's 9.02/10 Profitability Score is worse than QQQ's 9.74/10 Score. However, both are acceptable and indicative of high-quality holdings. Importantly, QQQE trades at 28.92x forward earnings, about one point less than QQQ. This was not the case two months ago. My records indicate that QQQE traded at a 1.4-point premium for the week ending December 16, 2022, with only a 2% edge on estimated earnings growth. In short, QQQE's fundamentals have improved.

Q4 2022 Earnings Season

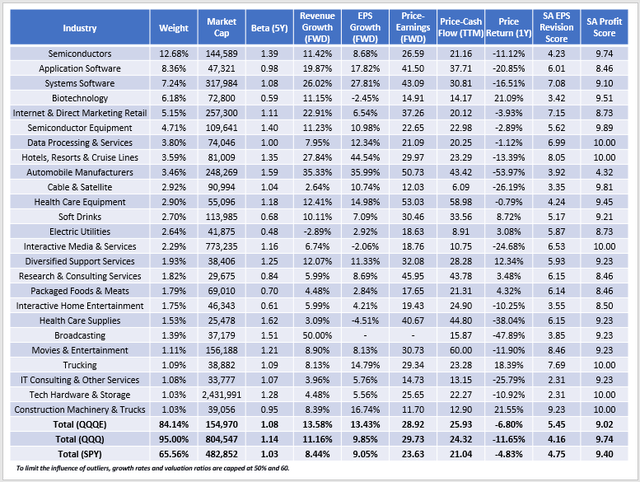

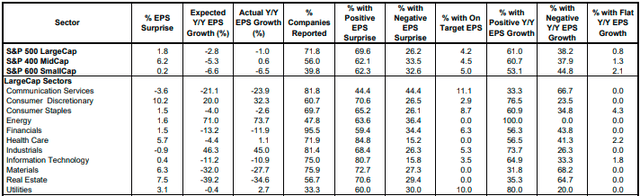

You may have noticed QQQE's superior 5.45/10 EPS Revision Score. This score, derived from Individual Seeking Alpha Factor Grades, has proved to be a solid leading indicator as it neatly summarizes Wall Street sentiment. Recently, I used it to identify an opportunity with the Consumer Discretionary Select Sector SPDR ETF (XLY) ahead of earnings season. One month later, with approximately two-thirds of S&P 500 companies reporting, Yardeni Research reports the highest aggregate earnings surprise for S&P 500 Consumer Discretionary stocks (10.2%).

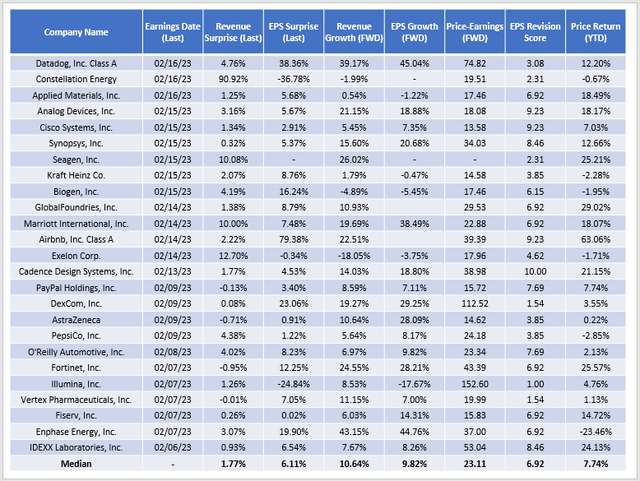

QQQE's score isn't as impressive, but it's still superior to QQQ's 4.16/10 and SPY's 4.75/10. The following table highlights earnings results and surprises for the last 25 securities to report.

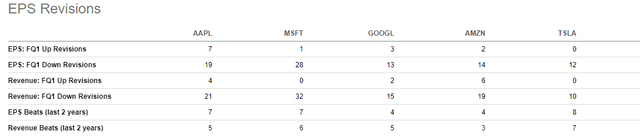

In this sample, the median revenue earnings surprise was 1.77% and 6.11%. Crucially, the median 6.92/10 EPS Revision Score is excellent, indicating that analysts have generally increased. In contrast, here are the EPS Revision Grades for QQQE's five most underweighted securities compared to QQQ:

- Apple: 2.31/10

- Microsoft: 1.54/10

- Alphabet (GOOG) (GOOGL): 3.85/10

- Amazon (AMZN): 3.85/10

- Tesla (TSLA): 1.00/10

Seeking Alpha provides the number of analysts' upward and downward sales and earnings revisions over the last 90 days to support these scores. Based on these figures, QQQ feels like a contrarian play right now. I prefer to spread out the risk and select more companies that Wall Street favors.

Investment Recommendation

In my search for growth opportunities, QQQE is one of the few standouts. I like its superior combination of growth and valuation compared to QQQ. Its equal-weighted approach provides for better diversification, and the Index's lesser-known stocks appear to have stronger earnings momentum backed by better quarterly results. Therefore, I support buying QQQE to re-enter growth stocks cautiously and have assigned a buy rating to the ETF. Thank you for reading, and I look forward to the discussion below.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I perform independent fundamental analysis for over 850 U.S. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha. My insights into how ETFs are constructed at the industry level are unique rather than surface-level reviews that’s standard on other investment platforms. My deep-dive articles always include a set of alternative funds, and I am active in the comments section and ready to answer your questions about the ETFs you own or are considering.

My qualifications include a Certificate in Advanced Investment Advice from the Canadian Securities Institute, the completion of all educational requirements for the Chartered Investment Manager (CIM) designation, and a Bachelor of Commerce degree with a major in Accounting. In addition, I passed the CFA Level 1 Exam and am on track to become licensed to advise on options and derivatives in 2023. In November 2021, I became a contributor for the Hoya Capital Income Builder Marketplace Service and manage the "Active Equity ETF Model Portfolio", which as a total return objective. Sign up for a free trial today! Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of SPY, MSFT, XLY, QQQE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: QQQE was recently added to the Active Equity Model ETF Portfolio I manage as part of the Hoya Capital Income Builder Marketplace.