Marathon Petroleum: A Top Refining Stock For Dividend Investors

Summary

- Marathon Petroleum Corporation reported strong operating performance for Q4 and the full year of 2022.

- Marathon Petroleum Corporation has a strong projects pipeline focused on growth, with a balance of traditional and low-carbon projects.

- Although the dividend yield has fallen due to a rise in stock price, Marathon Petroleum Corporation investors can expect a growing dividend in the coming years.

WendellandCarolyn

Investment Rationale

The largest independent refiner in the U.S., Marathon Petroleum Corporation (NYSE:MPC), reported strong operating performance for Q4 and the Full Year of 2022. Higher demand for transportation fuels due to the reopening of China's borders could be a tailwind for Marathon. The company has a strong projects pipeline focused on growth, with a balance of traditional and low-carbon projects. The company's focus on stock buybacks adds to the attractiveness of its stock.

Marathon Petroleum Corporation’s stock has rewarded more than 50% returns to investors in the past year. Although the dividend yield has fallen due to a rise in stock price, investors can expect a growing dividend in the coming years, in addition to capital appreciation.

Robust operating performance

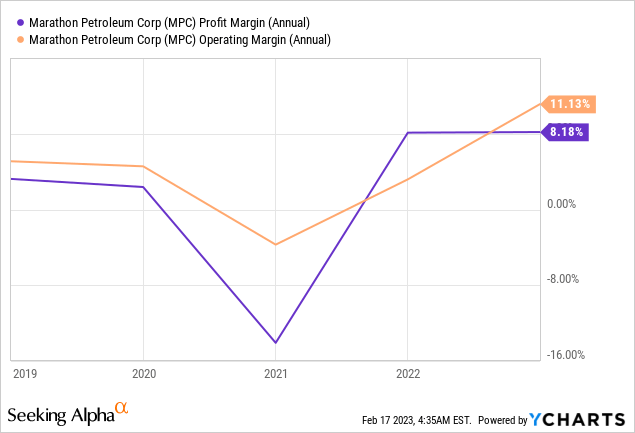

Compared to the first three quarters of 2022, Marathon Petroleum reported higher operating profit and net income margins in Q42022. Likewise, its margins for the full year 2022 were higher compared to those in the past five years. Several factors contributed to this outperformance.

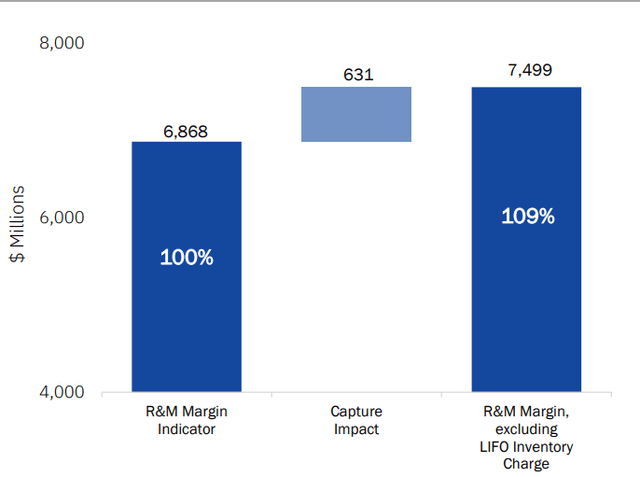

In Q42022, MPC's bottom line was positively impacted by a strong performance from Refining & Marketing (“R&M”) Segment. The performance of the R&M segment was affected at the end of the quarter by the winter storm Elliott. Despite the storm, the refining assets ran at 94% utilization, which shows the resiliency of the company's operations. The R&M capture was 109%, which reflects the percentage of the company's R&M margin indicator realized in its reported R&M margin. This was mainly aided by the company's higher commercial execution even during volatile market conditions, tailwinds for light product margins, and favorable inventory impacts.

Marathon Petroleum’s midstream business registered a growth of 7% on a YoY basis, which included 10% higher distributions from MPLX. MPLX, a partnership formed for carrying out MPC’s midstream operations, is a crucial source of earnings for the midstream segment, and its higher free cash flow generation and distribution will aid in further enhancing MPC’s shareholders' wealth.

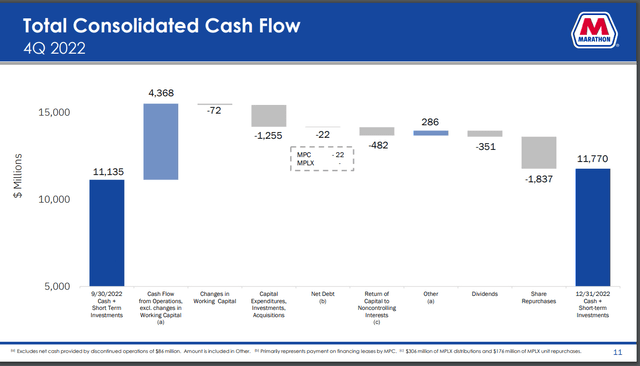

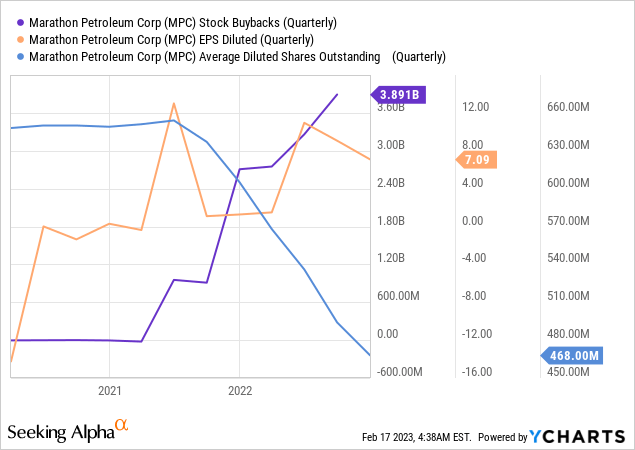

Higher focus on returning capital

For the full year 2022, MPC has returned a handsome amount of capital to shareholders, 75% of cash from operations, both in the form of dividends and share repurchases. Out of the total share repurchases of $12 billion through the year, $1.8 billion were executed in Q42022 and a further $700 million were executed till the end of January 2023. The company has a $7.6 billion remaining authorization for share repurchases, which includes a further $5 billion approved by the board in Q42022, showing the company's clear focus on higher share repurchases.

In Q42022, MPC’s net income and adjusted EBITDA showed a multifold increase with the EPS number jumping from $1.27 per share to $7.09. In addition to a strong operational performance, the positive impact of higher share repurchases also reflects in the jump in EPS numbers. The company plans to continue its focus on diverting the excess capital towards further share repurchases and lower its share count to further enhance EPS.

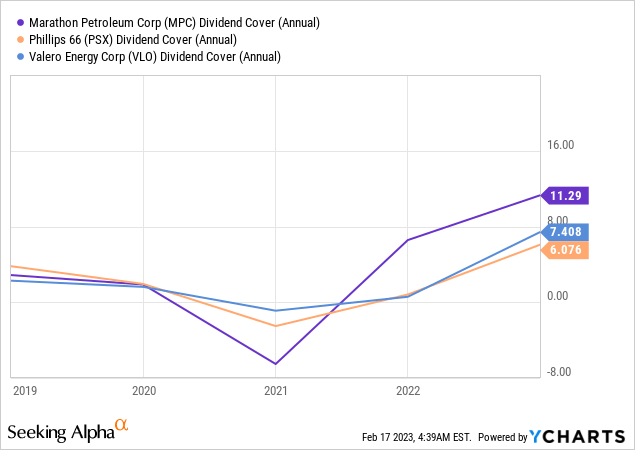

The fourth quarter recorded higher dividend payments which has been constant at $0.58 for the past three years. The dividend per share rose to $0.75 - a 30% increase. The total wealth returned in the form of dividends in 2022 was $1.3 billion and $351 million in Q42022. MPC also bears a substantially higher dividend coverage than its peer companies Phillips 66 (PSX) and Valero Energy (VLO).

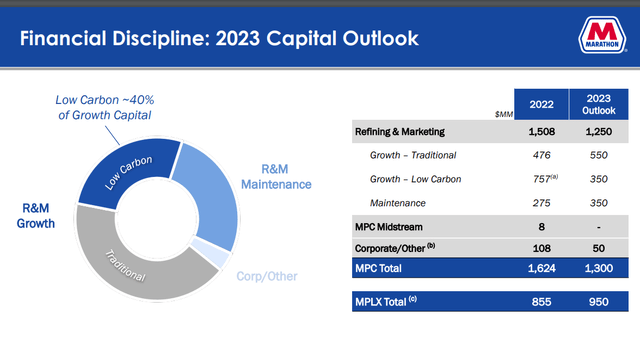

Attractive capex blend and outlook for 2023

Marathon Petroleum Corporation's capital expenditure shows a healthy blend focusing on growth as well as maintenance. The division of growth capital between traditional and low-carbon projects enhances MPC’s opportunity basket. The company also holds an optimistic capital outlook for 2023, as seen in the below figure.

Two of the significant projects that the company is focusing its capex on are the Martinez Renewable Fuels Facility and the STAR project in its Galveston refinery, located in Galveston Bay, Texas. Phase 1 of production capacity at the Martinez facility, which will fuel MPC's sustainable energy goals, is expected to be completed by end of Q12023. STAR is an ongoing project which is already in service and the company plans to complete the remaining work on it towards the end of Q12023. The company expects higher EBITDA contributions from STAR from Q22023.

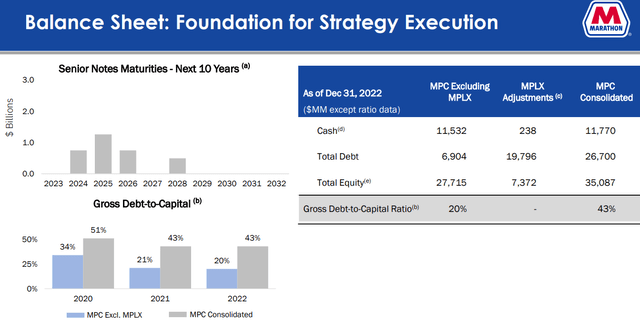

Healthy Financial Position

Over the last three years, MPC'S debt-to-capital ratio has declined on a consolidated as well as a standalone basis. The standalone debt-to-capital ratio is standing below the company's target debt-to-capital ratio of 25% to 30%. A healthy and increasing interest coverage ratio indicates comfortable coverage for interest payments. The table displaying senior notes maturities also shows a healthy debt maturity profile of MPC in the coming years.

At the end of 2022, the cash, cash equivalents, and short-term investments stood at $11,770 million. The cash and cash equivalents number has taken a substantial leap in 2022 as compared to the previous five years, indicating a strengthened cash position.

MPC’s profitability ratios explaining return on equity and return on invested capital are also attractive for the past five years.

MPC stock’s stock performance and valuation

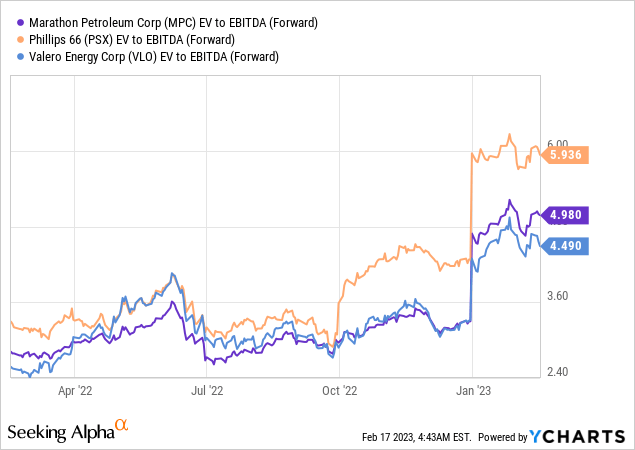

MPC stock valuation appears to be reasonable among the stocks of its peer companies based on the forward EV to EBITDA ratio.

The stock’s dividend yield has fallen to about 2% due to the significant rise in its stock price. However, investors can expect growing dividends, along with capital appreciation based on the company’s strong expected performance.

Seeking Alpha’s proprietary Quant Ratings rate MPC as a “Strong Buy.” The stock is rated high on profitability, revisions, and momentum factors.

Other Growth Drivers

Higher Demand for Transportation Fuels

Marathon Petroleum Corporation has experienced a recovery in demand for transportation fuels across all the products coming out of the pandemic. This recovery is expected to continue in 2023. Recently, China, one of the largest oil consumers globally, has reopened borders for the first time in three years. This has boosted the demand outlook for transportation fuels.

MPC’s sturdy financial priorities

MPC works mainly with three robust financial priorities which help the company in enhancing its financial and operational performance-

- Sustaining Capital - This includes safe operations of technical assets.

- Dividend - Annual evaluation of dividend coupled with share repurchases.

- Growth Capital - The company is focused on return on capital along with the competitiveness of its assets.

New multiyear project at Los Angeles Refinery

Marathon Petroleum Corporation is in the process of executing another project at its Los Angeles refinery in addition to Martinez Conversion. This project is focused on NOx reductions, in anticipation of future regulatory requirements around the same. MPC focuses on the competitive opportunity it has to modernize its utility systems to meet Phase 1 and Phase 2 of these requirements. The new project along with NOx reductions is also going to help reduce greenhouse gases, further reducing costs and improving reliability for the company.

Focus on capturing Sustainable Aviation Fuel opportunities

One of the growth strategies for Marathon Petroleum Corporation is maximizing the value of renewable liquid fuels. This also includes Sustainable Aviation Fuel (“SAF”), a near-term decarbonization tool. The company is a major supplier of fossil fuel which includes jet fuel and is constantly involved in R&D regarding the opportunities to be captured in SAF and cater to customers' demands going forward.

Conclusion

Marathon Petroleum Corporation's Q4FY22 and full-year 2022 results indicate a healthy operational as well as financial position of the company. Higher dividends along with a focus on share repurchases make the stock attractive. The company has strong capex plans with a balance of low carbon as well as traditional projects. MPC's balance sheet stands in a healthy position.

Marathon Petroleum Corporation stock’s dividend yield has fallen to about 2% due to the significant rise in its stock price. However, investors can expect growing dividends, along with capital appreciation based on Marathon Petroleum Corporation’s strong expected performance.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.