Hannon Armstrong: Overvalued As Market Continues To Ignore Mortgage REIT Basics

Summary

- Hannon Armstrong Sustainable Infrastructure Capital, Inc. posted solid results in 2022, with EPS growth of 11% YoY, and remains on track to hit their guidance for 2024.

- The company is well positioned to grow, but the valuation is stretched at this point, trading at almost two times book value.

- In this article, I demonstrate why traditional mortgage REITs should always trade close to their book value and that Hannon Armstrong simply isn't different enough to justify the current valuation.

Justin Paget

Dear readers/followers,

In this article, I want to analyze a mortgage real estate investment trust ("mREIT") focused on renewable energy, because I believe the sector is likely to face serious tailwinds over the next decade as countries try to transition away from their dependency on fossil fuels. Also, the recently passes Inflation Reduction Act will provide 10-years of tax credits in an effort to support green energy, which could significantly help companies that operate within the space.

Overview

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE:HASI) is a mortgage REIT that focuses on sustainable infrastructure investments across the U.S. The company primarily invests in projects related to renewable energy, energy efficiency, and climate solutions. The portfolio is composed of a variety of sustainable infrastructure investments, including wind and solar power projects, energy efficiency retrofits, and other clean energy projects.

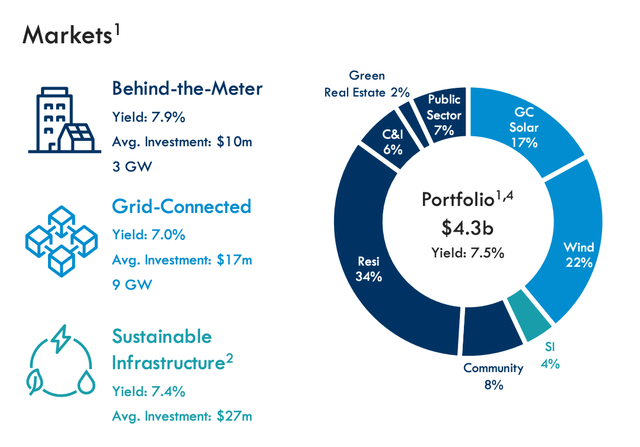

HASI currently has over 340 investments worth a total of $4.3 Billion and diversified across various sectors, with around 57% of the portfolio invested in Behind-the-Meter projects (meaning the energy is both generated and consumed on-site), 39% in Grid-Connected projects (larger scale projects in wind and solar), and the remainder in Sustainable Infrastructure projects. In addition, HASI also manages about $5 Billion of off-balance sheet assets on which it earns a fee.

Financials

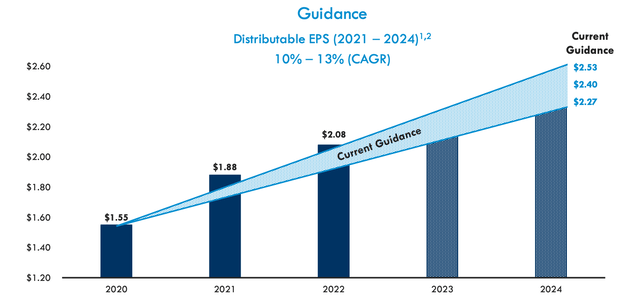

The company has just reported their 2022 results. Distributable earnings increase by 11% YoY to $2.08 per share - a great result, which reaffirmed management's guidance to grow their EPS by 10-13% from 2020 until 2024. The company remains on track to hit their 2024 median EPS target of $2.40 per share.

The company's growth comes mostly from its ability to grow its pipeline of investments. In 2022, the company closed transactions worth $1.8 Billion and grew its portfolio by 19% YoY. For 2023 they have a pipeline of potential transactions worth over $4.5 Billion. Of course, not all these transactions will close, but the company certainly has the potential to hit its targets.

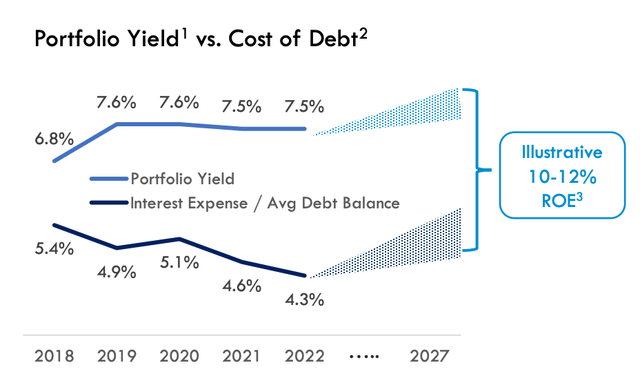

What makes the company profitable is a relatively large and growing spread between the yield they're able to earn on their investments (7.5%) and their cost of debt (4.3%). Since they have very little refinancing risk until 2025 and the majority of their debt is fixed-rate, they should be able to maintain this spread going forward. Though, if we enter a prolonged period with high interest rates (even post 2025), the company could see this spread narrow. Management provides an example (page 15 of report) to show that their spread will not narrow even if rates stay high (forecast in the chart below), though the math doesn't really add up in my opinion.

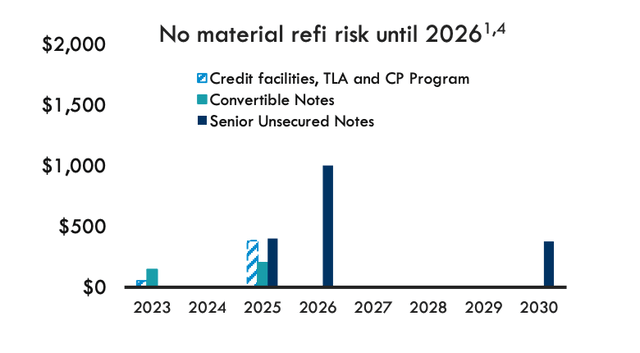

The company has a BB+ rating with about $2.9 Billion of debt, 86% of which is fixed-rate. As we already touched on, there are no major debt maturities in 2023 and 2024, which is great.

The company has declared a dividend of $1.58 per share, translating into a yield of 4.5%. With distributable earnings of $2.08 per share, the payout ratio stands at 76%. With most of the debt fixed and little to refinance over the next two years, the main risk to this dividend could be loan defaults. To date however, there has been no indication of this as 99% of loans are classified as performing and 1% as slightly below metrics, i.e. with a moderate risk. I would therefore conclude that the dividend is safe, but frankly very low compared to other mortgage REITs, for example, Blackstone Mortgage Trust, Inc. (BXMT) (covered in my previous article here), which has a nearly 11% dividend yield.

The one advantage HASI has, however, is its much faster forecasted growth - still, it would take 6 years of 15% annual growth to get to a yield on cost of 10.5%. This doesn't mean that HASI is a bad investment, it simply means that if your main objective is to collect high dividends, there may be better alternatives elsewhere.

Valuation

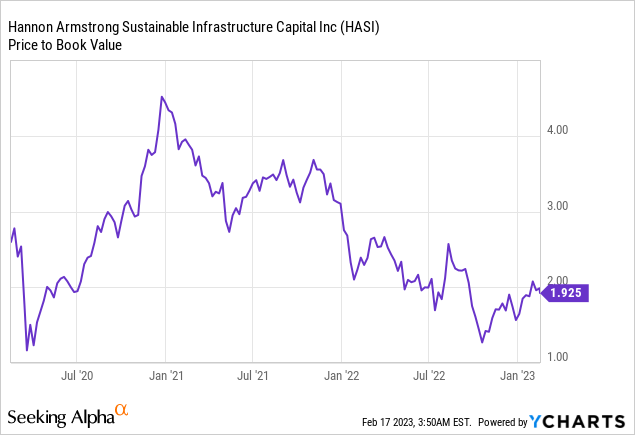

HASI stock has historically traded at a very high valuation, but having come down over 50% from its highs, some analysts have become very bullish on the stock, so let's look at the valuation.

HASI is rather specific compared to other more traditional mortgage REITs, but its main business is actually pretty similar - giving out loans and collecting interest, in addition to this it earns fees for managing the off-balance sheet assets. The best way to value such a company is to use P / BV and see if the multiple is reasonably close to 1.0x (ideally below) and how it compares to peers.

Why should the multiple be anchored around 1.0x? Let's have a look at an example. Assume that a company lends $100 and at some point in the future collects interest of 10% on that money. This interest essentially compensates the company for the possibility that the borrower defaults. So, assuming that the borrower repays the loan, the risk adjusted present value of this cash flow will be very close to the initial of $100. If the borrower doesn't repay, the company loses the $100. The business is essentially about collecting small wins and trying to avoid huge losers, but there's no way that the company is gonna turn the $100 into $200. Knowing this, how much would you pay for this company? It's easy to see that paying significantly more than $100 would be foolish.

Now, back to HASI - their P/BV stands at 1.92x! This is significantly below the crazy multiples seen back in 2021, but still significantly above the 1.0x threshold which marks "safe territory." It is also double that of peers - BXMT trades at 0.87x and LADR at 0.96x.

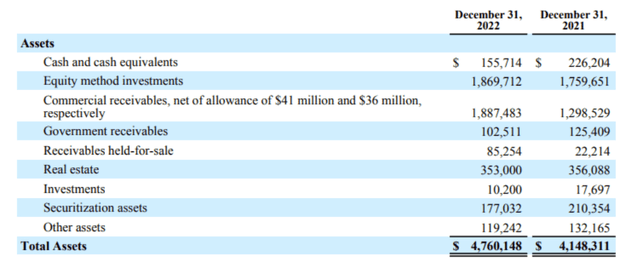

HASI trades at a market cap of $3.1 Billion and has about $2.9 Billion in debt, that means an enterprise value (EV) of $6 Billion. While assets are reported on the books at just $4.76 Billion. This suggests that we could be overpaying.

Now frankly, there are two things that this kind of valuation ignores.

- Firstly, the company generates fees of about $22 Million on the side by managing off-balance sheet assets, which is roughly 10% of their total revenues. To estimate the value of this, I'll do a simple back of an envelope calculation. I imagine that this probably has high synergies with the rest of their business so I'll assume a high margin of 60% and an exit multiple of 15x. This adjustment will give me roughly $200 Million of extra value not reported on the BS.

- Secondly, the company has equity investments in some projects that are essentially kept on the books at cost and account for 39% of total assets (see Equity method investments). I have no idea what the current market value of these could be, but for the sake of the calculation let's assume that it's 15% above the reported value. This will give me $215 Million of extra value.

Adding these adjustments to the actual asset value reported and we get an adjusted asset value of $5.18 Billion - still about 13% below the enterprise value of $6 Billion. Personally, I would only consider this company if P/BV falls to about 1.5x again.

Verdict

Hannon Armstrong Sustainable Infrastructure Capital, Inc. has done a great job of growing its portfolio as well as its earnings and is on track to hitting its 2024 EPS target of $2.40 per share. The dividend is well covered and likely to grow, but is currently very low compared to peers. Also, HASI still seems to be overvalued. And although it does have additional value compared to a traditional mortgage REIT, it does not justify trading a 1.93x book value.

For the simple reason of overvaluation, I rate Hannon Armstrong Sustainable Infrastructure Capital, Inc. as a HOLD here at $35.00 per share and would only consider this company if P/BV falls to about 1.5x again. Even with superb EPS growth, I don't see much potential for price appreciation from these levels, unless HASI stock trades at even more unrealistic P/BV levels again.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of HASI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.