The 'Higher For Longer' Trade: BIL May Soon Yield 5%

Summary

- Dry powder is no longer losing proposition to inflation.

- And with elevated valuations on the SPX, cash sports a high hurdle rate for equities.

- BIL features a high yield relative to the last 15 years, and I see that yield rising further in the next 6 months.

Riska

Higher for longer.

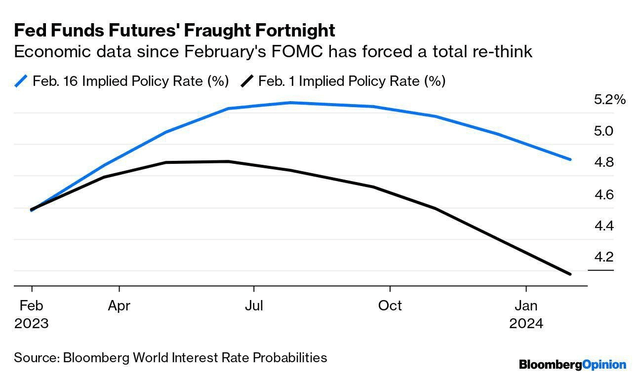

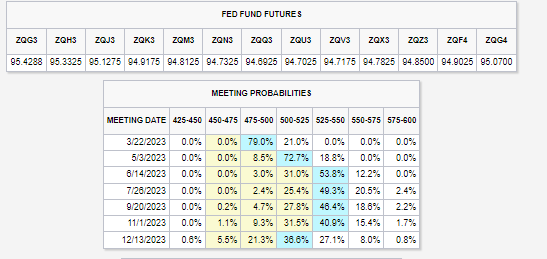

That's been the mantra when assessing the Fed's rate hike outlook, but the market has now finally come around to the notion that a 4%-plus Effective Federal Funds Rate is likely through much of 2024. The policy rate is forecasted to be higher than 5% all the way through this December. That means there is a tall hurdle for investors to grapple with.

My investment play is to be overweight T-bills and wait for volatility spikes over the next several months. I see the October lows as holding, but deploying cash in the upper 3000s on the SPX seems prudent, while keeping liquidity on hand in Treasury which now sport strong rates.

Loft Fed Rates Through Early 2024

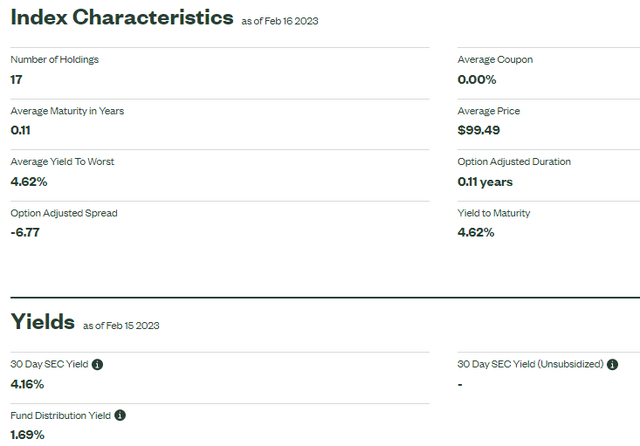

Near Zero Duration And A Yield Nearing 5% on Short-Term Treasury

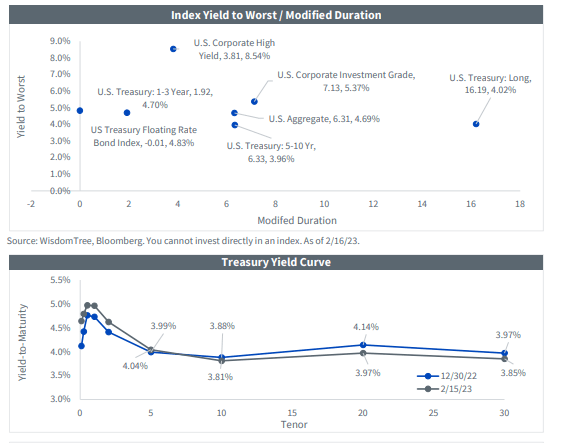

WisdomTree

I admit to owning a lot more cash than you would think for someone with years until I have to tap the funds. While I have it parked in a money market mutual fund currently earning 4.5%, I see short-term Treasury ETFs as solid options, too. The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (NYSEARCA:BIL) is an ideal choice to sit out market volatility and capture the highest risk-free short-term yields we've seen since early 2007. Let's perform an X-ray on why this is an ideal play right now.

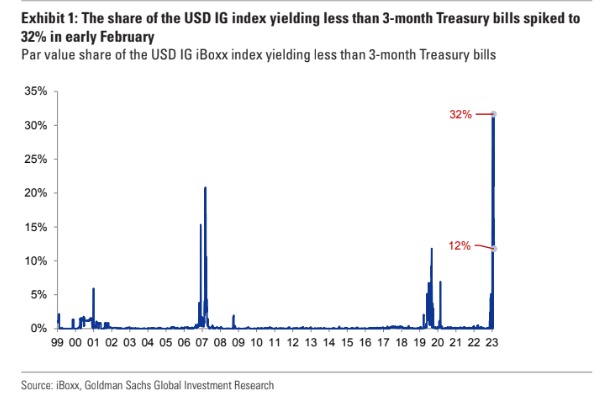

T-Bills Better Than Many IG Corporates? Arguably So.

Goldman Sachs

First off, the S&P 500 trades near 18 times projected earnings. That is above the 10-year average even with much higher discount rates used to price assets. I don't see a ton more upside from here in large-cap US stocks so long as rates hold where they are. While I do like small caps and foreign shares, something I am doing is taking from my US large-cap allocation and putting that into high-yield cash.

Next, BIL sports a low 0.135% expense ratio. According to SSGA Funds, the fund seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg 1-3 Month U.S. Treasury Bill Index. You don't have to go through the cumbersome process of buying bills on the Treasury Direct website or pay unattractive spreads that you will find on many brokerage transaction pages.

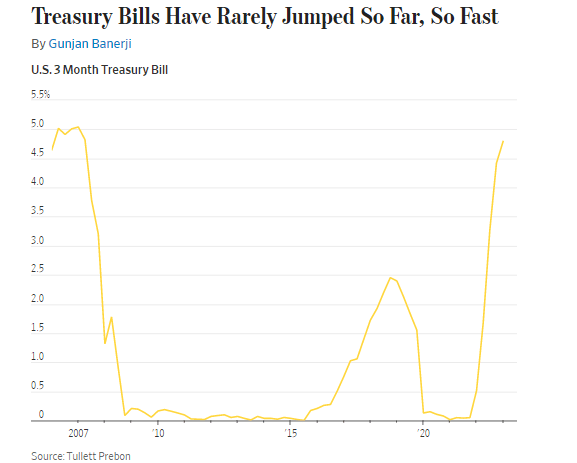

T-Bill Yield Rocketship

WSJ

I say that from experience as I bought a 1-year Treasury in Q3 last year just to see how it would go - I calculated that I paid about 13 basis points in spreads. With BIL, though, there's very little interest rate risk, and you will likely actually earn more as we progress through 2023 assuming traders' expectations (and the Fed's own dot plot outlook) is correct. You might even see an SEC yield near 5.5% come the middle of the year.

BIL Details: Low Duration, High Yield

Fed Watch: A Terminal Rate Above 5.25% Likely

CME Fed Watch

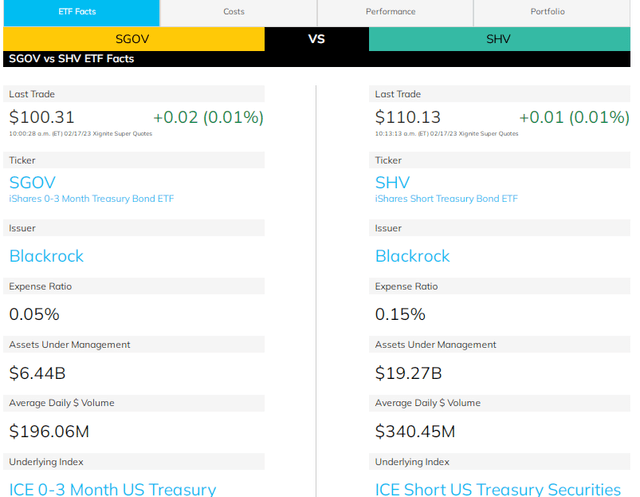

There are other plays as well: iShares 0-3 Month Treasury Bond ETF (SGOV) and iShares Short Treasury Bond ETF (SHV) are similar funds. I would give the nod to SGOV with its dirt-cheap 5-basis point expense ratio, though SHV has more AUM at nearly $20 billion, according to ETF.com. BIL leads the pack with more than $24 billion in AUM.

SGOV & SHV Attractive Cash Plays

The Bottom Line

I like holding a bit of dry powder here with stocks off to a strong start this year but now ebbing lower as rate hike fears resurface. That is exactly when you want to own something like BIL - it does not fall in value very much. Preservation of capital might be the theme of the back half of Q1 as the Fed aims to cool off a hot labor market and recent strong inflation readings.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.