Agnico Eagle Mines: Stock Weakness Offers A Good Opportunity

Summary

- Agnico Eagle Mines Limited posted a net income of $205.01 million in Q4 2022 or $0.45 per diluted share compared with $79.64 million or $0.17 in Q3 2022.

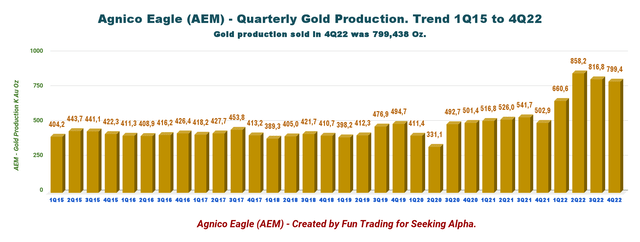

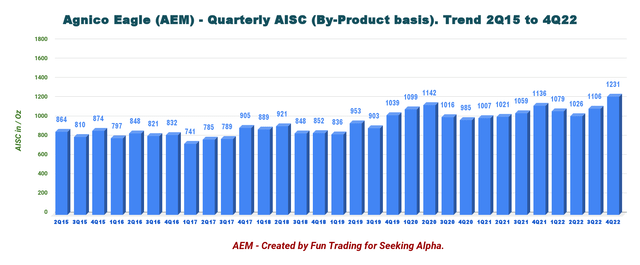

- Production in the fourth quarter of 2022 was 799,438 Au ounces above the 502,932 Au ounces produced last year. AISC per ounce was $1,231, a record high for the company.

- I recommend buying Agnico Eagle Mines Limited between $47.55 and $45, with possible lower support at $40.25.

- Looking for a helping hand in the market? Members of The Gold And Oil Corner get exclusive ideas and guidance to navigate any climate. Learn More »

Oat_Phawat

Part I - Introduction

Agnico Eagle Mines Limited (NYSE: AEM) is one of the preferred long-term gold miners I have covered quarterly on Seeking Alpha since 2014. The company reported its fourth-quarter 2022 and FY22 results on February 16, 2023.

Note: This article is an update of my article published on October 27, 2022.

As a reminder, on February 8, 2022, Agnico Eagle and Kirkland Lake Gold announced the completion of the merger of equals transaction.

Also, on November 14, 2022, Agnico Eagle and Pan American Silver (PAAS) agreed with Yamana Gold (AUY) to acquire all AUY assets.

Under the Binding Offer, each Yamana Share would be exchanged for approximately US$1.04 in cash, 0.1598 Pan American Shares and 0.0376 Agnico Eagle Shares, for an aggregate value of US$5.02 per Yamana Share. In addition, all outstanding restricted stock units of Yamana will be satisfied in cash.

The Arrangement would close late in the first quarter of 2023.

At closing, existing Pan American and Yamana shareholders would own approximately 58% and 42% of Pan American, respectively. Similarly, at closing, existing Agnico Eagle and Yamana shareholders would own approximately 93% and 7% of Agnico Eagle, respectively.

Note: On January 31, 2023, Pan American and Yamana shareholders overwhelmingly approved the Yamana Transaction at respective special meetings of shareholders. The Yamana Transaction is expected to close in March 2023.

Following closing, the Company will own 100% of the Canadian Malartic mine, 100% of the Wasamac project located in the Abitibi region of Quebec, and several other exploration properties in Ontario and Manitoba.

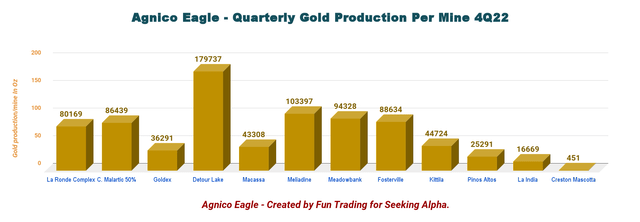

Canadian Malartic produced 86,439 Au Oz in 4Q22 (50%).

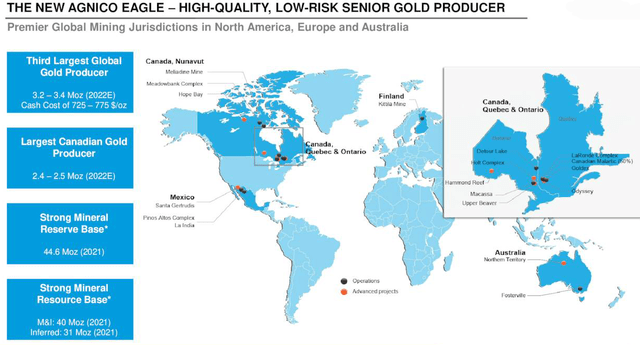

AEM Map Presentation (AEM's most recent presentation)

1 - 4Q22 and FY22 results snapshot

AEM posted a net income of $205.01 million in 4Q22, or $0.45 per diluted share, compared with $79.64 million, or $0.17, in 3Q22. Adjusted net income was $0.41 per share, and operating cash flow was $0.84 per share.

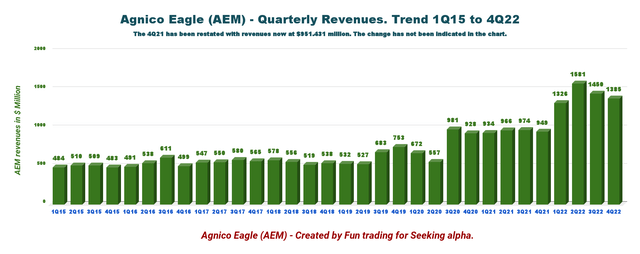

The company generated revenues of $1,384.72 million this quarter, well over the $951.53 million (restated) in 4Q21. Revenues were down 4.5% sequentially.

Production in the fourth quarter of 2022 was 799,438 Au ounces above the 502,932 Au ounces produced last year. All-in-sustaining costs ("AISC") per ounce was $1,231, a record high for the company, as we will see later. The cost increase is expected to affect 2023, but will decrease in 2024 and 2025. The company said:

The expected cost increases in 2023 are mostly related to inflationary pressures on labour, electricity, fuel and consumables. The company expects some easing on input costs to occur later in 2023 and, combined with increased gold production, unit costs are expected to be lower in 2024 and 2025,

Total payable gold production in 2022 was 3,280,731 Au ounces (including Kirkland Lake acquisition) at production costs per ounce of $821, total cash costs per ounce of $780, and AISC per ounce of $1,090. Those numbers were in line with the mid-point of 2022 production guidance and slightly above the top end of the cost guidance announced in February 2022.

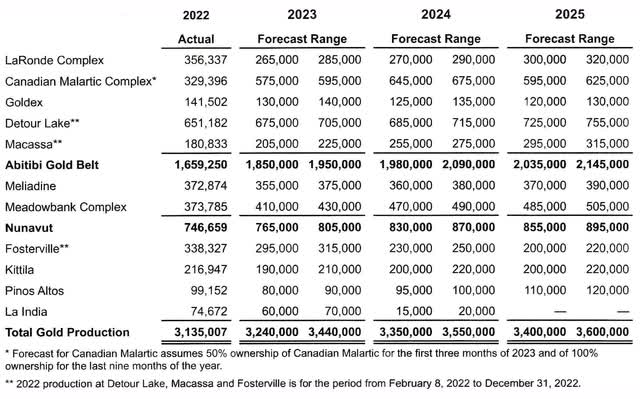

Agnico Eagle indicated 2023-2025 Guidance, including the recent Canadian Malartic portion of Yamana Gold, of excellent and consistent production for the next three years, going from 3,340K Au ounces in 2023 to 3,500K Au ounces in 2025.

AEM three years guidance (AEM Press release)

Also, Agnico Eagle Mines Limited reported that its gold mineral reserves increased by 9% to a record level of 48.7 Au Moz, primarily due to additions at Detour Lake and Micassa mines, as well as the successful conversion of mineral resources at several other operations. Those reserves will get higher with the Yamana Gold acquisition. In the press release:

Gold Mineral Reserves Increase 9% to Record 48.7 Moz at Year-End 2022 Driven by Drilling Success at Detour Lake, Replacement at Meliadine and First Declaration of Mineral Reserves at the Odyssey Project

Finally, Agnico Eagle reported that its Board of Directors had declared a quarterly cash dividend of $0.40 per common share in 4Q22, or a yield of 3.55%.

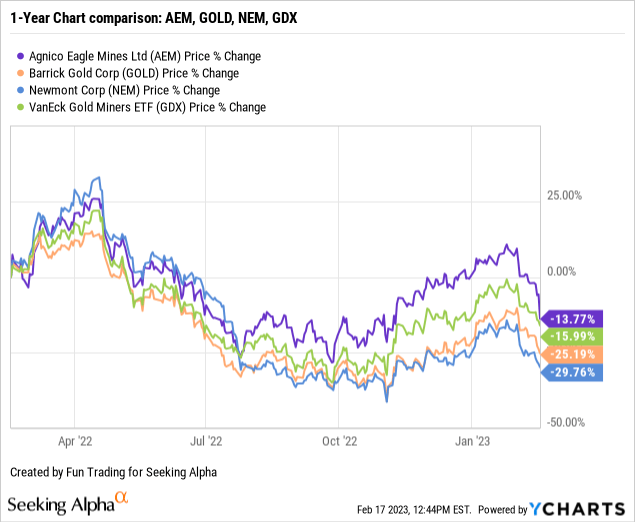

2 - Stock performance

Agnico Eagle, Newmont (NEM), and Barrick Gold (GOLD) have been my preferred long gold miners for years.

As shown below, AEM is down 14% on a one-year basis and has slightly outperformed the group, including the VanEck Gold miners ETF (GDX).

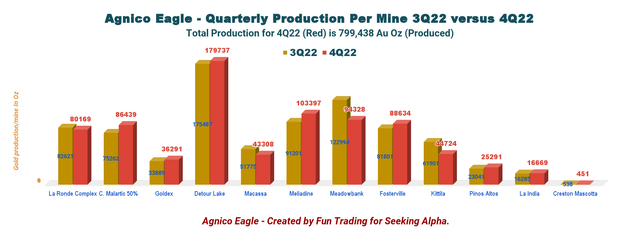

Agnico Eagle presently produces gold from 12 mines with details below:

AEM Quarterly production 3Q22 versus 4Q22 (Fun Trading)

Detour Lake, Macassa, and Fosterville mines are included in the chart above and represent the third total quarter production.

The project pipeline is vital, especially with Detour Lake, Odyssey, and Hope Bay.

3 - Investment thesis

Agnico Eagle Mines Limited is perhaps the best gold miner that we can find. The stock has been falling fast recently, not because of an intrinsic hidden weakness but primarily because of the FED action.

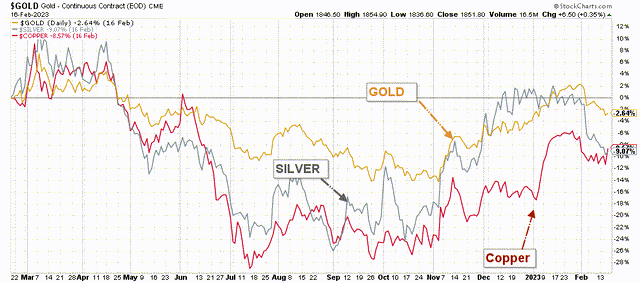

The CPI number was higher than expected; consequently, the gold price will struggle until H1 2023 or until the FED signals a pause. Furthermore, the U.S. dollar strength is here to stay for quite a while, adding more pressure on gold.

Thus, as I have said in my preceding articles, I recommend accumulating AEM on any weakness for the long term, as is the case now.

I am not expecting a solid uptrend unless gold turns extremely bullish and can cross $1,900 per ounce again, and it is not likely for the next few months.

AEM 1Year chart Au Ag Cu (Fun Trading StockCharts)

Thus, trading short-term LIFO at a minimum of 40% of your AEM position is crucial.

Agnico Eagle - Financials and Production history until 4Q22 - The Raw Numbers

| Agnico Eagle | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Total Revenues in $ Million | 949.1 | 1,325.7 | 1,581.1 | 1,449.7 | 1,384.7 |

| Net Income in $ Million | 101.1 | 109.8 | 275.9 | 79.6 | 205.0 |

| EBITDA $ Million | 388.4 | 458.0 | 747.7 | 518.8 | 568.6* |

| EPS diluted in $/share | 0.41 | 0.28 | 0.60 | 0.17 | 0.45 |

| Cash from operations in $ Million | 261.7 | 507.4 | 633.3 | 575.4 | 380.5 |

| Capital Expenditure in $ Million | 236.9 | 293.2 | 408.6 | 435.7 | 400.8 |

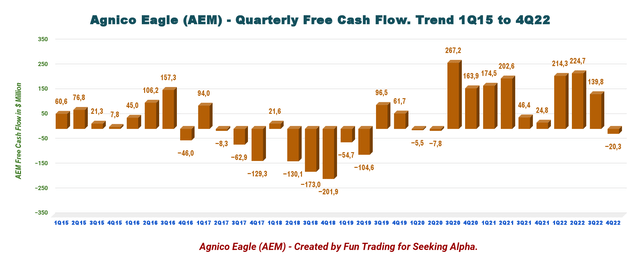

| Free Cash Flow in $ Million | 24.8 | 214.3 | 224.7 | 139.8 | -20.3 |

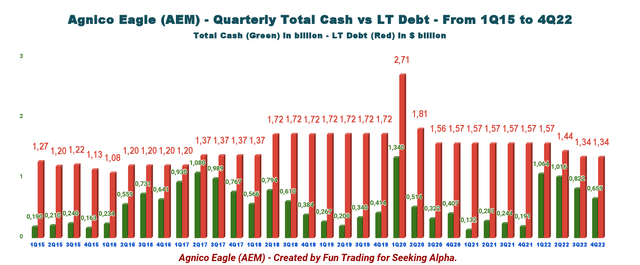

| Total cash $ Billion (including equity securities) | 0.19 | 1.06 | 1.02 | 0.82 | 0.66 |

| Total debt in $ Billion | 1.57 | 1.57 | 1.44 | 1.34 | 1.34 |

| Dividends per quarter in $/ share | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 |

| Shares outstanding diluted in millions | 245.5 | 385.6 | 456.8 | 456.3 | 456.4 |

Source: Company filing and Fun trading.

* Estimated by Fun Trading based on the press release only. Subject to change after the company releases its M&A files.

Part II - Gold Production Details

1 - Gold production

Agnico Eagle had gold production this quarter. Production was 799,438 Au Oz from 816,795 Au ounces the preceding quarter.

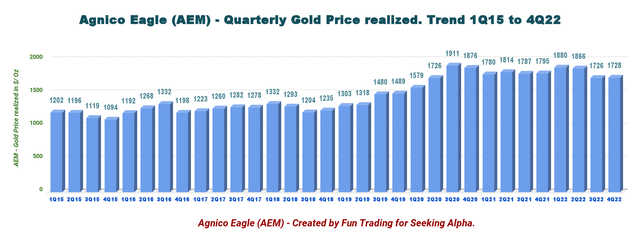

AEM Quarterly gold production history (Fun Trading) AEM included three new producing mines (Detour, Fosterville, and Macassa). The 4Q22 is the third full quarter of production, combining Agnico Eagle and Kirkland Lake Gold. AEM 4Q22 production per mine (Fun Trading) All-in sustainable costs, or AISC, were an average of $1,231 per ounce in 4Q22 compared to $1,136 in the prior-year period. Inflationary pressures did not help. AEM Quarterly Gold price history (Fun Trading)

Part III - Balance Sheet Analysis

1 - Revenues of $1,384.72 million in 4Q22

Revenues were $1,384.72 million, up 31.3% compared to the same quarter a year ago (before revised) and down 4.5% quarter over quarter.

The company posted a $205.01 million net income, or $0.45 per diluted share, in the fourth quarter of 2022. Adjusted net income was $0.41 per share or $185.4 million for the fourth quarter of 2022.

Note: The 4Q21 has been revised with a new revenue of $951.53 million.

AEM Quarterly Revenues history (Fun Trading) AEM Quarterly gold price history (Fun Trading)

2 - Free cash flow was estimated at a loss of $20.33 million in 4Q22

The trailing 12-month free cash flow ("FCF") is estimated at $558.40 million ("TTM"), and the free cash flow for 4Q22 was estimated at a loss of $20.33 million.

AEM Quarterly free cash flow history (Fun Trading)

3 - Net debt was $683 million in 4Q22

Agnico Eagle has solid financials with a low net debt of $683 million, down sequentially from $1,374 million last year.

Agnico Eagle's debt profile is what we want to see for a long-term investment.

AEM Quarterly Cash versus debt history (Fun Trading)

Agnico Eagle had total cash of $658.6 million in 4Q22 compared with $191.07 million as of December 31, 2021. Long-term debt was around $1,342.07 million (including current), compared with $1,341.6 million in 3Q22.

Part IV - Technical Analysis and Commentary

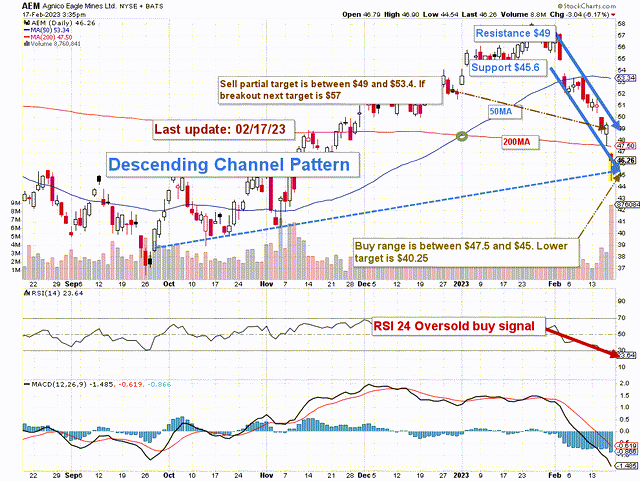

AEM TA Chart short-term (Fun Trading StockCharts)

Note: The chart has been adjusted for dividends.

AEM forms a descending channel pattern with resistance at $49 and support at $45.6. The RSI is now 24, an oversold situation with a buy signal. Looking at RSI history, we can see that 26 is quite a low number for AEM.

Descending channel patterns are short-term bearish in that a stock moves lower within a descending channel, but they often form within longer-term uptrends as continuation patterns. The descending channel pattern is often followed by higher prices, but only after an upside penetration of the upper trend line. The stock will continue channeling downward until it is able to break either the upper or lower trend line.

The trading strategy I recommend is to sell Agnico Eagle Mines Limited about 40% between $49 and $53.4 with a potential upper resistance at $57. On the other side, I recommend buying between $47.55 and $45, with possible lower support at $40.25.

I still expect the miners to experience frequent wild swings for the next several months until the Fed signals a pause in interest rate hikes, which could happen in 3Q23 or a bit later. Look at this period as an excellent opportunity to add.

However, it is crucial to allocate a sizeable portion of your investment in Agnico Eagle Mines Limited to trade short-term LIFO and take advantage of the volatility. About 40% is reasonable.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below to vote of support. Thanks.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Disclosure: I/we have a beneficial long position in the shares of AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade short-term AEM and own a long-term position, as explained in my article.