TIP: Don't Be Put Off By Falling CPI

Summary

- The decline in investor interest in iShares TIPS Bond ETF likely reflects the widespread view that CPI is set to continue falling, which undermines the appeal of the ETF as an inflation hedge.

- However, TIP's returns depend much more on capital gains and losses than they do on the CPI, and falling CPI may well trigger a reversal in the ETF's performance.

- The current 1.8% real yield on TIP is in line with the real annual returns seen on USTs since WWII, while the real GDP growth outlook is much weaker.

- If real yields were indeed to fall back to their 2021 lows of -1.3% over the next 12 months, TIP investors would see gains of around 22% in real terms.

Torsten Asmus

By their very nature, Treasury Inflation Protected Securities benefit from high and rising inflation, as these bonds pay coupons that correspond to U.S. CPI. However, this does not mean that falling inflation is necessarily negative for TIPS. Rising CPI undermined TIPS in 2022, as the Fed responded to the inflation threat with aggressive rate hikes, causing a simultaneous rise in bond yields and fall in inflation expectations. The stage is now set for a reversal in performance, as falling CPI allows monetary conditions to ease.

The iShares TIPS Bond ETF (NYSEARCA:TIP) should generate strong returns in this environment. While the exchange-traded fund ("ETF") is at risk from a deflationary credit crunch, any weakness would further drive up already-strong long-term real total return prospects, which are already high based on the real GDP growth outlook.

The TIP ETF

The TIP tracks the performance of U.S. Treasury inflation-protected securities, with a weighted average maturity of 7.3 years and an effective duration of 6.8 years. The current real yield on the TIP is 1.8.%, which is what investors should expect to receive per year over the long term after inflation, less the fund's expense fee of 0.19%. However, there is also the potential for significant capital gains if either long-term bond yields fall, or long-term inflation expectations rise. The TIP is the largest inflation-linked bond ETF, with USD22.1bn in assets under management, although the fund has lost almost 30% of its assets since they peaked in late-2021, which coincided with the highs in the TIP's price.

CPI Decline Positive For Long-Term Inflation

The decline in investor interest in the TIP likely reflects the widespread view that inflation is set to continue falling, which undermines the appeal of the TIP as an inflation hedge. However, TIP's returns in any given year depend much more on capital gains and losses than they do on the CPI, and falling CPI may well trigger a reversal in the performance of the ETF.

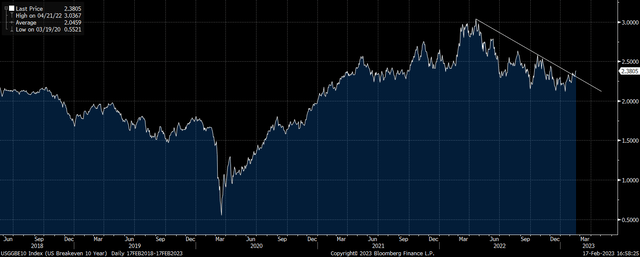

US 10-Year Breakeven Inflation Expectations (Bloomberg)

Long-term inflation expectations appear to be breaking to the upside after being on a downtrend over the past year as investors anticipate the end of the Fed's hiking cycle. While we have seen renewed upside pressure on short-term rates, the precarious economic outlook will make it increasingly difficult for the Fed to avoid rate cuts over the next 12 months. Further economic weakness is likely to cause a simultaneous fall in bond yields and rise in inflation expectations as investors anticipate reflation, which should lead to strong gains for the TIP.

1.8% Real Yields Is High In The Context Of Weak Real GDP Growth

We cannot rule out that the Fed maintains its tight monetary stance longer than expected at the cost of continued upside pressure on bond yields and renewed downside pressure on inflation expectations, which would see the TIP's bear market continue. However, any further upside in yields would raise the risk of a deep recession and credit crunch, which would necessitate a return to deeply negative real bond yields.

The current 1.8% real yield on the TIP is in line with the real annual returns on US Treasuries since WWII. Over this period real GDP growth has averaged 3.1%, meaning that real borrowing costs have been set below the rate of real GDP growth by around 1.3%. Even if productivity were to rise in line with its long-term average, the stagnating working-age population alone shaves at least 1 percentage point off future real GDP growth, suggesting that real UST yields should sit around 0.8% based on historical averages. I expect real GDP growth to average around zero over the coming years, which suggests real UST yields should be around -1.3%, where they were 18 months ago. If real yields were indeed to fall back to -1.3% over the next 12 months, TIP investors would see gains of around 22% in real terms.

We could even see real yields fall deeper into negative territory if policymakers respond to any economic weakness with ballooning fiscal deficits. The reason being that Treasury funding costs would explode relative to tax revenues, potentially necessitating some form of Fed-imposed ceiling on Treasury yields as was employed to fund the cost of WWII. During this period real 10-year UST yields averaged around -4%.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TIP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.