Equinix Q4 Earnings: Too Pricey At The Moment

Summary

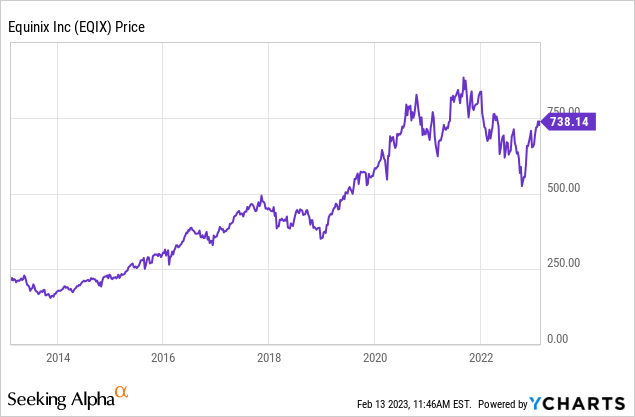

- Equinix has been one of the best-performing REITs for the past decade.

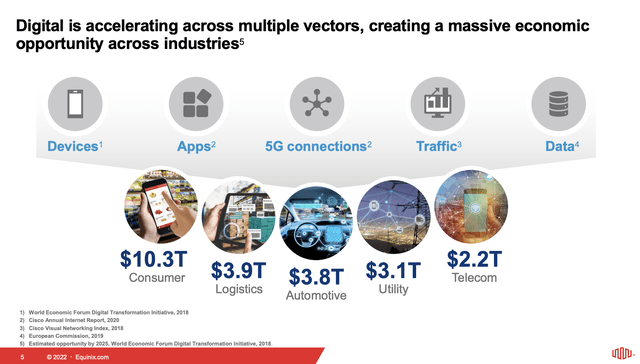

- The company has massive market opportunities and continues to benefit from strong tailwinds.

- Its fourth-quarter earnings result showed solid growth but guidance for bottom line looks a bit soft.

- The current valuation seems expensive compared to peers.

- I rate the company as a hold.

mesh cube

Investment Thesis

Equinix (NASDAQ:EQIX) has been one of the best-performing REITs (real estate investment trusts) in the past decade, with shares up 250% during the period. The company has been benefiting from the acceleration of digital transformation which significantly increased the demand for data centers, as the amount of data circulating sky-rocketed. The market opportunity for the company remains huge and continues to grow as new technologies like AI (artificial intelligence) and autonomous vehicle emerges. However, the share price has rallied over 40% in the past few months and the current valuation seems quite elevated, with multiples meaningfully above peers. Its AFFO guidance for FY23 is also pretty soft. I don’t see much further upside potential at the moment therefore I rate EQIX stock as a hold.

Strong Fundamentals

Equinix is the world’s leading company for digital infrastructures. The company owns multiple data centers internationally and leases them out to customers such as Amazon (AMZN) and Microsoft (MSFT) which use them for their cloud services. The company currently has 249 data centers across 32 countries with over 10,000 customers. This creates a strong interconnected ecosystem that offers strong reliability and consistency. This also gives the company a significant competitive advantage as it is hard for others to compete with such a massive coverage and reach. The company claimed it invested $35 billion in order to reach the current scale.

Data center is an extremely huge market that continues to grow rapidly. According to Allied Market Research, the global TAM (total addressable market) for data centers is forecasted to grow from $187.4 billion in 2020 to $517.2 billion in 2030, representing a solid CAGR (compounded annual growth rate) of 10.5%. The market is continuing to benefit from strong tailwinds. Digital transformation is one of the biggest trends in this decade and it is not slowing down any time soon.

The shift to the cloud is still in the early innings as the industry is expected to grow at a CAGR of 15.7% in the next few years. IoT (internet of things) is getting more popular with a lot of our products now being connected (e.g. connected vehicles). Not to mention the opportunity in AI which has been the latest hot topic with Microsoft and Google (GOOG) (GOOGL) both going at each other. I believe the market is well-positioned to benefit from these trends and should also continue to drive Equinix’s growth moving forward.

Charles Meyers, CEO, on digital transformation:

In the current macroeconomic environment, we believe spending on digital transformation will remain robust for two simple reasons. First, as companies work harder for each incremental revenue dollar, digital is seen as a critical driver of competitive differentiation, accelerating time to market and enabling product set evolution. And second, digital transformation is increasingly a means to do more with less, enabling businesses to reduce costs and drive operating leverage while simultaneously becoming more agile and responsive in serving their customers.

Q4 Earnings

Equinix just reported its fourth-quarter earnings and the results are solid. The company reported revenue of $1.87 billion, up 10% YoY (year over year) from $1.71 billion. The growth is mainly driven by strong demand for data centers and increased pricing due to higher energy costs. As most of the increase in costs is passed on to customers, costs of revenues only grew 6.6% from $910.4 million to $970.7 million. This resulted in gross profit increasing 13.1% from $795.9 million to $900.1 million. The gross profit margin widened 150 basis points from 46.6% to 48.1%.

The bottom line was also solid as the company managed to be disciplined on spending. Operating expenses were up $617.9 million, up 13.2% YoY compared to $546.2 million. Most of the increase is attributed to G&A (general and administrative) expenses which were up 16.4% to $400.2 million. Partially offset by S&M (sales and marketing ) expenses which were up 8.9% to $207.2 million. AFFO (adjusted funds from operations) was $658 million compared to $564 million, up 17% YoY. AFFO per share was $7.09, up 14% YoY. Due to higher interest expenses and other expenses, adjusted EBITDA grew at a slower pace of 6% YoY to $839 million. Adjusted EBITDA margin was down 100 basis points from 46% to 45%. Tax expenses were also up therefore net income only increased by 4% YoY to $128.9 million with a net income margin of 6.9%. The company also initiated guidance for FY23. It expects revenue growth to be 12% to 14% while AFFO and AFFO per Share to increase by 6% to 9% and 4% to 7% respectively (around 3 percentage points higher on a constant currency basis).

Investor Takeaway

Overall, I think this quarter’s results were decent but guidance seems a bit soft, especially for the bottom line which signals a deceleration in growth. Equinix has strong fundamentals and tailwinds but the current valuation isn’t justified after the rally in my opinion. The company is trading at a fwd price/AFFO ratio of 24.9x which is quite elevated. This is meaningfully above other specialized REITs such as Digital Realty (DLR) and American Tower (AMT). They have a fwd price/AFFO ratio of 18x and 22.1x respectively, representing a discount of 27.7% and 11.2%. With such a lofty valuation and just high single-digit bottom-line growth for FY23, I do not see much upside potential from the current price. Therefore I rate Equinix as a hold and will wait for a better price point before considering getting in.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.