Pinterest: Underlying Strength Hidden By Macro Weakness

Summary

- User growth issues are largely behind Pinterest and engagement appears to be improving rapidly.

- An increasing supply of ad inventory is likely to continue being offset by relatively weak advertiser demand.

- Even though the stock is up significantly off the lows, Pinterest remains undervalued.

5./15 WEST

Pinterest (NYSE:PINS) continues to disappoint from a revenue growth perspective, but this is primarily the result of market conditions, as evidenced by the performance of peers. User growth issues are now behind Pinterest and continued investments in adtech and shopping should lead to revenue growth in time. This, along with a shift in focus to profitability, points towards strong free cash flow generation, although this may not be fully apparent until 2024.

Pinterest currently has four strategic priorities:

- Growing monetization and engagement per user

- Integrating shopping into the core of the product experience

- Improving operational rigor and in turn improving margins

- Strengthening their position as a positive and brand-safe platform

The company is slowly making progress in these areas, although this is somewhat difficult to see given macro headwinds.

Advertising

Pinterest continues to work on their ad tech and measurement solutions in order to improve return on ad spend for advertisers. Pinterest launched a conversion API in Q4 and recently integrated this API with Shopify (SHOP) so that merchants can use the conversion measurement tool. While Pinterest's integration efforts with Shopify are an important part of making the platform more shoppable, it is interesting to note that when Shopify discusses social media partners, Pinterest is rarely mentioned.

In January, Pinterest announced a privacy safe clean room solution in conjunction with LiveRamp and Albertsons (ACI). This provides a space where brands can combine first-party data with Pinterest's data in a privacy safe environment. LiveRamp offers a data enablement platform that is focused on privacy. Their solutions make data safe and easy for customers to use, and include data onboarding and data transfer. Albertsons is a grocery retailer and is the first advertiser trialing the new solution.

Pinterest also launched ad load management with whole page optimization in Q4. This varies ad loads based on context, increasing total ad load when the user demonstrates commercial intent so that the user experience is not negatively impacted. Based on initial testing, this improved search ad relevance while reducing CPAs for advertisers. Pinterest expects these types of innovations to allow monetizable inventory growth to outpace overall engagement gains.

Pinterest is also trying to improve advertising coverage across the acquisition funnel. In the past Pinterest has primarily been a top of funnel advertising tool, but revenue is now roughly evenly split across the funnel (brand, consideration and conversion). Pinterest believes that advertisers who are taking a full funnel approach are seeing more success than those who focus on only one campaign objective. In 2022, advertisers adopting a multi-objective media strategy saw up to a 50% improvement in sales lift compared to those who use one objective.

As a result of some of these efforts, Pinterest believes they are gaining share of advertisers' wallets, particularly larger and more sophisticated advertisers. Third-party demand also continues to be an underutilized lever, particularly in comparison to other platforms. Demand could be brought in by retail media networks, DSPs and other third parties to supplement direct sales. Pinterest has already done work around retail media networks and believe there are still more opportunities there.

Engagement

Engagement continues to be a focus area for Pinterest, and the company is making progress in this area. Much of this effort is focused on serving users with content that is more personalized, relevant and engaging. Sessions are growing significantly faster than users, which should improve per user monetization in time. The ratio of weekly active to monthly active Pinterest users is now at 61%, the highest ever.

Part of this increase in engagement is due to the rise of video content. Pinterest continues to grow their supply of videos from multiple sources, including creators, brands and publishers, with the supply of video content increasing 30% sequentially in Q4. It is hoped that the addition of quality inspirational content will deepen engagement amongst Gen Z in particular.

Pinterest has stated that over 10% of user engagement is on video and that more than 30% of revenue is generated by short-form video. This is somewhat surprising as management suggested in 2021 that videos were a lightly monetized surface that was detracting from growth.

Shopping

One of the most promising aspects of Pinterest's platform is the commercial intent of users, although this is something that Pinterest is still trying to capitalize on. 50% of users view Pinterest as a place to shop and yet shoppable content has not been integrated into core experiences.

Pinterest eventually wants to make every pin shoppable. Part of this effort involves utilizing computer vision technology to make video content more shoppable, in a similar manner to what Pinterest has done with static images. For example, Pinterest's new computer vision model has over 1 billion parameters and has led to an 8% increase in visual search shopping relevance.

Pinterest is also trying to reduce friction during the purchasing process. One initiative in this area is taking users directly to the product detail page on the merchant's app. Pinterest continues to deploy their mobile deep linking format on shopping ads. During the holiday period, MDL accounted for 40% of Pinterest's shopping ad revenue.

Financial Analysis

Pinterest's revenue increased by 4% YoY in the fourth quarter, roughly in line with guidance. International markets and large retail advertisers in the US were areas of strength in the fourth quarter. There were also some emerging verticals, including automotive, travel and financial services, that posted strong revenue growth. CPG advertisers and small and mid-market advertisers in the US contributed to relatively weak growth.

Revenue growth in the first quarter of 2023 is expected to be in the low single-digit percentage range YoY. So far, revenue growth in the first quarter of 2023 is trending in line with Q4. SMBs in the US are expected to provide an ongoing headwind due to the macro environment. Pinterest has made progress in increasing ad inventory and reducing CPAs, but these advertisers remain price-sensitive.

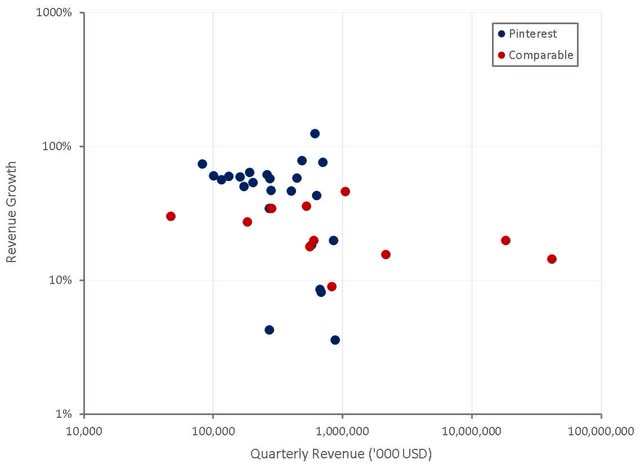

Figure 1: Pinterest Revenue Growth (source: Created by author using data from company reports)

While Pinterest's weak growth is likely disappointing investors, it must be viewed in the light of Apple's (AAPL) ATT initiative, an uncertain macro environment and extremely difficult comparable periods in 2021. Relative to peers, Pinterest's revenue growth actually continues to be quite strong, and this is primarily due to the fact that Pinterest is still in the process of monetizing their user base and improving their ad tech. Meta (META) has a far more optimized business, leaving far fewer easy growth levers to offset macro headwinds.

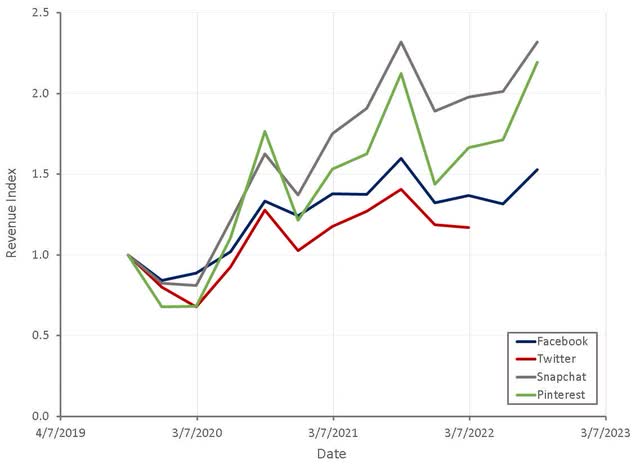

Figure 2: Digital Advertising Platform Revenue (source: Created by author using data from company reports)

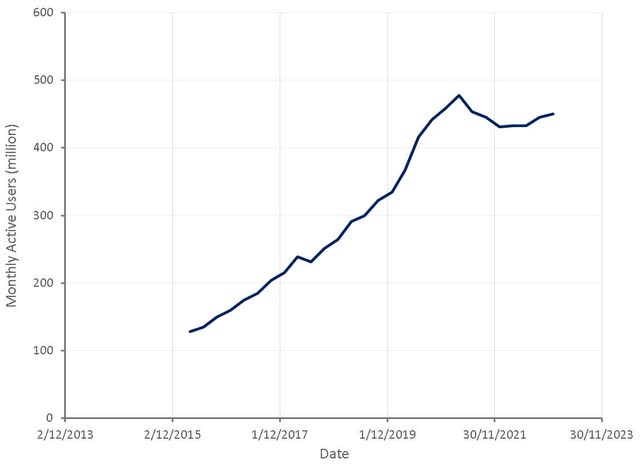

While Pinterest's days of rapid user growth appear to be behind them, their user base continues to grow and there is a large opportunity to increase engagement. MAUs increased approximately 4% YoY in the fourth quarter to 450 million. Mobile app users increased 14% over the same period, which is important given that 80% of impressions and revenue come from this user group.

Gen Z is Pinterest's fastest growing cohort, increasing by double digits in the fourth quarter. Gen Z sessions also grew much faster than sessions from other demographics. This is important as penetration of younger user groups has been a perceived weakness for Pinterest. Pinterest believes they are gaining traction largely on the back of video content. Nearly half of all new videos pinned in Q4 were from Gen Z users.

In addition to Pinterest's 450 million MAUs, there are hundreds of millions of logged in users who visit Pinterest episodically. Pinterest are working on bringing these users to the platform on a more regular basis using machine learning driven recommendations and by building new experiences.

Figure 3: Pinterest Monthly Active Users (source: Created by author using data from Pinterest)

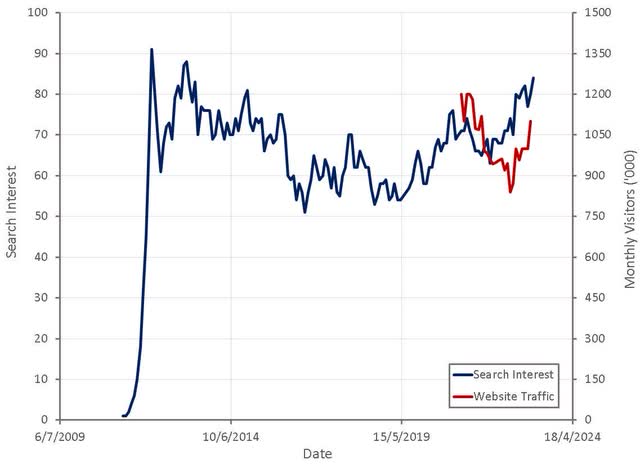

Both internet search interest and website traffic indicate that Pinterest's post-pandemic hangover and problems related to changes in Google's search algorithm are in the past. While indicators of usage outside of the app are largely irrelevant to near-term revenue, it is potentially important to top of the funnel user acquisition.

Figure 4: Pinterest Search Interest and Website Traffic (source: Created by author using data from Google Trends and similarweb)

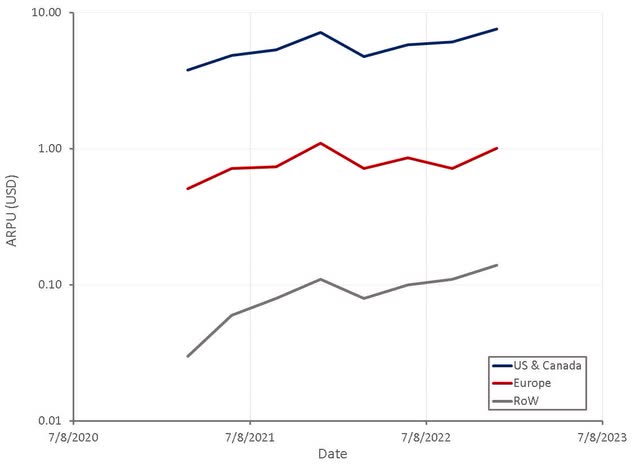

2022 likely saw improvements in engagement and increases in ad inventory offset by declining advertiser demand and willingness to pay for actions. ARPU has been steadily increasing across geographies, although Europe has faced headwinds over the past 12 months. In the RoW group, rapid increases in user monetization are being offset to some extent by growth in unmonetized and low-value users.

Figure 5: Pinterest ARPU (source: Created by author using data from Pinterest)

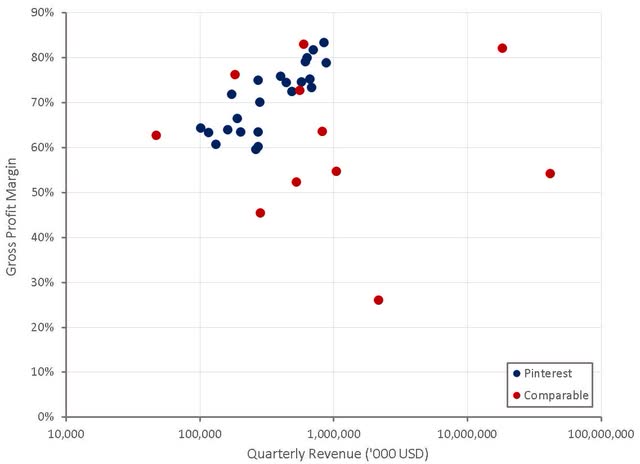

Pinterest's gross margins ticked up in the fourth quarter due to a reduction in infrastructure costs and optimization efforts. It is not really clear how Pinterest's gross margins will evolve going forward. Machine learning initiatives aimed at improving the user experience are likely to weigh on margins, as are content costs as Pinterest continues to focus on high-quality video content. This will be offset by optimization efforts and improved monetization of the user base.

Figure 6: Pinterest Gross Profit Margins (source: Created by author using data from company reports)

Pinterest is taking actions to control costs, including:

- Reduction in the pace of hiring

- Reduction in the number of recruiting staff

- Reduced infrastructure spend

- Rationalization of their real estate portfolio

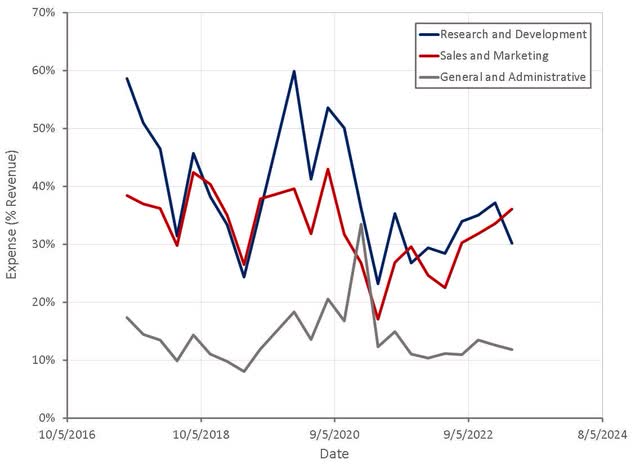

As a result of these types of actions, Pinterest expects EBITDA margins to expand in 2023, despite relatively weak growth. The burden of R&D expenses will naturally decline over time as Pinterest's platform matures. The company needs to reduce the burden of sales and marketing expenses though. Some of this will come naturally when the macro environment improves, but Pinterest also needs to improve sales productivity, which may come from greater utilization of third-party demand.

Figure 7: Pinterest Operating Expenses (source: Created by author using data from Pinterest)

Valuation

Pinterest ended the fourth quarter of 2022 with approximately 2.7 billion USD in cash, cash equivalents and marketable securities. Management plans on utilizing some of this cash balance to execute a stock buyback program of up to 500 million USD, to help mitigate dilution from stock-based compensation.

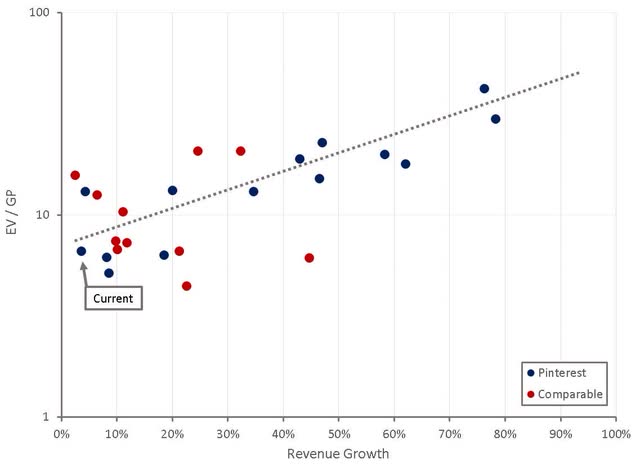

Based on an estimated normalized profit margin, Pinterest's PE ratio is broadly in line with the S&P500, which doesn't make sense given that many companies are currently overearning and that Pinterest has far better growth prospects than most companies. Based on a discounted cash flow analysis, I estimate that Pinterest's stock is work approximately 50 USD per share.

Social media platforms continue to be out of favor with investors and this is likely to continue in 2023. With greater financial discipline and a return to more robust growth in the next 1-2 years, Pinterest's stock should do well over a 5+ year period.

Figure 8: Pinterest Relative Valuation (source: Created by author using data from Seeking Alpha)

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PINS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.