Toll Brothers: The Price Is Too High, Margins Are Too Low

Summary

- Toll Brothers has grown to become one of the top Homebuilders in the US by focusing on the affordable luxury market.

- The stock market is pricing in a high growth rate or higher than historical margins for the company.

- But I question if the company can continue to grow and create shareholder value leading me to believe that the stock is overvalued.

Bulgac/E+ via Getty Images

Toll Brothers, Inc. (NYSE:TOL) is a national homebuilder that builds homes for affluent individuals and families. My last article was on the homebuilder D.R. Horton (DHI), and the difference in the median home sold is striking. In 2022, DHI sold U.S. homes at an average price of $385,000 per home, while Toll Brothers had an average sale price of about $923,000. So, Toll Brothers is definitely high end, or as the company describes it, "affordable luxury" (my new favorite oxymoron). In 2022, TOL did over $10B in revenue, $1.5B in operating income (~15% margins), and netted $1.2B (~13% margins).

Although the company has performed well in recent years, the current stock price is currently too rich for me. The company has some flaws which concern me, like historically low return on capital and low operating margins. The market appears to be pricing in a high growth rate or believes that TOL will be able to operate at higher than historical margins.

Homebuilding Industry Summary

In my last article, I wrote an in-depth analysis of the industry and its current outlook. For the full analysis, please check out the Industry Outlook section of that article here. Here is a very quick summary of that section.

The homebuilding industry has some major short term headwinds, such as high inflation, high home prices, and the threat of a recession. All of these factors lead to reduced housing demand in the short term and therefore reduced sales for homebuilders.

On the other hand, the long term outlook is positive. It is widely known that the US currently has a housing shortage of over 4 million homes. That's incredibly positive for homebuilders as they will be necessary to add to the supply of homes in order to shrink the shortage. This is a major tailwind for the industry as a whole.

TOL Outlook

How does the industry outlook affect Toll Brothers? Well, management believes that the headwinds are real and will affect them in the short term.

"For full fiscal year 2023, we are projecting new home deliveries of between 8,000 and 9,000 homes with an average price between $965,000 and $985,000."

This guidance indicates lower revenue for the company (between $7.7B and $8.9B) as they completed over 10,000 deliveries in 2022, even with the average price per home rising.

Management doesn't guide for the long term, and no one really knows the future. But even though the longer term outlook is positive for the industry, I'm not as excited for Toll Brothers in particular due to their specific market within the homebuilding industry. The housing shortage is unlikely to be dramatically positive for the company as its affluent customers can afford homes and can afford to overpay. My industry research indicated that the shortage mainly lies in entry-level homes under 1,400 square feet. Unfortunately for Toll Brothers, its target customer will not be in this demographic, and therefore, TOL may not be the largest beneficiary of the industry tailwind.

Valuation

Growth

What the growth looks like for Toll Brothers is the biggest question that I have about the company. For a homebuilder that has a specific target customer, it is difficult to project how many more markets the company can enter successfully.

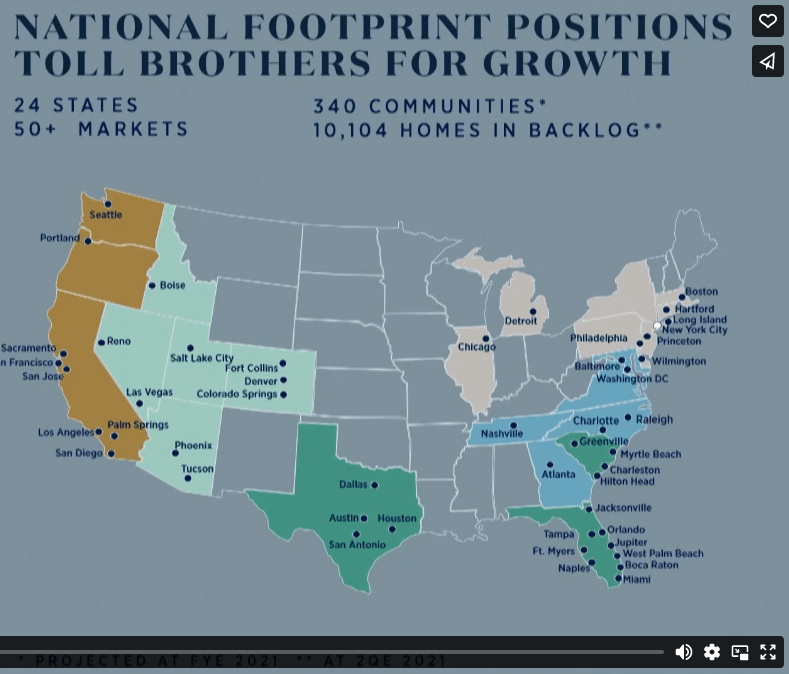

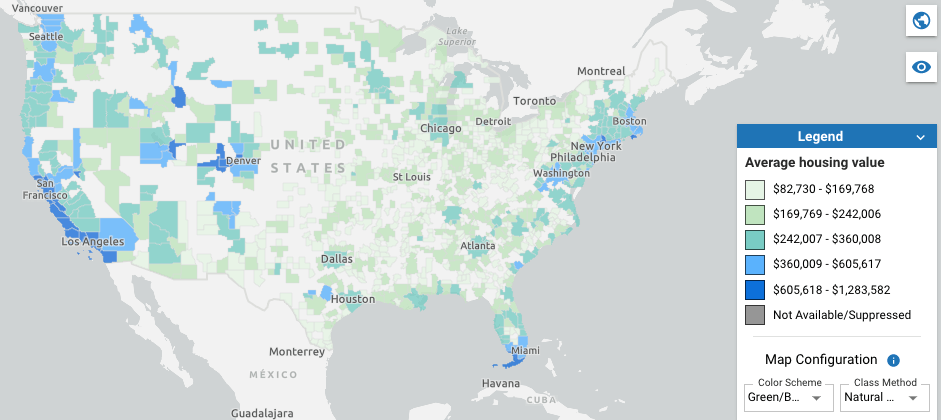

Based on the next two graphics, Toll Brothers is located in almost every major area with housing values above $400k, with the exception of a couple of areas in the Upper Midwest.

TOL 2021 Investor Presentation Census.gov

The company appears to be nearing the end of its natural growth in the United States and will need to become more creative in its efforts if it wants to continue to grow its top line.

Profitability and Reinvestment

Although growth is the biggest question for TOL, I'm not sure that the amount of growth is as relevant as the profitability and reinvestment efficiency of the company. This is due to the fact that growth is only good if it creates value for the company.

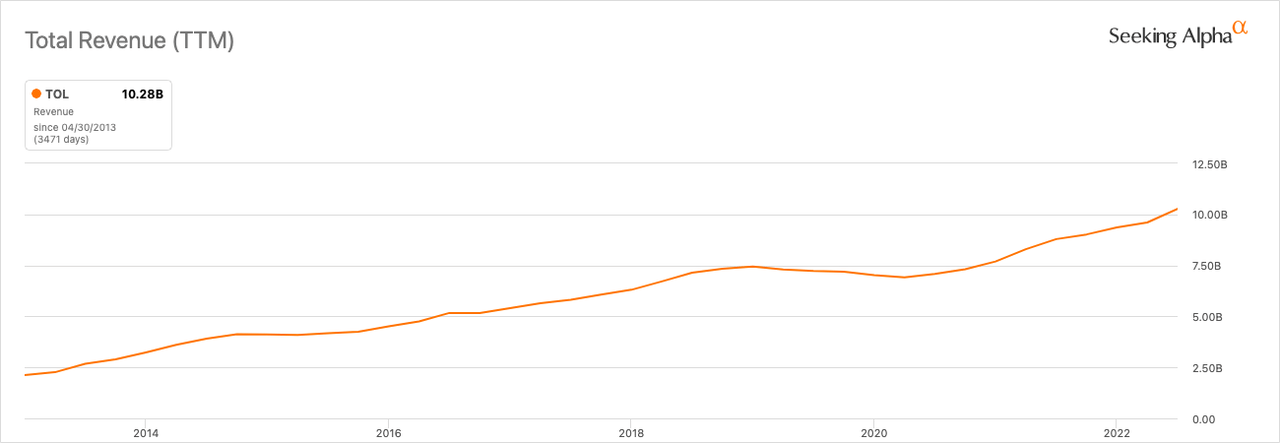

As shown below, the revenue growth over the last 10 years for Toll Brothers has been great.

Seeking Alpha

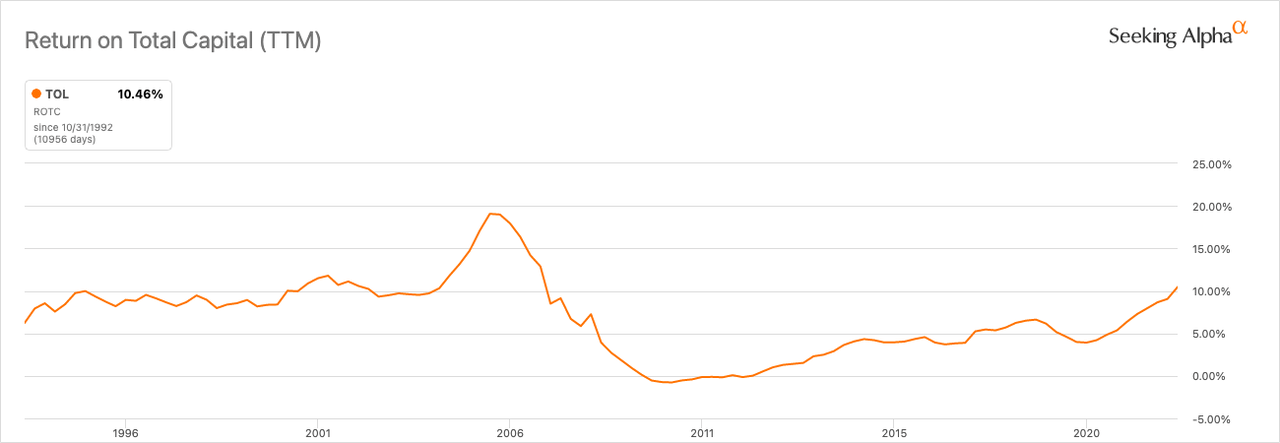

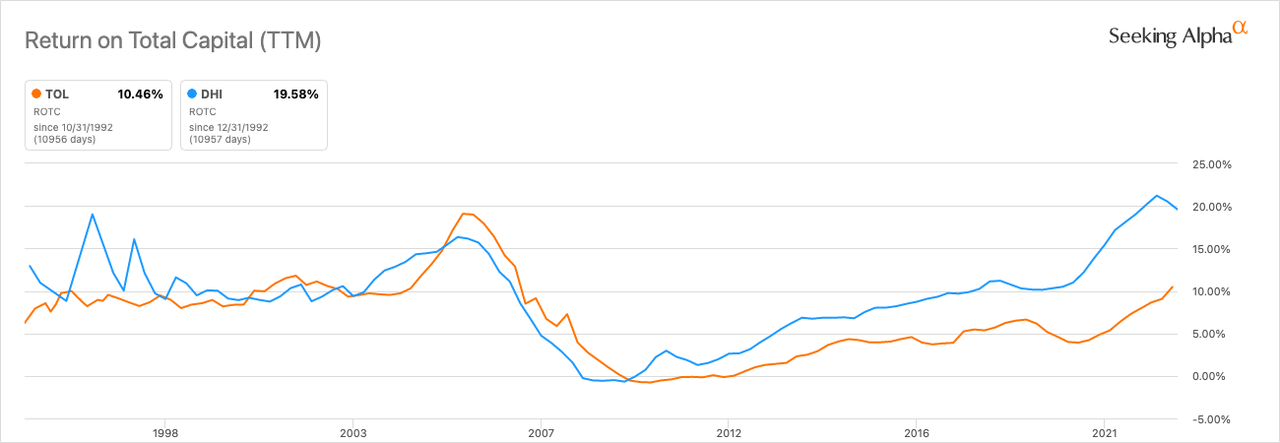

But it has come at a cost. Their return on capital has almost halved since the Great Recession, indicating that their growth has come but in terms of less profitable projects.

Seeking Alpha

When compared to the largest homebuilder in the US (DHI), we can see the difference in returns that each company has generated. Prior to the Great Recession, both companies had similar returns. But now there is a large gap between the two companies. This is counter to my expectations of a luxury homebuilder, as I would think that the company building homes at a higher price point would yield higher margins along with a higher return on capital.

Seeking Alpha

In the 2021 investor presentation, management cited their shift from luxury to affordable luxury. This is shown in its revenue growth figures; as its return on capital suggests, the company hasn't figured out the efficiency part of the formula for the new markets that they have entered.

In the same presentation, management stated that they are focused on their ROE and believe that they can achieve an ROE of 20% sustainably. Although TOL did hit this target in 2022, I am skeptical of the long term sustainability of these returns. This is because home prices have skyrocketed recently, which could be the main factor in their returns being higher than normal. In other words, I want to see it before I believe it.

DCF Model

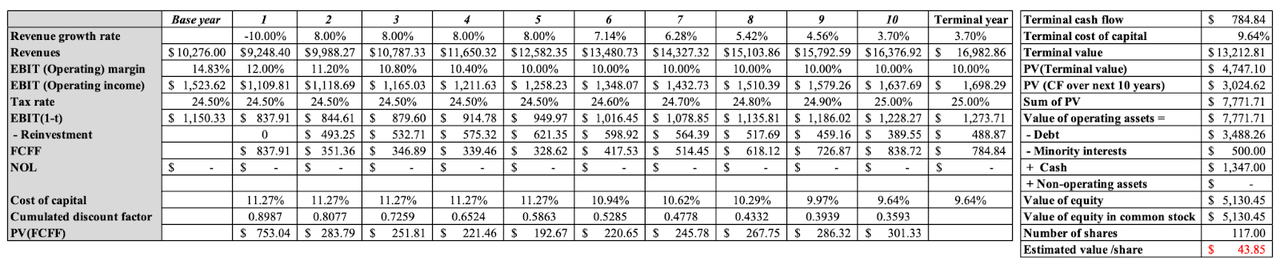

Author's Work

Highlights of the Model

For my valuation, I used a -10% top line growth rate for year one to be in line with management's expectations in 2023. I built in an 8% growth rate from years 2-5 as I believe that management will be able to grow, but likely from selling housing at lower price points.

I scaled their operating margins down from 15% to 10% by year 5, as 10% is the company's historical margin (10-year average).

Based on my model, I estimate that Toll Brothers is worth ~$44/share.

Risks/Question Marks

How much growth can the company generate? And how efficiently can they manage these new projects? My main concern is that the company is reaching for growth. They are taking on less profitable projects and entering markets outside of their expertise, which is hindering their efficiency. In the '80s and '90s, Toll Brothers consistently had margins of 15% and higher. But today, the company is struggling to be over 10% year after year. Management seems to believe that their 2022 margin of ~15% can be sustained, but based on their more recent performance, I am skeptical.

As with all homebuilders, the macro environment is a highly important factor and should always be considered a risk as it can be highly unpredictable.

The last risk is the question of how much market share the company can gain. In my research, it was particularly difficult to find specific metrics for homebuilders who build specifically for luxury buyers. Therefore, it was difficult to determine how large the market is, how many homes are sold in Toll Brothers' price range, and what the potential is for the company. For this reason, many of the assumptions embedded in my model may be wrong.

Bottom Line

Toll Brothers has grown tremendously over the past 10 years, but I question the extent that they will continue to grow efficiently and create shareholder value. My DCF Model estimates TOL to be worth $43.85/share. As my valuation is about 25% lower than the current market price, I'm placing a sell rating on TOL.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.