Fixing Inflation: The History And Opportunities

Summary

- A historical look at prior inflationary periods (1910s, 1940s, and 1970s) to see what they have to say about the 2020s.

- An analysis of two very different types of money creation: fiscal-driven inflation and lending-driven inflation.

- An outlook on investment opportunities for the 2020s decade.

- Looking for a helping hand in the market? Members of Stock Waves get exclusive ideas and guidance to navigate any climate. Learn More »

NNehring/E+ via Getty Images

This article examines the topic of inflation, to take a data-driven look at the causes and fixes for inflation over the past century.

Inflation is currently on a downtrend, but with some of the underlying problems still unresolved, it risks a resurgence in the years ahead.

Money Supply and Price Increases

Price inflation happens when too much money chases too few goods and services.

On one side of this, a sharp and persistent increase in the broad money supply is the biggest quantifiable correlate with price inflation. On the other side, sharp changes in the supply of goods and services (e.g. a major boom or a major loss in productive capacity) also significantly affect price inflation.

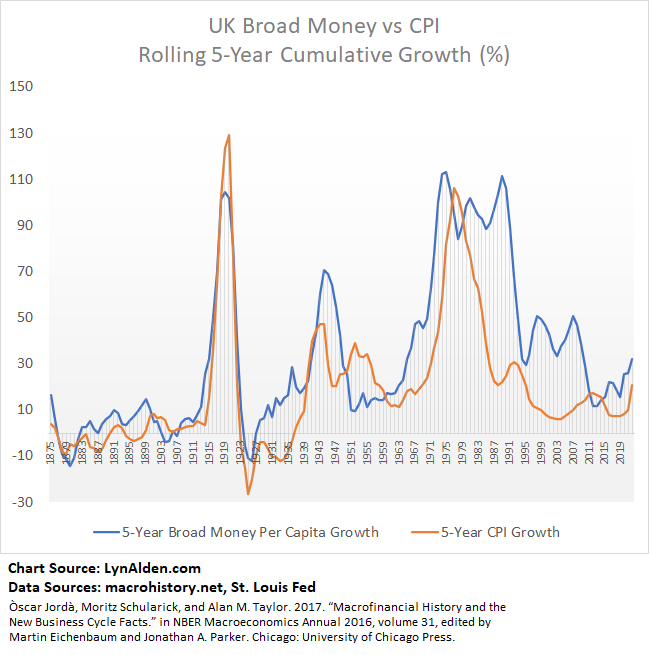

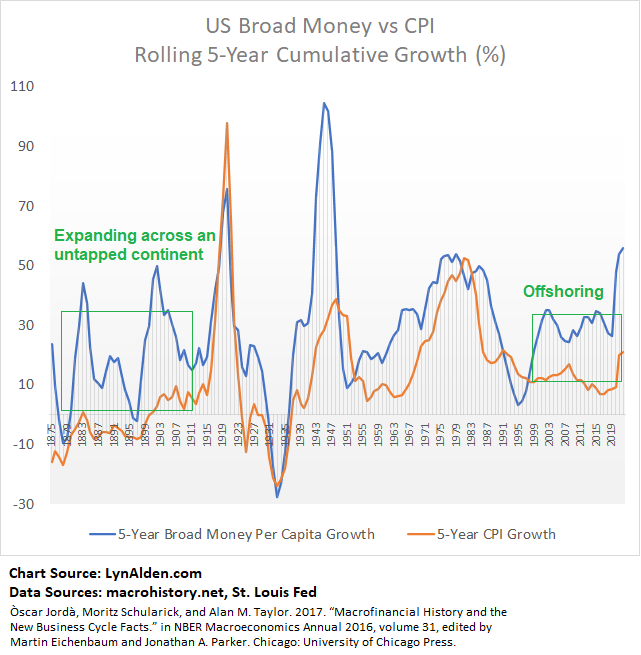

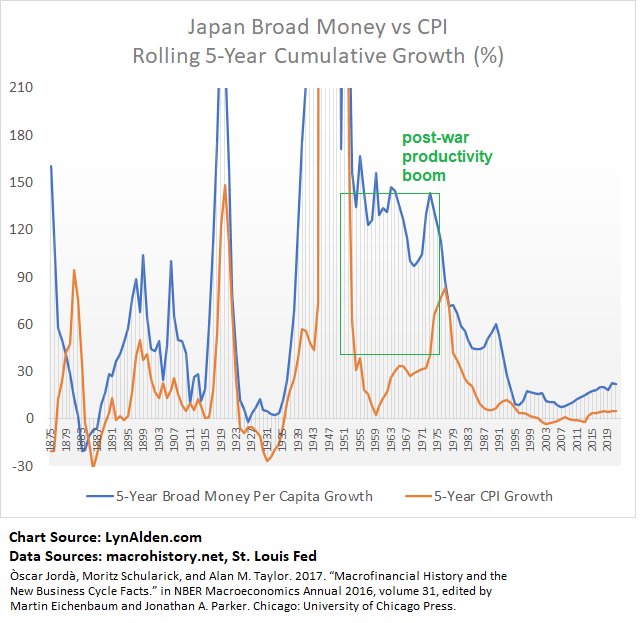

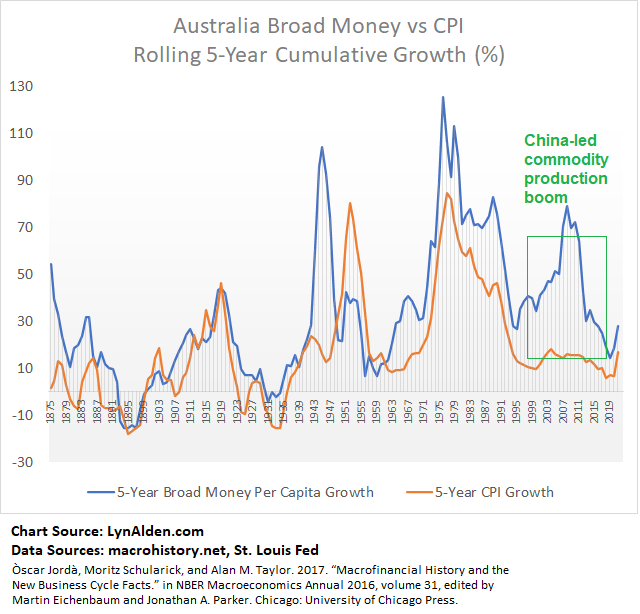

We can see this with long-term charts of several different developed countries as examples. These charts show the five-year rolling cumulative amount of broad money supply growth and consumer price index growth. Areas where money supply growth greatly exceeded changes to consumer price index were generally due to some sort of productivity boom.

The United Kingdom:

Lyn Alden

The United States:

Lyn Alden

Japan:

Lyn Alden

Australia:

Lyn Alden

Fiscal and Monetary Responses

When a relatively unlevered economy is struck by a significant economic shock or contraction, it’s unpleasant but workable. The economy muddles through, malinvestment gets wiped out, some debts get defaulted on, and productive investment can rebuild from there.

However, when a highly-leveraged economy up to the sovereign level is struck by a significant economic shock and contraction, it faces the prospect of widespread default or extraordinary money printing to finance the debts and devalue the currency instead.

For this second scenario, in a 2019 article where I examined the prospect of the world being in a bond bubble, I discussed how the next economic downturn could see a massive combination of fiscal and monetary policy, resulting in major inflation:

So far, central bank tools have not been inflationary because they have primarily benefited asset prices rather than middle class consumption. They printed money, but kept the money on the central bank balance sheets by buying bonds.

If central bank actions get more aggressive, combine with fiscal policies, and start targeting the middle class, they have the power to override these various deflationary forces with sheer monetary expansion. They can issue helicopter money to pay off debts, boost inflation, build infrastructure, bail out unfunded pension systems, and prop up the middle class if that’s what policymakers decide to do.

I wouldn’t want to be holding a 20-year or 30-year bond at super-low fixed yields in that kind of environment. Negative yields would be even more vulnerable.

-July 2019, “Are We In a Bond Bubble?“

Throughout 2020 and 2021, that’s what happened, and in a bigger way than even I would have expected when I wrote that in 2019, due to the COVID-19 catalyst. Trillions of dollars in new money creation occurred, especially in the United States but also globally across most developed countries. And money creation occurred not just in bank reserves for the financial system, but out in the broad money supply for consumers and businesses to spend.

I began cataloguing this in multiple articles, newsletters, and premium reports throughout 2020 and 2021, with my May 2021 Newsletter being the culmination of much of that analysis. Official inflation was 2.7% at the time, and rising:

On the other hand, rapid increases in the broad money supply that boost demand for goods and services without boosting the supply of goods and services, result in supply shocks and cause price inflation. As the market adjusts over time, this price inflation becomes transitory in rate of change terms, but with prices that ultimately settle at a higher level, due to more money permanently being in the system. This second type of inflation is likely what we’re experiencing at this time.

Some specific parabolic price levels will almost certainly come back down pretty far. Lumber’s extreme price behavior, for example, is due to an acute sawmill bottleneck.

However, many prices are unlikely to revert back to where they were pre-2021. Many companies including Procter & Gamble (PG) and Coca-Cola (KO) are raising prices due to higher input costs. Many commodities such as copper are unlikely to fully retrace their 2020/2021 gains. Chipotle (CMG) is unlikely to reverse the shift towards $15 average wages once it implements them. These are higher equilibrium levels, with a lot more money in the system.

-May 2021, “Fiscal-Driven Inflation“

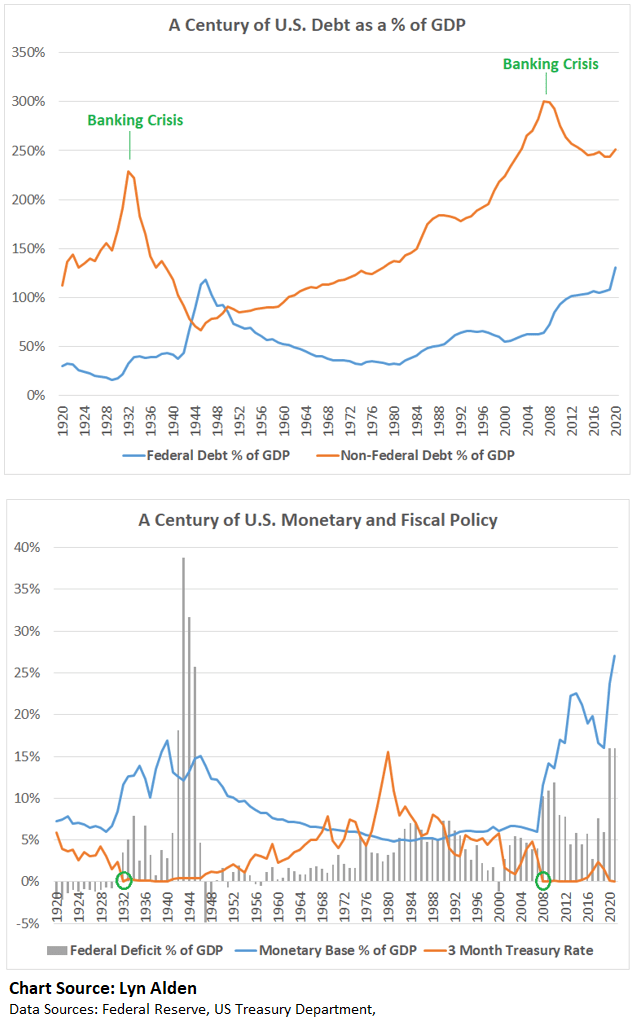

In that May 2021 piece, as part of my argument for why the 2020s will likely look more like the 1940s than the 1970s, I included a chart that I have referred many times since. It is beginning to get out of date, but remains historically informative.

Lyn Alden

The crux of the matter is that the 2021/2022 inflation came from a surge in fiscal policy that occurred in 2020/2021, not from a surge in bank loans. It was much like the 1940s war-financing era, in this sense. It was quite unlike the 1970s in most ways.

By the second half of 2022, after reaching 9% official inflation in the U.S. (and upwards of 12% or more based on older ways of calculating it), it has begun to come back down. Fiscal injections have subsided, and tighter monetary policy has reduced speculation and asset prices broadly.

No, It’s Not Transitory (In Absolute Terms)

Major periods of price inflation are usually transitory in rate-of-change terms, but not in absolute terms. In other words, prices don’t come back down to where they were, but their rate of growth cools off.

I’ve seen analysts argue that the 1940s wasn’t really inflationary due to money supply increases, but rather just due to war-related price shocks. These arguments are often made to refer to the 2020s as well, with the argument that pandemic-related price shocks are temporary.

Fortunately, there’s an easy and rather definitive way to test for that. Temporary price shocks with a specific catalyst (e.g. a shortage of a specific metal in a war, or a shortage of hand sanitizer in a pandemic) will retrace back to their pre-war price when the catalyst is over. These price increases aren’t primarily from new money creation; they’re from a temporary surge in demand or a temporary supply problem.

On the other hand, if substantial new money creation is what primarily drove price increases in aggregate, then even after certain catalysts are finished, the equilibrium of most prices will remain permanently higher going forward, because the unit of currency that they are measured in has been permanently debased.

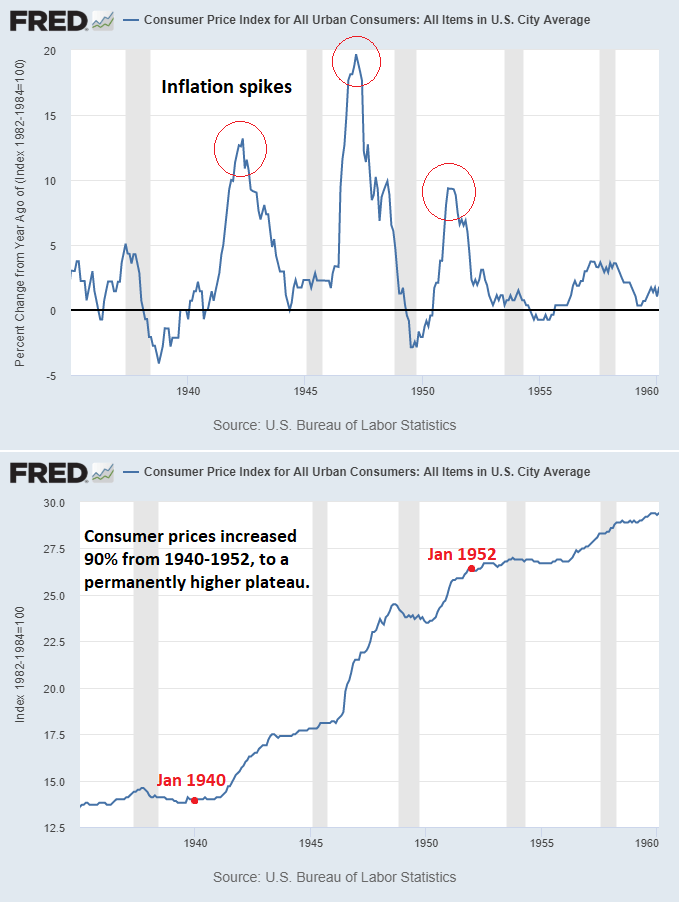

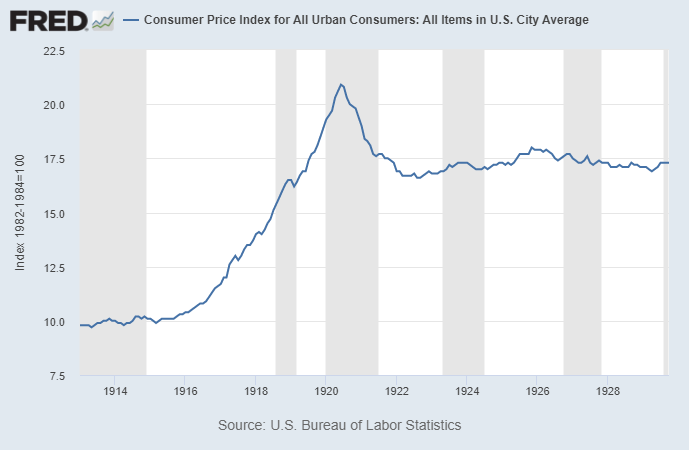

For the 1940s inflation spike, we see the latter. We see waves of temporary inflation in rate-of-change terms, but prices eventually settle at a structurally higher level due to the substantial amount of new money creation that occurred throughout the period:

St. Louis Fed

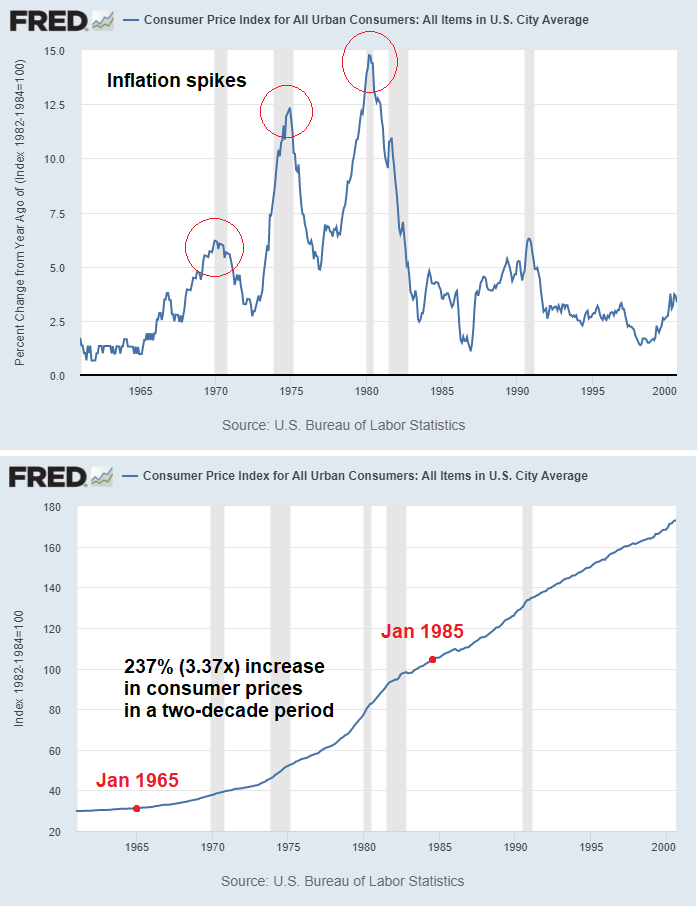

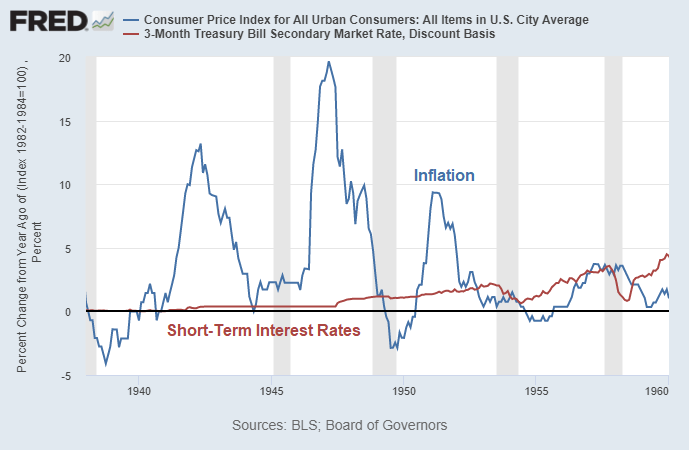

In the 1970s we see the same thing. Oil supply shocks, war, and waves of excessive credit creation led to temporary spikes of inflation, which eventually subsided. However, prices settled at permanently higher levels, and then continued growing at a slower pace from there:

St. Louis Fed

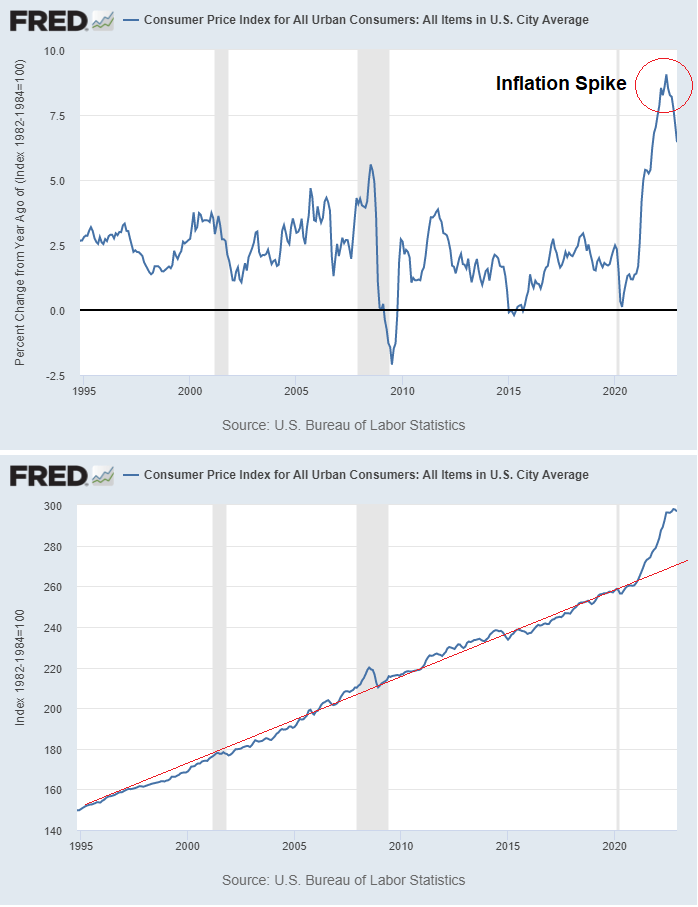

The full 2020s story has yet to be written, but my base case continues to be that while inflation will come and go in rate-of-change terms, we won’t be seeing the prior price trend, let alone actual prior price levels. This is because price levels will permanently be at noticeably higher levels due to the amount of new money creation:

St. Louis Fed

Back in 1913, the price for a barrel of oil was $0.95. Today it is $79.

Also in 1913, one gold ounce could buy you 22 barrels of oil. Today, one gold ounce can buy you 24 barrels of oil. In other words, oil priced in gold has been basically flat over a century. It just had volatile ups and downs along the way due to wars, recessions, and other things. Oil priced in dollars had similar ups and downs, but also had a 4.5% annualized upward price trend that compounded over a century.

This is because, at the end of the day, most of what we measure as price inflation is due to money creation and the declining purchasing power of individual units of currency. It’s like doing carpentry work for decades while your measuring tools get slightly smaller each year, and so everything seems like it is gradually getting bigger. Around that trend there are various more noticeable supply/demand imbalances.

Sources of Money Creation

If money creation is the primary driver of structural price increases (with the other being changes in productivity and other details around resource demand and supply), then we really need to know what specifically is causing money supply to rise or fall.

In my November 2020 article “Banks, QE, and Money-Printing“, I discussed in detail how both base money and broad money are created or destroyed in a fiat financial system. The summary is that base money is mainly created or destroyed by central bank activity, and broad money is mainly created either from 1) bank lending or 2) fiscal deficits. When it comes to consumer price inflation, broad money is what we mainly care about.

The reason I wrote that article was to counter a popular narrative at the time that argued “only banks create broad money” and therefore that we wouldn’t see much inflation. A lot of analysts were incorrectly looking back and saying “look how much money-printing happened in 2008 and we didn’t get inflation, so we won’t get it this time either”.

My inbox was filled with questions from people that had read those types of analysis and wanted my take on it. These analysts generally confused base money with broad money, or put too much emphasis on the bank lending channel of money creation without fully understanding the fiscal channel for money creation, and so my article was an attempt to tie it all together step by step and show how both bank lending and/or fiscal deficits can create a lot of new spendable broad money among the population, and thus price inflation.

Here in 2023, we have some updated data.

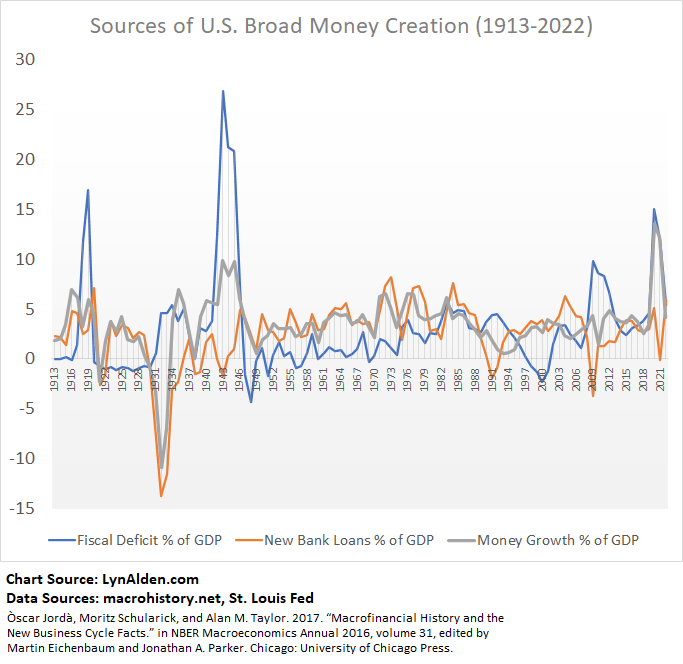

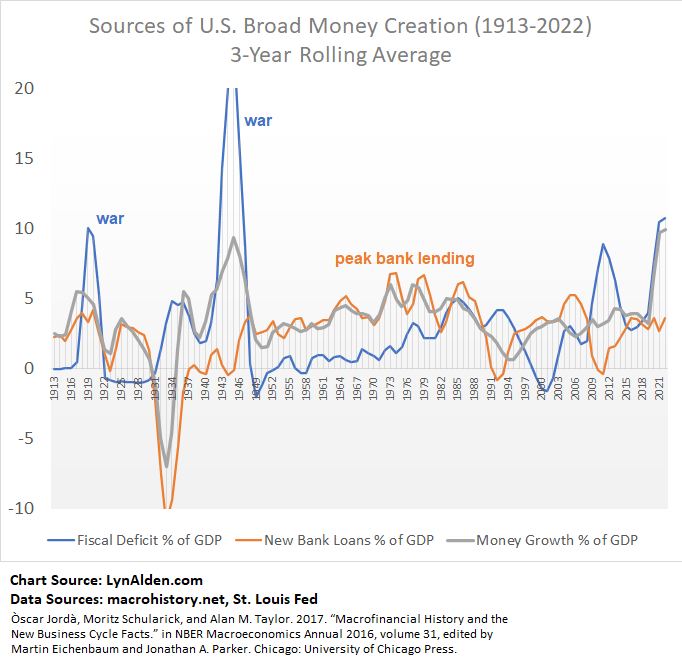

This chart shows the year-over-year percentage change in three numbers. The first number in blue is the fiscal deficit as a percentage of GDP. The second number in orange is the amount of new bank loans as a percentage of GDP. The third number, bolded in gray, is the amount of new broad money as a percentage of GDP:

Lyn Alden

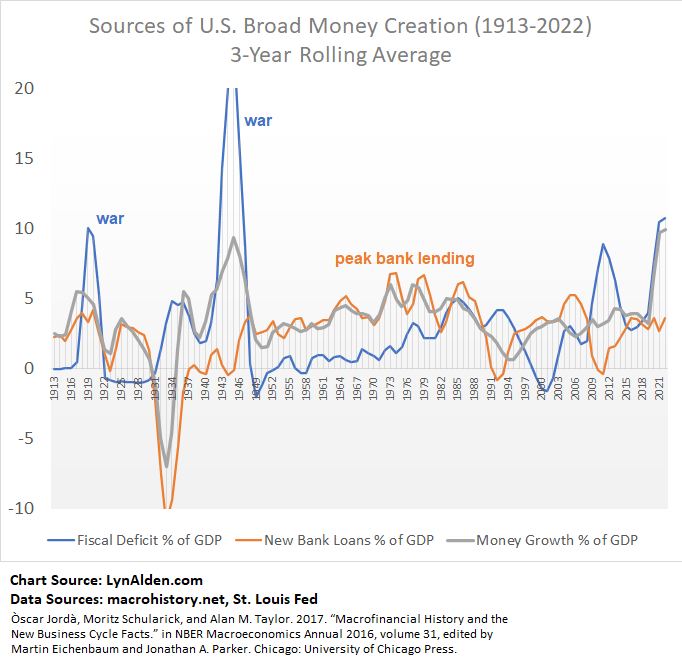

That chart is a bit messy, so here is a version that uses a rolling 3-year average to reduce noise, and zooms in a bit:

Lyn Alden

During World War I (1910s), U.S. bank lending first had an uptick in order to finance allies like the United Kingdom without getting involved directly. And then by the end, the U.S. got involved directly, and fiscal deficits spiked. Both of these aspects caused an uptick in money creation.

During the Great Depression (1930s), a significant amount of broad money was destroyed, as bad loans were defaulted on and banks failed. There was an uptick in fiscal spending, but it was smaller than the amount of loan losses, and so money supply went down and price inflation was negative.

During World War II (1940s), the rate of new money creation spiked due to war-related fiscal spending. There was not much bank lending during this time. Broad money was created in spite of banks, and went around banks. The post-war years generally saw temporary fiscal austerity (surplus), and this contributed to a post-war recession as the economy digested what had happened and shifted back to a more normal baseline.

During the 1970s, the baby boomer generation (the first of which were born in the late 1940s) began reaching their mid-20s homebuying years. This demographics surge caused a big uptick in demand for goods and services, and especially energy. While some money was created through deficit spending (the Vietnam War and Great Society programs), the majority of it was created via bank lending. A boom in credit creation fueled a boom in consumption.

During the Great Recession (2008 and into the early 2010s), there was negative loan creation due to widespread defaults, and an approximately equal amount of money creation from fiscal stimulus and bailouts. The result was generally neutral for the money supply and prices, like a less intense version of the Great Depression.

During the COVID-19 shock and the first half of the 2020s decade thus far, the situation has been much like the 1940s. There was a huge spike in money creation due to large fiscal stimulus, while bank lending was normal.

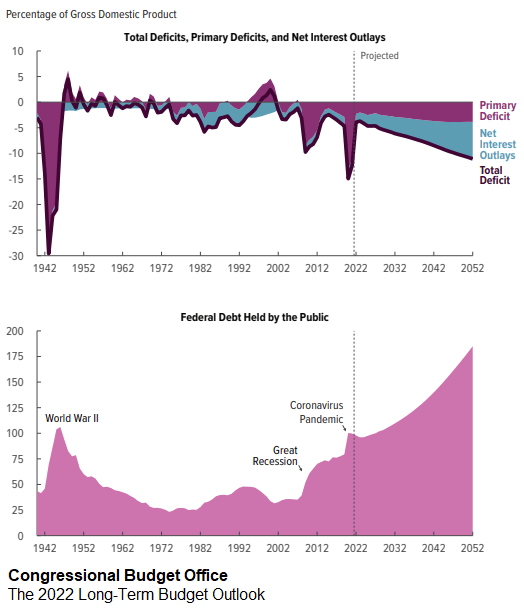

However, unlike the 1940s, the U.S. government today is set to run $1+ trillion fiscal deficits for the foreseeable future due to top-heavy entitlement programs and persistently large military spending. Moreover, the highly-financialized economy relies on ever-higher asset prices in order to fuel ever-higher tax revenue, and so even attempts at fiscal austerity would have a tough time reining in deficits at this point.

CBO

The Causes and Fixes for Inflation

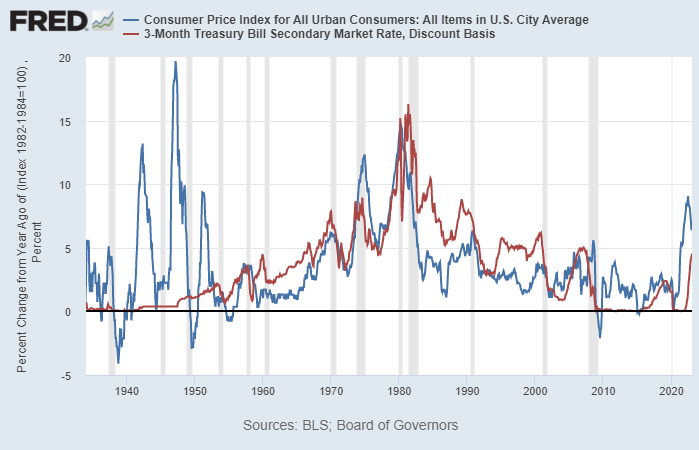

St. Louis Fed

1910s Inflation

The inflation of the 1910s was primarily caused by bank lending and fiscal spending on World War I, and was resolved as the war spending ceased.

However, even as the war was finished, a greater amount of broad money was permanently in the system. The aggregate price level was 75% higher throughout the 1920s than it was before the war.

St. Louis Fed

1940s Inflation

The inflation of the 1940s was also primarily caused by fiscal spending on World War II, and was resolved as the war spending ceased and as fiscal austerity took precedent in the 1950s.

Note, this inflation was not fixed by raising interest rates. In fact, the Fed was basically captured by the Treasury and kept interest rates very low despite a peak of 19% inflation, in order to help the government finance the war at deeply negative real rates, and to inflate large swaths of debt away.

St. Louis Fed

1970s Inflation

The 1970s inflation was more complex, and had four primary factors:

One) The large Baby Boomer generation entered into homebuying years, resulting in a strong uptick in consumer demand and bank lending (demand for goods and services, and new money creation to finance it). This was resolved in the subsequent decades as the generation naturally finished its peak consumptive years, resulting in less overall demand and less loan-driven money creation.

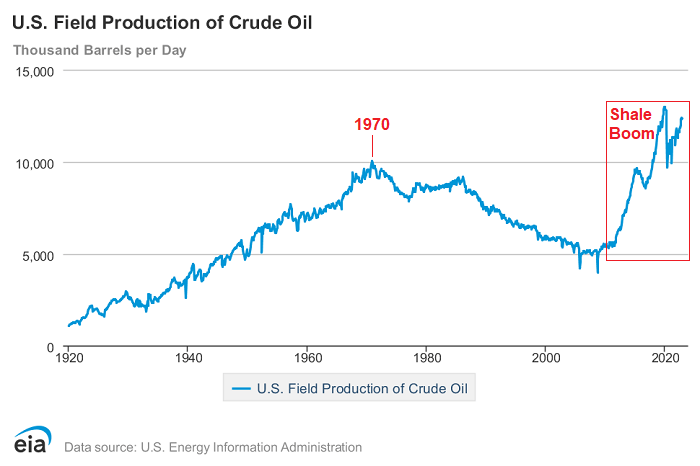

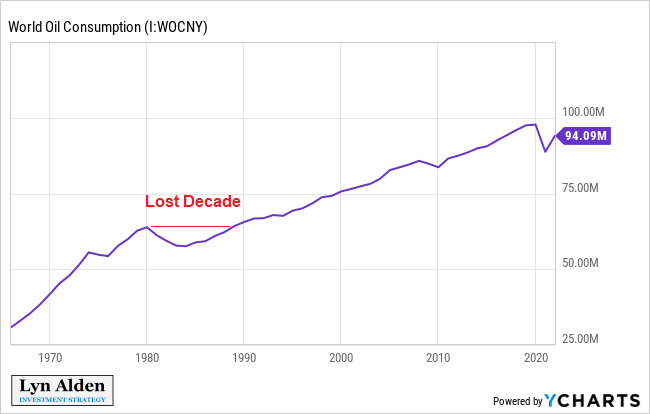

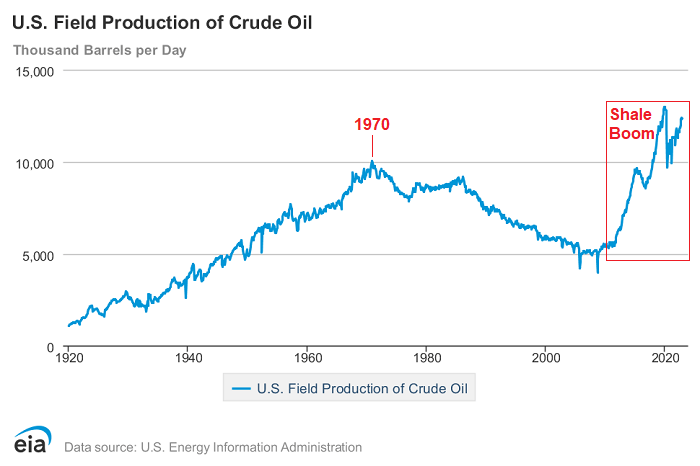

Two) Domestic oil production in the United States peaked and rolled over in 1970 after a century of persistent supply increases, resulting in unprecedented oil supply limitations. This was exacerbated by an oil embargo by Saudi Arabia and other countries in 1973 and by the collapse of Iranian oil production in 1979. More and more demand for goods was running into severe resource and geopolitical limitations.

EIA

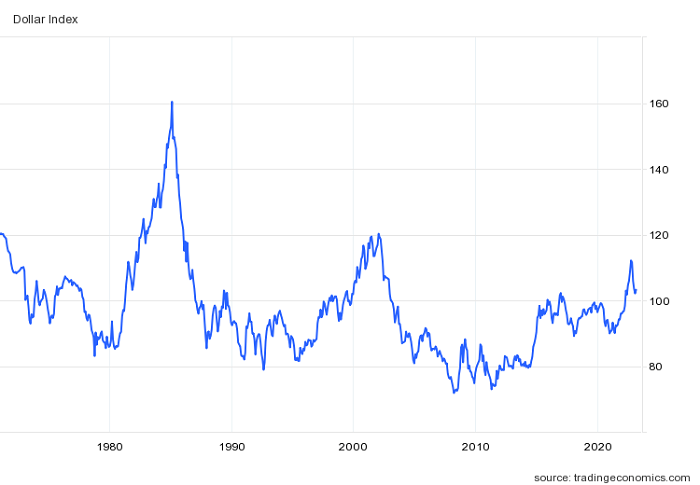

This was partially fixed in 1974 due to a deal with the Saudis, partially fixed by an uptick in offshore oil production, and partially fixed by squeezing developing countries and slowing down their economic growth and oil consumption with hawkish monetary policy. Latin America in particular had significant dollar-denominated debt, and so strengthening the dollar hardened their liabilities and triggered a series of defaults.

The dollar index:

Trading Economics

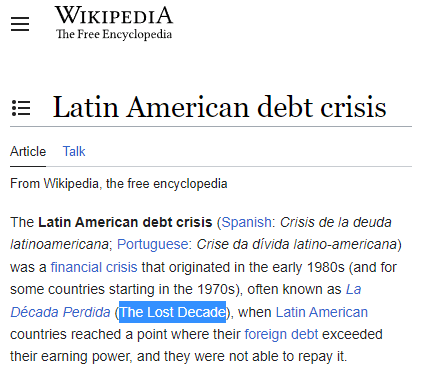

Latin American debt crisis:

Wikipedia

Global oil demand:

Ycharts

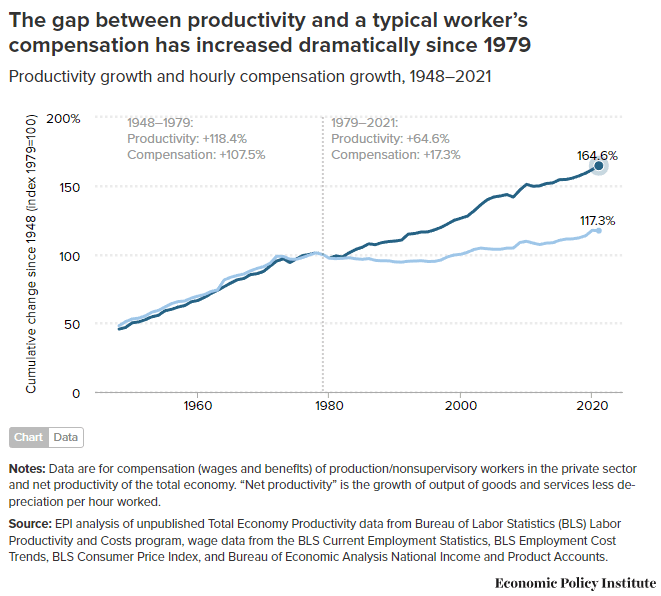

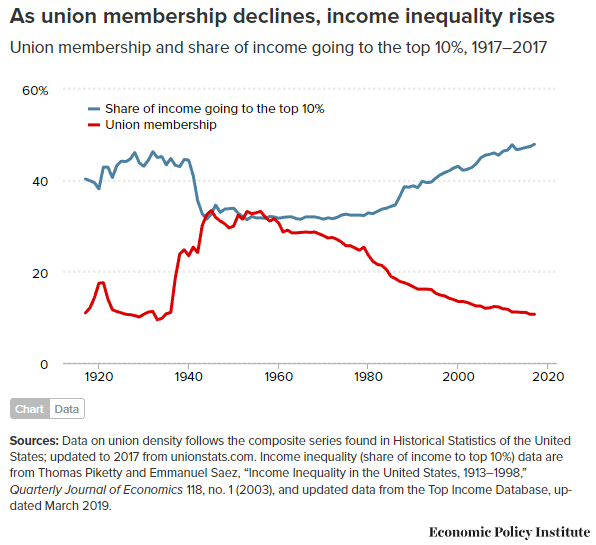

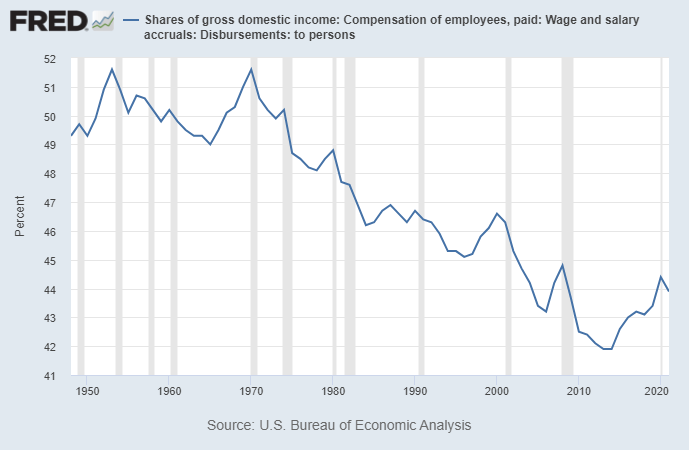

Three) Powerful unions gave domestic workers a lot of pricing power on wages into the 1970s. A combination of union-busting in the 1980s, accelerated globalization (cheap foreign labor) in the 1990s, and to a lesser extent automation, collectively reduced the negotiating power of domestic workers and suppressed wage inflation going forward.

Worker productivity vs wages:

EPI

Union membership and income distribution:

EPI

Wage share of gross domestic income:

St. Louis Fed

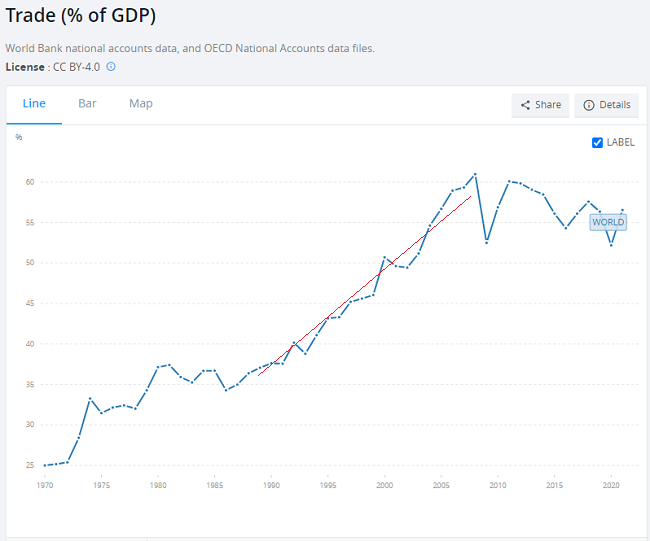

Global trade as a percentage of global GDP:

World Bank

Chart Source: World Bank

Fed Chairman Paul Volcker is often given credit for breaking the back of inflation, but tight monetary policy was just one piece of the puzzle. It was a full-spectrum geopolitical and public/private sector combination of approaches.

Four) An uptick in both domestic fiscal spending and war-related fiscal spending contributed to rising fiscal deficits and new money creation throughout the 1970s. However, as can be seen on the blue line of the chart regarding the sources of money creation, this was a much smaller factor than it was in the 1910s and 1940s, and took a backseat to unusually high bank lending (orange line) and oil shortages and unions-vs-globalization. This widening fiscal deficit went generally unfixed, except for temporarily in the late 1990s, and resulted in a major increase of public debt over time.

Here’s that money creation chart again:

Lyn Alden

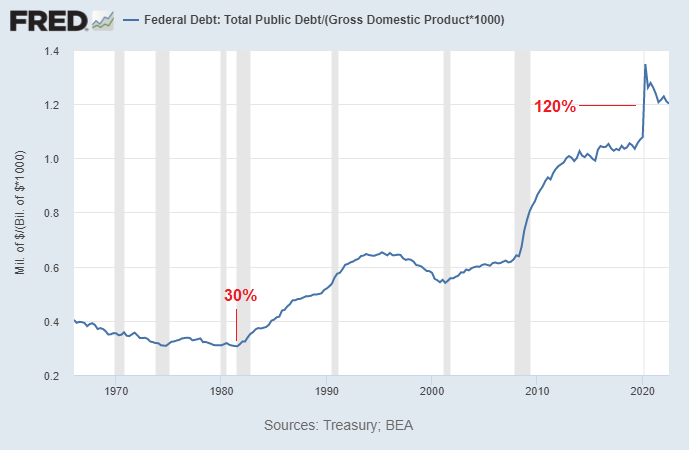

Debt as a percentage of GDP:

St. Louis Fed

Here’s the rather bearish summary for the 1970s-to-1980s transition. To quell the 1970s inflation, the U.S. domestic working class along with people throughout Latin America were disempowered and economically stagnated via strong dollar policy and accelerated globalization in order to keep prices and the cost of capital low for the wealthy capital class. A greater share of profits was directed to corporate profits and away from wages. Income concentration and public debt began to sharply increase, with multinational corporations and financiers making the majority of gains.

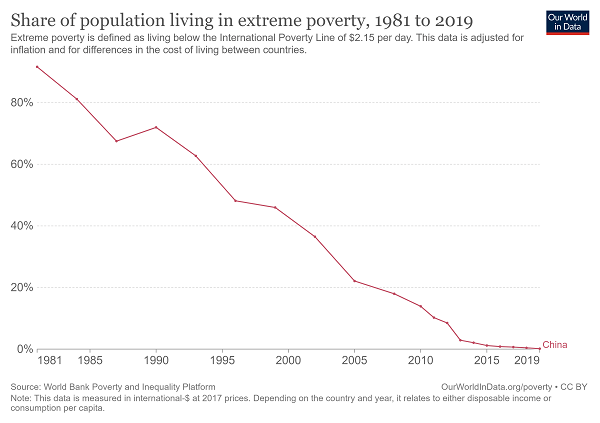

The bullish rebuttal to that would be that as painful as this process was for domestic workers and people in Latin America, it helped win the Cold War, opened up quite a lot of global productivity growth, brought together capital from the West and labor from the East, shifted emerging market balance of power towards Asia, and brought a billion people out of extreme poverty. Meanwhile, American and other global consumers happily bought inexpensive Chinese-made products for decades, as they ramped up major industrial policy.

Our World in Data

2020s Inflation

The 2020s inflation was, much like the 1940s, caused by a massive spike in fiscal spending combined with some supply chain limitations. People quickly rotated the types of things they buy (e.g. home remodeling in place of vacations in 2020 and 2021), and due to fiscal stimulus they had significantly more dollars in their pocket to buy goods and services with while the actual supply of goods and services remained limited. This included not only stimulus checks and child-care tax credits, but also PPP loans that turn into grants for many wealthy business owners (e.g. law firms, investment managers, and so forth).

Unlike the 1970s, the inflation in the money supply and prices in the 2020s was not caused by heightened levels of bank lending.

Additionally, energy shortages once again reared their head, which is one of the few ways that the 2020s indeed does resemble aspects of the 1970s. U.S. shale oil is becoming less cheap and abundant, cheap Russian natural gas no longer flows to Europe as it once did, developed countries have not been building nuclear reactors, and yet the world continues to demand dense sources of energy if it wants to grow. This is especially true in the developing world where energy usage per capita is still way below what is typical in the developed world.

How persistent inflation will be in the 2020s, and how it will be fixed, remain open questions. I think we’ll see waves of inflation, and take quite a bit of time to fix it fundamentally. There will probably be a number of disinflationary periods or “false dawns” along the way, including the one we’re in now.

Temporary fixes can come from demand suppression. By tightening the dollar and trying to squeeze the developing world (which is highly indebted in dollars) out of the energy market, it leaves more energy for the United States, Europe, and Japan. It’s cruel, but that’s the playbook. As described before, in the 1980s hawkish monetary policy by the U.S. triggered a Latin American debt crisis and depression, and squeezed them out of the energy market with a lost decade. More recently, Europe’s mismanagement of its energy supply compounded by Russia’s invasion of Ukraine, and Europe’s subsequent turn to more LNG, contributed to squeezing countries like Pakistan out of the LNG market and into a power crisis. The United States’ tightening of monetary policy has ripple effects throughout the developing world, causing them to tighten their belts and leave more energy for U.S. consumers. Of course, many of them are trying to fight back, such as China making deals to buy oil in yuan, or Ghana making deals to buy oil in gold.

If we want disinflationary growth (rather than disinflationary depression “lost decade” or inflationary stagnation), then a long-term fix will likely only come from a significant uptick in energy production. Technology can provide us with various sources of disinflation, including the recent surge in artificial intelligence applications, but at the end of the day it’s the availability of abundant and cheap energy that really helps get aggregate prices under control, especially for the developing world.

Meanwhile, I expect fiscal deficits in the United States to remain unresolved, and to be long-term contributors to structural money supply growth and price inflation this decade, once we get past this current lull of tightening. A key difference between the 2020s and 1970s decades is that the U.S. has over 120% debt-to-GDP today, compared to only 30-35% back then. Raising interest rates can cause a fiscal spiral of even more deficit spending and money creation in order to cover those higher interest levels.

Final Thoughts: The Japan Rebuttal

As an addendum to this newsletter on inflation, it would be worthwhile to address the Japan comparison, which often comes up.

The argument goes something along these lines:

“The situation in Japan has showed us that large public debts and demographics stagnation doesn’t result in inflation. Instead, it results in deflation. That will be the fate of most of the developed world.”

My rebuttal to that goes along three primary lines:

1) Japan Had Slow Money Creation

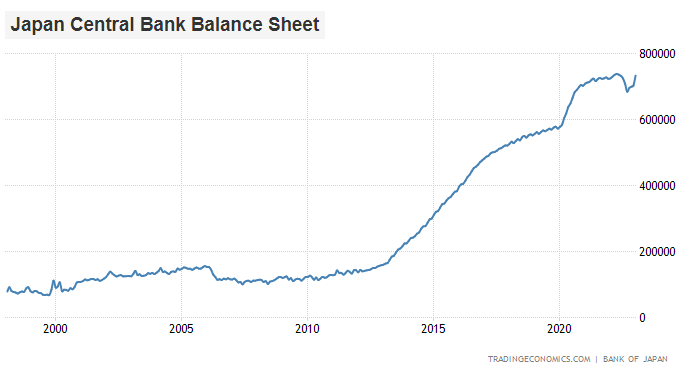

People are used to seeing charts like this, which is a chart of the Bank of Japan’s balance sheet. It looks massively inflationary starting with “Abenomics” in 2012:

Trading Economics

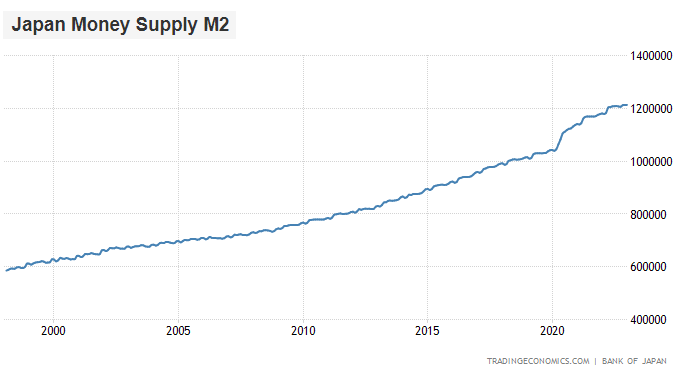

However, none of that translated into accelerated growth of broad money, at least until 2020 when it was combined with additional fiscal policy. It’s a change in broad money that tends to be inflationary, rather than changes in base money per se. Japan had the slowest broad money supply growth in the world over the past couple decades, and quite expectedly, had the least price inflation as well. Their broad money growth from the early 2000s to the beginning of 2020 was only about 50%.

Trading Economics

This is because the government ran deficits of approximately 5% of GDP per year on average (which created new broad money, since it was funded by the central bank), fueled by low interest rates, while the corporate sector reduced their aggregate debt position by about 2% of GDP per year on average (which destroyed broad money, via negative loan creation), resulting in only about 3% actual money supply growth per year on average.

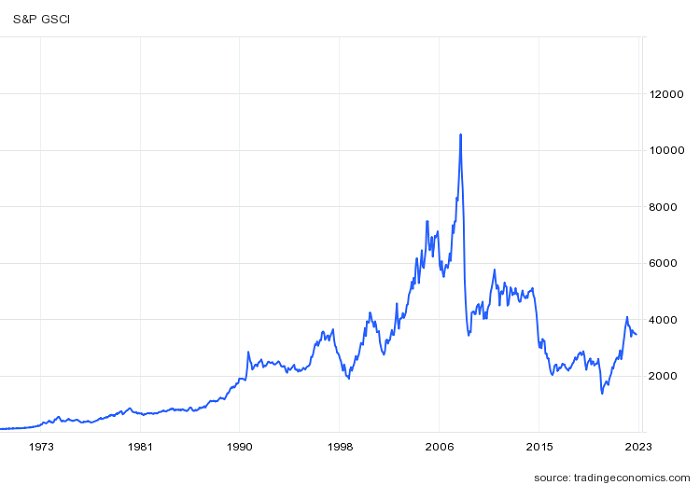

2) The 2010s Decade Had Abundant and Cheap Commodities

A slowdown in developing country growth from strong dollar policy, and a massive increase in U.S. shale oil production, resulted in commodity oversupply during the 2010s decade, and especially for oil. The developed world, including Japan, had all the energy that they wanted and deflationary prices.

That parabolic increase in the Bank of Japan’s balance sheet, and their years and years of deficit monetization, occurred during this time of abundant and cheap commodities in the 2010s decade:

Trading Economics

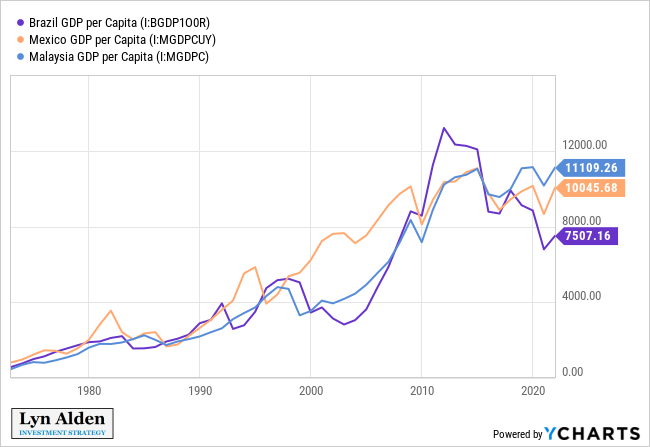

Brazil and a number of other developing countries experienced economic stagnation throughout the 2010s decade, much like they did in the 1980s. This was in large part due to the surging U.S. dollar index, which squeezed their sovereign and corporate credit situations, since they utilize a lot of dollar-denominated debt.

YCharts

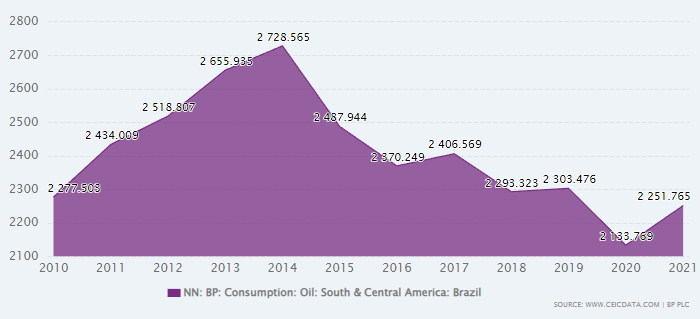

Brazil’s oil consumption has been down significantly since 2014. It has been a lost decade for much of Latin America and parts of Africa.

CEIC

Meanwhile, U.S. shale oil production surged in the 2010s decade, due to the combination of new technology and unusually low costs of capital:

EIA

Japan’s disinflationary 2010s decade was partially fueled from this combined uptick in U.S. shale oil production and the depression-like conditions in Latin America, which reduced their oil consumption and left plenty of cheap oil for Japan and other countries.

Going forward, that period of commodity abundance has likely played out. U.S. shale oil was responsible for the majority of global oil growth in the 2010s decade, but is not as productive as it used to be, and the easiest regions of production growth have already been tapped into. Going forward, it will take more expensive wells to get less new oil compared to what it took several years ago at the earlier stages of shale growth. In other words, we’ve already picked the low-hanging fruit.

Meanwhile, I’m reasonably bullish on a number of emerging markets over the next decade. I think we’ll see a structural top or slowdown in the dollar index, and another period of growth for some of these countries such as Brazil, and a continuation of growth in India. If this occurs, they will compete more with Japan and other developed countries for energy.

3) What is Fine for One is Bad for Many

Japan reached its peak demographics before most other countries. By the time it became a very top-heavy and no-growth population, with an increasing ratio of elders to workers, they could rely on a wave of globalization to avoid labor shortages and help keep their prices low.

All throughout the 1990s, 2000s, and 2010s Japan stagnation, they benefited from the end of the cold war, the massive opening up of China, and in general an increased amount of trade with the developing world, which provided plenty of inexpensive labor for labor-intensive industries.

Japan is only about 5% of global GDP. They spent decades after World War II being incredibly productive, and now they’re kind of coasting on that productivity, and sustaining it as best they can as they go through a major demographics stagnation. They’ve been at the forefront of automation as well, augmenting their productivity as much as possible.

Today, Europe, the United States, China, and parts of Latin America are also aging, which represents a very large portion of global GDP. Only India, certain other parts of southeast Asia, and most parts of Africa still have real demographics growth, and they’re in the minority.

Meanwhile, rising geopolitical tensions (after a period of a unipolar world order from 1990s through the 2010s, along with accelerated globalization) are contributing to a stall in globalization and less efficient supply chains, with more of an emphasis on redundancy and resiliency. As the whole world ages together, and without another big disinflationary labor offset anywhere in sight, it should be generally inflationary. This can partially be offset by an uptick in automation of white-collar labor, but it remains to be seen if that will be sufficient to combat the inflationary forces this decade (I doubt it).

To put it simply, as Japan aged, they benefited from a rising tide of globalization happening around them to continue the trend of cheaper labor costs. As Europe, the United States, and China age, they are unlikely to have that type of rising tide, and may even have a receding tide with structurally higher labor costs.

The Bottom Line

The overarching theme for this article is that the combination of high debt, high interest rates on that debt, aging demographics, geopolitical tensions, and tight energy supplies are likely to result in ongoing waves of inflation. For periods where we generally get inflation under control, it will likely be due to global demand suppression and economic stagnation, rather than what we actually want: global disinflationary growth.

From an investing standpoint, I am structurally bullish with a 5+ year view on energy pipelines, energy producers, bank stocks, healthcare stocks, gold, and bitcoin. Since I think inflation is more likely to win out over economic stagnation during this decade, and that developed market central banks will perform further rounds of deficit monetization, I am also somewhat bullish on select emerging markets such as Brazil and India over that time period.

However, for temporary periods of time where I think disinflation is likely to be the theme of the year, or where tight monetary policy is likely to pressure most risk assets, T-bills and money market funds are rather attractive as a defensive position as well.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

I share model portfolios and exclusive analysis on Stock Waves. Members receive exclusive ideas, technical charts, and commentary from three analysts. The goal is to find opportunities where the fundamentals are solid and the technicals suggest a timing signal. We're looking for the best of both worlds, high-probability investing where fundamentals and technicals align.

Start a free trial here.

This article was written by

.

My work can be found at LynAlden.com, ElliotWaveTrader.net, and within the Seeking Alpha marketplace where I work with the Stock Waves team to blend their technical analysis with my fundamental analysis for high-probability long-term setups.

Disclosure: I/we have a beneficial long position in the shares of BTC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have a globally diversified portfolio of equities, bonds, cash, precious metals, and bitcoin.