USA Compression Partners: Their Near-10% Yield Is Now Secured

Summary

- USA Compression Partners narrowly avoided cutting their distributions back in 2021.

- As 2022 progressed, their recovery continued gaining momentum on the back of the otherwise tragic Russia-Ukraine war.

- In the fourth quarter, their underlying operating cash flow that excludes working capital movements posted its highest result since at least the beginning of 2021.

- Even better, their guidance for 2023 points to earnings growth of circa 20% year-on-year, which now leaves their distributions safe for the first time in years.

- Since I expect this will also translate into a higher unit price, I believe that maintaining my strong buy rating is appropriate.

Aslan Alphan

Introduction

The last three years were a roller coaster for USA Compression Partners (NYSE:USAC) who narrowly avoided a distribution cut, before subsequently seeing a game-changer after Russia invaded Ukraine and as my previous article highlighted, there was more upside potential as the narrative changes. Following the release of their impressive guidance for 2023, it seems their high near-10% distribution yield is now secured, which should see their unit price steadily climbing higher as the year progresses.

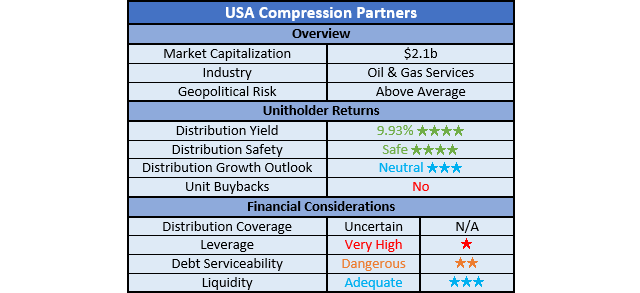

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

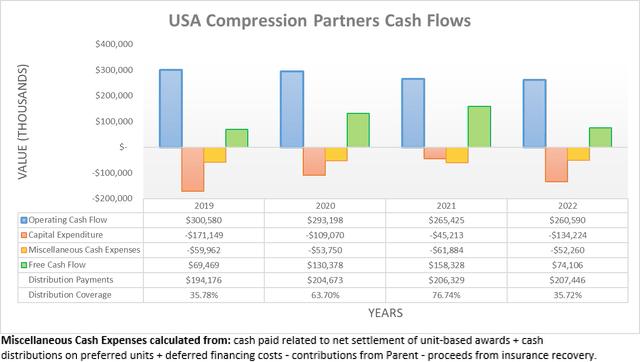

After seeing their recovery gaining momentum during the second and third quarters of 2022, it was very positive to see this continuing during the fourth quarter with their cash flow performance once again strengthening. To this point, their operating cash flow closed out the year at $260.6m and thus almost matched their previous result of $265.4m during 2021. Whilst this may not sound too positive on the surface, it actually marks a noticeable strengthening since the first nine months of 2022 that at the time, saw their result of $178.5m more noticeably beneath their previous result of $184.4m during the first nine months of 2021.

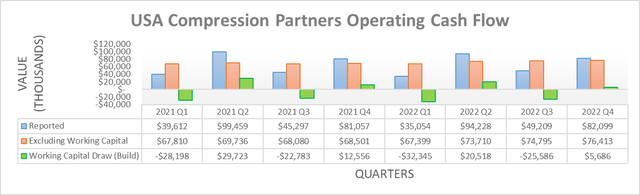

When moving to a quarterly lens, it confirms their recovery continued gaining momentum during the fourth quarter of 2022. On the surface, their reported result of $82.1m was solid but more so, the bigger deal is their underlying result of $76.4m that excludes the routine volatility of their working capital movements. If casting an eye backwards, this is their highest result in recent history since at least the beginning of 2021 and therefore, builds upon the previous improvements earlier in 2022 that were highlighted within my previous analysis. That said, 2022 still ultimately ended with a working capital build of $31.7m that will hopefully land as a cash infusion later in 2023. Regardless, their outlook for the year ahead is certainly looking up with management issuing impressive guidance, as per their fourth quarter of 2022 results announcement.

The most notable parts of their guidance for 2023 are firstly, their adjusted EBITDA, which is forecast to hit $500m at the midpoint, whilst secondarily, their accompanying distributable cash flow is forecast to reach $270m at the midpoint. During 2022, these saw respective results of $426m and $221.5m and thus if their guidance comes to pass, it represents impressive improvements of circa 17% and 22% year-on-year respectively. In theory, these should flow through into their operating cash flow to a similar extent, given their positive correlations.

Notwithstanding natural gas prices recently plummeting on the back of warmer-than-expected weather, this guidance is not unrealistic in my eyes. As discussed within my previously linked article as well as my earlier article, they face a strong medium to long-term tailwind as Europe seeks to source more of their natural gas from outside of Russia. In turn, this provides a strong catalyst for higher production in the United States and thus by extension, it creates a comparably strong demand for their compression equipment.

Unfortunately, as they do not provide capital expenditure guidance, their distribution coverage via free cash flow remains uncertain and thus a wait-and-see situation. Despite not necessarily being ideal, thankfully the benefits to their financial position are actually more important when it comes to improving their distribution safety and thus in turn, seeing a higher unit price.

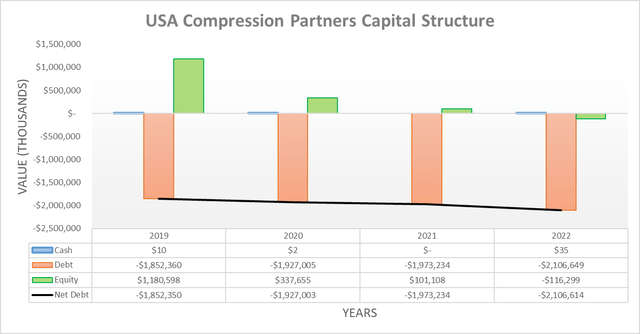

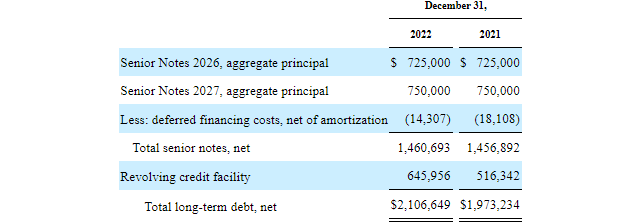

Thanks to their cash flow performance strengthening during the fourth quarter of 2022, their net debt slowed its increases, thereby ending the year at $2.107b, which was only marginally higher than its previous level of $2.078b following the third quarter. Going forwards, the prospects of seeing their operating cash flow climbing circa 20% year-on-year in conjunction with their impressive guidance stands to further help ease the pressure on their balance sheet. That said, the extent remains a wait-and-see situation given their lack of guidance surrounding their accompanying capital expenditure.

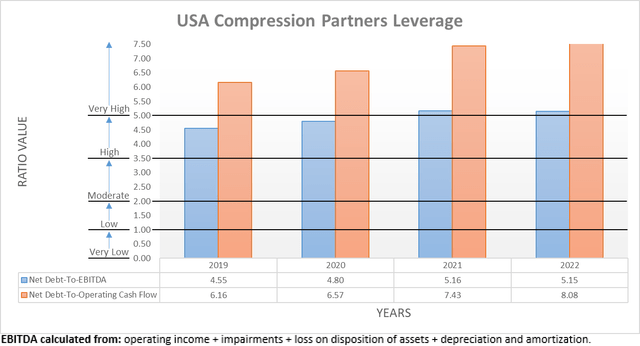

When turning to their leverage, it was positive to see leverage broadly stabilize during the fourth quarter of 2022, most notably with their net debt-to-EBITDA landing at 5.15 versus its previous result of 5.16 following the third quarter. Meanwhile, their accompanying net debt-to-operating cash flow defied this direction, thereby landing at 8.08 versus 7.22 across these same two respective points in time. This is largely due to the former still being weighed down by working capital movements that were previously excluded from the latter given the shorter length of time. Whilst these both remain above the threshold of 5.01 for the very high territory, these should head lower throughout 2023 on the back of their impressive guidance and in turn, help improve their distribution safety and thus command a higher unit price in the market.

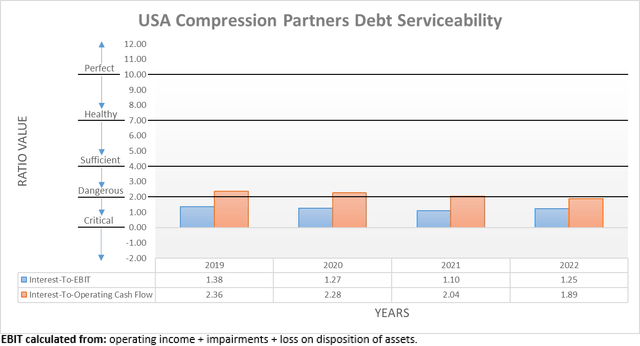

Similar to their leverage, their debt serviceability also broadly stabilized during the fourth quarter of 2022 with their interest coverage ending the year at 1.25 and 1.89 when compared against their EBIT and operating cash flow, respectively. On the first account, this result is identical to their previous result following the third quarter, whilst on the second account, the previous result was ever-so-slightly lower at 1.78. Despite unfortunately remaining at dangerous levels, thankfully their impressive guidance for 2023 should see both of these improve and thus, likely become sufficient and in turn, further improve their distribution safety.

In the past, quite possibly the single biggest risk for their distributions laid within their liquidity, not necessarily the headline results, such as their current ratio that following the fourth quarter of 2022 remains adequate at 1.07 versus its previous result of 1.14 following the third quarter. More so, it was the covenant leverage ratio for their credit facility that was sitting only slightly beneath its limit of 5.25. After seeing improvements during the second and third quarters, thankfully further improvements occurred during the fourth quarter with it falling to 4.76, as per the commentary from management included below.

During the fourth quarter, we also achieved another sequential decline in our bank covenant leverage ratio, which decreased to 4.76x."

- USA Compression Partners Q4 2022 Conference Call.

Since their guidance sees impressive circa 20% earnings growth ahead in 2023 for their earnings, it will obviously suppress their covenant leverage ratio and going forwards, this is no longer nearly as important of a topic as a margin of safety will be achieved. This will also help increase the borrowing capacity under their credit facility, which following the fourth quarter was $333.1m but sees a total of $954m remaining beneath its borrowing base of $1.6b, given their drawings of $946m. Thankfully, it does not mature until December 2026, which provides ample time to arrange refinancing, similar to their accompanying senior notes that mature in April 2026 and September 2027.

USA Compression Partners 2022 10-K

Conclusion

After battling to secure their distributions during the past three years ever since the Covid-19 pandemic spread across the globe, they now appear safe for the first time. It would be very unlikely to see management relent at this point, especially right when everything is looking up with impressive guidance for circa 20% higher earnings year-on-year in 2023. Since risk and reward normally move in tandem, this should lead to a lower distribution yield as a high almost 10% yield is normally associated with a risky outlook and therefore, the likelihood of a cut. As the year progresses, I expect this will be forthcoming by their unit price steadily climbing higher and thus, I believe that maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from USA Compression Partners' SEC Filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of USAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.