Alaska Air To Benefit From Fleet Modernization

Summary

- Fleet modernization to lead to increased revenue and margin improvements.

- Alaska Air has one of the best balance sheets in the airline industry.

- ALK stock trades at a low valuation vs. peers.

400tmax/iStock Unreleased via Getty Images

Alaska Air Group's (NYSE:ALK) superior balance sheet versus peers gives it a strategic advantage. This has allowed the company to modernize its fleet, which should increase revenue opportunities through more overall and premium seats, as well as lower fuel consumption and maintenance costs.

Company Profile

ALK is the fifth-largest airline in the U.S. flying to 120 destinations in North America. It operates both its namesake Mainline airline as well as low-cost regional airline Horizon.

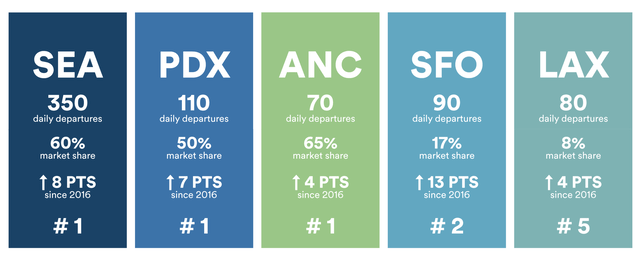

Its Mainline service sees its largest concentration of flights from the west coast markets of Seattle, Portland, and the Bay area.

Seattle is its main hub with 350 departures and 60% market shares. In Portland, meanwhile, it has over 100 daily departures and 60% market share. It also has strong positions in the San Francisco and Los Angeles markets with the #2 and #5 market share at those airports. And given its name, not surprisingly it holds the #1 market share in Anchorage at 65% while offering around 70 daily departures.

Company Presentation

ALK is also part of the oneworld network, which gives its frequent fliers access to international destinations from the West Coast via code shares. The company's frequent flyers Mileage Plan accounted for about 16% of its revenue in 2022.

Horizon operates flights under the Horizon and SkyWest banners. It serves primarily the states of Washington, Oregon, Idaho, and California. It's the largest regional airline in the Pacific Northwest.

Opportunities

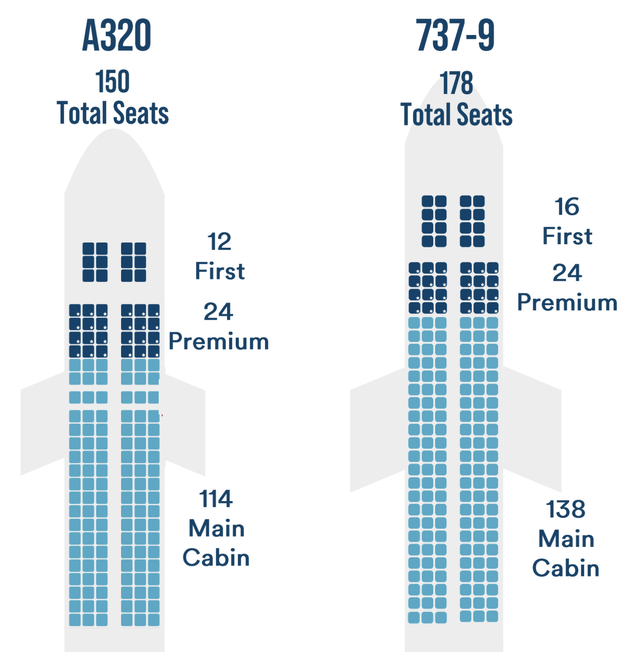

I think ALK's biggest opportunities come from its fleet modernization program. The company will shift the composition of its fleet from a relatively even mix of medium-sized and large-sized planes to be much more centered on larger planes with over 175+ seats. The move from 50% large-sized planes to 75% will give the company more overall seats, more premium seats (first class and premium-plus), as well as lower the cost per seat. Most of the new planes will be a variant of the 737 MAX. The company flew its last A320 in early January.

The move from an Airbus A320 to a Boeing 737-9, for example, adds 19% more seats and 33% more first-class seats. Approximately 22% of the seats on the 737 MAXs that ALK is getting delivered are considered premium.

Company presentation

Newer planes are also more fuel efficient than older models. The move to the 739-9 from the A320 saves about 25% in fuel consumption per seat.

In conjunction with its fleet modernization program, ALK is also moving both its Mainline and regional fleets to a single aircraft. The Mainline service will only operate Boeing (BA) aircraft, while Horizon will only fly Embraer E175s. This will reduce aircraft maintenance costs, as well as pilot training costs. The company expects $75 million in savings from the move.

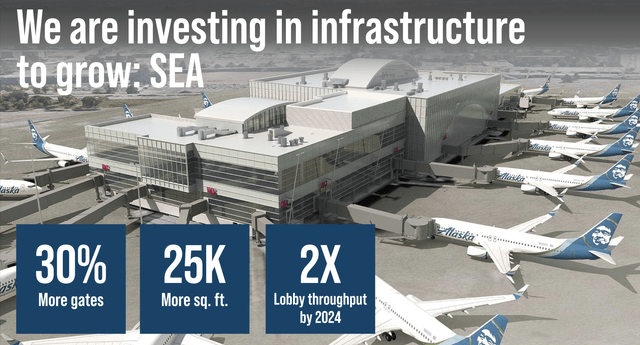

In addition to upgrading its fleet, ALK is also investing in its on-ground infrastructure. The company is investing to improve the terminal infrastructure in both Seattle and Portland, its two biggest hubs. Seattle is expanding in size and increasing the number of gates by 30%. Portland, meanwhile, is introducing a new lobby in 2024 and a new flagship lounge in 2026. LAX is also adding 20% gates by 2024.

Company Presentation

ALK has been able to invest in its business because it has one of the best balance sheets in the airline sector. The company has $2.4 billion in cash and marketable securities against $2.2 billion in debt and $1.5 billion in long-term operating leases. It also carries minimal pension liabilities.

Risks

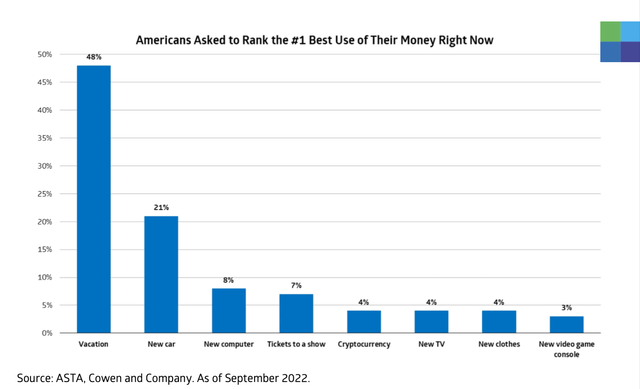

Airlines share many of the same risks. General economic conditions are always a risk, as a weak economy can negatively impact both leisure and corporate travel. Leisure travel has rebounded strongly from the pandemic and people probably view going on vacation as one of the best uses of their money, so if consumer demand wanes, it would have a negative impact on the industry, which is being driven by leisure travel.

Cowen

Capacity-demand dynamics are always worth watching, as excess capacity in the industry can cause a weak pricing environment. Overbuilding capacity is something that has plagued the industry in the past, but airlines have been much more disciplined the past decade.

High fuel costs are another risk. ALK is hedged, but after it any many other airlines saw a nice benefit in 2022, it will be more of a headwind in 2023. ALK management said it saw a $170 million hedging benefit in 2022, but that it will likely see a net cost in 2023.

For ALK specifically, given its ties to the Pacific Northwest and Bay areas, the recent tech layoffs could continue to keep business travel weak. For 2022, the company said corporate travel had recovered 75% based on volumes and 85% on revenues.

Hawaii, meanwhile, represents nearly 15% of ALK's Mainline capacity. This can be a competitive market, and before the pandemic, Southwest Airlines' (LUV) move into the market created an upheaval.

Weather can also be a risk, as storms in the Pacific Northwest hit ALK particularly hard. The severe winter weather impacted ALK's Q4 revenue by $45 million in Q4.

Valuation

ALK is expected to generate over $1.7 billion in EBITDA in 2023, putting it at a below 4.5x multiple. For 2024 it is projected to produce EBITDA of about $2 billion, valuing it at under 4x. This multiple is similar to United Airlines (UAL) at 4.8x and lower than Delta (DAL) at around 5.7x, but ALK has a stronger balance sheet. Historically, ALK can trade as high as 6-7x trialing EBITDA.

On a PE basis, the stock trades at about 9x the 2023 consensus of $5.53. For 2024, analysts are looking for EPS of $6.91, putting its forward multiple at just above 7x. According to Cowen, the average PE for airlines based on 2023 estimates was 16x in December.

Conclusion

ALK is riding several company-specific tailwinds. Its strong balance sheet has allowed it upgrade and modernize its fleet, which will create both revenue and cost savings opportunities in the years ahead. Meanwhile, it has also been investing in its on-ground infrastructure, as well.

These combined upgrades, along with its entry into the oneworld network in 2021, should create a better customer experience, which can then feed into its loyalty and branded credit card programs. The company recently renewed its credit card agreement with Bank of America (BAC), which has also likely helped drive revenue. There is an argument that the loyalty and credit card revenues are of higher quality and should be given a higher multiple in my view.

All in all, I think ALK looks attractively priced as long as the economy cooperates. Of course, that is a risk, given the current environment where the Fed is aggressively raising rates and tech companies lay off workers.

As such, I'd prefer to be a buyer of ALK's stock on a dip. However, I think if we can avoid a recession, the stock could move to between $65-70.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.