Strong Rebound In Retail Sales Gives Fed More Room To Lift Rates

Summary

- Economists were expecting a sharp recovery in US retail spending in January, but the actual number blew past even the most optimistic forecast.

- The strength in retail spending and payrolls in January conflicts with a variety of broad business-cycle indicators that reflect a weak economy.

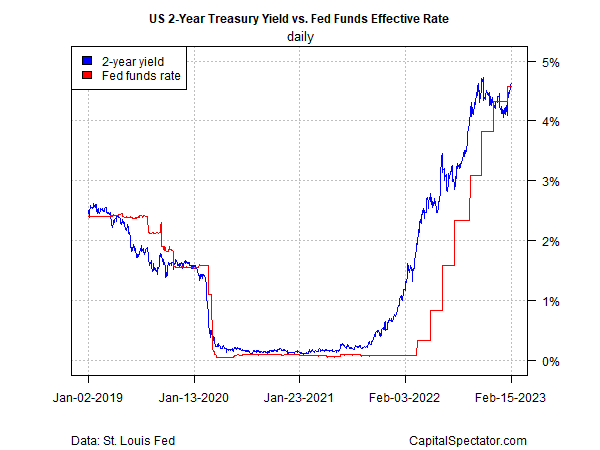

- Judging by the renewed push higher in the policy-sensitive 2-year Treasury yield, the bond market is again leaning toward the view that monetary policy will need to stay tighter for longer to tame inflation.

TERADAT SANTIVIVUT

Economists were expecting a sharp recovery in US retail spending in January, but the actual number blew past even the most optimistic forecast. One month could be noise, but for the moment it appears that the Federal Reserve’s aggressive campaign to tame inflation by slowing economic activity is faltering.

The red-hot 3.0% rise in retail sales last month follows news that payrolls surged in January. The two numbers suggest that the American economy remains resilient at 2023’s start, despite the Fed’s hawkish policy shift that’s lifted interest rates aggressively over the past 11 months.

The strength in retail spending and payrolls in January conflicts with a variety of broad business-cycle indicators that reflect a weak economy. The Conference Board’s Leading Economic Index for December, for instance, suggests the US is in recession. The US Composite PMI, a survey-based GDP proxy, also indicates the economy is contracting in January.

But if there’s trouble brewing, it’s not obvious in last month’s payrolls and consumer spending data. In fact, the contrast could hardly be any starker. The question is which profile is correct? Judging by the renewed push higher in the policy-sensitive 2-year Treasury yield, the bond market is again leaning toward the view that monetary policy will need to stay tighter for longer to tame inflation.

Indeed, the January numbers for the consumer price index slowed less than forecast, suggesting that the Fed’s efforts to strengthen the disinflationary process aren’t working as quickly and effectively as expected. “While the overall trend continues to improve, inflation continues to wield formidable momentum,” says Sarah House, senior economist at Wells Fargo. “The Federal Reserve is justified in its concern that inflation won’t easily be brought to heel.”

The 2-year rate ticked higher yesterday (Feb. 15), edging up to 4.62%, just below the previous peak of 4.72% in November, which still stands as the highest level since 2007.

The latest bounce in the 2-year rate has again lifted it above the 4.58% effective Fed funds rate, which suggests that the market may be recalibrating its outlook for a higher than previously expected terminal rate for the central bank’s hiking cycle.

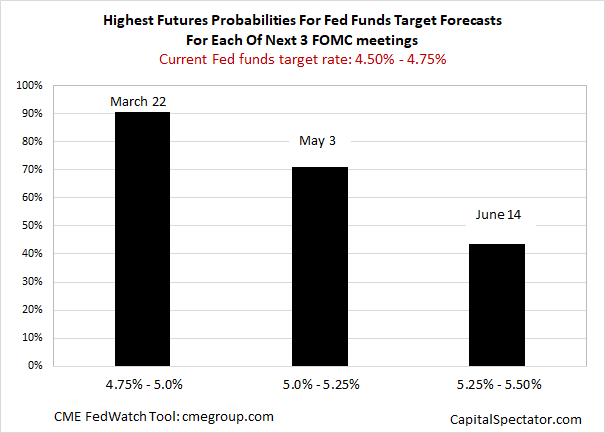

Fed funds futures may also be revising the outlook for interest rates. Focusing on the highest implied probabilities for Fed funds in each of the next three FOMC meetings indicates a path that lifts the current 4.5%-to-4.75% range to 5.25%-to-5.5% by the June 14 meeting, according to CME data.

The question is whether the January data for retail sales, payrolls and inflation is the more accurate profile of the economy? Or do other indicators that track the broader economic trend and paint a weaker profile capture reality?

Each side of this debate offers a compelling case for dismissing the other. But using the Treasury market as a guide suggests that it’s too early to declare a winner and loser. The bond market won’t stay balanced on the head of a pin for long, however. The next several weeks will likely show which side of this debate the 2-year yield is on. A decisive move above or below the effective Fed funds rate will be telling.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by