PJT Was Not That Well Positioned For The Latter Half Of The Downcycle

Summary

- PJT was an interesting idea, and indeed one that was given a premium by markets, because it might have benefited from economic strife.

- It seems that with the trajectory of the recession proving to be very garden variety, PJT may never get its heyday as a countercyclical advisor.

- They are adding headcount to try to build more recovery levered businesses presumably, and also their Park Hill sponsor-facing business turned out to be a weak performer.

- Overall, PJT was not well positioned, and while some smaller players are seeing restructuring pick up, that idiosyncratic data point is not mirrored in PJT.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Pgiam/iStock via Getty Images

PJT Partners (NYSE:PJT) is an advisory firm that does primarily restructuring, and is probably one of the best at it in the global market. They also do placements for sponsors. While restructuring seemed an obvious play for the economic downturn, it proved disappointing. Dialogue never became a flood of mandates, and the placement business of course languished as capital got called away from alternative investments. Their headcount is rising but they never got that kick from the downturn that markets are pricing them for. Compared to other companies like Moelis (MC) they are now discounted, so the market looks to be wise to the fact that PJT isn't the sharpest play.

Q4 Notes

In our coverage of the advisory houses, we saw some notice of at least some conversion in restructuring with Greenhill (GHL). 2021 was a trough year for restructuring, but 2022 ended up being just as bad. Default rates were too low to get real distress in the system. The problem is that these default rates may never materialise.

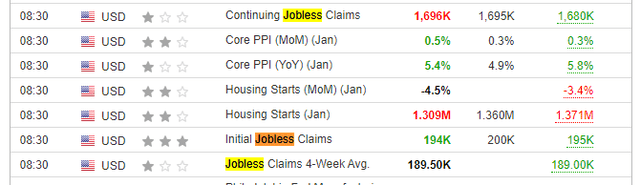

We believe that markets may be overestimating how quickly the rate cycle will end. There is quite a lot of hawkishness still, and it makes a lot of sense for the Fed to talk big. Besides their words being able to affect expectations, the problem is that we are still seeing labor market tightness, confirmed further by still pretty flat jobless claims, and concerns around not only how effectively inflation can be reduced, but how quickly.

Jobless Claims in line with last year (investing.com)

Higher rates can cool down parts of the economy, and a subsiding goods boom and reduced supply chain issues have been a major help too, but the inflation rates still need to come down further quite soon before they embed in expectations. The categories of inflation, like shelter, are also a concern for their effect on consumer inflation expectations.

However, as seen last week, inflation expectations are still really low. They're only a little over 3.9% according to the Michigan Consumer Expectations data, which is the most widely reported consumer expectations figure. Rates are probably not getting to the level where they'll meaningfully move default rates upon which restructuring activity relies. It's not been a great year for PJT despite a focus on restructuring over other types of advisory - and to be clear restructuring existed resiliently but just didn't grow from pretty trough levels.

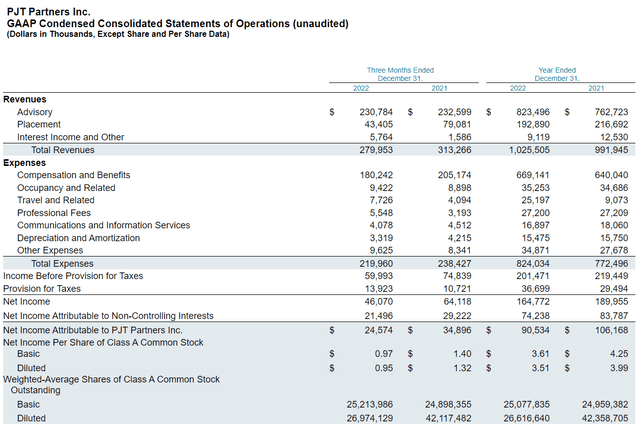

Q4 Income Statement (PR Q4 2022)

Other companies like Moelis, and the M&A and advisory industry overall saw massive decreases in engagements, easily 20% in the first half of the year due to base effects and later declines of more than 50% in many cases. But that's over now and recovery levered businesses are going to be the next thing, not restructuring.

Meanwhile, PJT's Park Hill business suffered. And placements came down about as badly as the rest of M&A due to the total focus on sponsor activity in placements, and with sponsor activity also driving down M&A activity as the debt markets closed shut. This may see recovery but the company itself admits:

And I think that there’s a recognition in corporate boardrooms that at least in the near-term while the playing field may not have tilted to strategics, it’s at least leveled. It’s high level or tilted a bit their way and I suspect that you will see with the increasing pickup in activity in to be more corporate-led than sponsor-led.

Paul Taubman, CEO of PJT

Bottom Line

Headcounts are rising by almost 10%, yet there's not much to show for it now. It's alright if they're investing for a recovery moment, but a lot of other companies are already primed for that like Moelis. Ultimately, PJT would have been the right pick earlier on for its resilience, but that restructuring pop hasn't come yet, and a recovery will likely come sooner than that. It's time has somewhat passed. While placements could see a recovery, it's not so much of the business and sponsor activity is a little more impaired than corporate activity for the time being, although we'd bet on some initiation of the sponsor recovery in 2023.

With M&A and advisory engagements having troughed now, we think they'll be much more positioned for a recovery situation. Markets certainly think so too where they've repriced the likes of Moelis and Greenhill and not PJT. PJT turns out to not have been that well positioned for this latter part of the countercycle. While things are likely to stay not-so-great economically, moving into a situation of major defaults seems like it'll take a lot more. It's cheaper than Moelis at 20x P/E instead of 24x, but some premium seems sensible at this point given what could come next.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Valkyrie Trading Society seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.