Energy Transfer 2023: Steady As It Goes

Summary

- 2023 EBITDA Guidance of $12.9-13.3 billion is very strong considering the weaker commodity price environment.

- 2023 CapEx guidance of $1.6-1.8 billion should probably be considered just a starting point, and is likely to increase.

- ET is now within their goal of 4-4.5x target leverage. All 3 rating agencies have a positive outlook for the senior unsecured debt.

- ET did not announce the redemption of the Series A preferred shares, which I expected.

- I believe unit repurchases are unlikely and ET will use additional cash flow for tuck-in M&A and additional CapEx. But this is probably ok!

kodda

Energy Transfer (NYSE:ET) reported 2022 earnings that were in-line with my expectations, and 2023 EBITDA guidance was slightly above what I expected considering the weaker commodity environment.

We got great news on the distribution a few weeks ago and on the debt ratings today, with CapEx guidance higher than what I expected.

2023 EBITDA Guidance

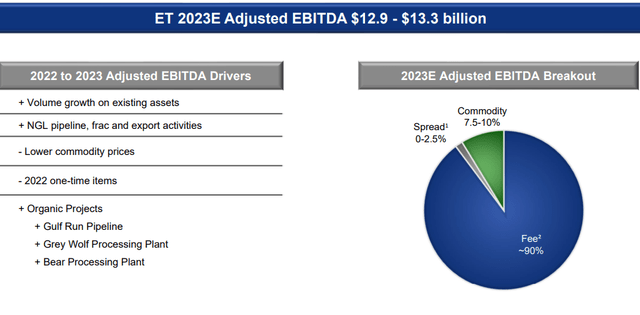

In my January article Energy Transfer: What to Expect in 2023 I said that I expected initial 2023 EBITDA guidance to be $12.8-13.2 billion, in line with 2022 results, with upside provided if commodity prices strengthen this year. I was close, with ET guiding to $12.9-13.3 billion, centered around the $13.1 billion in EBITDA they finished 2022 with.

ET 2023 EBITDA Guidance (ET FY22 Investor Presentation)

As noted on the conference call by ET Management, remember that we entered 2022 with EBITDA guidance of $11.8-12.2 billion.

Last February, natural gas traded at ~$4.50/MMBtu and crude oil was at $95/barrel, versus the current prices of $2.45/MMBtu and $78/barrel. Considering the substantially weaker price environment (far weaker for natural gas than when I estimated in early January) I think this is a great result that shows ET is truly building value-added assets.

I'm very happy with this guidance, even at the low end.

2023 Capital Expenditures Guidance

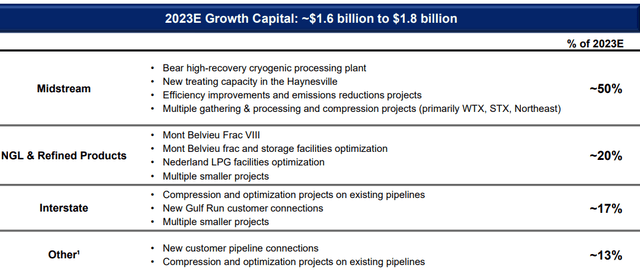

ET guided 2023 growth CapEx lower to $1.6 to $1.8 billion, down from $1.9 billion in FY2022. ET management did mention some 2022 spend slipping into 2023, which seems to be a yearly justification. The "$500-700 million a year" of CapEx guided for most of 2021 still remains elusive.

ET 2023 CapEx Guide (ET FY22 Investor Presentation)

It was noted several times that this number does not include any spending for projects that have not made it to FID, including the Lake Charles LNG mega-project, the Warrior pipeline, and several under consideration, including a CO2 project with Occidental Petroleum (OXY) and expansions at Nederland and Marcus Hook.

Of note, management cited a competitive environment as a key reason for not progressing to FID on Lake Charles.

The conclusion I took away from today's call was that the $1.6-1.8 billion is just a starting point for 2023 capital spend.

Leverage

Energy Transfer is now within its stated goal of 4-4.5x target leverage, and the senior unsecured debt rating is now on positive outlook from all three rating agencies.

ET Management indicated that it looked to keep leverage towards the low end of the range to maintain financial flexibility, but did not shift the range lower like Enterprise Products Partners (EPD) did.

I've read commentary that the "largest risk" to the Energy Transfer thesis is the "massive debt load". I believe this is wrong.

First, looking at a nominal number isn't helpful. Yes, the $48.2 billion of debt and additional ~$6 billion in Preferred Equity are big numbers, but so is $13.1 billion in EBITDA and $7.4 billion in DCF. That's why it's much more helpful to discuss leverage ratios, rather that point at big numbers. This is especially the case with ET's debt being termed out as well as it is. This, plus the stability of ET's cash flows, makes me comfortable with debt in this range, especially when ET is able to offer 10-year debt under 6% in this environment.

Dare I say it, but considering the majority of ET's debt is fixed, I'm happy they have it, for a few reasons

- Inflation is increasing the replacement cost of their assets

- Inflation is reducing the real value of their debt

- Many of their pipeline tariff rates include some inflationary index, such as the FERC (which is based of PPI-FG minus 0.21%.)

ET's debt is at a level and termed out well enough that even in an adverse scenario where credit markets closed completely, they could redirect sufficient cash flow to retire all their debt as it came due.

ET's debt does not concern me one bit.

Preferred Shares

Surprisingly (at least to me) Energy Transfer did not mention their preferred shares on the conference call, which I believed they would begin to redeem.

The $1 billion in Series A preferred shares became floating on February 15, 2023. Another $450 million of the publicly traded Series C preferred shares (NYSE:ET.PC) become floating on May 15th, followed shortly by $400 million of Series D (NYSE:ET.PD) on August 15th.

These shares will reset to the 9-10% range this year. ET does have the available cash (and credit lines) to redeem these, but made no indication that they're doing so thus far.

Unit Repurchases Coming? (tldr; probably not.)

I doubt we'll see substantial unit repurchases in 2023. While they weren't outright dismissed on the call, my read is that we will not see them this year, despite the extra cash ET will generate.

ET finished 2022 with $7.4 billion in Distributable Cash Flow. EBITDA guidance for next year is effectively flat with 2022 (plus or minus $200 million) because of a tougher commodity price environment. DCF will likely be in the same ballpark, perhaps a touch lower on slightly higher interest and preferred distribution expense. I'll use $7.2 billion to be ultra conservative.

From the $7.2 billion, they'll use $3.8 billion on distributions (3.1 billion units x $1.22/unit) leaving $3.4 billion remaining. Subtracting the high end of CapEx guidance of $1.8 billion, leaves $1.6 billion left over, about enough to retire 4% of the outstanding units.

But ET Management said that this CapEx did not include any consideration for tuck-in M&A (like the August 2022 Woodford Express acquisition for $485 million) or other "exciting" projects being considered. It won't take many of these projects reaching FID to use up most of the additional cash.

Conclusion

The welcome news to all unit holders is that the distribution is restored back to $1.22/unit as promised, and EBITDA guidance is strong considering the challenging commodity environment.

The more mixed news is that ET looks to be continuing down the path of prioritizing growth and tuck-in M&A over unit repurchases. It would not surprise me to see units pressured over the next few days because of this.

I believe ET offers incredible value at these levels, and even though I would like to see unit repurchases over CapEx, I'm growing more comfortable with the strategy. I believe recent results have been good and projects are being completed on time, and proposed capital projects are either short-cycle, located in friendly jurisdictions, or both.

Absent higher commodity prices, I'm tempering my expectations for unit price growth for this year and think units will be rangebound between $12-14. But my longer term view remains unchanged. Offering a 9.3% yield while reinvesting $3+ billion in the business, ET offers a compelling combination of income and growth, and is one of the best risk/reward opportunities in today's market.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.