EnLink Midstream: Buy Their 4% Yield, Line Up A Potential 8%+

Summary

- EnLink Midstream, LLC recently lifted their dividend circa 11% higher.

- They also posted impressive cash flow performance during 2022 that built upon their already very strong results from 2021.

- When looking ahead into 2023, despite continuing to pursue growth investments, EnLink Midstream should still see circa 200% dividend coverage.

- This should leave plenty more dividend growth in the coming years and potentially turn EnLink's moderate circa 4% yield into a high 8%+ yield on current cost.

- Following this analysis, it should not be surprising that I once again believe maintaining my buy rating on EnLink Midstream, LLC is appropriate.

JamesBrey

Introduction

When last discussing EnLink Midstream, LLC (NYSE:ENLC), their exposure to natural gas saw them all gassed up for an era of dividend growth following the otherwise tragic Russia-Ukraine war, as my previous article discussed. In the subsequent months, they did not disappoint, with circa 11% dividend growth. When combined with further very impressive results and strong guidance for 2023, it shows that if investors buy their 4% yield, it can see them line up a potential 8%+ yield on current cost in the coming years.

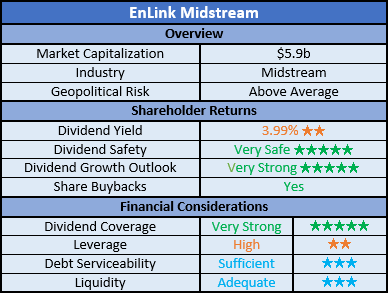

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and, importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

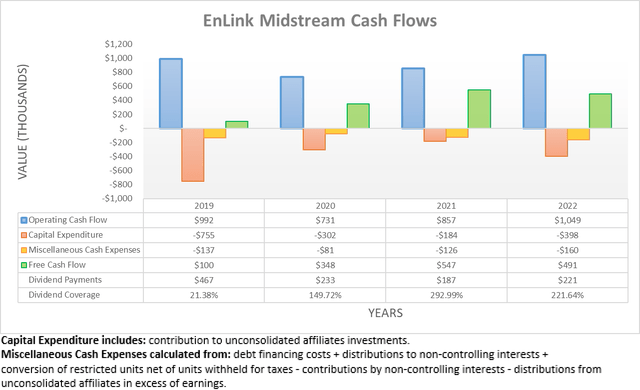

After seeing their cash flow performance continue to power even higher during the first half of 2022 following a very strong set of results during 2021, it raised the bar for the second half of the year and, thankfully, they did not disappoint. When everything was finally said and done, they locked in an operating cash flow of $1.049b, which represents a very impressive increase of circa 22% year-on-year versus their previous result of $857m during 2021. Naturally, their only modest capital expenditure allowed a sizeable portion to be converted into free cash flow of $491m during 2022, which in turn provided very strong coverage to their accompanying dividend payments of $221m.

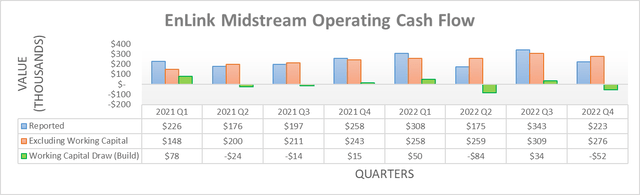

The strengthening of their results for 2022 is further confirmed when viewed on a quarterly basis when excluding their working capital movements. Whilst their reported results vary quarter-to-quarter in part due to the former, if excluded, their underlying results in each quarter during 2022 showed year-on-year improvements. Most recently, the third and fourth quarters saw underlying respective results of $309m and $276m, which were both significantly higher than their respective equivalent previous results of $211m and $243m during 2021. This sets a positive base heading into 2023, which itself sees strong guidance for another good year ahead.

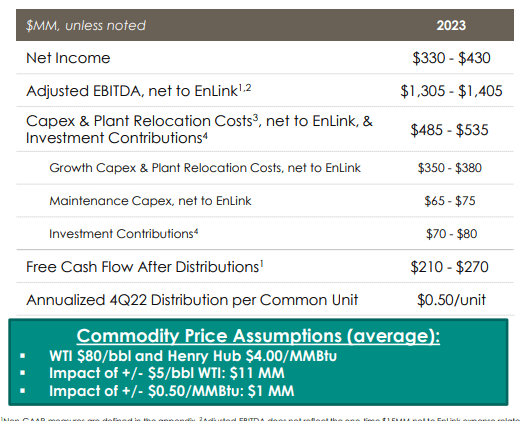

EnLink Midstream Fourth Quarter Of 2022 Results Presentation

When looking at their guidance for 2023, it forecasts adjusted EBITDA of $1.355b at the midpoint that is circa 5.50% higher year-on-year versus their result of $1.285b during 2022, as per their fourth quarter of 2022 results announcement. Meanwhile, they also forecast capital expenditure of $510m at the midpoint that is expected to leave $240m of free cash flow after dividend payments at the midpoint. Since this broadly matches their dividend payments, it indicates approximate coverage of 200%. Therefore, their very strong coverage should continue throughout 2023 with ample free cash flow to facilitate more large dividend growth, especially as they are not pulling back on growth investments given the $365m at the midpoint they forecast directing that way concurrently. Their ability to back up very strong results with even better results bodes well for the quality of their assets and thus, by extension, it sees potential for investors who buy now to line up a high 8%+ yield on current cost in the coming years as they pass along more of their free cash flow.

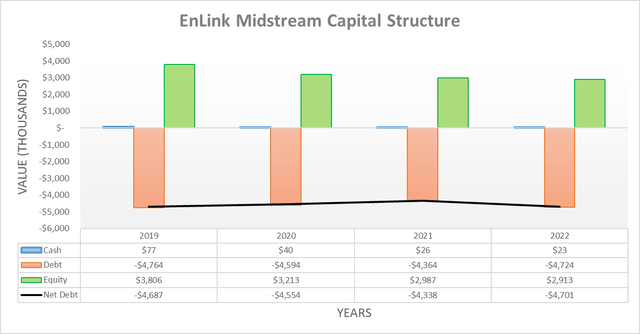

Despite producing ample free cash flow during the second half of 2022 since conducting the previous analysis, their net debt still jumped higher to end the year at $4.701b versus its previous level of $4.302b following the second quarter. This resulted from a combination of $124.3m of share buybacks as well as $390.3m for acquisitions, which largely pertained to those acquired from Crestwood Equity Partners (CEQP) in the Barnett Shale region.

Since the previous analysis assessed their leverage, debt serviceability, and liquidity in detail, it would be redundant to cover these in detail once again, especially as their outlook for 2023 was the main focus of this follow-up analysis. Even though their net debt is now modestly higher, when looking ahead into 2023 it should resume its downward trajectory once again given their very strong dividend coverage, barring any further presently unknown acquisitions. When this is combined with their strong guidance for 2023, it largely removes any significant risks or hindrances to further dividend growth.

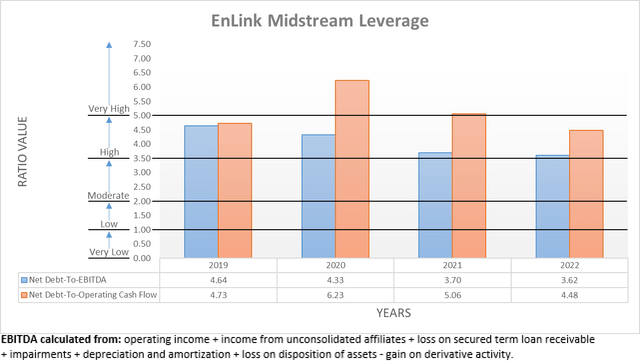

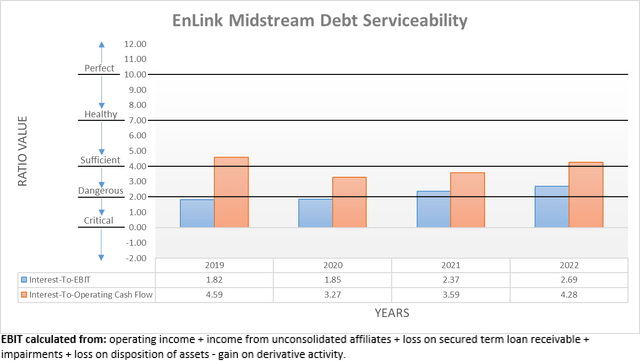

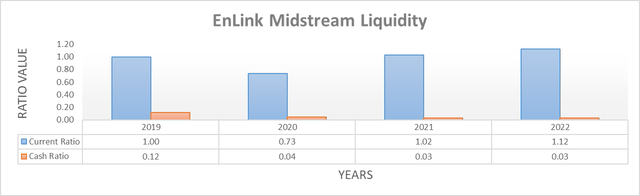

The three relevant graphs are still included below to provide context for any new readers, which shows their net debt-to-EBITDA of 3.62 is now towards the bottom of the high territory of between 3.51 and 5.00, whilst their accompanying net debt-to-operating cash flow of 4.48 is slightly past the middle point. Similarly, their debt serviceability is sufficient with interest coverage of 2.69 when compared against their EBIT and whilst a comparison against their operating cash flow sees a materially better result of 4.28 that would normally be considered healthy, I prefer to judge on the worst side. These are accompanied by adequate liquidity given their current ratio of 1.12 and cash ratio of 0.03. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

Another year has come and gone and once again. EnLink Midstream, LLC stock has provided shareholders with a very impressive set of results that build upon already very strong results in prior years. Their financial position is solid and exciting, and they are producing roughly twice the amount of free cash flow required to fund their dividend payments, despite also funding further growth projects. Since this could see EnLink Midstream, LLC's moderate circa 4% dividend yield turns into a high circa 8%+ yield on current cost in the coming years, it should not be surprising that I believe maintaining my buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from EnLink Midstream's SEC filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.