Tracking Prem Watsa's Fairfax Financial Holdings Portfolio - Q4 2022 Update

Summary

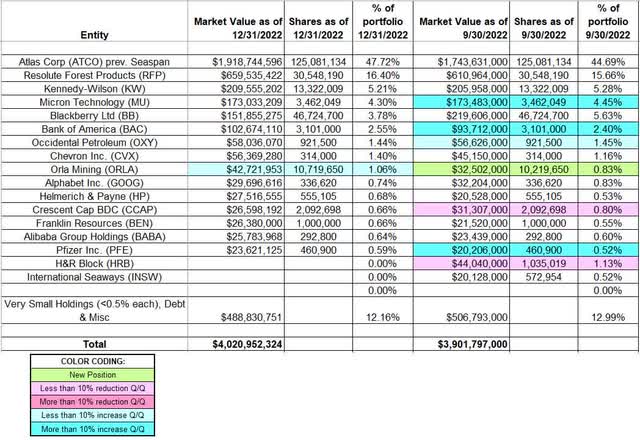

- Prem Watsa’s 13F portfolio value increased from $3.90B to $4.02B this quarter.

- Fairfax Financial's largest three stakes are Atlas Corp, Resolute Forest Products, and Kennedy-Wilson. They together account for ~69% of the 13F assets.

- The 13F securities form a small portion of their overall investment portfolio.

cagkansayin

This article is part of a series that provides an ongoing analysis of the changes made to Prem Watsa's 13F portfolio on a quarterly basis. It is based on Watsa's regulatory 13F Form filed on 2/14/2023. Please visit our Tracking Prem Watsa's Fairfax Financial Holdings Portfolio series to get an idea of his investment philosophy and our previous update for the fund's moves during Q3 2022.

This quarter, Watsa's 13F portfolio value increased ~3% from $3.90B to $4.02B. There are 75 securities in the portfolio, but it is concentrated among a few large stakes. The focus of this article is on the larger (greater than 0.5% of the portfolio each) equity holdings. The top three positions are Atlas Corp., Resolute Forest Products, and Kennedy-Wilson. Together, they account for ~69% of the entire 13F portfolio.

Note 1: Fairfax Financial's (OTCPK:FRFHF) 13F holdings only represent a small portion of their overall investment portfolio. The total size as of Q3 2022 was ~$52B of which ~$8.2B was in cash and short-term positions. The bond allocation went up from ~$14B to ~$27.4B during the year. FRFHF currently trades at ~$649 compared to Book Value (Q3 2022) of ~$570 per share. The equity portfolio was 100% hedged starting from around 2003 but those were removed in Q4 2016.

Note 2: Prominent equity allocations not in the 13F report include investments in Greece and India (OTCPK:FFXDF). Greek allocation primarily consists of a ~32% ownership of Eurobank (OTCPK:EGFEY) (OTCPK:EGFEF). Other prominent stakes include ~27% of Thomas Cook India, 54% of Bangalore International Airport Limited, and 31% of Quess Corp Limited.

Stake Disposals:

H&R Block (HRB): HRB was a small 1.13% of the portfolio position established in Q1 2021 at prices between ~$15.50 and ~$22. Q3 2021 saw a ~45% stake increase at prices between $23.35 and $26.30. The disposal this quarter was at prices between ~$36 and ~$44. The stock is now at $39.71.

International Seaways (INSW): The very small 0.52% stake in INSW was sold this quarter.

Stake Increases:

Orla Mining (ORLA): ORLA is a small ~1% of the portfolio stake purchased last quarter at prices between ~$2.40 and ~$3.70. There was a minor ~5% stake increase this quarter. The stock currently trades at $4.11.

Kept Steady:

Atlas Corp. (ATCO) previously Seaspan Corp: ATCO is currently the largest 13F stake at ~48% of the portfolio. It came about from exercising 38.46M in warrants in July 2018 and the same amount in January 2019 at $6.50 per share. Later on, 25M in warrants that had a strike price of $8.05 was also exercised. The stock currently trades at $15.34. They have a 47.5% ownership stake in the business. Last August, Atlas Corp received a "take private" proposal from a consortium that included Fairfax at $14.45 per share. The offer was later increased and accepted at $15.50 per share.

Resolute Forest Products (RFP): The large (top three) RFP stake is now at ~16% of the portfolio. The position was first established in Q4 2010 when it was named Abitibi Bowater and the stake has since been more than doubled. Over the years, their net investment in RFP was $745M ($24.39 per share) and the current value is ~$665M ($21.80 per share). Their ownership stake is just under ~39% of the business.

Note: On 7/6/2022, Paper Excellence Group agreed to acquire Resolute Forest Products for $20.50 per share and one CVR (not tradeable) tied to potential duty refunds of $500M. Resolute to become a subsidiary of Domtar which was acquired by Paper Excellence Group last year.

Kennedy-Wilson Holdings (KW): KW stake is a large (top three) 5.21% of the 13F portfolio position first purchased in 2010. Q4 2016 saw a ~40% increase at prices between $20 and $23 and that was followed with a ~8% increase in Q1 2018. KW currently trades at $18.11.

Note 1: They also have a 13M share stake in the warrants (7-year term, $23 strike) that they received as part of a $300M investment in perpetual preferred stock (4.5% dividend) made last February.

Note 2: The original 2010 stake was from a private placement for Kennedy Wilson convertible preferred stock. The total investment from that point thru Q3 2016 was $645M. Since then, they invested another ~$85M. By EOY 2015, they had already received distributions of $625M and so the net investment was ~$105M. That is compared to current market value of ~$240M.

Micron Technology (MU): MU is a 4.30% portfolio position that saw a ~60% stake increase in Q1 2019 at prices between $31 and $44. The position was increased by ~115% in Q1 2020 at prices between $34.50 and $60. That was followed with a whopping ~400% stake increase last quarter at prices between ~$49 and ~$65. The stock currently trades at $61.84.

BlackBerry Ltd (BB): BB stake is now at 3.78% of the portfolio. The position was first purchased in 2010 at around $50 for 2M shares. The stake was aggressively built up to 46.7M shares in the following years. Their net cost on a fully converted basis is ~$10 per share and the stock currently trades at $4.37. There has only been very minor activity in the last ten years.

Note: In Q4 2013, Fairfax co-sponsored a cash-infusion of $1B through convertible debentures ($10 conversion price earning 6% interest) - they financed $500M of that transaction and the remaining was funded by a consortium of other investment funds. In Q3 2016, those shares were redeemed, and new ones issued ($605M in 3.75% debentures convertible at $10 due 11/13/2020) to the same entities in a private placement. On 9/2/2020, those were redeemed, and new ones issued ($330M in 1.75% debentures convertible at $6 due 11/13/2023). Assuming full conversion of these debentures, Fairfax would beneficially own ~16.4% of the business (~102M shares).

Bank of America (BAC) and Occidental Petroleum (OXY): These two positions were built over the last two quarters. The 2.55% BAC stake was established at prices between ~$30 and ~$41 and the stock currently trades at $35.56. OXY is a 1.44% of the portfolio position purchased at prices between ~$55 and ~$75 and it is now at $62.90.

Chevron Inc. (CVX): The 1.40% of the portfolio CVX stake was doubled in Q2 2022 at prices between ~$142 and ~$181. The stock is now at ~$169.

Alphabet Inc. (GOOGL) (GOOG): GOOG is a 0.74% stake purchased in Q1 2020 at prices between ~$53 and ~$76 and it now goes for $97.10. There was a ~22% stake increase in Q4 2020 at prices between ~$71 and ~$91.

Crescent Capital BDC (CCAP): CCAP is a 0.66% of the portfolio stake purchased in Q1 2020 at prices between $6.21 and $17.10 and the stock currently trades at $14.68. Last four quarters saw selling.

Note: Their ownership stake in the business is ~6.8%.

Franklin Resources (BEN): The 0.66% BEN position was established in Q1 2020 at prices between $15.30 and $26.25 and it is now at $31.74.

Alibaba Group Holding (BABA): BABA is a 0.64% of the portfolio position established in Q4 2021 at prices between ~$112 and ~$178. Q2 2022 saw a stake doubling at prices between ~$81 and ~$120. The stock currently trades at ~$103.

Helmerich & Payne (HP) and Pfizer Inc. (PFE): These two very small (less than ~1% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Watsa's 13F stock holdings in Q4 2022:

Prem Watsa - Fairfax Financial's Q4 2022 13F Report Q/Q Comparison (John Vincent (author))

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of FRFHF, BB, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.