BP: Moving From Buy To Hold After A 73% Gain

Summary

- We have been bullish on BP since 2021, with a $37/share price target.

- After doing yet another U-turn, this Oil & Gas major has decided to stick with oil for now.

- The latest company pivot has seen its P/E multiple increases, and its stock price finally exceed its pre-Covid levels.

- Having reached our target, we are now on Hold for the name, not having much faith in the current flip-flop management at the helm.

- There is not much upside left here given true Oil & Gas Majors like XOM and CVX trade with a 10x multiple, and BP will always have a much lower basis given its poor management record.

jewhyte

Thesis

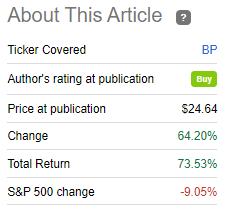

We have been bullish BP (NYSE:BP) for a while via our articles, outlining our thesis on why this laggard Oil & Gas Major will eventually get back its mojo. Our first article on the name was in September 2021, and the stock is up over 73% since our initial Buy Rating:

Author Performance (Seeking Alpha)

We continued covering the name with articles such as the one below, where we were highlighting the substantial return opportunity in overlooked value names with low P/E ratios:

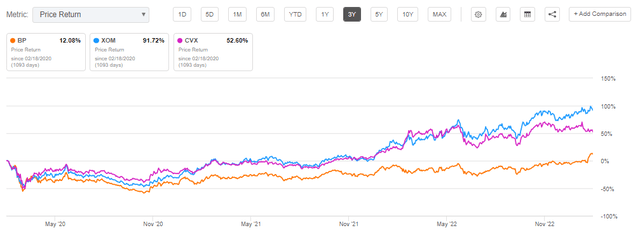

BP is a European Oil & Gas Major that has been very slow in recovering from the Covid crisis:

We can see from the above chart that only now in February 2023 BP finally was able to get to a price point above its pre-Covid levels. When looking at (XOM) or (CVX) we can notice it took them only 1 year after the pandemic to close out their drawdowns. It took BP almost 3 years! The reasons behind this slow performance are the usual suspects:

- the company trying to pivot to a green energy company rather than stick to its guns

- poor communication from management regarding strategy and profit optimization per segment

- European company with significant political risk associated with it

- impact of Russian assets write-downs on the balance sheet

Why is BP above our target price level of $37/share?

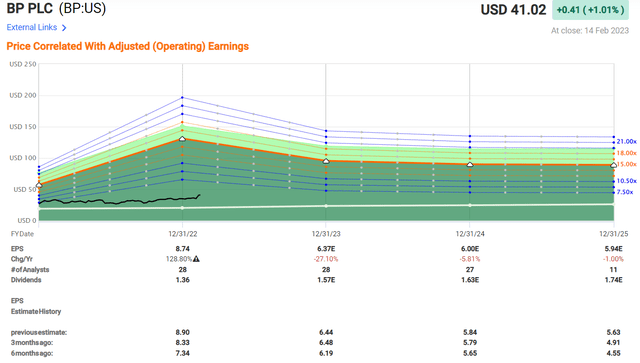

The reason behind the recent rally in the BP shares is not really profit driven - it is more regarding its ethos and management communication. Basically in the latest iteration of the BP saga, management has now pivoted 180 degrees to having BP be an Oil & Gas Major first, and a clean energy company second. Its projected earnings per share have not changed that much, in effect they are set to decrease in the upcoming years:

We can notice from the above graph, courtesy of FastGraphs, that BP is set for lower earnings in 2023 and 2024 when compared to 2022. So what gives? Why has the price in the company suddenly exploded when in effect the EPS growth is behind us?

The answer lies in optics, and in the P/E multiple. Since Covid the company has blundered its way into selling profitable Oil & Gas assets while allocating more capital to low return green energy endeavors. This tactic has kept the P/E ratio for the enterprise at very low depressed levels of 4x to 5x earnings. Even when the EPS component grew, the price did not move that much because the multiple was low. Few people realize that equity appreciation comes from P/E expansion rather than substantial EPS moves. With a $8.7 EPS in 2022 the company was trading in the high $20s / low $30s. Now with forward earnings around $6/share the company is trading in the $40s. Why? Because the P/E is now higher, with the market enjoying the fact that BP is at least saying they will be more of an Oil & Gas major rather than a green energy enterprise.

Should we believe them? I mean this management team has pivoted more times that it can remember. And honestly it feels more like the BP leadership is akin to 'The Office' TV show where inept management consultants brainstorm on how they can spin off more new and innovative ideas without much substance around them. I mean this is the company that in 2021 sold its extremely profitable Oman natural gas business in order to allocate that capital to green energy. What followed? The biggest spike in nat gas and LNG prices in recent memory in 2022. It looks like BP likes to sell low and buy high. Maybe an investor should think of BP as the new Jim Cramer - i.e. a contrarian indicator. My point is that I do not trust one bit the management here, that pivots every other year and destroys value by buying assets high and selling them low. BP has managed to have a price in the $40s, DESPITE its management team. Our profit target being met, we are happy to exit the stake here. Any future gains here will come from the P/E ratio going up, not from EPS growth. And it only takes a new management blunder to de-rate the company yet again. The likes of Exxon trade at 10x P/E ratios because they always identified themselves as a big oil company and acted as such. Engulfed in European politics and a flip-flop management team, BP does not have much upside in terms of P/E ratio. It surely does not deserve to be in the same bracket as the likes of XOM or CVX.

Conclusion

BP is an Oil & Gas Major that fancied itself as a green energy company for a while. It sold very profitable oil and gas assets at the lows in 2021 and moved towards low profitability renewable energy projects. Even as its EPS soared, the company's price lagged as the market assigned a very low multiple of 4x to its shares. Kindly keep in mind that the overall S&P 500 currently trades with a 17x multiple, while the likes of XOM and CVX trade with 10x multiples. After pivoting yet again on their latest earnings call, BP has once again decided to be an Oil and Gas major. The market has rewarded the latest flip-flop with a 20% rally and a P/E re-rating to 6.5x. There is not much trust in management here and there will always be a basis to the well-run American Oil & Gas majors. Expect a maximum 7x P/E multiple here. We do not think BP is undervalued anymore, hence we are moving from Buy to Hold.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.