New Fortress Energy: Continued Portfolio Optimization Into 2023

Summary

- NFE is known for using a disruptive approach in its development of stalled gas assets such as Lakach in Mexico.

- The 5 Fast LNG units under development by NFE represent a liquefaction increment of about 7 million tons per annum (mta).

- NFE is targeting an operating cash flow of up to $10 billion in the next 3 years.

SanderStock/iStock Editorial via Getty Images

Ahead of its Q4 2022 earnings date on February 28, 2023, New Fortress Energy (NASDAQ:NFE) is working to increase its liquidity above $5 billion over the next three years. Q3 2022 revenue hit $731.93 million, growing 140.25% (YoY) and beating Wall Street estimates by $128.04 million. NFE’s EPS of $0.41 missed consensus estimates by $0.32. Into FY 2023, NFE expects quick positioning of Fast LNG 1, higher operating margins for its core business, and perpetual optimization of its portfolio.

Thesis

NFE expects to add up to 350 trillion British thermal units (TBtu) to its LNG supply portfolio by 2025 after current supply contracts hit 88 TBtu in 2022. The management also expected to return significant capital to shareholders with the $5 billion in liquidity to be generated by 2025. This liquidity will be used as CapEx, paying down debt and issuing dividends to investors. The company is setting up novel assets while developing new market locations to cope with the surging demand for LNG, especially in Europe and Asia.

Company developments into 2023

NFE is projecting substantial growth in its LNG portfolio through 2025. As of 2021, NFE’s supply of floating liquefied natural gas (FLNG) stood at 74 TBtu before it raised it by 18.9% to 88 TBtu in 2022. After deploying its first Fast LNG 1, NFE expects to reach 161 TBtu in 2023 before hiking it by 350 TBtu in 2025 to 464 TBtu. In its Q3 2022 earnings call, NFE explained that it had 5 FLNG units under development to ensure it realizes this goal. It has already submitted its Maritime Administration (MARAD) application to install 2 FLNG assets in West Delta, Texas; and three assets in Altamira.

According to NFE, the 5 Fast LNG units under development represent a liquefaction increment of about 7 million tons per annum (mta) that stands above half of the global LNG incremental supply expected between 2023 and 2024. The company primarily had Europe and Asia as target customers while developing this technology for deployment. These LNG vessels use jack up rigs that would have smaller liquefaction trains whose deployment will cost less and will be quick.

NFE is known for using a disruptive approach in its development of stalled gas assets. In the Mexican operation at Lakach (one of the five FLNG units to be developed in the next 2 years), NFE is forecasting an all-in-cost LNG producer. Along with the nearby fields, Lakach has a total natural gas resource potential of about 3.3 trillion cubic feet with the ability to yield more than 10 years of production.

NFE’s focus is on providing LNG and energy in needy locations with electricity providers being its largest consumers. In Q2 2022, NFE’s revenue rose 15.8% after the company sold 3 million gallons per day of LNG up 66.7% (YoY) from 1.8 million gal/day. In October 2022, the global LNG benchmark price touched $29.74 per million metric British thermal units. In North Asia, the spot LNG price dropped to $18.50 per mmBtu in the first week of February 2023.

The price drop followed a 1.1% (MoM) increase in Asian imports of the commodity in January 2023 to 24 million tons while Europe's imports slipped 8.1% (MoM). There is a scramble to deliver LNG cargoes to Europe since it was a recipient of about 40% of its natural gas supply from Russia before the Ukraine war. The focus on Europe may also continue to boost Asian LNG prices in 2023.

Q3 2022 saw NFE sell 24 TBtu in total volumes. This was equal to the mean operating margin of about $15 per MMBtu. An increase in the NLNG assets will mean an equivalent increase in revenue and asset development into 2023. NFE stated in its earnings call that it had increased its illustrative goals for 2023 to $2.5 billion from $1.5 billion. Already, the adjusted EBITDA for the quarter stood at $291 million indicating an increase of 2.83% (QoQ). Current assets in the 9 months ending on September 30, 2022, stood at $1.04 billion, a 78.6% increase from the sum realized as of December 31, 2022.

Business transactions to consider

NFE recently announced that it had reached an agreement with Golar LNG Ltd (GLNG) for the sale of its 4.1 million shares in Hilli as well as an additional $100 million in cash. As of Q3 2022, NFE had guaranteed about $323 million under the Hilli Leaseback which Golar will take over in this transaction. NFE intends to sell its minority stake in trains 1 and 2 of the Cameroonian FLNG Hilli whose clients include, the Anglo-French oil & gas firm, Perenco, and Cameroon’s national oil company, SNH. This deal is expected to close in Q1 2023 and it reduces NFE’s outstanding shares by about 2% to 204.7 million from 208.8 million shares listed in the quarter.

In praising this deal, NFE’s CEO stated,

From a strategic perspective, it will allow us to focus solely on our FLNG portfolio that we own 100 percent of as well as buy back NFE stock at an attractive valuation.”

The total capacity of LNG held by FLNG Hilli stands at 2.4 million metric tons per annum (MTPA).

In Q3 2022, NFE began operations in the EemsEnergy Terminal in the Netherlands where it chartered a floating storage and regasification unit (FSRU). There has been a booming demand for FSRUs in Europe as the continent continues to seek independence from Russian energy. Netherlands has been named among other European heavyweights such as Germany, Italy, and Finland which are all chartering FSRUs to quickly boost their import capacity of LNG. The Dutch government is expected to spend $548.4 million to fill its gas storage facilities which as of December 2022 were 86% full and needed to be at 90% capacity in 2023.

Dividend Policy

NFE announced an update to its dividend policy for FY 2023 where it would allocate 40% of its annual adjusted EBITDA guidance of $2.5 billion for dividend payout on a semi-annual basis. This payout was structured from January 2023 based on a $3 per share rate. NFE is confident of generating extra liquidity of $11 billion by 2025 to propel accretive investments, downstream CapEx, FLNGs, and higher dividend payout to investors.

Beyond 2023, I expect the company to possess more FLNG vessels under operation a move that will contribute to higher income levels thereby giving more room for higher dividends. The company’s growth including shareholders’ value should be funded organically to ensure sustainability. With the dividend yield (FWD) now at 1.01%, I expect it to exceed 10% into 2024.

Risks to Consider

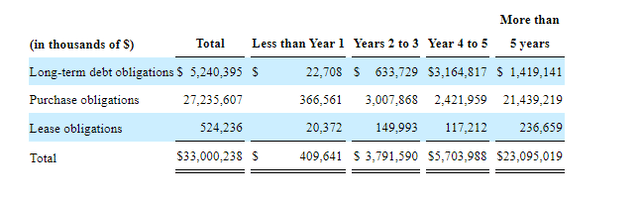

While NFE is targeting an operating cash flow of up to $10 billion in the next 3 years, it may signal that the company is prepared to spend billions on CapEx, debt interest payment, and other heightened operating expenses. NFE is determined to make cash payments of its long-term debt, purchase, and lease obligations which amount to $33 billion accumulated for more than 5 years.

I believe that the divestiture of Hilli is also part of NFE’s plan to lower its long-term/ lease obligations that have been weighing in on the company’s earnings. NFE's total asset cover as of September 30, 2022, stood at $7.441 billion which is lower than its long-term debt obligations. However, the company has been working to increase earnings over the years leading to an accumulated loss reduction of 96.9% (QoQ) to $2 million from $63.9 million.

NFE will probably find it hard to balance CapEx and dividend payments in 2023 due to their high investments expected on FLNG and downstream LNG operations. However, I think it is still possible to look towards a dividend payout of $2.50 a share into H2 2023. This can be possible if NFE manages to set up its 3 new terminals for European gas infrastructure by Q1 2023 as indicated in its earnings call. By 2024, NFE estimated that its run rate will be supported by 9 terminals, 5 FLNG units, and a $5 billion illustrative adjusted EBITDA. The company is also focusing on deleveraging its debt obligations by up to $3 billion in the year.

Bottom Line

New Fortress Energy is an important stock to watch as far as the growing LNG space is concerned. NFE has been acquiring assets and setting up new areas of operations to try to satisfy the growing demand for LNG not just in the US but also in Europe and Asia. The company established a new dividend policy of 40% of illustrative adjusted EBITDA to indicate growth of shareholder earnings in 2023. I believe that it will be stabilized in 2024 after the infrastructural developments have been set up. The stock is trading up by about 79.30% (YoY) as of this writing and I expect it to grow above 100% after the earnings release on February 28, 2023. I recommend a buy rating for the stock.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of NFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.