Upstart: This Is A Contrarian Bet

Summary

- Upstart's guidance for Q1 is a disaster.

- Upstart is one of the worst capital allocators. Period.

- Balance sheet is not severely constricted.

- And despite all this, I'm still bullish on UPST. Here's why.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

SolStock

Investment Thesis

Upstart (NASDAQ:UPST) has gone from a crowd favorite to one of the worst stocks out of the bubble period. And the guidance ahead does not look enticing. Not at all.

Furthermore, the most shocking insight is just how bad UPST's balance sheet has become. And then, on top of all this, Upstart deployed nearly 10% of its market cap to buy out shareholders at prices meaningfully higher than the current share price.

And yet, I'm bullish on this company. Here's why.

Revenue Growth Rate Guidance is Appalling

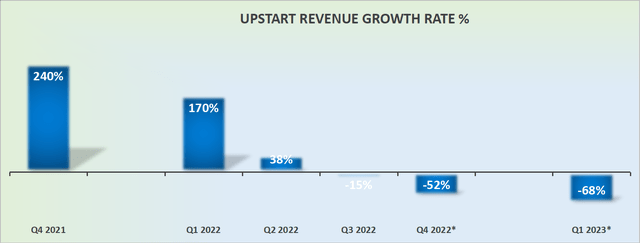

UPST revenue growth rates

Guidance for Q1 is truly awful. It's difficult to imagine how bad things have gotten for this once high-flying AI-driven lending platform.

It's not only that revenues in Q4 were less than half of those of the prior-year quarter, but that guidance for Q1 is even worse. So, why am I bullish on Upstart?

The thing with investing is that it works best if you narrow down the thesis to one or two simple trackable variables. For example, Warren Buffett asserts that his thesis on Coca-Cola (KO) is surmised as this: the number of shares going down as ounces of Coke consumed going up.

It's nothing too complicated. It's the simplicity that allows for clarity in the investment thesis.

I know that UPST is not KO. There are countless variables that make UPST a less-than-easy investment. I recognize this now. I didn't recognize it in the past. I was too caught up drinking the Kool-Aid.

And on top of this, UPST has proven to be a very poor capital allocator.

Poor Capital Allocators

Aside from UPST having been a very poor-performing company in 2022, management compounded their mishaps by using precious capital to repurchase shares at the wrong time.

More specifically, UPST spent $178 million to repurchase 5.9 million shares. To put this figure in context, it's not only that UPST's average share repurchase was at $30, which is nearly 100% higher than the current share price.

But that 10% of the company's market cap has now gone out the door. Think of it this way, to whom did that $178 million of capital go?

That capital went to shareholders that exited the company. In sum, UPST gave the capital to shareholders that wanted to leave the company. It took capital away from those that remain ''long-term'' believers and investors of Upstart.

Let me put it this way. In last year's Q4 2021 results, UPST had a net cash position of approximately $250 million. And the business was reporting positive cash flows.

Today, the business exited Q4 with a net debt position of about $550 million. And the business is expected to be burning through free cash flow, at least in the early parts of 2023.

How much worse can the business get?

Why I'm Bullish on UPST

There's no doubt that loan originators want nothing to do with an ailing loan approval company such as UPST. When the company was flying high, there was a mystique and many banks and credit lenders would have been quick to consider Upstart's credit approval platform.

UPST was seen as having a ''secret sauce'', with disruptive AI driven technology.

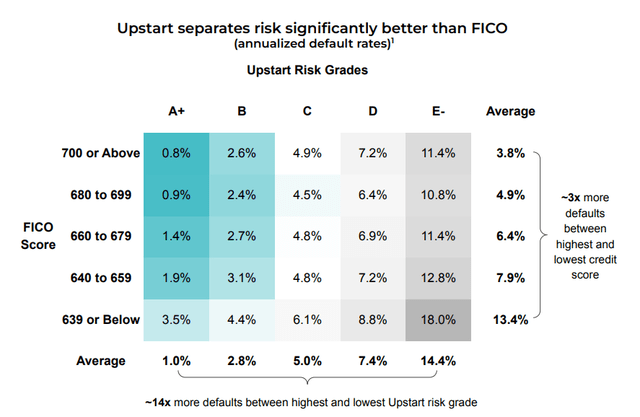

UPST Q4 2022

As you can see here, Upstart's business model is able to discern significantly better than FICO scores.

But now that the credit cycle has turned, banks and lending partners want very little to do with Upstart.

Consequently, Upstart is being forced to retain more of its loans on its platforms. And that's what we are seeing here and what I've discussed above.

But I believe that by now, all of these are known knowns. I believe that there are another two quarters, or 6 months, for Upstart to be swimming uphill and that after that period, starting Q3 2022, Upstart's prospects will stabilize.

The Bottom Line

When considering Upstart it is not that the company is cheaply valued. In fact, there's no way that I can declare that this business in the state that it is now, is a bargain.

Upstart is struggling to shed its loans and improve its balance sheet. Its revenue growth rates are moving in the wrong direction. Furthermore, Upstart has proven to be a remarkably poor capital allocator.

But these are now largely known knowns. Nobody expects much from this company. And I believe that from this price point, once the economy starts to stabilize, as it will inevitably improve with time, Upstart will be well positioned to take many of its learnings from the past 3 years. Both the good times and the bad times.

I have shown myself throughout SA to be able to change my mind when the facts change. But I honestly don't believe that this is the time to throw in the towel here. It's only a matter of time before interest rates start to get cut. And when that happens, the credit environment will substantially improve, providing a lifeline to this frail business. This is a contrarian bet. So, if you consider this name, be sure to appropriately size it in your portfolio.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.