First Industrial Realty: The Speculative Exposure Still Warrants A Higher Risk Premium

Summary

- First Industrial Realty Trust continues to benefit from strong market fundamentals in the industrial real estate sector.

- Vacancy rates that are averaging 3% nationally and even lower in some of their strongest markets have enabled the company to realize rent spreads well in excess of 20%.

- The robust earnings growth has translated to continued dividend growth for existing shareholders.

- Though shares could track higher in the periods ahead, their speculative exposure does warrant a higher risk premium in the current market environment.

Vanit Janthra

First Industrial Realty Trust (NYSE:FR) continues to post robust earnings results on favorable industry-wide demand drivers. Their operations are concentrated in 15 key logistics markets, with particular emphasis on some of the most supply-constrained markets in the country. A quarter of their total revenues, for example, are generated in the Southern California market.

Record low vacancies in these markets have enabled FR to drive rents higher on spreads well in excess of 20%. And looking ahead, the company expects to realize 40-50% rent growth in 2023 due to opportunities embedded in their Inland Empire market.

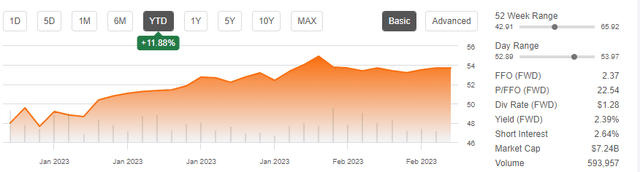

The strong performance has resulted in continuous dividend growth for investors. In addition, shares are up nearly 12% YTD.

Seeking Alpha - Basic Trading Data Of FR

While shares are still down over the past year, the stock appears fairly priced. Currently, shares trade at about 22x forward funds from operations (“FFO”), which is in-line with their peer set. In addition, a greater risk premium is warranted due to the size of their speculative portfolio, which could create a drag on earnings in the event they are not leased-up as expected. Furthermore, one of their top tenants is on watch due to the current financial position of their parent company. For these reasons, FR shares may be best left on hold, despite otherwise strong operating performance.

Recent Performance and Current Portfolio Metrics

FR ended fiscal 2022 with in-service occupancy of 98.8%. The record occupancy levels also coincided with record low vacancy rates in the overall market. At the date of their presentation, overall industrial vacancy was 3%, according to real estate firm, CBRE Group (CBRE).

Similar to others within the industrial sector, the severely supply-constrained market enabled FR to realize annual cash rental rate increases of 26.7%. This in-turn contributed to record annual growth in same-store net operating income (“NOI”) of 10.1%.

And subsequent to year end, the leasing environment exhibited no apparent signs of slowing down. At the date of their earnings release, for example, they had already burned through 50% of their 2023 lease expirations. Moreover, these signings were done at cash spreads of 33%, which is already above the pace set at the same time in 2022.

Furthermore, management noted that four out of their five largest remaining expirations for 2023 are in the Inland Empire, which is one of the most supply-constrained markets in the country. As such, cash spreads of 40-50% are expected for the full 2023 fiscal year.

The company also made significant headway on their development pipeline, placing into service 4.1M SF of space during the year.

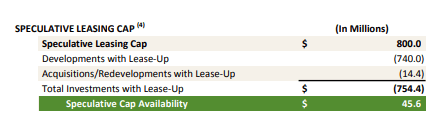

There is, however, limited availability in their speculative cap. And this is paired with an anticipated 12-month lease-up timetable on their existing developments. This is longer than their historical average of six months or less over the past three years.

Q4FY22 Investor Supplement - Summary Of Current Speculative Development Cap

As such, the development pipeline is likely to be more focused on lease-up efforts as opposed to new starts.

Nevertheless, the company was still able to initiate one new start during the quarter in Northern California. Including this start, their developments in progress total about +$556M. On this, they are expecting to earn a development margin of 75%, which is in-line with expectations.

One notable blip in an otherwise strong portfolio is their exposure to ADESA, which is an auto auction and related services provider that was acquired by Carvana (CVNA). Presently, the company accounts for just 1.8% of total rental income.

But they are currently on watch due to Carvana’s current financial predicament. Should they turnover, though, FR could benefit since their spaces are all currently significantly below market and are considered prime candidates for high-margin redevelopment.

Liquidity and Debt Profile

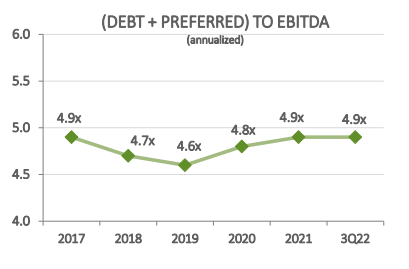

In recent periods, FR did incur more indebtedness to fund their investments on their developments. But despite this, the company remains on a solid financial foundation. Net debt to adjusted EBITDA at year end, for example, was 5.1x and 4.6x on a pro-forma basis. This is little changed from the 4.9x and 4.6x levels, respectively, at the end of 2021.

November 2022 Investor Presentation - Historical Chart Of Year End Leverage

And the higher debt load did little to affect their coverage ratios, as their coverage of fixed charges is stronger now than it was in prior years. For the full 2022 fiscal year, coverage stood at 5.4x. This is well above the 3.5x coverage levels in 2017. It’s also higher than the 5.1x that they turned in for fiscal 2021.

Looking ahead, FR needs about +$225M to cover their current in-process developments. After accounting for their dividend, which should eat up about +$75M of available funds, the company still would have excess cash flow to apply towards their development pipeline.

Additionally, management also guided for about +$100M in sales in 2023 at the midpoint. If that came to fruition, that would add on to existing funds, as well as the +$600M that is available on their line of credit.

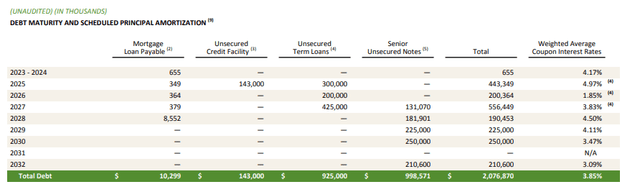

And this is all supplemented by their favorable debt ladder, which spares them from any significant near-term maturities until 2025 at the earliest.

Q4FY22 Investor Supplement - Debt Maturity Schedule

Dividend Safety

FR increased their dividend by 9.3% in 2022 to a quarterly rate of $0.295/share. And then following their Q4 earnings release, they increased it another 8.5% at the start of 2023 to $0.32/share.

This is a continuation of a strong track record of prior increases. Over the past five years, for example, the payout has grown at a compound rate of 7%.

November 2022 Investor Presentation - Summary Of Dividend Growth Since 2017

At current pricing, the quarterly payout represents an annualized yield of about 2.3%. Though this isn’t much to get excited about, the continuity and positive growth record does provide credibility to the strength of the company’s recurring cash flows.

From a coverage standpoint, the payout was less than 50% of FFO for the quarter and just above that for the year. This is a slight improvement from the prior year, where the payout was about 55% of FFO.

On an adjusted basis, the new payout represents approximately 70% of their expected funds for 2023. Compared to the broader sector, coverage still outperforms. Though their larger peer, Prologis (PLD), does operate more leanly at a 60% payout ratio.

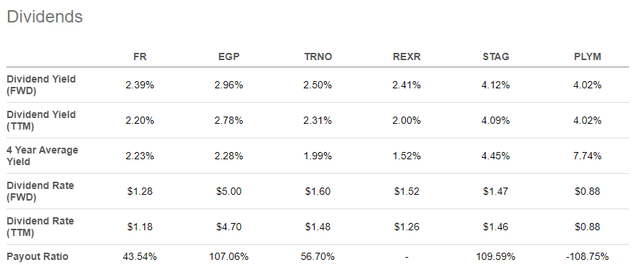

And though the yield is on the lower end, it is generally on par with most others in the industrial property class, save STAG Industrial (STAG) and Plymouth Industrial (PLYM), who both currently offer payouts north of 4%.

Seeking Alpha - Dividend Yield Of FR Compared To Peers

Final Thoughts

FR currently trades at 22.5x forward FFO. While this is significantly higher than some in the sector; Plymouth, for example, fetches just 12x. The multiple is in-line with several other components. Prologis trades at about 23x and Rexford Industrial (REXR) commands 29x.

In a sense, the premium multiple is justified, given the current supply/demand dynamics in the industry. And based on their most recent earnings release, a slowdown from the record activity levels seems unlikely.

For one, the year has just started, and the company has already completed 50% of the year’s leasing expirations. And for the largest remaining leases, four out of the five are in a market that is expected to yield cash spreads of between 40-50%.

The record growth is in-turn translating to a strong windfall for investors. Shares are up 12% YTD and the quarterly payout was just increased by 8.5% after having been increased by over 9% in 2022. If earnings continue to grow as expected, shareholders should expect further growth in the periods ahead.

For all that there is to cheer about, investors should also consider the company’s recent run-up in relation to their current pricing multiple. On their earnings call, management’s guidance assumed a 12-month timetable on their development lease-ups. But it’s been six months or less over the last three years. The longer timeframe could partly be attributable to a lull in the leasing environment as companies take stock of the amount of space they will truly need.

Since their pipeline is primarily speculative, the company would be inherently more exposed to any slowdown in the industrial market.

In addition, FR is also exposed to some weaker tenants, such as ADESA, who is among their top five tenants, but is on watch due to the status of their parent company, Carvana. Granted, the tenant accounts for just 1.8% of base rents and occupies space that is significantly below market rent. But the loss of the tenant could create an earnings gap, nevertheless, while the company works through its backfill.

Overall, FR continues to post strong results, but the risks relating to their speculative pipeline still creates a headwind on new initiation.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.